Arkansas Sales Tax Rebate Web The form may be obtained by contacting the Sales and Use Tax Section by telephone at 501 682 7105 or may be downloaded from the Sales Tax website at and selecting

Web The state of Arkansas has historically capped local sales tax paid to suppliers on business purchases with invoices exceeding 2 500 In recent years the state reduced the statute Web 22 f 233 vr 2020 nbsp 0183 32 Except as provided in Subdivision B 4 the rebate applies to any local sales or use tax collected by the Director pursuant to any state tax law authorizing a

Arkansas Sales Tax Rebate

Arkansas Sales Tax Rebate

https://www.pdffiller.com/preview/100/468/100468923/large.png

Arkansas Resale Certificate PDF Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/0/100/100431/large.png

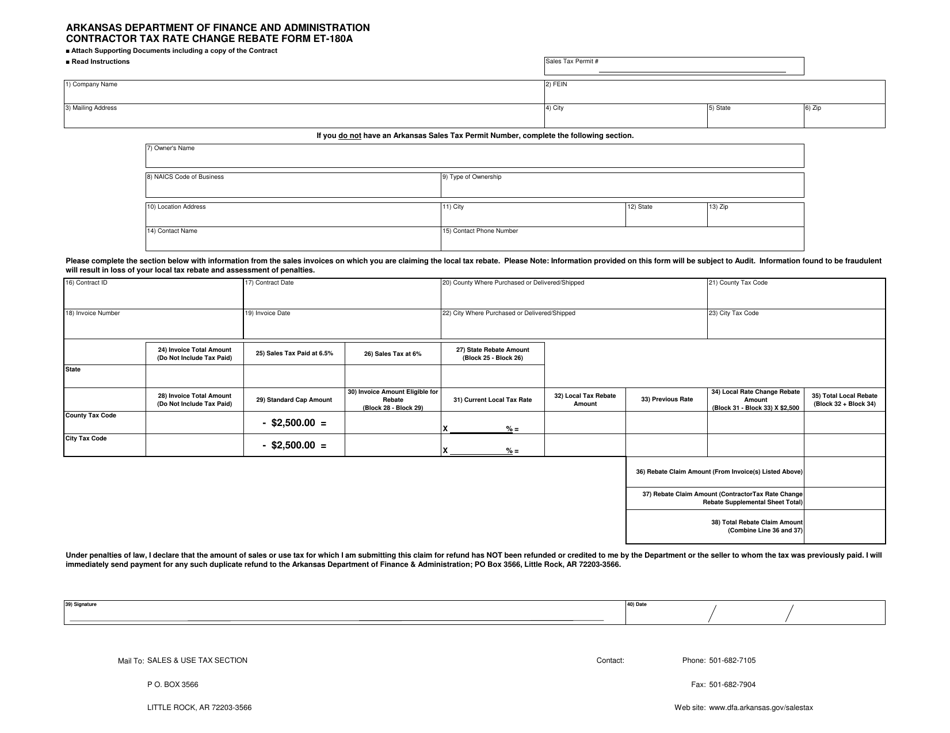

Form ET 180A Download Printable PDF Or Fill Online Contractor Tax Rate

https://data.templateroller.com/pdf_docs_html/2108/21087/2108788/form-et-180a-contractor-tax-rate-change-rebate-form-arkansas_print_big.png

Web Sales and Use Tax Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws This includes Sales Use Aviation Sales and Use Web Act 1404 of 2013 as codified in 167 167 26 52 447 26 53 149 and 15 4 3501 establishes two options by which certain state sales and use taxes relating to the partial replacement

Web 28 janv 2020 nbsp 0183 32 Response Two questions are presented for opinion response First you question whether Taxpayer may claim a rebate pursuant to the provisions of Arkansas Web Effective January 1 2022 Act 776 Provides that the Department prepare and deliver a report of the awarded amounts of credit or rebate of sales and use tax in Ark Code 167 167

