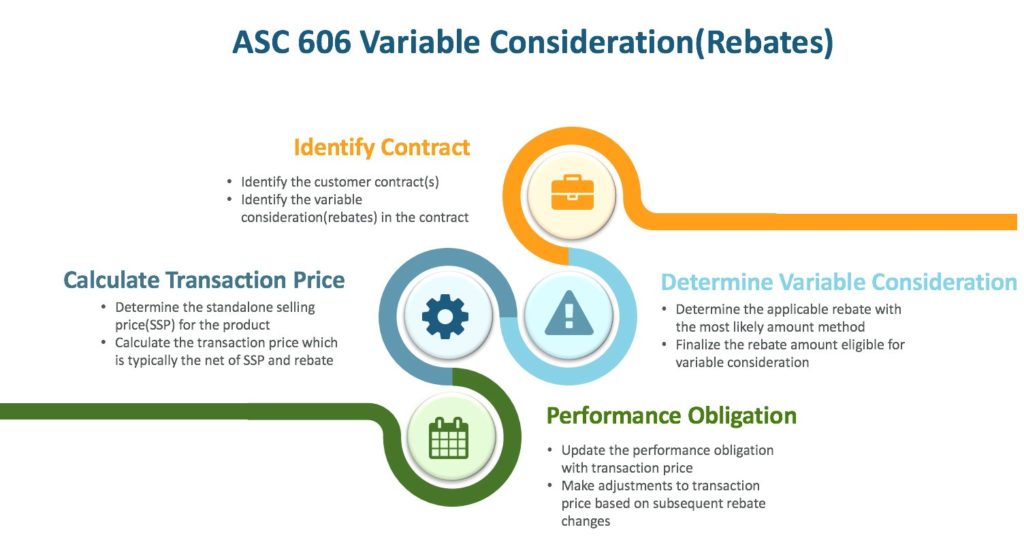

Asc 606 Vendor Rebates Web 4 3 Variable consideration Publication date 31 Oct 2022 us Revenue guide 4 3 The revenue standard requires a reporting entity to estimate the amount of variable consideration to

Web 21 juil 2020 nbsp 0183 32 This publication summarizes the requirements of ASC 606 and provides questions for companies to consider Overview Companies may need to make Web Revenue recognition within the software industry has historically been highly complex with much industry specific guidance The new revenue standards ASC 606 and IFRS 15

Asc 606 Vendor Rebates

Asc 606 Vendor Rebates

https://gbq.com/wp-content/uploads/2018/03/Revenue-Recognition-ASC-606-Placemat-1.jpg

How To Determine Variable Consideration Rebates For ASC 606

https://media.licdn.com/dms/image/C5612AQE3oYtEhG2Yyw/article-cover_image-shrink_720_1280/0/1520180712215?e=2147483647&v=beta&t=TVCsW24mAzqAOrDKF0TA9sYOUIu-1z1ug2Sv4FOqRZA

