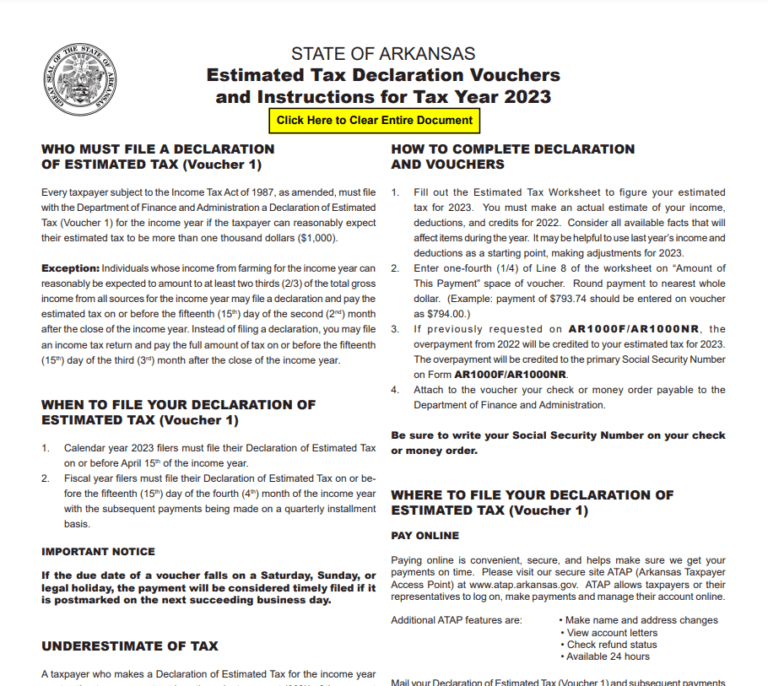

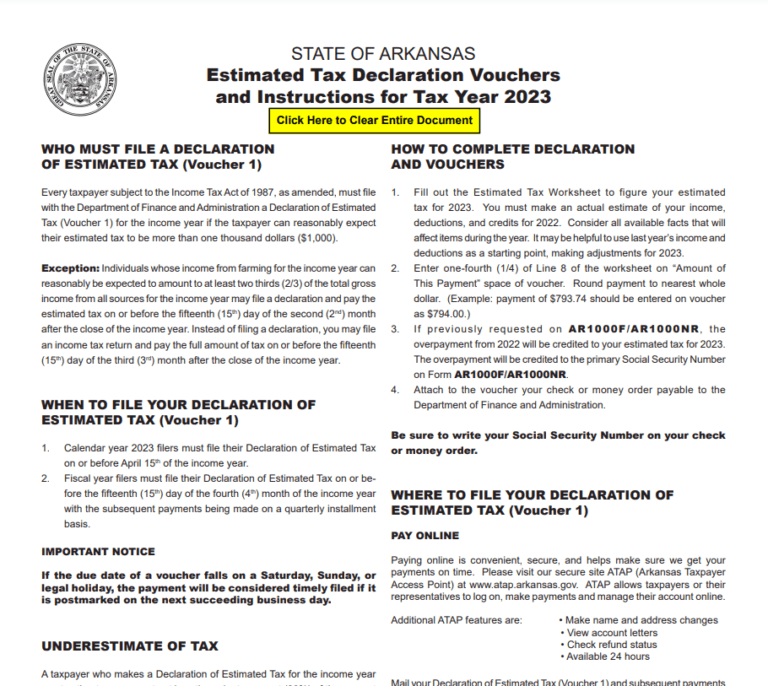

Arkansas Tax Rebate 2024 The tax credit from Arkansas will be effective only for tax year 2023 and will come into effect in January 2024 It is a non refundable credit meaning taxpayers can t get it back as a tax refund rather it can only be used to reduce the taxes owed Unlike the income tax credit the 150 tax credit is retroactive to tax year 2023

