Arizona 529 College Savings Plan Tax Benefits Arizona s Education Savings Plan is a state sponsored 529 plan designed to provide a parent grandparent or future students an opportunity to save for educational expenses

Are there tax benefits for investing in the Arizona 529 Plan Effective September 29 2021 for Tax Year 2021 and after the state of Arizona offers a tax deduction each year for AZ529 Plan savings can be used to pay for college vocational and workforce training apprenticeships and private K 12 education AZ529 Plan earnings grow tax free and will

Arizona 529 College Savings Plan Tax Benefits

Arizona 529 College Savings Plan Tax Benefits

https://i.pinimg.com/originals/e2/4d/2f/e24d2f2b7a93d26110c648b377b7de8f.jpg

529 Plans 29 Thoughts For 5 29 Lazy Man And Money

https://static.lazymanandmoney.com/images/2019/05/29121050/529-Plans.jpg

10 Things Every Arizona Family Should Know About College Savings

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/10/10_Things_Arizona_01-1-1-679x2048.jpg

The Arizona 529 plan offers federal and state tax benefits as you save for a child s education Flexible use of funds Use the funds for a wide range of college Tax savings is one of the big benefits of using a 529 plan to save for college On a federal level there is no tax savings for contributions but qualified distributions are tax free

Married filing jointly residents contributing 100 month can expect an additional 0 a year in tax savings Program match on contributions State tax deduction or credit for contributions AZ529 is a state sponsored savings plan designed to provide a parent grandparent or future student an opportunity to save for educational expenses in a tax deferred manner

Download Arizona 529 College Savings Plan Tax Benefits

More picture related to Arizona 529 College Savings Plan Tax Benefits

9 Benefits Of A 529 Plan District Capital

https://districtcapitalmanagement.com/wp-content/uploads/2022/02/529-Benefits-1.jpg

Everything You Need To Know About 529 College Savings Plans In 2023

https://529-planning.com/wp-content/uploads/2020/12/GettyImages-182175346-5c4e721dc9e77c0001d7bb0f.jpg