Supplier Rebate Agreement Template

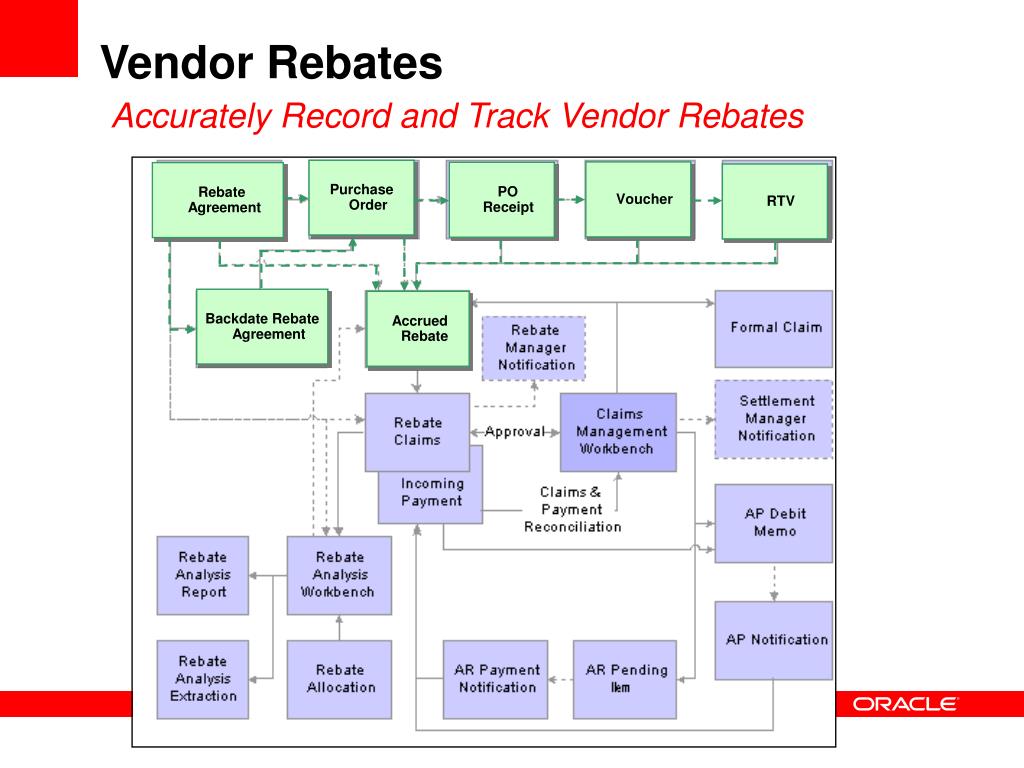

https://image1.slideserve.com/2924033/vendor-rebates-accurately-record-and-track-vendor-rebates-l.jpg

Web ASC 606 10 55 84 If an entity recognizes revenue for the sale of a product on a bill and hold basis the entity should consider whether it has remaining performance obligations for example for custodial services in Web 1 d 233 c 2020 nbsp 0183 32 4 50 Consideration paid to a customer ASC 606 Angela explains the vendor s accounting when payments are made to a customer touching on related

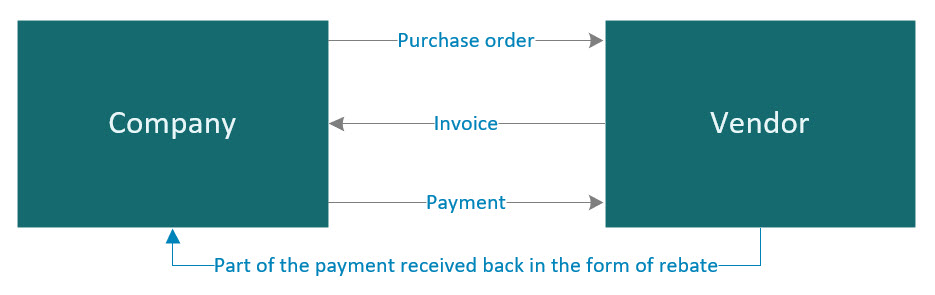

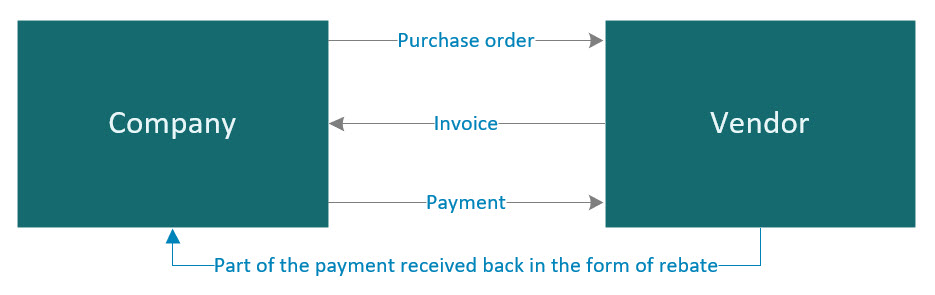

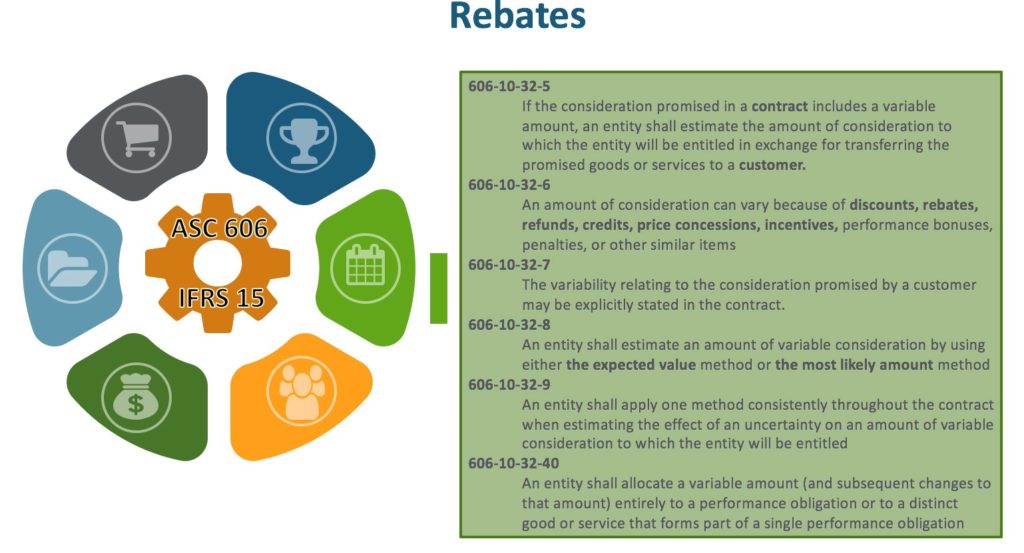

Web 2 oct 2017 nbsp 0183 32 Because rebates are a future consideration promised to customers they are treated as variable consideration in ASC 606 The following are the provisions in the standard that give guidance Web Our FRD publication on ASC 606 Revenue from Contracts with Customers has been updated to enhance and clarify our interpretative guidance Appendix A summarizes the