Download Arkansas Sales Tax Rebate

More picture related to Arkansas Sales Tax Rebate

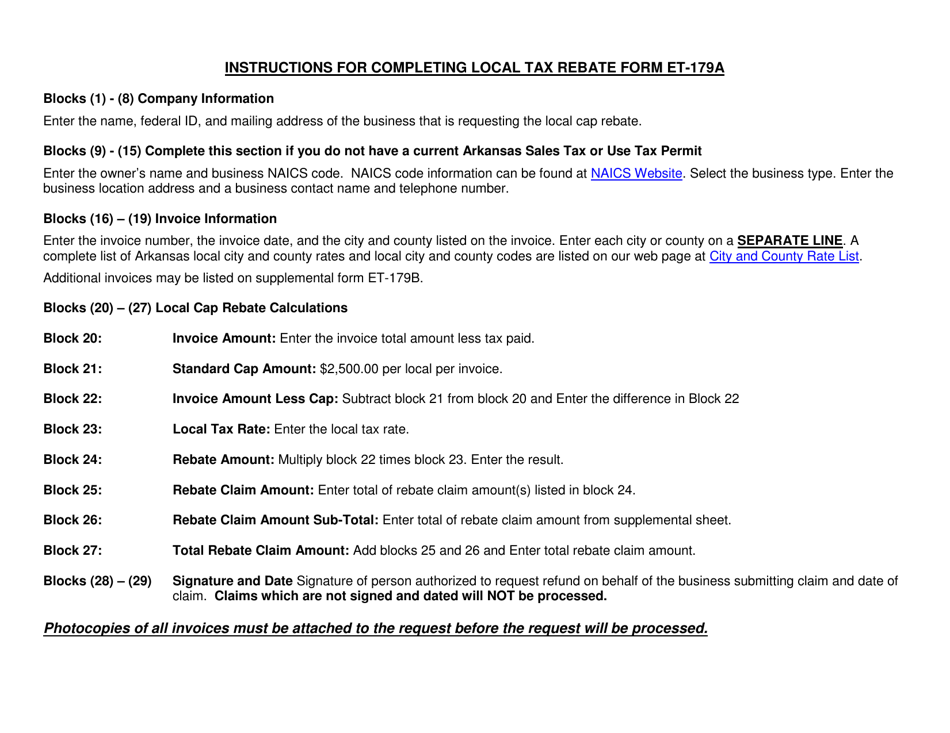

Form ET 179A Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2114/21148/2114813/page_2_thumb_950.png