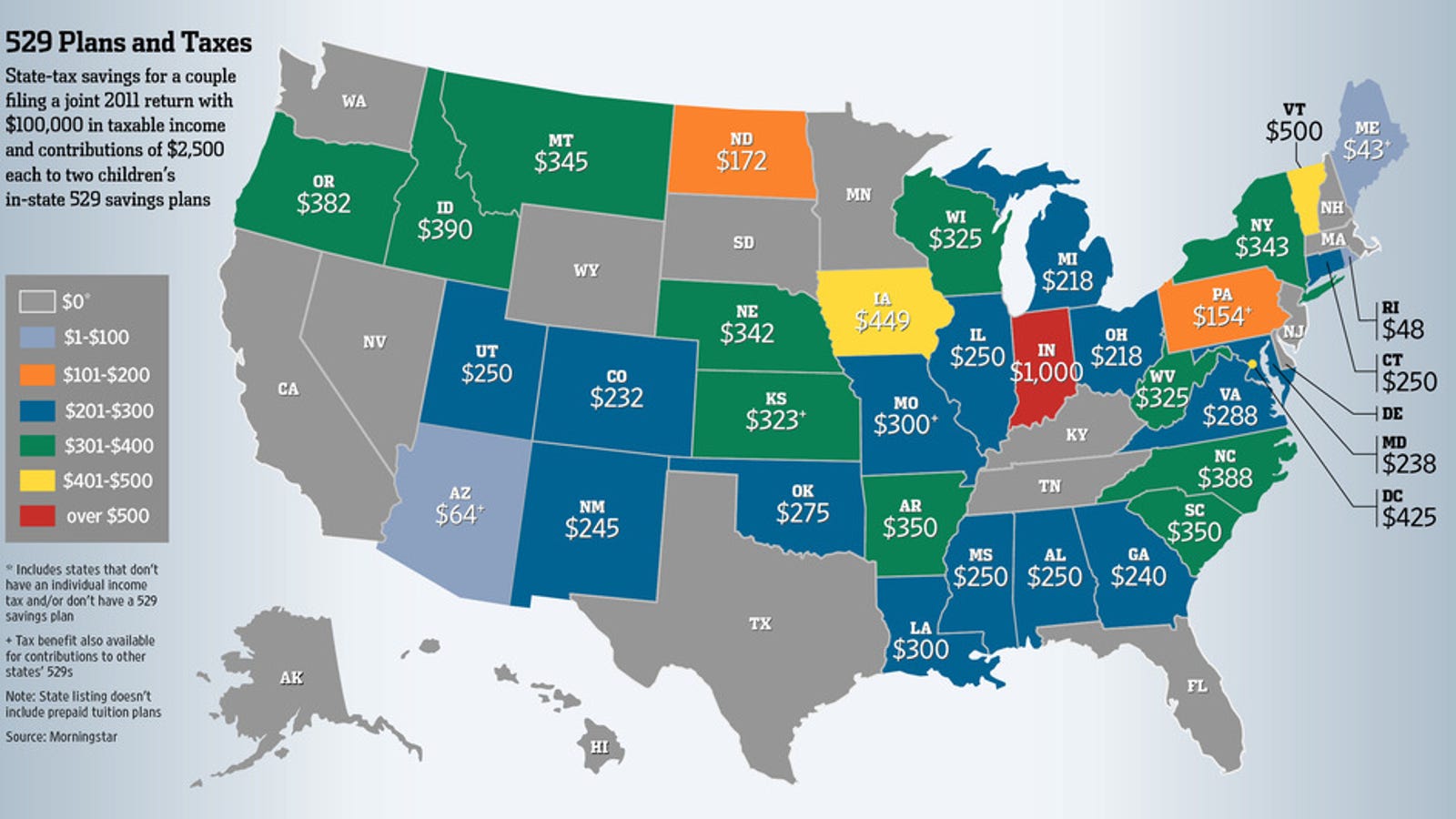

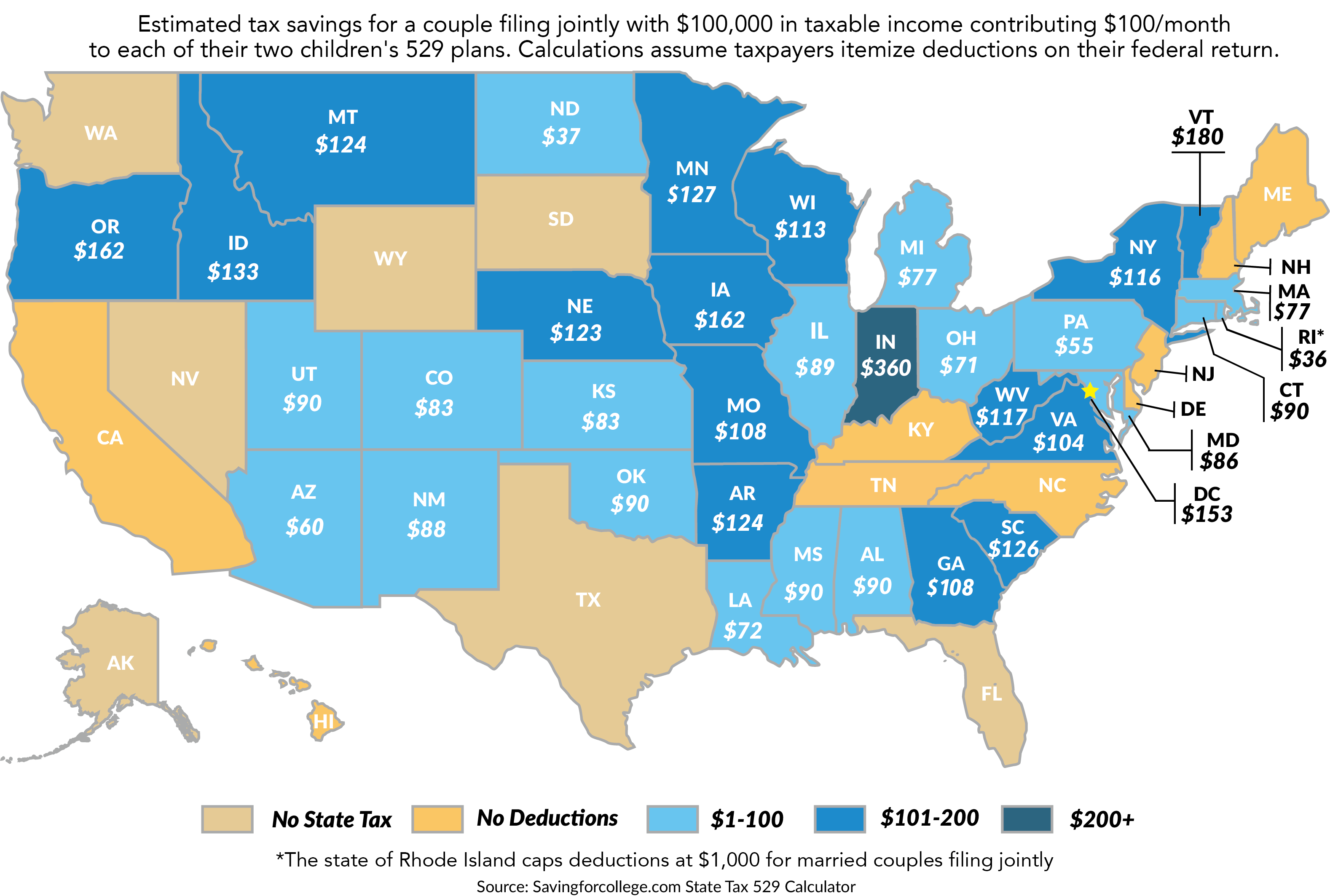

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

Arizona residents are eligible for a 2 000 deduction to gross income per taxpayer or 4 000 for those married filing jointly based on contributions to the AFCSP Arizona 529 Tax Benefit For single filers 2 000 yr For joint filers 4 000 yr Consumer Plans Did you know that you can open a 529 plan offered by another state Here s an

The Arizona 529 Plan is a college savings plan that allows you to save for your child s future education within a tax advantaged savings account Qualified The greatest benefit of 529 plans is their tax advantages But to understand these benefits you must understand deductions and penalties Tax penalties punish

10 Things Every Arizona Family Should Know About College Savings

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/10/AdobeStock_64160752-2048x1365.jpg