Additionally all Arkansas corporations with net incomes over 11 000 will pay a tax rate of 4 8 recently reduced from 5 1 in 2024 150 tax credit in Arkansas Unlike the income tax Act 192 This law will change how Arkansas will file taxes It will require people who have an average of 5 000 in gross receipts tax liability or monthly compensating use tax liability per

Arkansas Tax Rebate 2024

Arkansas Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2022/06/Arkansas-Income-Tax-Calculator-taxuni-1.jpg

Arkansas Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Arkansas-Tax-Rebate-2023-768x686.png

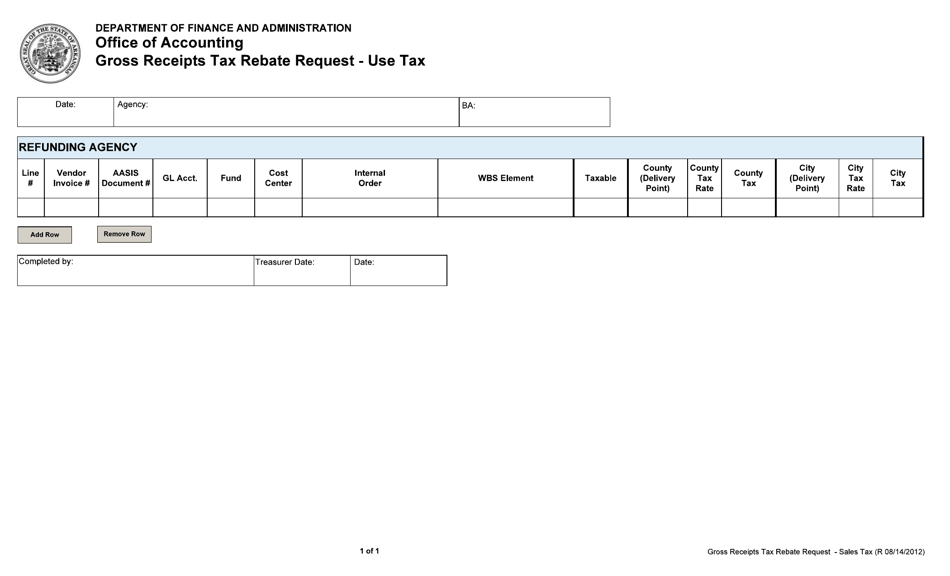

Arkansas Gross Receipts Tax Rebate Request Use Tax Download Fillable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/2083/20839/2083970/gross-receipts-tax-rebate-request-use-tax-arkansas_print_big.png

If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to know now The IRS has weighed in on State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both

Entergy offers residential customers in Arkansas up to a 250 rebate for the purchase of a qualifying home EV charge station Visit our EV community on Facebook to connect with other electric vehicle owners in your area and find out if specific offers are available 01 04 2024 AR OI Other Income Loss and Depreciation Differences Instructions 01 04 2024 AR1000V Individual Income Tax Payment Voucher 01 04 2024 AR1075 Deduction for Tuition Paid to Post Secondary Educational Institutions 01 04 2024 Tax Tables 01 04 2024 Tax Brackets 2023 01 04 2024 Additional Tax Credit for Qualified Individuals