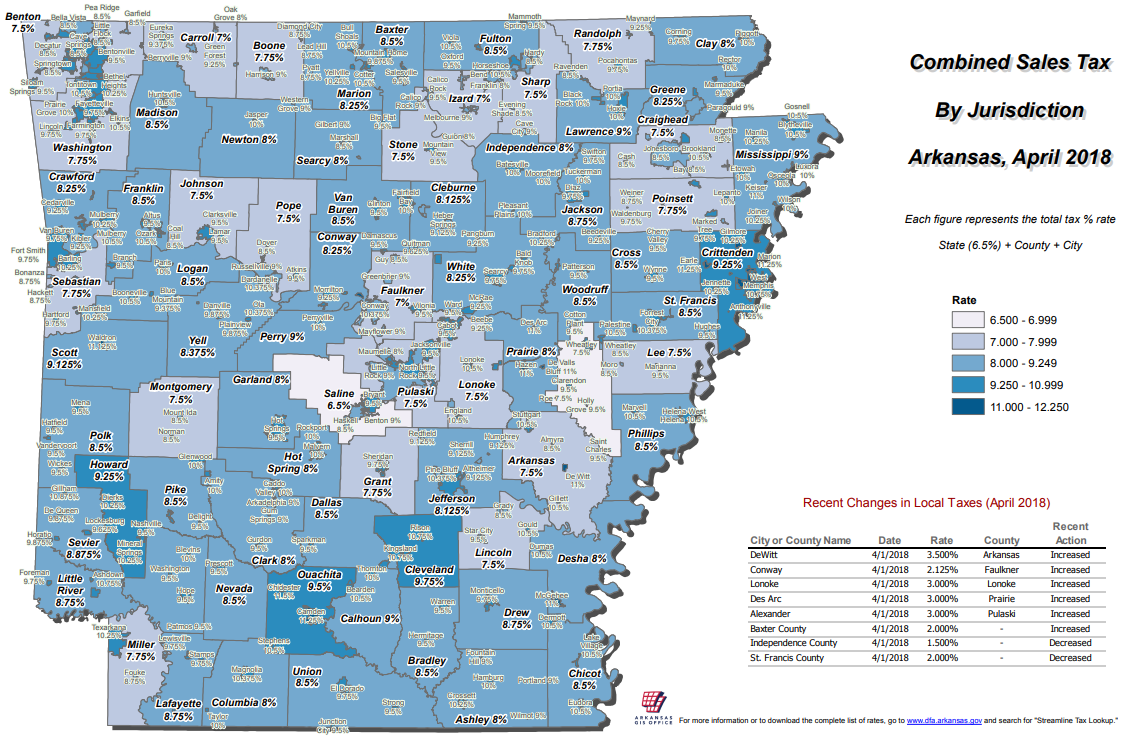

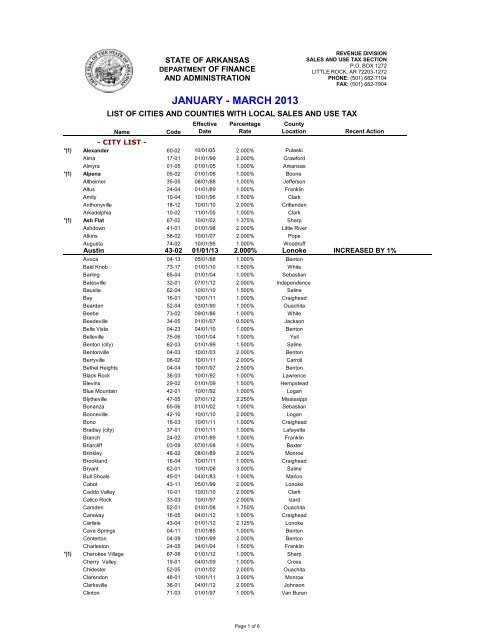

Arkansas Sales And Use Tax Rates April 2018 Arkansas GIS Office

https://gis.arkansas.gov/wp-content/uploads/2018/03/aprilsalestax.png

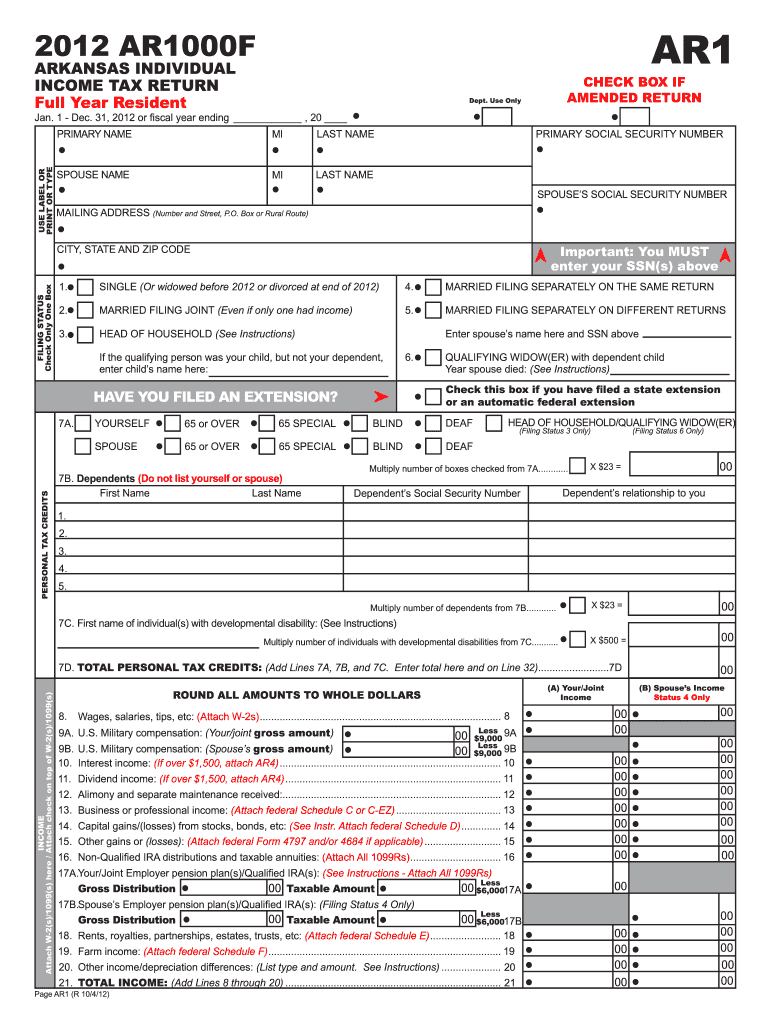

Arkansas Form Tax Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/97/100097555/large.png