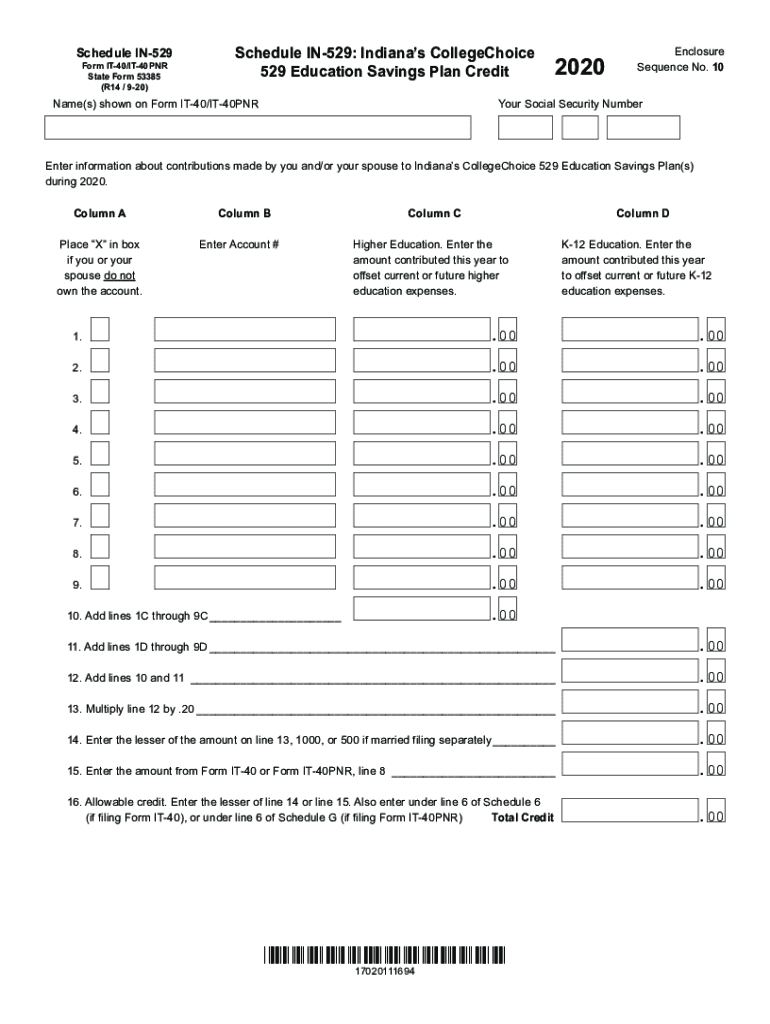

Indiana 529 Login 2020 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/563/641/563641079/large.png

https://az529.gov

Arizona s Education Savings Plan is a state sponsored 529 plan designed to provide a parent grandparent or future students an opportunity to save for educational expenses

https://az529.gov/faq

Are there tax benefits for investing in the Arizona 529 Plan Effective September 29 2021 for Tax Year 2021 and after the state of Arizona offers a tax deduction each year for

