Arizona Charities Eligible For Tax Credit Search for qualified charities that are certified by the AZ Dept of Revenue as eligible for a financial contribution tax credit AZTAXCREDITLIST COM is an interactive web experience to explore

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations one for donations to Qualifying Charitable Organizations QCO and the second Explore these great Organizations below Maximum total contributions for this category are 938 for married filing jointly or 470 for filing single And 987 for married filing jointly or 495 for

Arizona Charities Eligible For Tax Credit

Arizona Charities Eligible For Tax Credit

https://blog.greenenergyconsumers.org/hubfs/Federal Tax Credit Blog header.png

Eitc

https://eitc.dc.gov/sites/default/files/dc/sites/eitc/eitc.png

TAX Credit 1099 Expert

http://1099.expert/wp-content/uploads/2023/10/b1-1024x989.png

Learn how to claim the Arizona Charitable Tax Credit for donations to certified charities such as Phoenix Children s and reduce your state tax liability Find out the limits deadlines eligible organizations and other tax credits for 2023 To qualify as a tax credit charitable financial donations MUST be to an AZ Dept of Revenue certified approved charity that has meets specific qualifications hence a Qualified Charitable

When you choose to avail the tax benefits for donations it is essential to note that there are two types of tax credits for charitable contributions Qualified Charitable Organizations or Qualifying Foster Care Charitable Arizona Charitable Tax Credit Give to a qualified charity that provides immediate basic needs to residents of Arizona who receive temporary assistance for needy families TANF benefits are