Web Currently combined sales tax rates in Arkansas range from 6 5 percent to 11 5 percent depending on the location of the sale As a business owner selling taxable goods or Web Eligible computer related businesses must derive at least 51 of their revenue from out of state sales and pay an average in excess of 125 of the lesser of the state or county

Web Local Tax Distribution by NAICS The Local Distribution by NAICS Report reflecting monthly tax collection statistical information local tax rebates issued and audit Web Aaron Giles Apr 11 2022 Arkansas Sales Tax Exemptions Act 465 Act 465 will significantly change the Arkansas sales and use tax exemptions available to

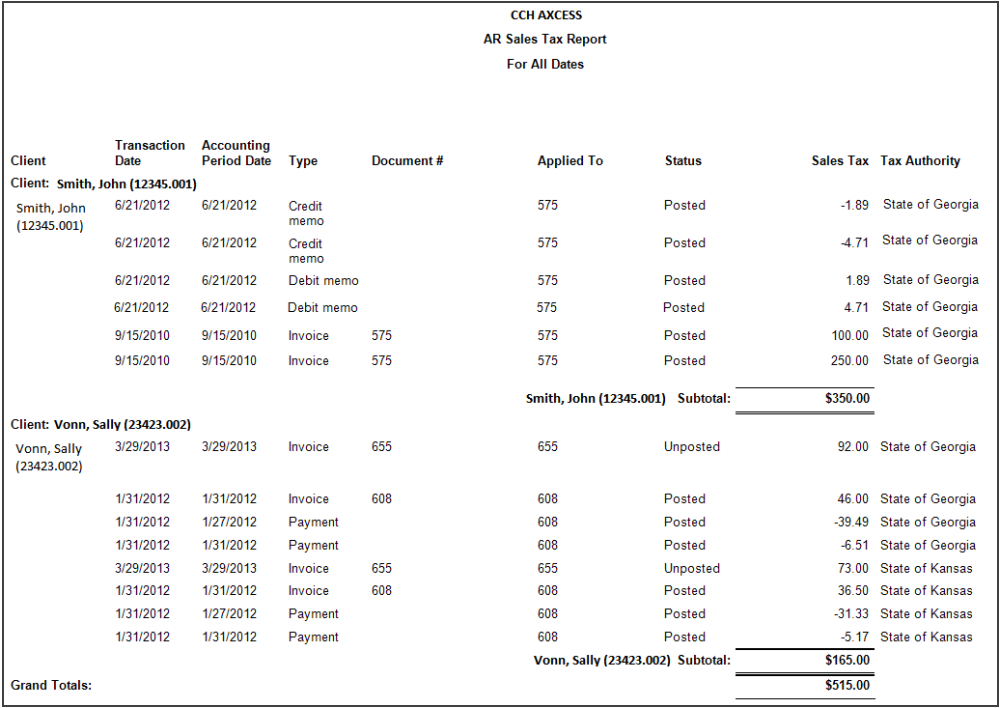

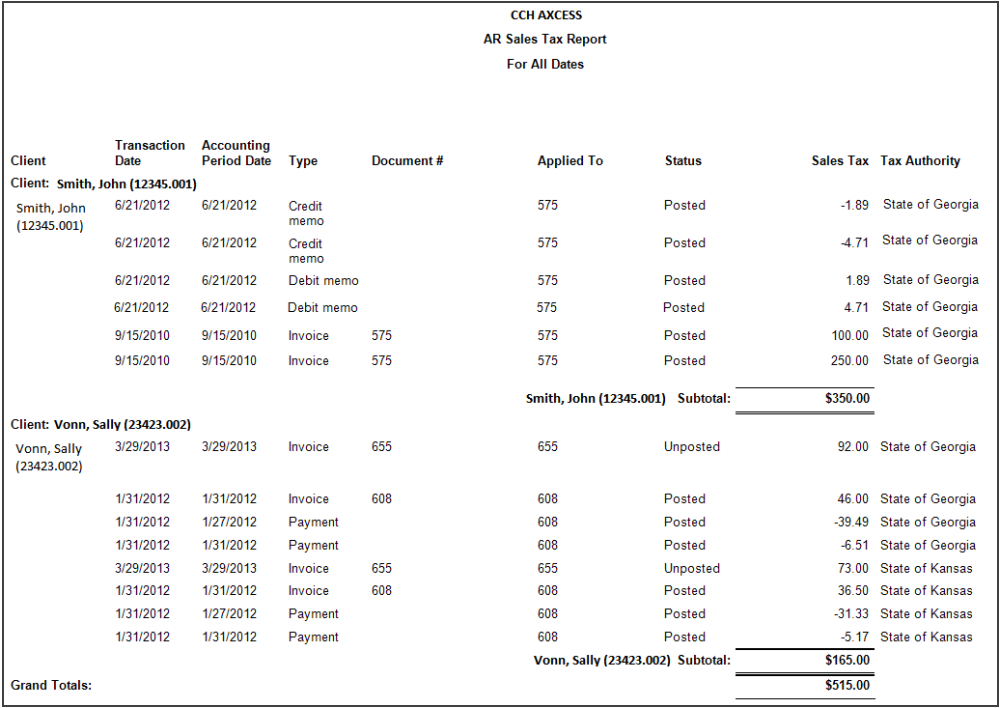

AR Sales Tax

https://z003download.cchaxcess.com/PfxBrowserHelp/ReportsMgr/Content/Resources/Images/AR Sales Tax.png