Download Arkansas Tax Rebate 2024

More picture related to Arkansas Tax Rebate 2024

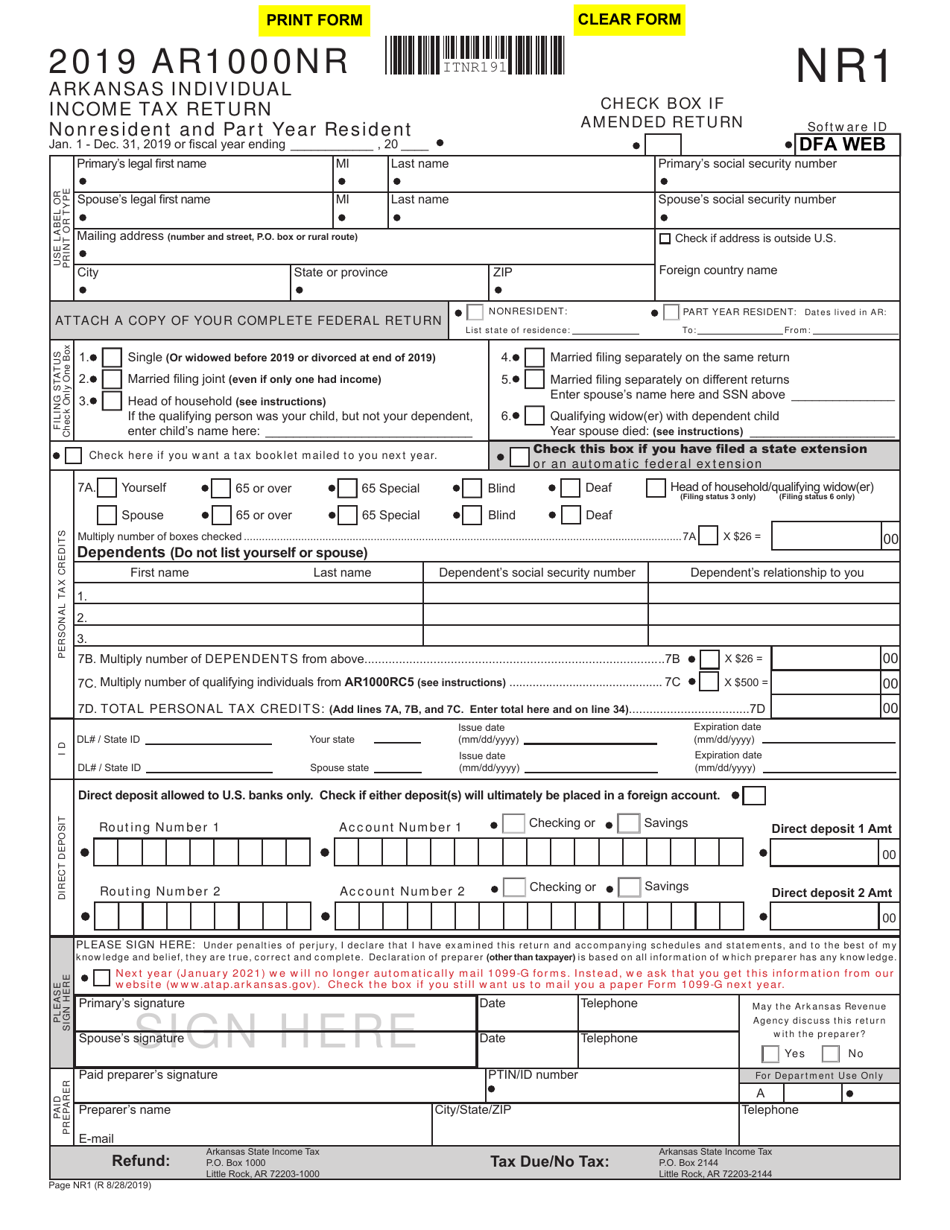

Arkansas Income Tax Forms Fillable Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2022/20223/2022319/form-ar1000nr-arkansas-individual-income-tax-return-nonresident-and-part-year-resident-arkansas_print_big.png