Download Arizona Charities Eligible For Tax Credit

More picture related to Arizona Charities Eligible For Tax Credit

AZ Charitable Tax Credit Resources Vail

https://resourcesvail.org/wp-content/uploads/2023/11/az-tax-credit-img.png

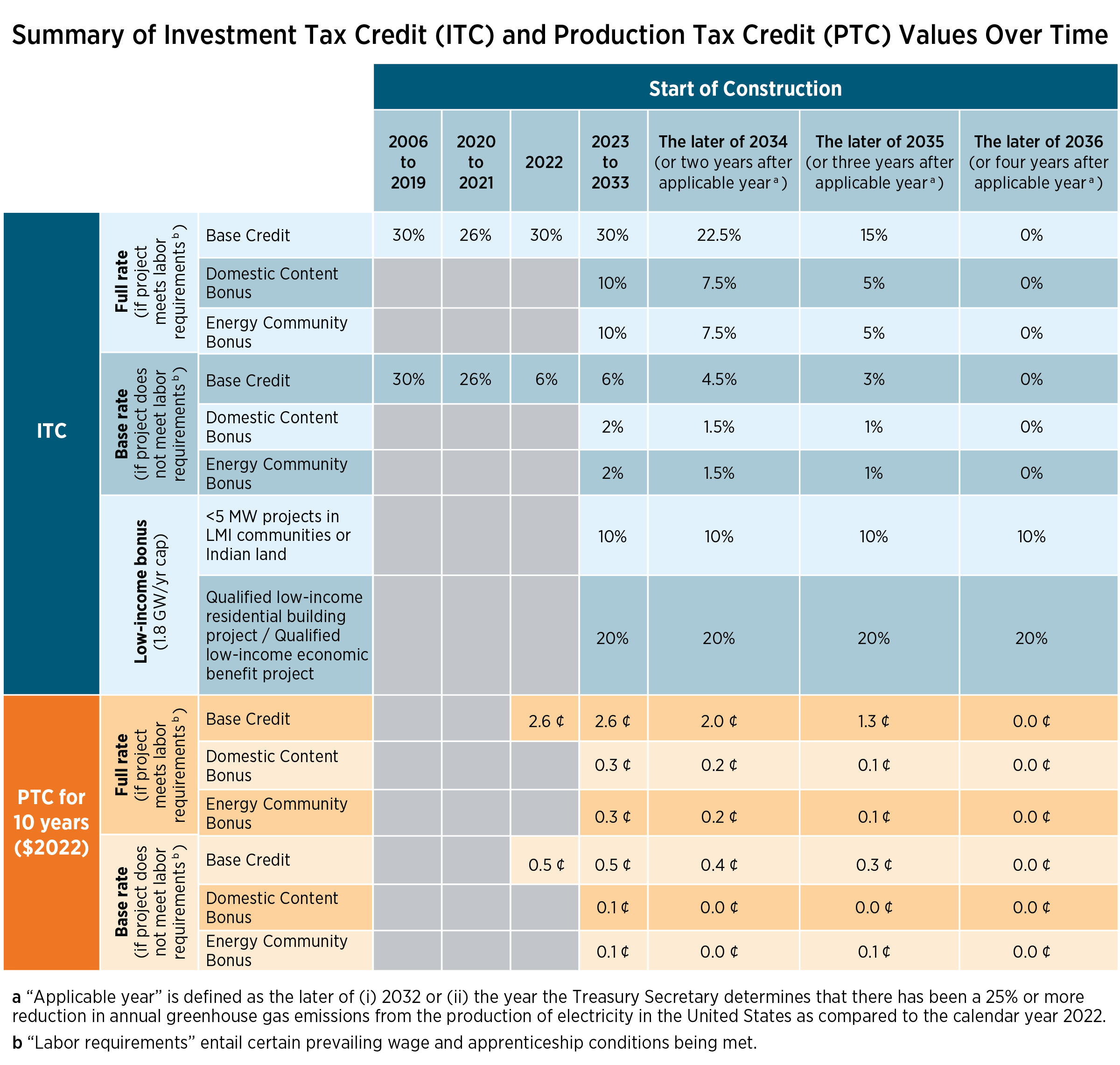

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

Tax Credits Fortified Solar

https://fortifiedsolar.com/wp-content/uploads/2023/06/TaxCredit_PieChart.png

The Arizona Charitable Tax Credit allows individuals to reduce their state tax liability by making eligible contributions to qualifying charitable organizations QCOs When you donate to a certified QCO you can receive a dollar for Arizona residents can claim up to 400 as an individual or unmarried head of household or up to 800 for married couples filing jointly Contributions to a QCO up to 12 00 AM midnight on

Organizations that Qualify for Arizona Tax Credit Arizona has a lot of the best charitable organizations in the country The tax credit is due to donors many incentives The charitable tax credit in Arizona is a program that encourages AZ residents to contribute to charity in exchange for a reduced tax bill In 2024 single filers could claim a

.webp)

Common Terms And Negotiating Points In A Tax Credit Transfer Agreement

https://assets-global.website-files.com/6449438b8885011ff7be8199/655a72cabab8837a57f34b32_image (23).webp

Everything You Need To Know About Tax Deductions For Small Businesses

https://www.hpr.com.ph/wp-content/uploads/2023/02/Everything-You-Need-to-Know-About-Tax-Deductions-for-Small-Businesses-How-to-Take-Advantage-of-Them-980x655.jpg

https://www.aztaxcreditlist.com › az-qualified-charities.html

Search for qualified charities that are certified by the AZ Dept of Revenue as eligible for a financial contribution tax credit AZTAXCREDITLIST COM is an interactive web experience to explore

https://azdor.gov › tax-credits › credits-contributions-qcos-and-qfcos

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations one for donations to Qualifying Charitable Organizations QCO and the second

SSPN Contributors No Longer Eligible For Tax Release Bizworld 27

.webp)

Common Terms And Negotiating Points In A Tax Credit Transfer Agreement

Non Filers Can Still Benefit From Several 2021 Credits Taxing Subjects

Tax Treatment On Australian Employee Stock Options Adrian Chaudhary

Boost Your Tax Return Good Neighbours Australia

The 17 EVs Eligible For Tax Credits Newsmax

The 17 EVs Eligible For Tax Credits Newsmax

What Is Postal Life Insurance PLI Vineesh Rohini

Understanding Tax Obligations For Charities

Income Tax Notices For Bogus Political Donation Issue Option

Arizona Charities Eligible For Tax Credit - Arizona Form 321 offers taxpayers an opportunity to support qualifying charitable organizations while receiving a state tax credit This form is a valuable tool for Arizona