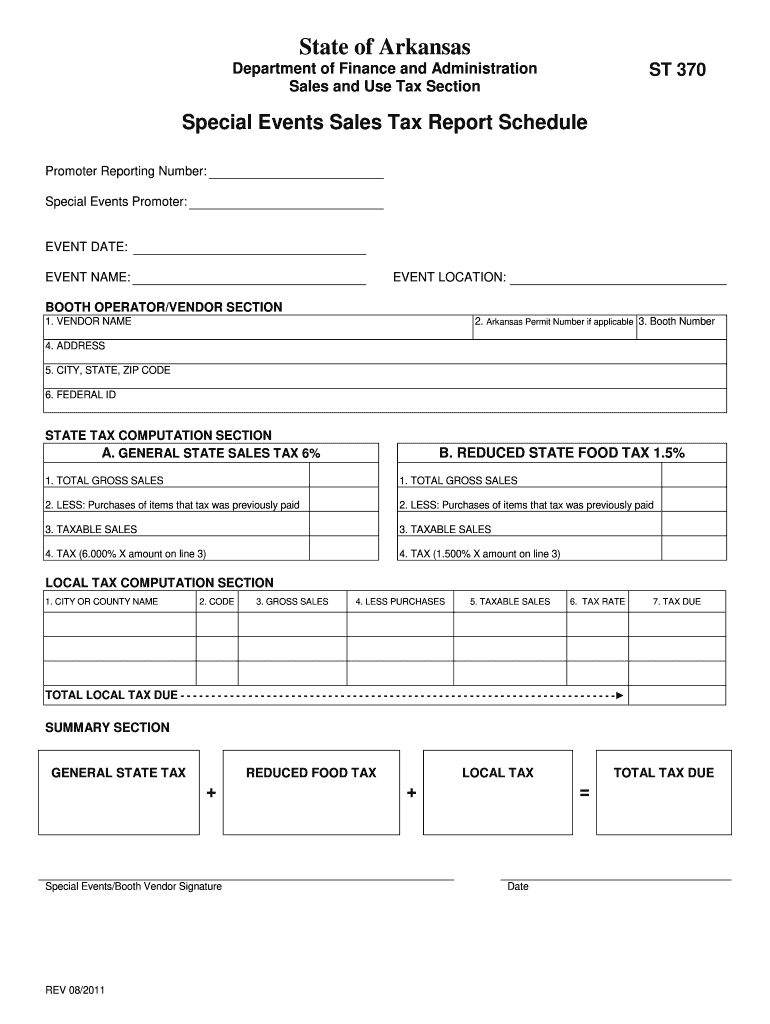

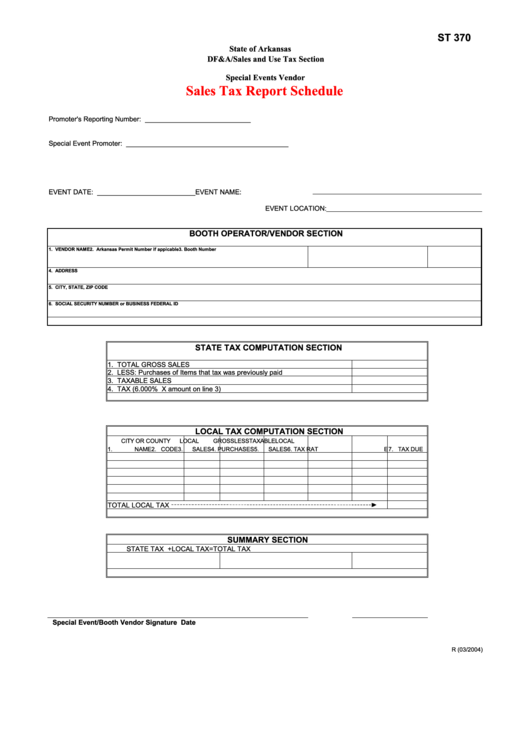

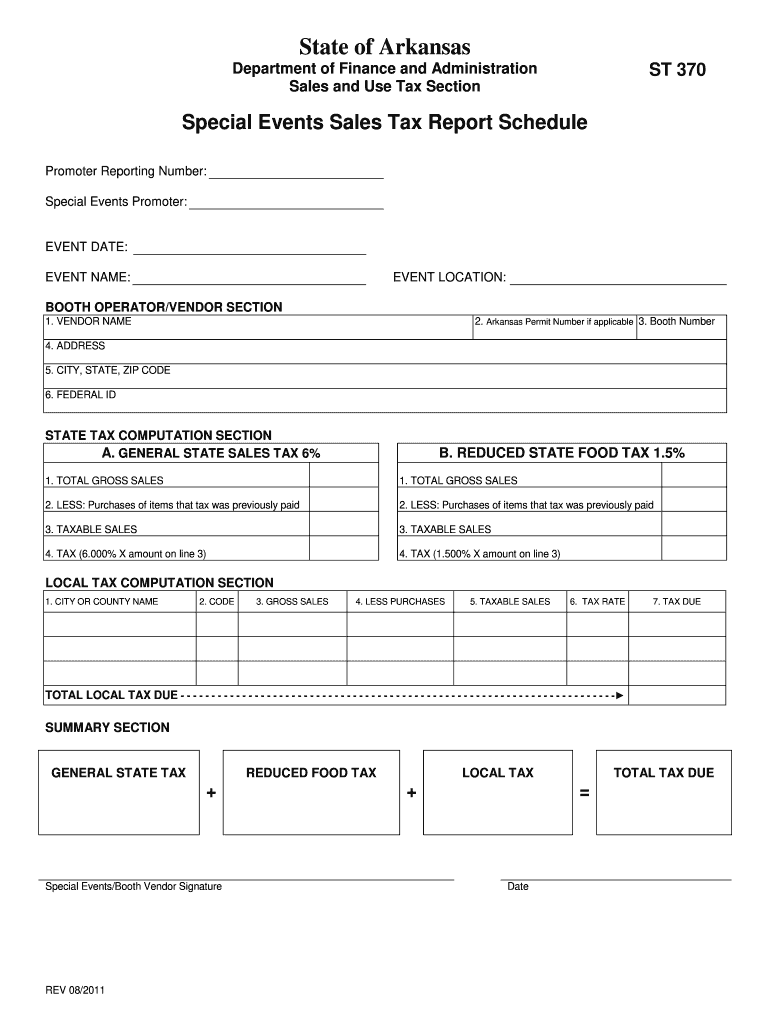

Fillable St 370 Sales Tax Report Schedule Arkansas Printable Pdf

https://data.formsbank.com/pdf_docs_html/172/1722/172242/page_1_thumb_big.png

https://www.dfa.arkansas.gov/excise-tax/sales-and-use-tax/sales-and...

