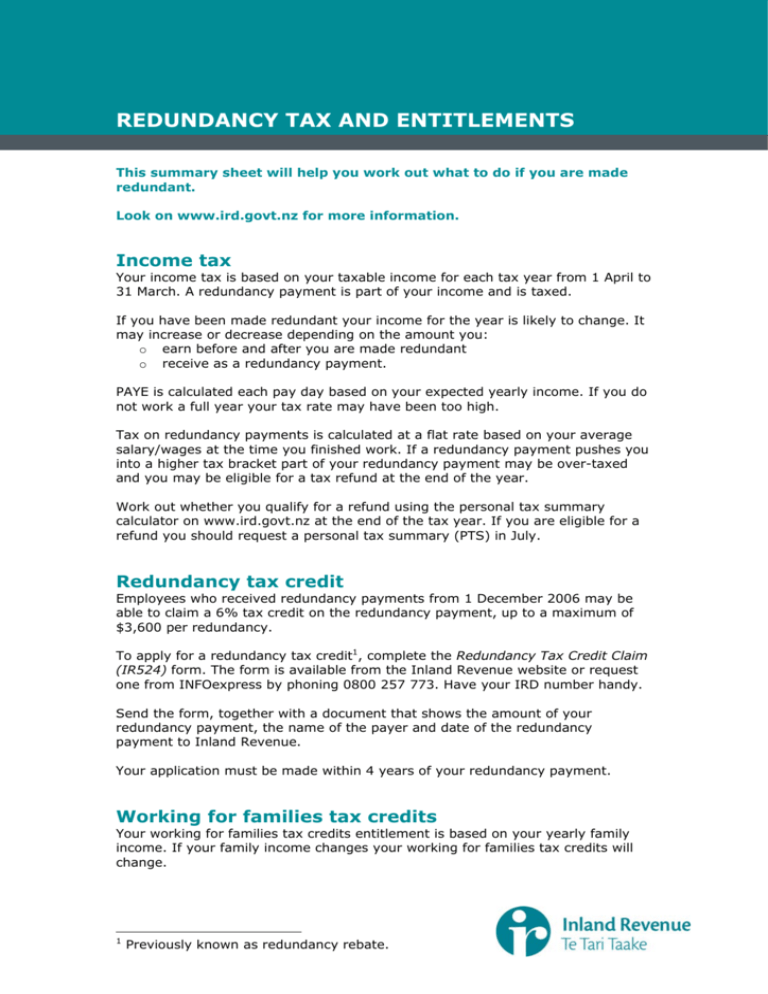

Are You Taxed On Redundancy Payment If you ve been made redundant and are getting redundancy pay you might be wondering if you have to pay tax on it Redundancy pay is treated differently to income and up to 30 000 of it is tax free

Statutory Redundancy Pay The minimum amount of redundancy pay that an eligible employee is entitled to by law based on their length of service age and weekly pay Tax Free Threshold The maximum amount of Redundancy pay is compensation for your job loss As such up to 30k of it is tax free This applies to a statutory or non statutory where the employer has paid more in accordance with the contract of employment

Are You Taxed On Redundancy Payment

Are You Taxed On Redundancy Payment

https://www.madisontrust.com/wp-content/uploads/2023/02/most-taxed-state-5_thumb.jpg

How Is A Redundancy Payment Taxed Wingate Financial Planning

https://wingatefp.com/wp-content/uploads/2021/04/pexels-pixabay-209224-scaled-1-1024x683.jpg

Tax Deduction Deadlines For Company Contributions

https://mybenefits.me/wp-content/uploads/2023/04/pexels-karolina-grabowska-4386372-scaled.jpg

Given statutory redundancy pay is capped at 19 290 you won t pay any tax if you just receive the legal minimum Any portion of your redundancy pay above 30 000 is treated as income and will be taxed at the same rate as your Is redundancy pay taxed The first 30 000 of your redundancy pay is tax free but any amount above this will be subject to income tax at the standard rate You don t have to pay National

You will be taxed on the redundancy payment in the tax year that you receive it even if you were made redundant in an earlier tax year The 30 000 limit applies to one job and can be carried forward to be used against Statutory redundancy pay is tax free up to a certain limit As of the current tax year 2024 2025 the first 30 000 of redundancy pay is exempt from income tax This exemption applies regardless of the employee s tax bracket

