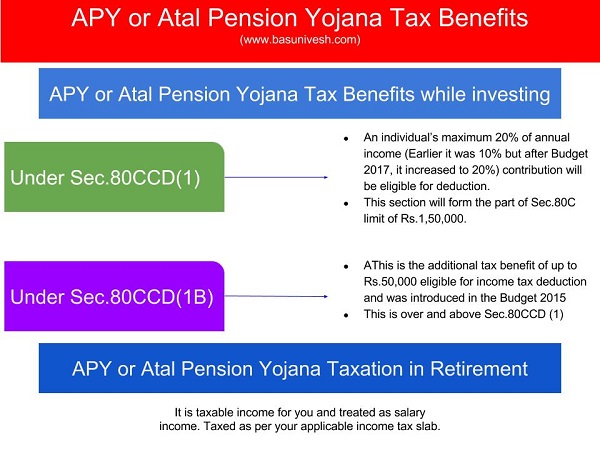

Atal Pension Scheme Income Tax Benefit Web 11 Dez 2023 nbsp 0183 32 What is Section 80CCD Section 80CCD relates to the deductions available to individuals against contributions made to the National Pension Scheme NPS or the Atal Pension Yojana APY Contributions made by employers towards the NPS also come under this section Deductions Under 80CCD 1 and 80CCD 2

Web 14 Sept 2017 nbsp 0183 32 2 APY or Atal Pension Yojana Tax Benefits under Sec 80CCD 1B This is the additional tax benefit of up to Rs 50 000 eligible for income tax deduction and was introduced in the Budget 2015 Introduced in Budget 2015 One can avail the benefit of this Sect 80CCD 1B from FY 2015 16 Web Atal Pension Yojana APY scheme aims to provide pension benefits and social security to the people working in unorganized sector with a minimum contribution per month Read on to know about APY Online Scheme eligibility and benefits

Atal Pension Scheme Income Tax Benefit

Atal Pension Scheme Income Tax Benefit

https://www.personalfinanceplan.in/wp-content/uploads/2017/12/20171212_Atal-Pension-Yojana-Benefits-JPEG-Feature-image.jpg?x85738

Atal Pension Yojana Benefits And Features

http://www.gconnect.in/gc22/wp-content/uploads/2015/06/Atal-Pension-Yojana-Premium.png

Atal Pension Scheme APY Objectives Eligibility Benefits

https://1.bp.blogspot.com/-wiUNYHwQPQA/YDs3FWbXLcI/AAAAAAAABlc/1ozSaUaqHEcP-GO-Wr6Vy7J9577bVfsZwCNcBGAsYHQ/s16000/Atal%2BPension%2BScheme%2B%2528APY%2529%2BObjectives%252C%2BEligibility%2B%2526%2BBenefits.jpg

