Arizona Tax Credit Rebate 2024 Note that the rebate is not subject to Arizona income tax and should be subtracted from your federal adjusted gross income on your 2023 Arizona individual income tax return ADOR will provide taxpayers with Form 1099 MISC online on and after January 31 2024 by visiting azdor gov arizona families tax rebate and clicking on View my 1099 MISC

The EV Tax Credit Changed Again New Year s Day What to Know Tax Credits The federal tax credit for electric vehicles has changed again for 2024 Here s what you need to know if you want to You can use this page to check your rebate status update your rebate address or to make a claim for your rebate Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return

Arizona Tax Credit Rebate 2024

Arizona Tax Credit Rebate 2024

https://www.choicesaz.com/wp-content/uploads/2022/12/unnamed.png

2021 2024 Form AZ DoR 5000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/578/946/578946897/large.png

Top Things About Arizona Tax Credit School Donations Children s Care Arizona

https://childrenscareaz.org/wp-content/uploads/2020/08/tax-credit.jpg

The tax rebate will be sent to the direct deposit account on file or a paper check will be issued to the last known address referenced in your tax year 2021 or 2022 return filed with the Arizona More than 700 000 families were eligible for this tax credit for roughly 250 per child up to three kids for a maximum rebate of around 750 How much of that will now go to taxes That depends

The announcement comes over five months after the Arizona Families Tax Rebate was signed into law as part of the Fiscal Year 2024 state budget Hobbs calls the rebate the first of its kind saying A 750 rebate could carry a tax of 165 for filers in the 22 federal tax bracket That bracket applies to married couples who file jointly and earned between 89 451 and 190 750 in 2023