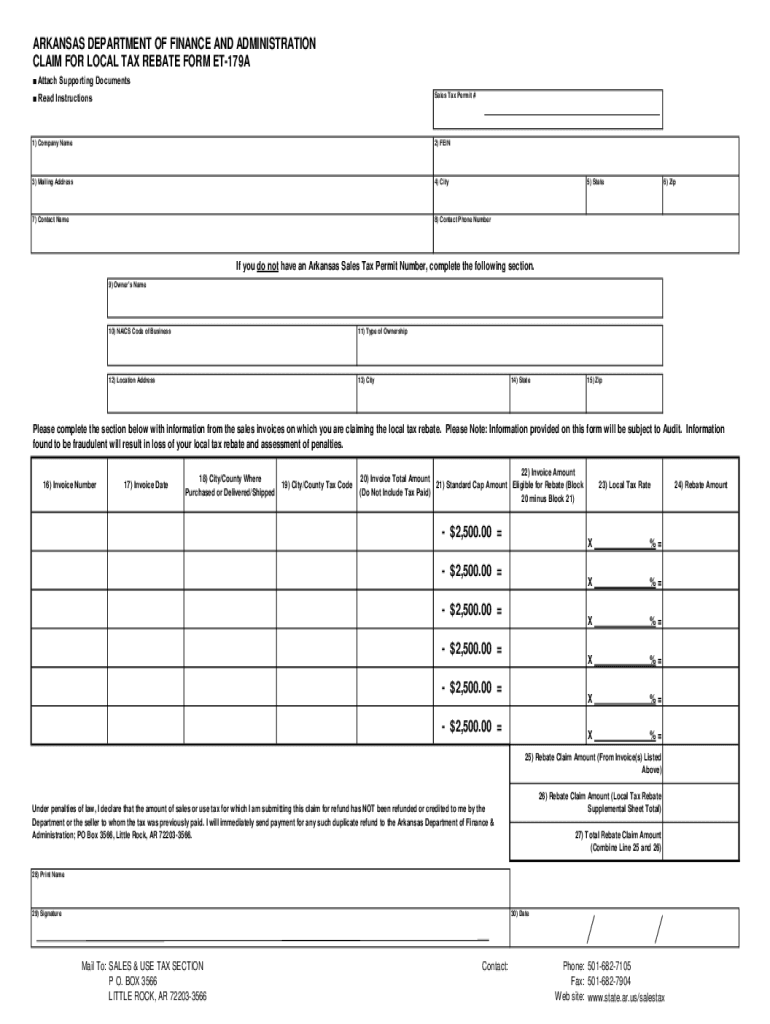

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/620/550/620550056/large.png

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

The rate changes take effect in 2024 and the 150 credit is for 2023 By permanently reducing the personal and corporate income tax rates the legislature would achieve another goal of right sizing the Arkansas tax system for current spending levels The standard deduction for a Single Filer in Arkansas for 2024 is 2 340 00 Arkansas Single Filer Tax Tables For those who annual gross income is less than 84 500 00 in 2024 For those who annual gross income is greater than 84 500 00 in 2024 Arkansas Married Joint Filer Standard Deduction

Use this tool to find Arkansas tax credits incentives and rebates that may apply to your purchase or lease of an electric vehicle 2024 Clean Vehicle Tax Credits may be initiated and September 20 2023 2023 1569 Arkansas lowers personal income and corporate tax rates starting in 2024 On September 15 2023 Governor Sarah Huckabee Sanders signed into law SB 8 which effective January 1 2024 lowers the top personal tax rate from 4 7 to 4 4 and reduces the top corporate tax rate from 5 1 to 4 8 for domestic and

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.valuewalk.com/150-tax-credit-from-arkansas-coming-january/

The tax credit from Arkansas will be effective only for tax year 2023 and will come into effect in January 2024 It is a non refundable credit meaning taxpayers can t get it back as a tax refund rather it can only be used to reduce the taxes owed Unlike the income tax credit the 150 tax credit is retroactive to tax year 2023

https://www.kiplinger.com/taxes/arkansas-tax-cut-bill

Additionally all Arkansas corporations with net incomes over 11 000 will pay a tax rate of 4 8 recently reduced from 5 1 in 2024 150 tax credit in Arkansas Unlike the income tax