Download Asc 606 Vendor Rebates

More picture related to Asc 606 Vendor Rebates

Accounting For Vendor Rebates Procedures Challenges

https://uploads-ssl.webflow.com/60e3caa50ec2a701bbf83598/624d0b0723154505a6bb1d1d_Untitled design-67-min.jpg

How To Choose The Right Vendor To Automate ASC 606 IFRS 15 Zuora

https://www.zuora.com/wp-content/uploads/2022/07/2377_MGI_x_Zuora_Webinar_Organic_Social_1200x627_Live-1.png

Accounting For Vendor Rebates Procedures Challenges

https://no-cache.hubspot.com/cta/default/3448054/29aec4f5-68c8-4e58-96b5-89924455a2af.png

Web 11 juil 2019 nbsp 0183 32 Typically rebates are offered in multiple tiers with higher tiers offering larger rebate amounts which will encourage customers to buy more goods and services Because rebates are a future consideration Web The revenue recognition standard ASC 606 provides a comprehensive industry neutral model for recognizing revenue from contracts with customers Read more Welcome

Web Customer payments or consideration payable to the customer per ASC 606 can include rebates discounts or other sales incentives related to the contract These payments will Web Under ASC 606 the transaction price needs to include any and all variable considerations such as rebates contract modifications price concessions or customer incentives