Download Are You Taxed On Redundancy Payment

More picture related to Are You Taxed On Redundancy Payment

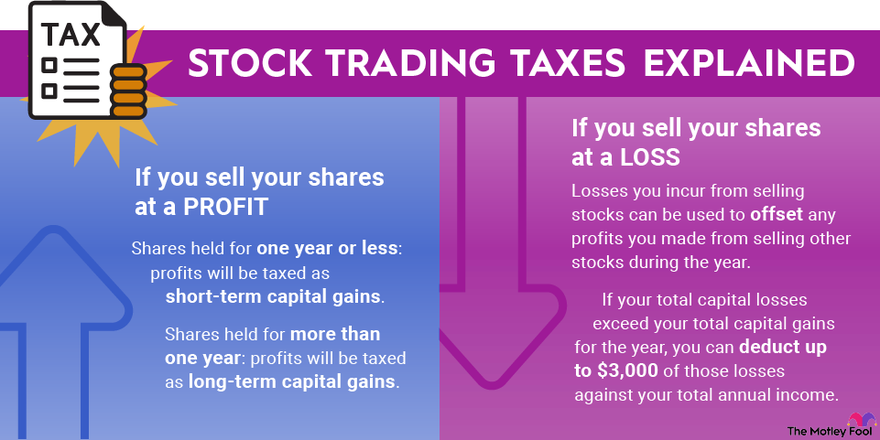

HOW REDUNDANCY PAYMENTS ARE TAXED

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

Redundancy Notice Sample Template Word PDF

https://www.wonder.legal/Les_thumbnails/redundancy-notice.png

Termination Pay Redundancy CooperAitken Chartered Accountants

http://www.cooperaitken.co.nz/wp-content/webpc-passthru.php?src=https://www.cooperaitken.co.nz/wp-content/uploads/2020/08/Redundancy.png&nocache=1

Is a redundancy payment tax free The answer is clearly no as you have a limit of up to 30 000 and anything above that you are taxed Be sure to know how much tax you will The first 30 000 of redundancy and unfair dismissal is tax free Tax on restrictive covenants an payments in lieu of notice Tax exemption on outplacement employee legal costs related to compromise agreements and unfair dismissal

You will be taxed on the redundancy payment in the tax year that you get it even if you were made redundant in an earlier tax year The 30 000 limit applies to one particular job and can Redundancies qualify for special treatment under tax law you can receive up to 30 000 in redundancy pay without having to pay any tax on it There s a legal minimum your

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

https://slowfortune.com/wp-content/uploads/2020/01/How-Is-A-Redundancy-Payment-Taxed-In-Australia.jpg