Don t Forget Tax free Weekend In Arkansas Axios NW Arkansas

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

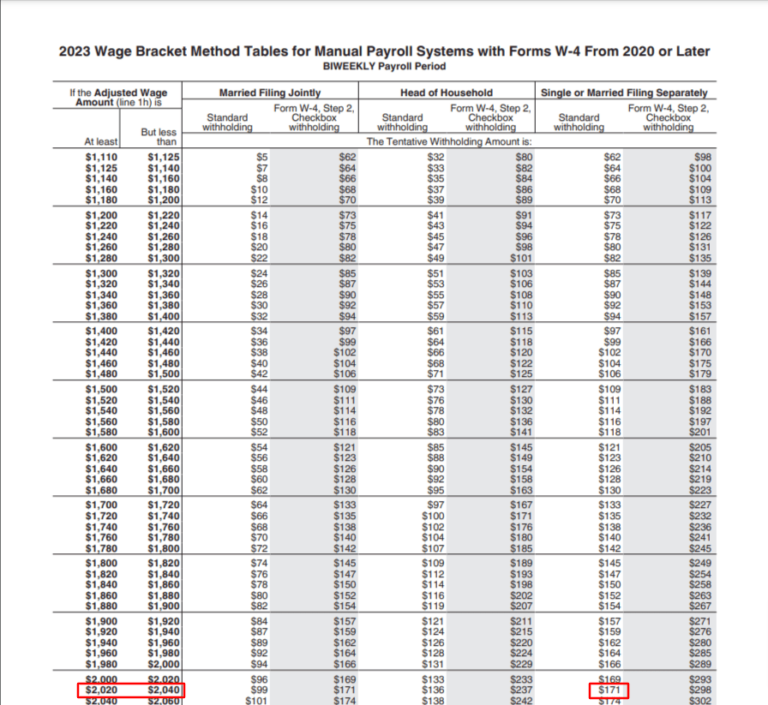

Arkansas Withholding Tax Formula 2023 Printable Forms Free Online

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

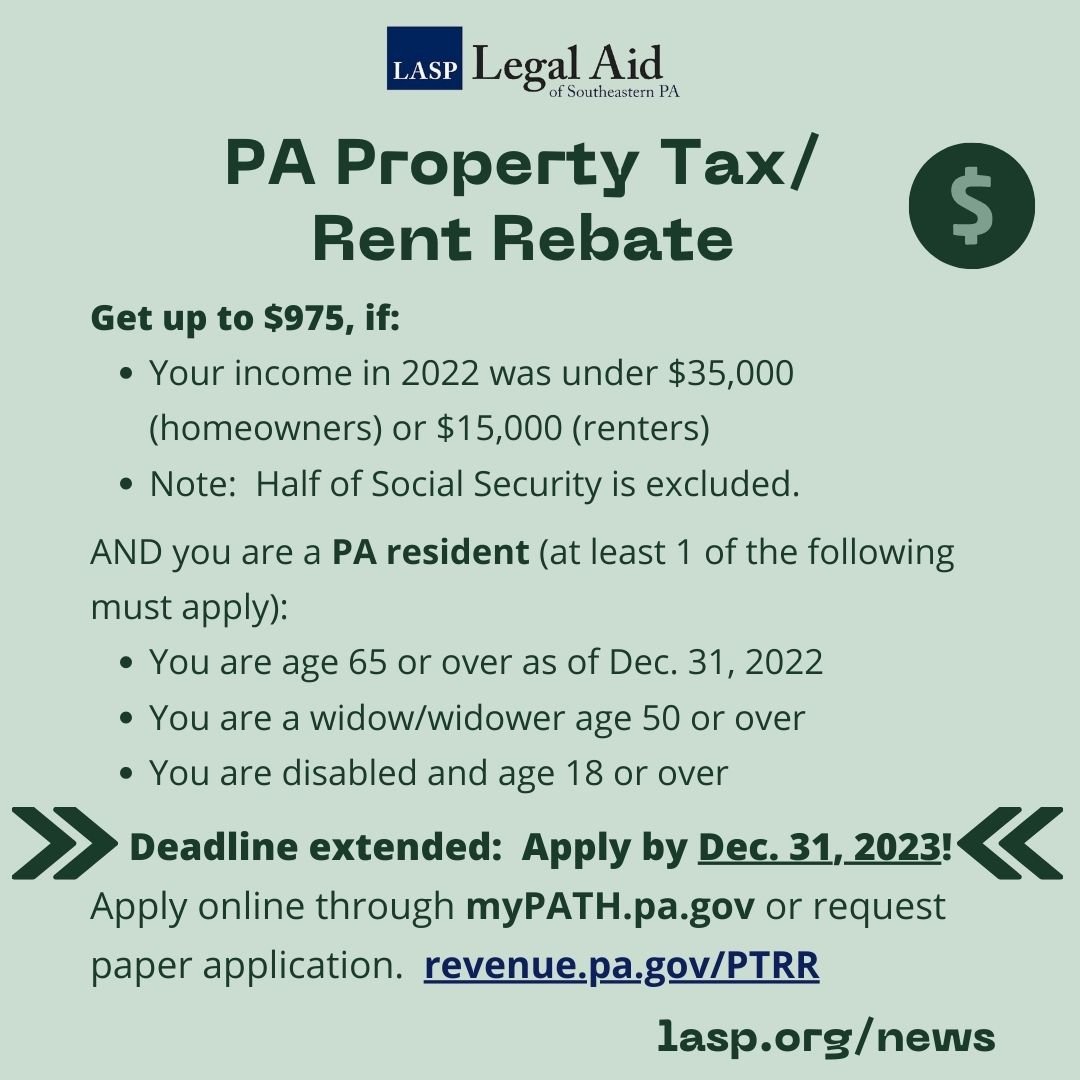