Web The form may be obtained by contacting the Sales and Use Tax Section by telephone at 501 682 7105 or may be downloaded from the Sales Tax website at and selecting

https://insights.bdo.com/arkansas-local-tax-rebates

Web The state of Arkansas has historically capped local sales tax paid to suppliers on business purchases with invoices exceeding 2 500 In recent years the state reduced the statute

AR Sales Tax Received Report Silvertrek Systems Knowledge Base

AR Sales Tax

Arkansas Exemption Tax Form Fill Out And Sign Printable PDF Template

Checking In On Arkansas Taxes Yep Still High The Arkansas Project

Arkansas Prior Year Warrant Cancellation Refund Rebate Certification

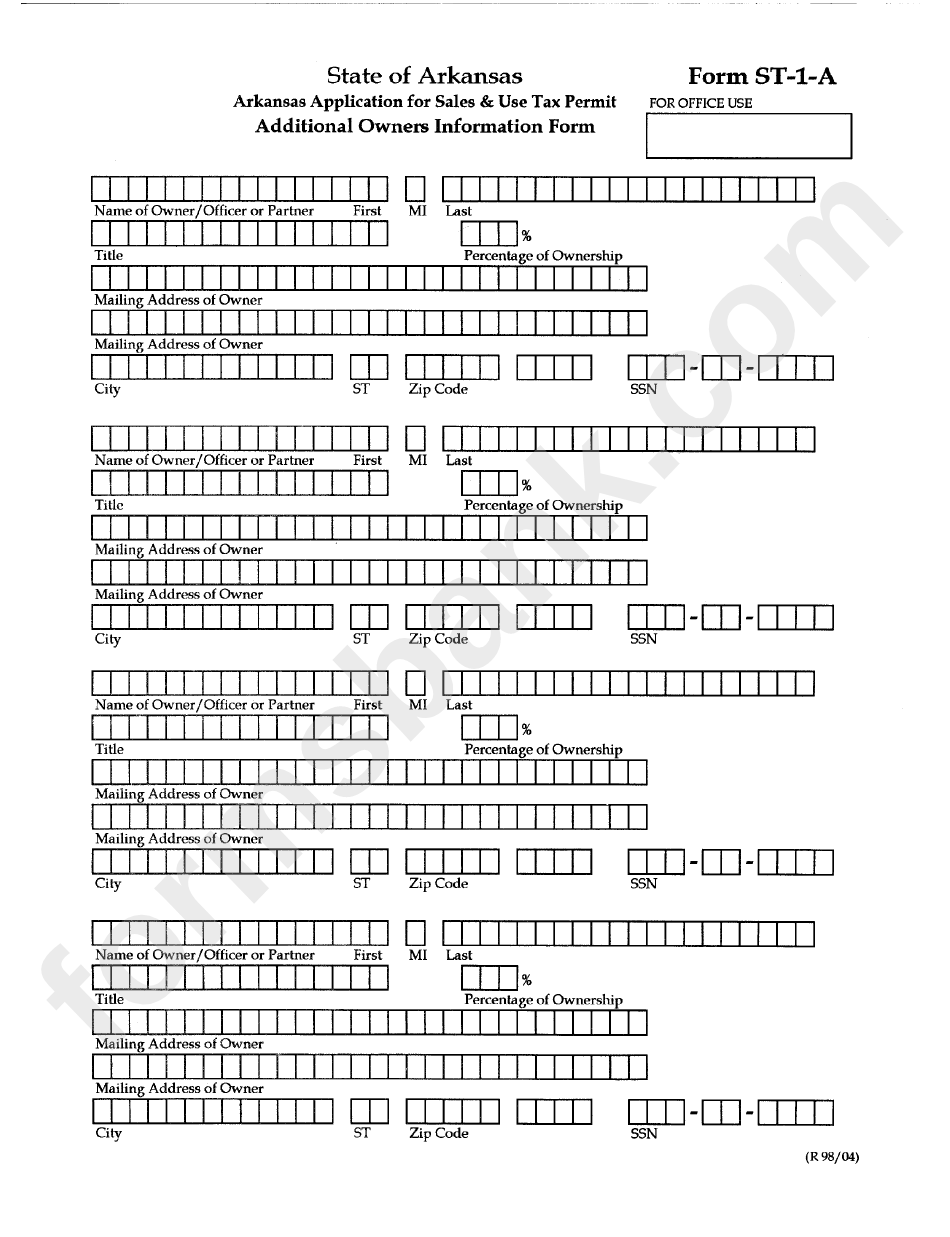

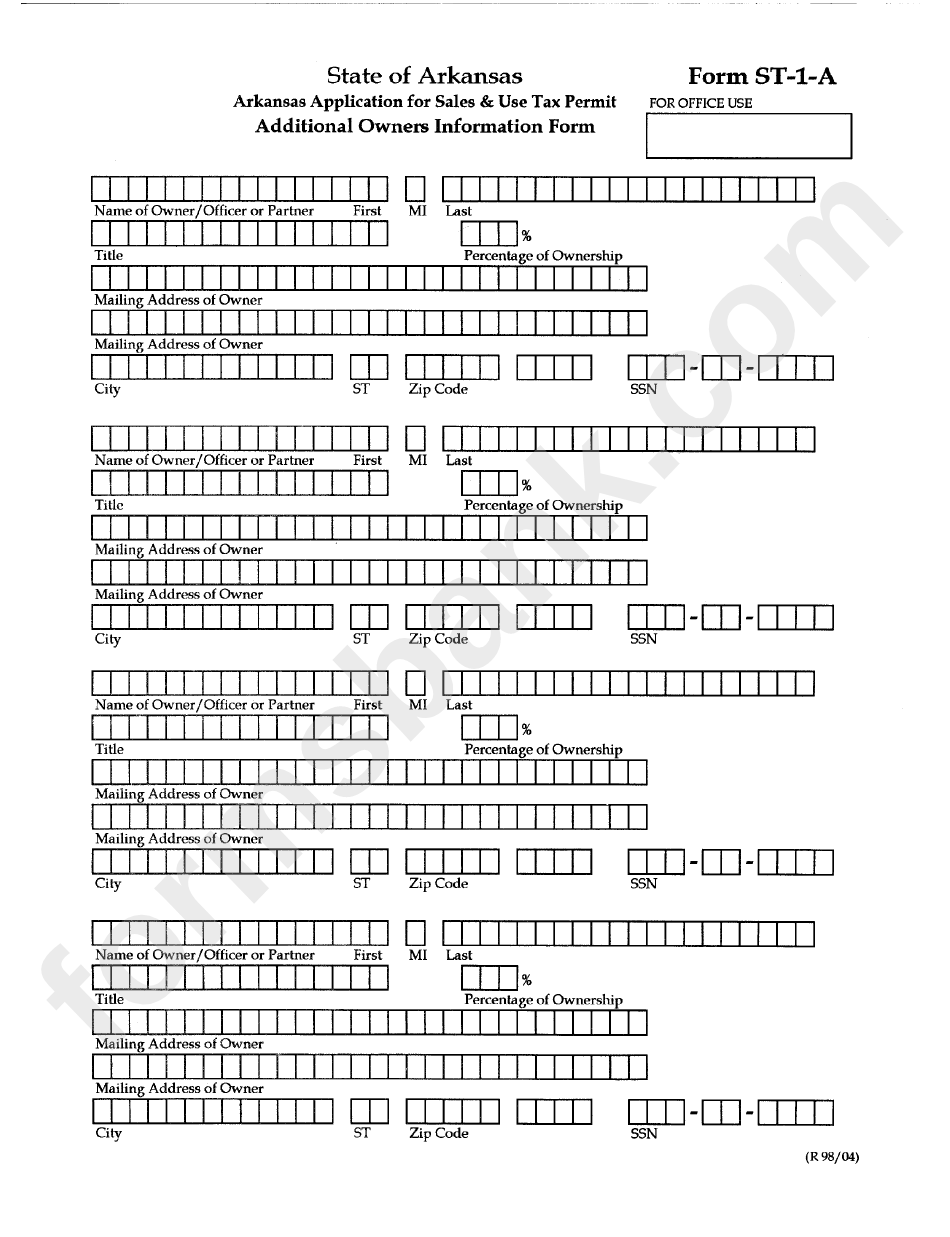

Form St 1 A Arkansas Application For Sales Use Tax Permit

Form St 1 A Arkansas Application For Sales Use Tax Permit

Free Arkansas Vehicle Tax Credit Bill Of Sale Form PDF Word doc

Revenue Department Wynne Ar REVNEUS

Arkansas Excise Tax Return Et 1 Form Fill Out Sign Online DocHub

Arkansas Sales Tax Rebate - Web The Arkansas compensating use tax of 6 5 is levied on tangible personal property purchased from outside the state of Arkansas for use storage or consumption within the