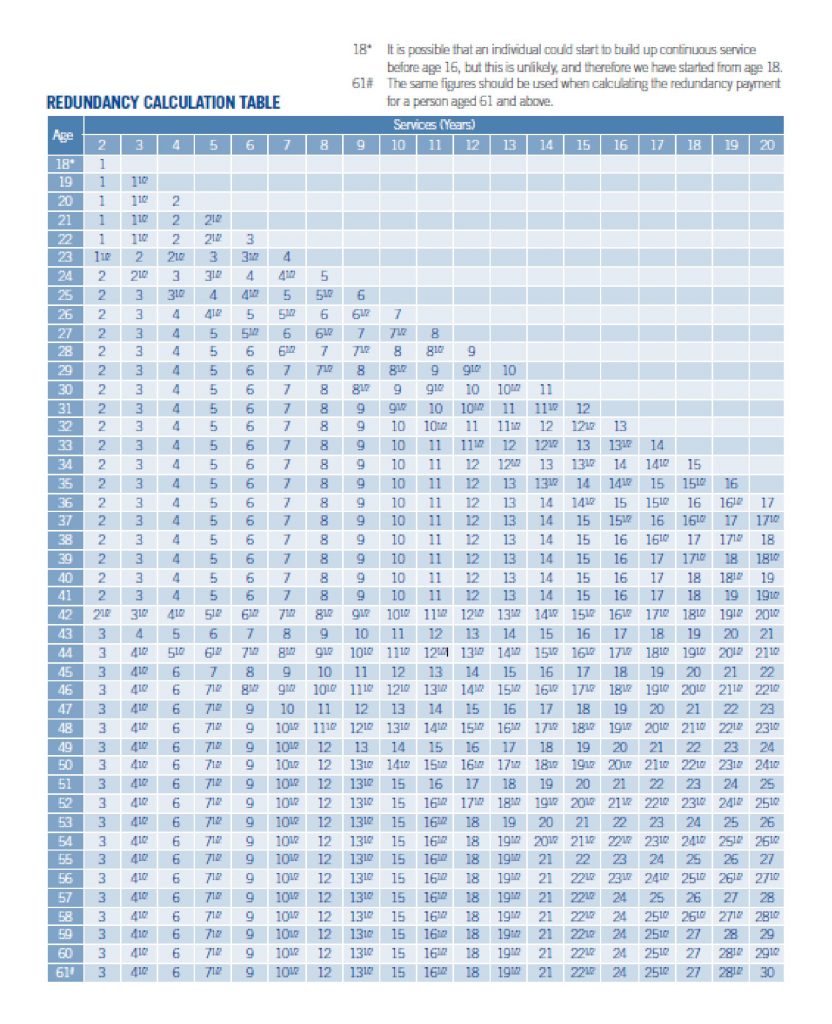

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

https://www.moneyhelper.org.uk › en › wor…

If you ve been made redundant and are getting redundancy pay you might be wondering if you have to pay tax on it Redundancy pay is treated differently to income and up to 30 000 of it is tax free

https://www.davidsonmorris.com › is-redun…

Statutory Redundancy Pay The minimum amount of redundancy pay that an eligible employee is entitled to by law based on their length of service age and weekly pay Tax Free Threshold The maximum amount of