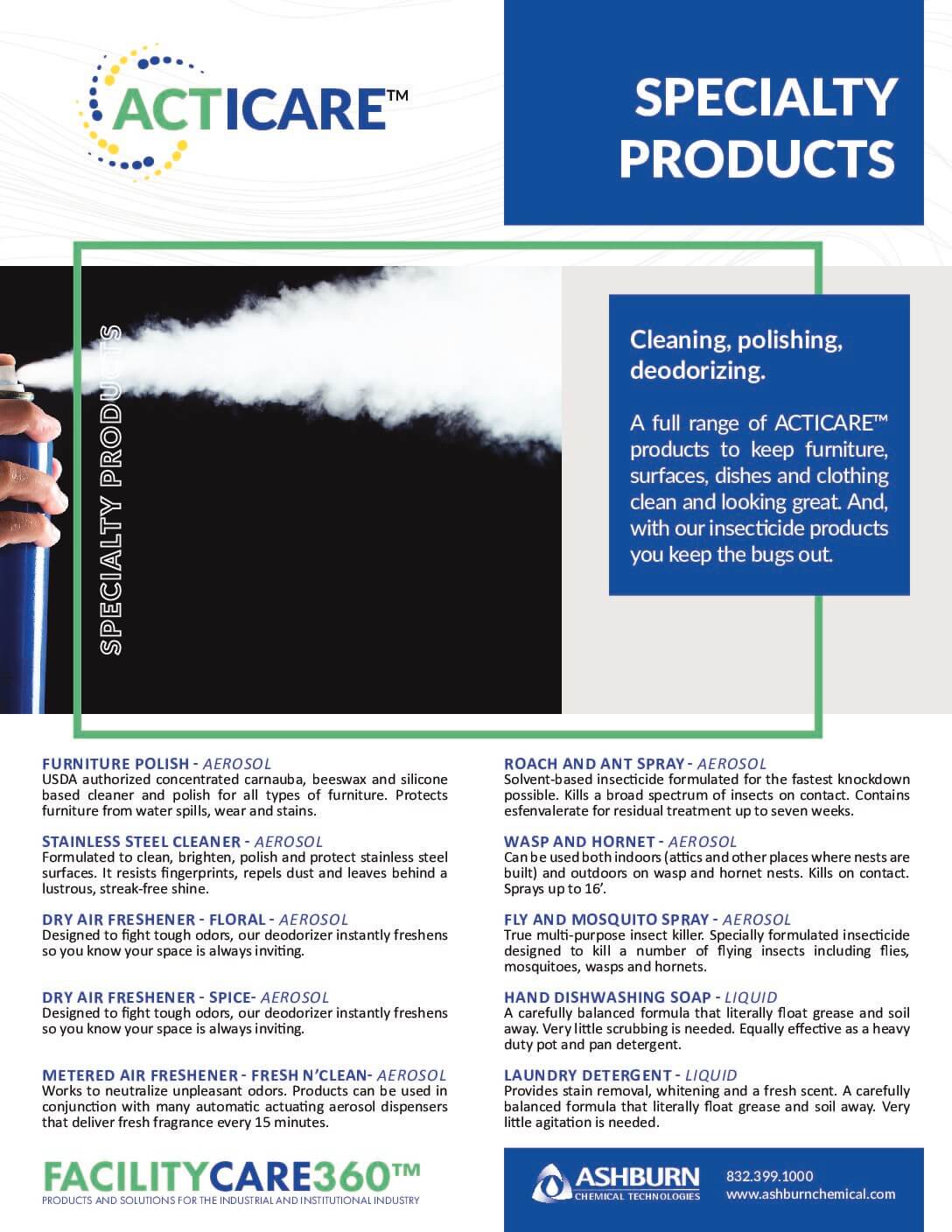

Vendor Rebates Specials Techni Tool Inc

https://www.technitoolinc.com/wp-content/uploads/2022/06/FacilityCare-Specialty-Flyer-03122021-pdf.jpg

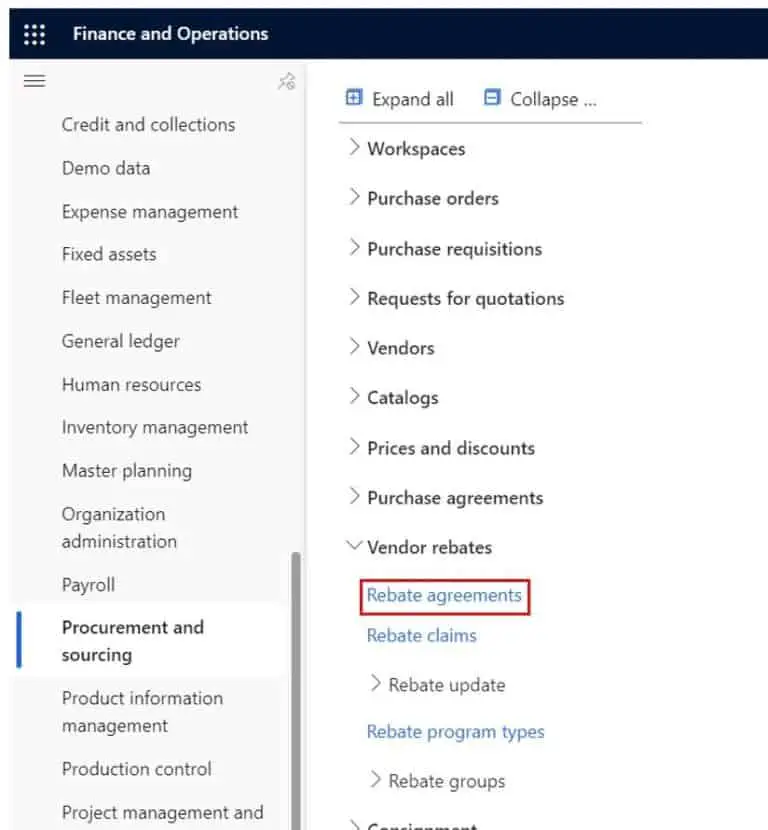

Process Vendor Rebates Dynamics 365 Finance And Operations Dynamics Tips

https://dynamics-tips.com/wp-content/uploads/2020/10/image-514-768x830.jpeg

https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/revenue_from...

Web 4 3 Variable consideration Publication date 31 Oct 2022 us Revenue guide 4 3 The revenue standard requires a reporting entity to estimate the amount of variable consideration to

https://assets.ey.com/content/dam/ey-sites/ey-com/en_us/to…

Web 21 juil 2020 nbsp 0183 32 This publication summarizes the requirements of ASC 606 and provides questions for companies to consider Overview Companies may need to make

How To Determine Variable Consideration Rebates For ASC 606 Ayara

Vendor Rebates Specials Techni Tool Inc

New Mobile App Features Automated Construction Rebates Training Tools

How To Record A Vendor Rebate In QuickBooks Purchase Rebate

How ASC 606 Impacts Sales Commissions Sales Commissions Explained

Silver Bullet Configure Vendor Rebates In Microsoft Dynamics 365 F SCM

Silver Bullet Configure Vendor Rebates In Microsoft Dynamics 365 F SCM

Revenue Recognition Principle ASC 606 Accrual Accounting

How To Determine Variable Consideration Rebates For ASC 606 Ayara

How To Determine Variable Consideration Rebates For ASC 606 Ayara

Asc 606 Vendor Rebates - Web ASC 606 10 55 84 If an entity recognizes revenue for the sale of a product on a bill and hold basis the entity should consider whether it has remaining performance obligations for example for custodial services in