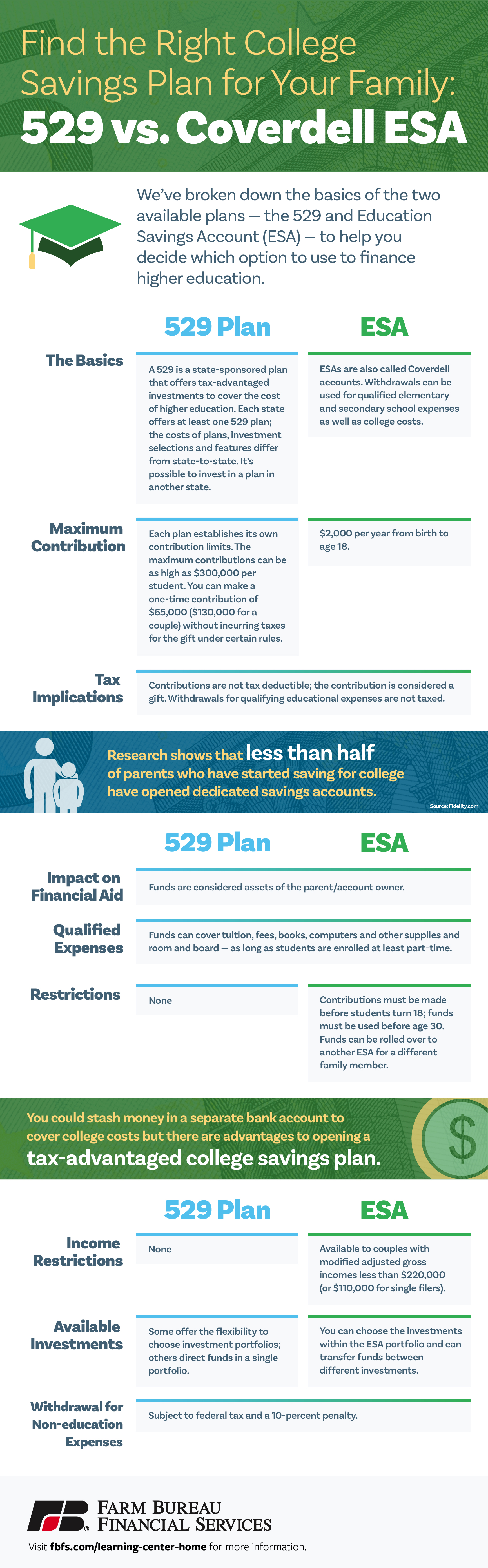

ESA Vs 529 Which Is Right For Your Family Farm Bureau Financial

10 Things Every Arizona Family Should Know About College Savings

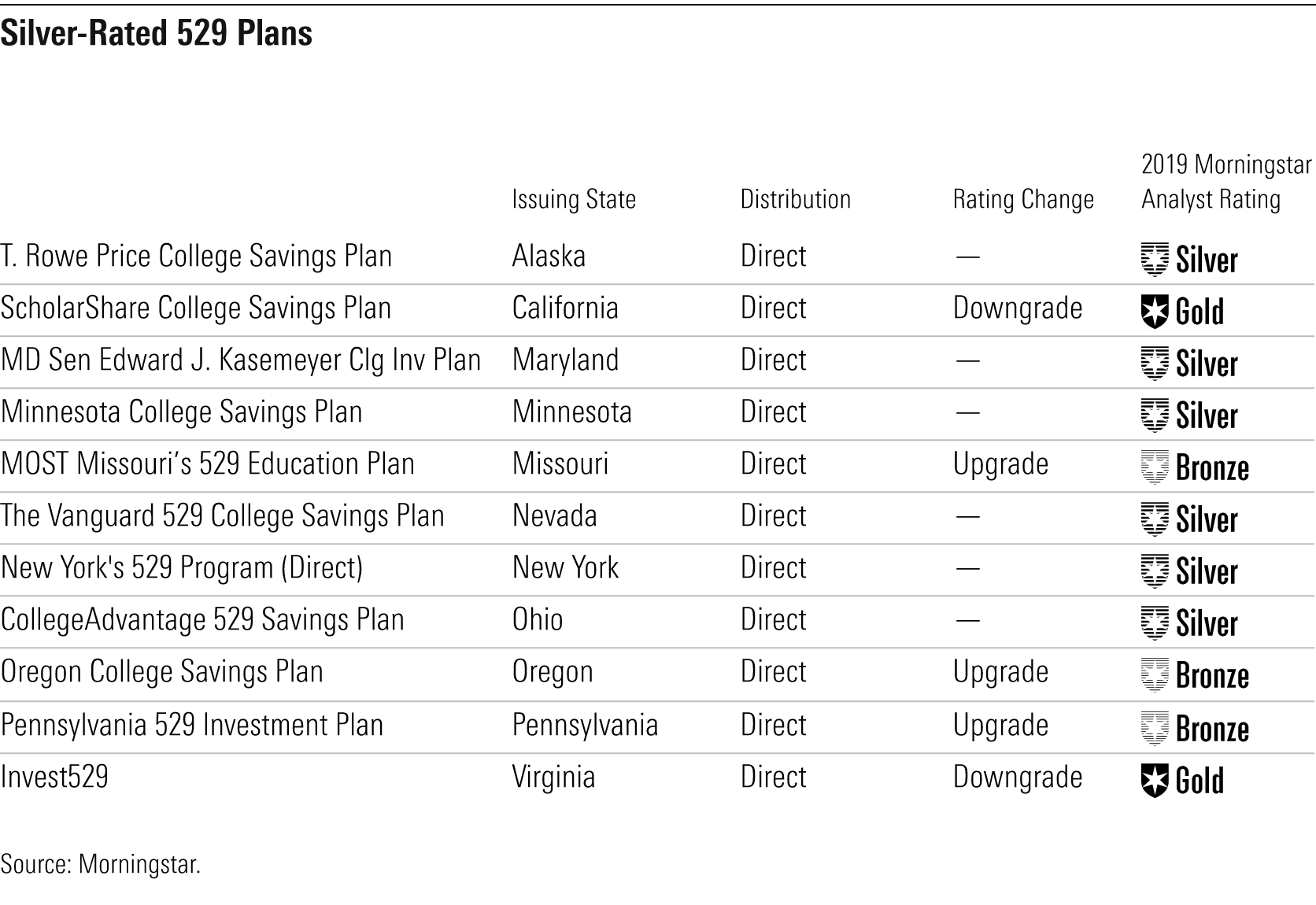

The Top 529 College Savings Plans Of 2020 Morningstar

If You Use Your 529 College Savings Plan For This You May Get A Tax

Is Oregon 529 College Savings Plan Tax Deductible EverythingCollege info

Investing In Education A Guide To Arizona s 529 College Savings Plan

Investing In Education A Guide To Arizona s 529 College Savings Plan

Arizona College Savings Plan AZ529 Arizona s Education Savings Plan

The Benefits Of and How To Open 529 Plans For College Savings

529 College Savings Plan Unused White Oaks Wealth Advisors

Arizona 529 College Savings Plan Tax Benefits - Tuition at a 4 year university in AZ rose 15 ranked 30th in the US while a 2 year or trade school increased their tuition by 7 percent 529 Tax Benefits for Arizona