Letter Of Termination Of Employment Redundancy

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

Near Mesee1958

Yo Dawg We Herd U Like Taxes So We Put Taxes On Your Taxed Income So

5 Redundancy Letter Template Uk Sampletemplatess Within Failed

SO LET ME GET THIS STRAIGHT I m Paying TAXES On My Wages Then

SO LET ME GET THIS STRAIGHT I m Paying TAXES On My Wages Then

A Guide To Statutory Redundancy Payments Cashfloat

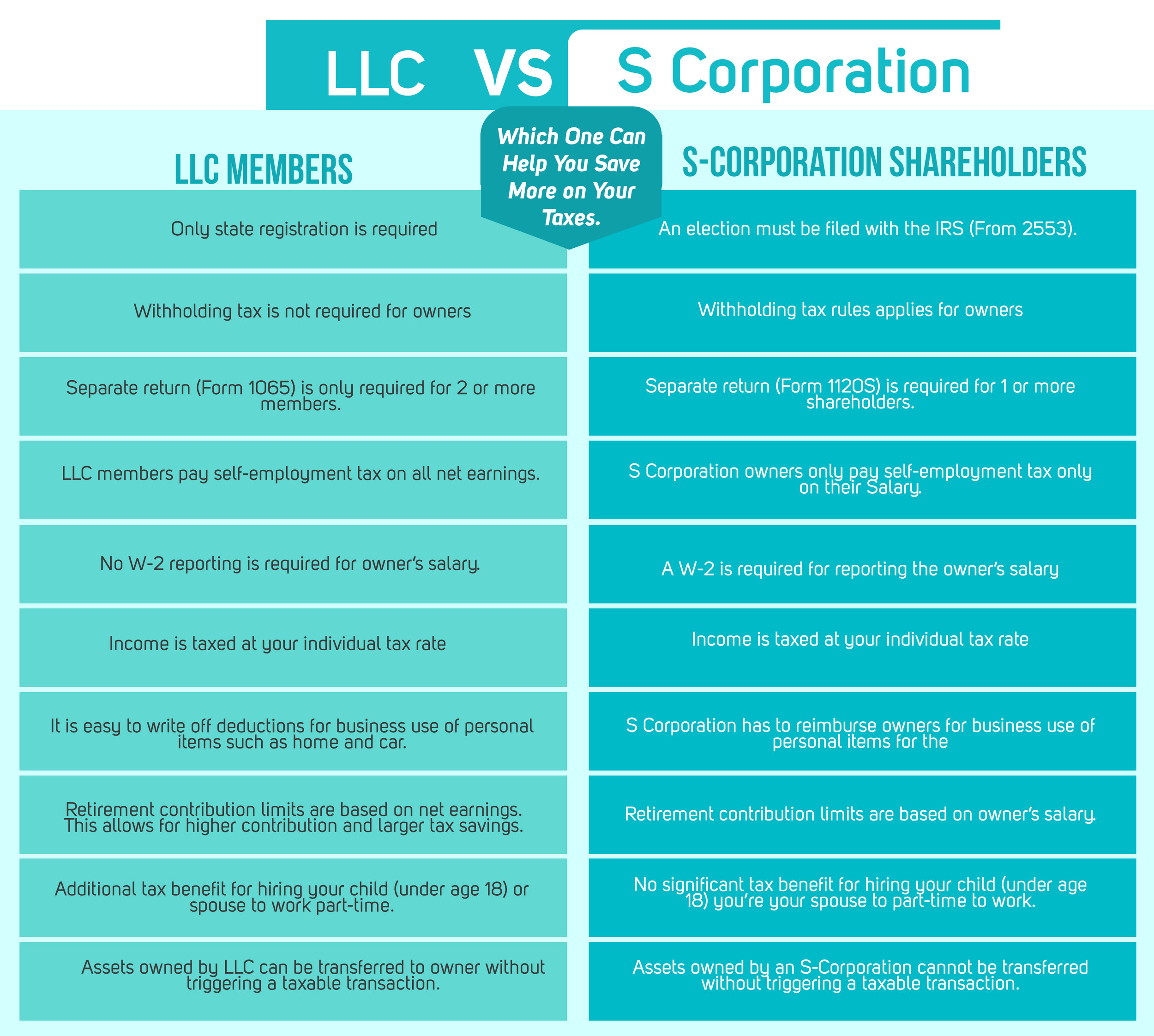

LLC Vs S Corporation Which One Can Save You More On Your Taxes RBA

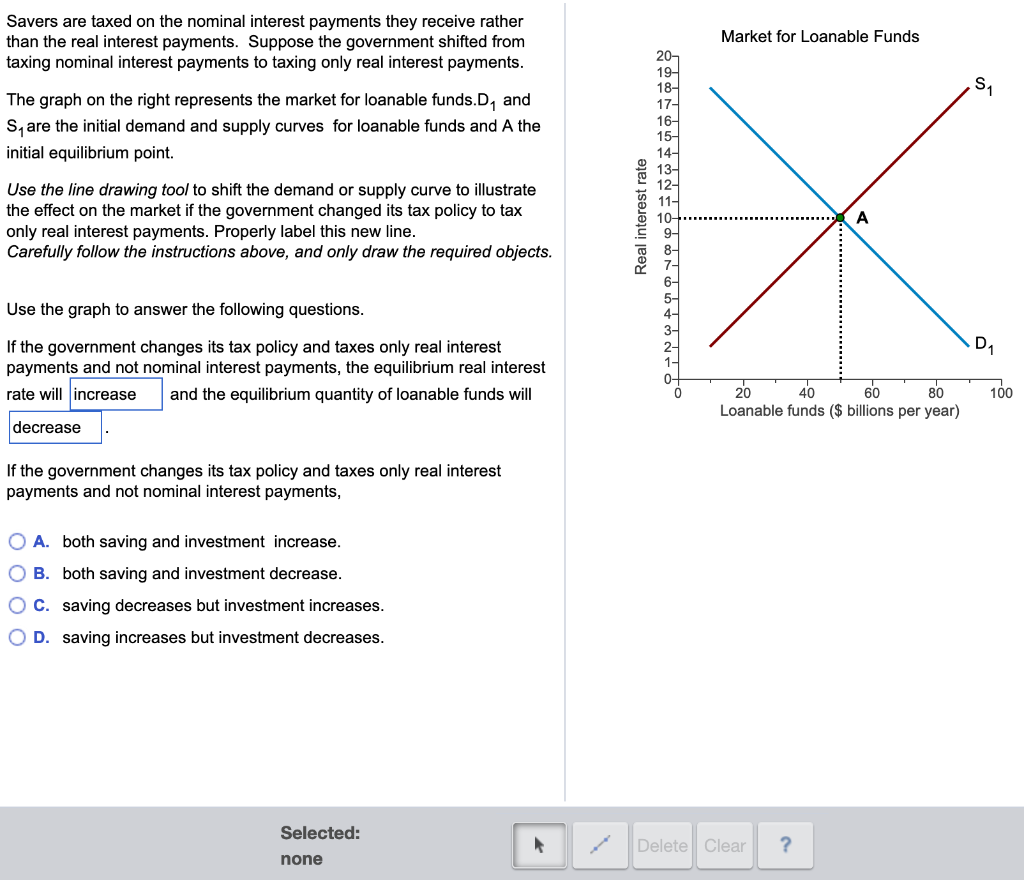

Solved Savers Are Taxed On The Nominal Interest Payments Chegg

Are You Taxed On Redundancy Payment - Is redundancy pay taxed The first 30 000 of your redundancy pay is tax free but any amount above this will be subject to income tax at the standard rate You don t have to pay National