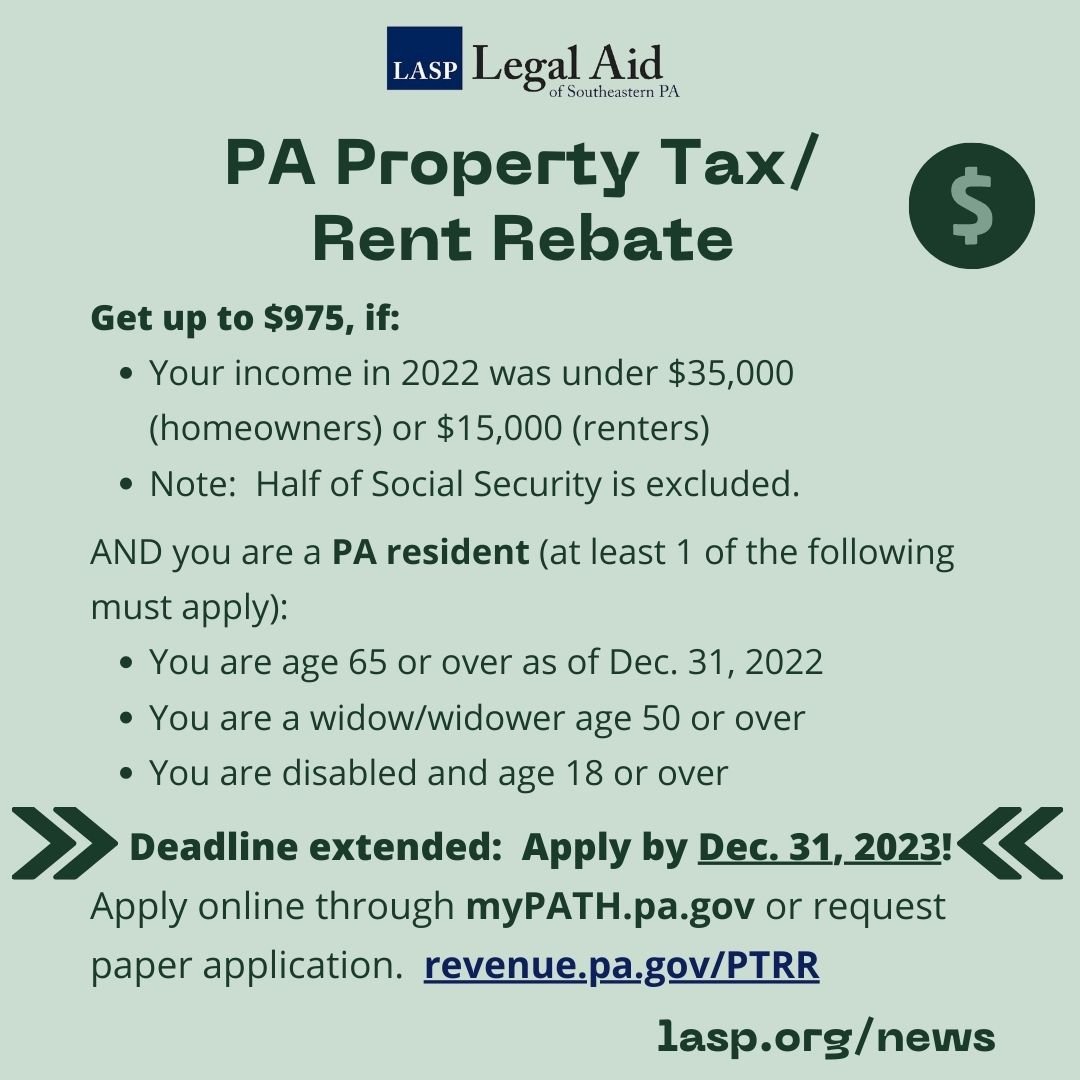

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Property Tax Rebate Pennsylvania LatestRebate

Blog Topsheet

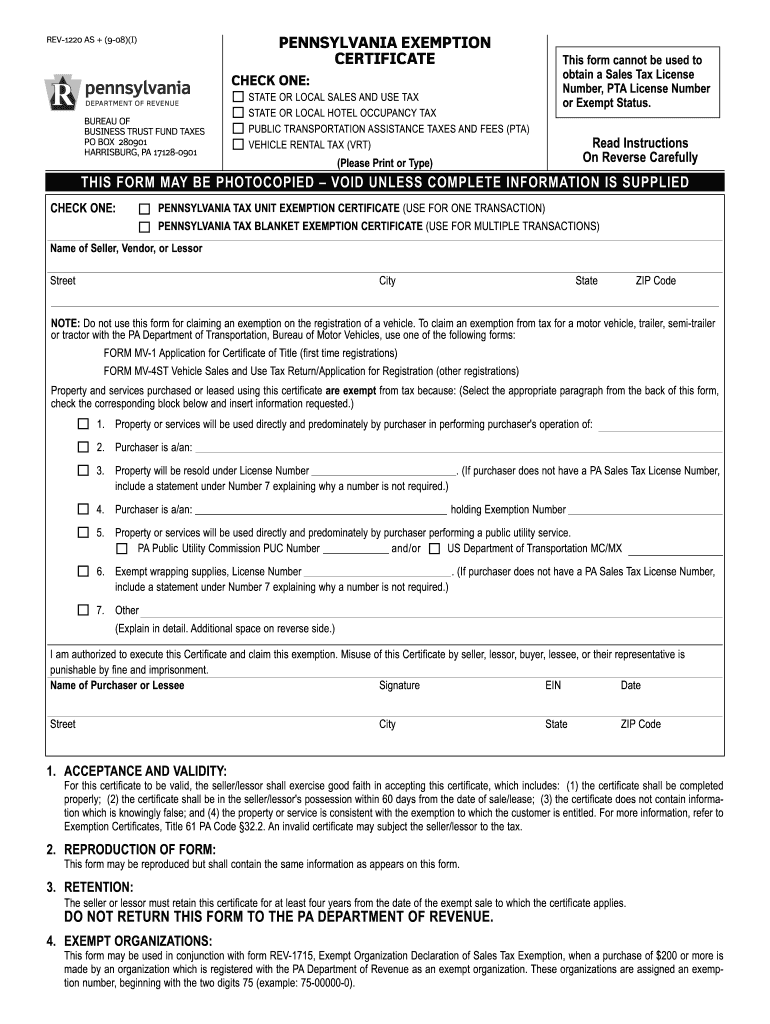

2023 Tax Exemption Form Pennsylvania ExemptForm

Arkansas Tax Rebate 2024 - The Arkansas Department of Finance and Administration s Taxpayer Access Point ATAP service is an online platform designed to streamline the tax filing process for Arkansas taxpayers The ATAP service allows taxpayers to file and pay taxes online view their tax account information and communicate with the department The system is user