Download Arizona Tax Credit Rebate 2024

More picture related to Arizona Tax Credit Rebate 2024

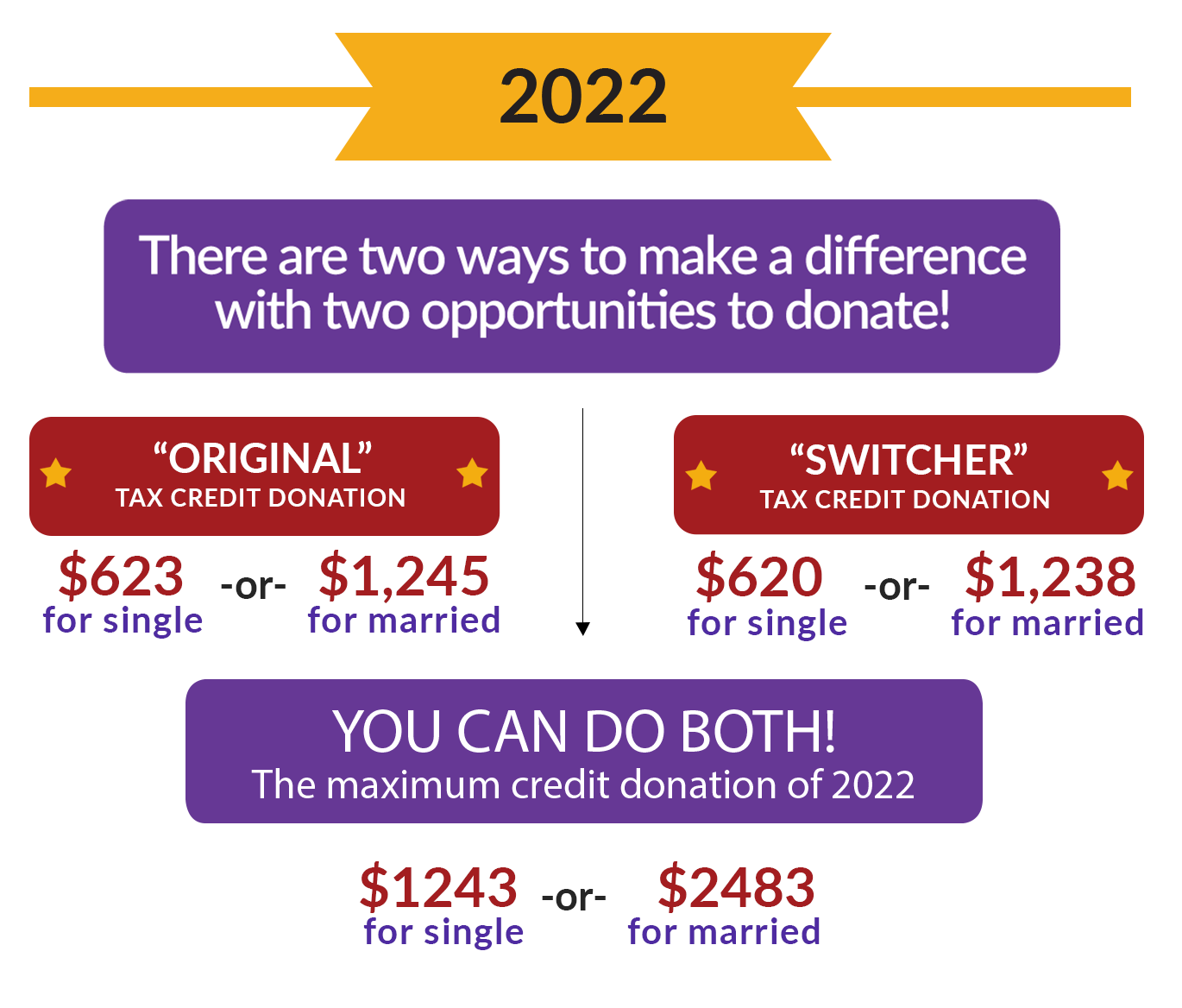

Aztxcrd 2022 Arizona Tax Credit

https://aztxcr.org/wp-content/uploads/2021/12/aztxcrd-2022.png

Why Didn t I Get My Arizona Tax Credit Returned

https://childrenscareaz.org/wp-content/uploads/2022/03/Why-Didnt-I-Get-My-Arizona-Tax-Credit-Returned-Banner.jpg

What Organizations Qualify For Arizona Tax Credit

https://childrenscareaz.org/wp-content/uploads/2022/03/Arizona-Tax-Credit-Types-and-Programs-for-Employers-to-Look-Into-Banner-2.jpg

The rebate is available to year round residents who claimed Arizona s existing tax credit for dependents in 2021 on their tax returns which were due in 2022 and owed at least 1 in taxes during The new Arizona flat personal income tax rate wasn t expected until 2024 However the lower rate is effective as of last year 2023 due to higher than expected tax revenues Arizona tax rebate

The Arizona Department of Revenue and Hobbs launched a site that allows Arizona residents to check their eligibility and status to receive up to 750 in tax rebates By abc15 staff Posted at It is inequitable because approximately 75 of Arizonans who received a tax rebate payment had a tax liability in excess of the rebate amount she said Mayes cited figures saying that Arizonans who claimed a rebate had an average tax liability of about 1 700 for the year the rebate was claimed against an average rebate amount of 370

Guide To Arizona Charitable Tax Credit AZ Tax Credits

https://childrenscareaz.org/wp-content/uploads/2022/03/Guide-to-Arizona-Charitable-Tax-Credit.jpg

Arizona Tax Credit How Tos A Quick Guide

https://childrenscareaz.org/wp-content/uploads/2022/03/Arizona-Tax-Credit-How-Tos-Your-Ultimate-Guide-Banner.jpg

https://azdor.gov/sites/default/files/2024-01/ind_updates-2401.pdf

Note that the rebate is not subject to Arizona income tax and should be subtracted from your federal adjusted gross income on your 2023 Arizona individual income tax return ADOR will provide taxpayers with Form 1099 MISC online on and after January 31 2024 by visiting azdor gov arizona families tax rebate and clicking on View my 1099 MISC

https://www.kiplinger.com/taxes/irs-will-tax-arizona-families-rebate

The EV Tax Credit Changed Again New Year s Day What to Know Tax Credits The federal tax credit for electric vehicles has changed again for 2024 Here s what you need to know if you want to

When Can I Contribute To Arizona Tax Credit For 2016

Guide To Arizona Charitable Tax Credit AZ Tax Credits

Arizona Charitable Tax Credit

Low Income Housing Tax Credit Program 2017 Qualified Allocation Plan Arizona Memory Project

The Arizona Charitable Tax Credit Explained YouTube

Arizona Foster Care Tax Credit Information The Center

Arizona Foster Care Tax Credit Information The Center

Tax Credits Save You More Than Deductions Here Are The Best Ones

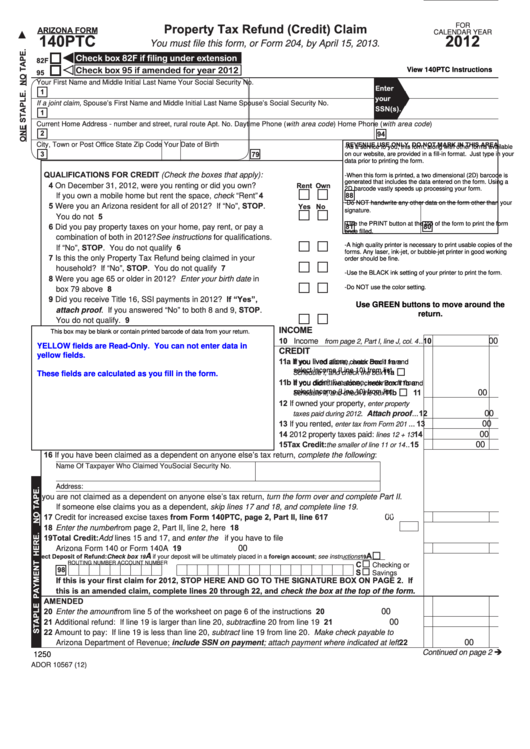

Fillable Arizona Form 140ptc Property Tax Refund Credit Claim 2012 Printable Pdf Download

Revenue Impact Of Arizona s Tax Expenditures FY 2006 07 Preliminary Arizona Memory Project

Arizona Tax Credit Rebate 2024 - The announcement comes over five months after the Arizona Families Tax Rebate was signed into law as part of the Fiscal Year 2024 state budget Hobbs calls the rebate the first of its kind saying