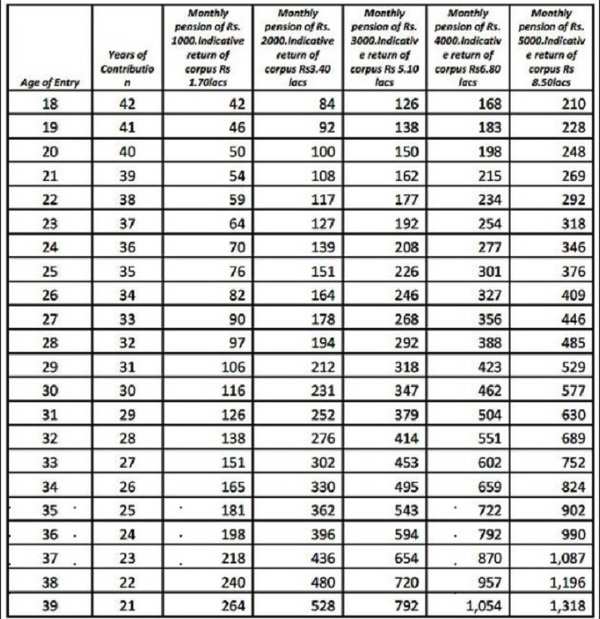

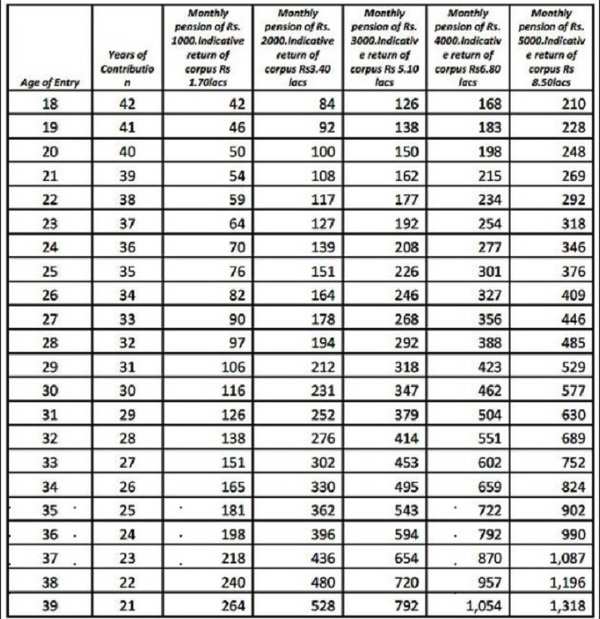

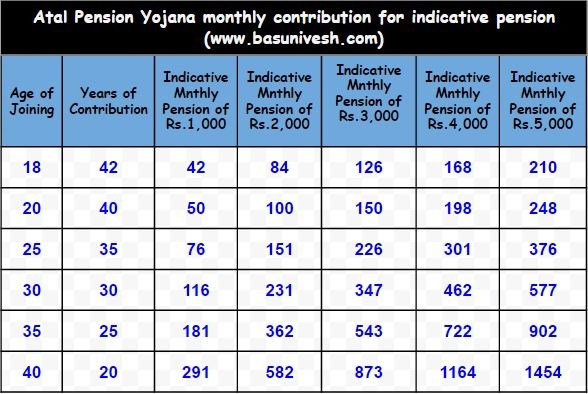

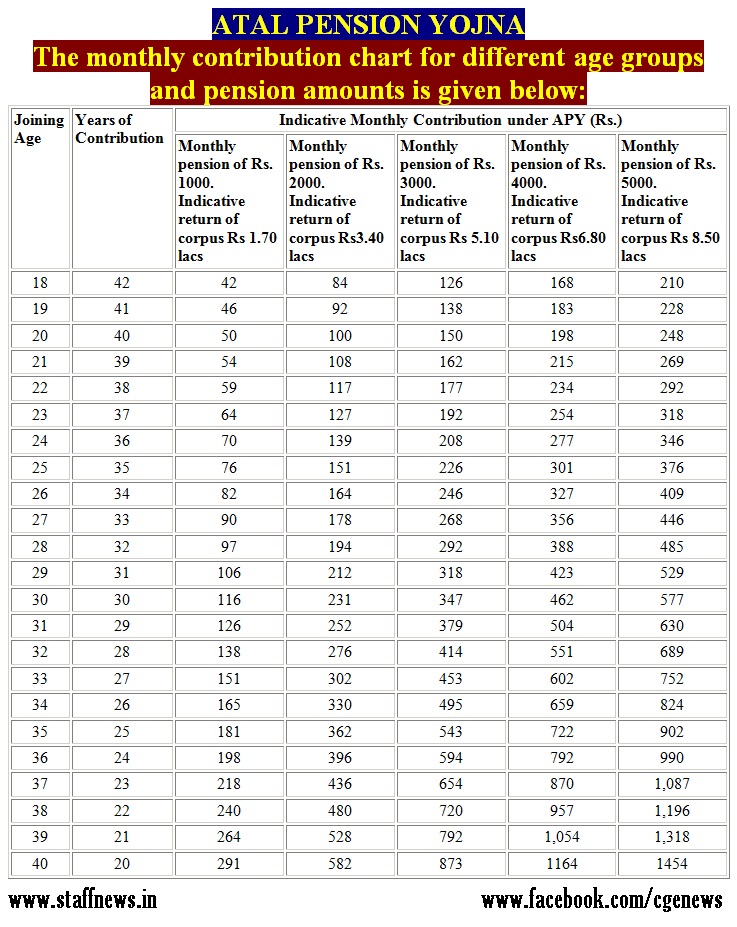

Web 21 Okt 2022 nbsp 0183 32 An additional contribution of Rs 50 000 p a is eligible for an additional deduction of Rs 50 000 p a under section 80CCD 1B of the Income Tax Act 1961 These deductions are subject to the fulfilment of the conditions mentioned in the Income Tax Act 1961 Taxpayers Not Eligible w e f October 2022 Web Under the APY minimum guaranteed pension of Rs 1 000 or 2 000 or 3 000 or 4 000 or 5 000 per month will start after attaining the age of 60 years depending on the contributions by the subscribers for their chosen pension amount 3 Who can subscribe to APY Any Citizen of India can join APY scheme

Web 28 Dez 2023 nbsp 0183 32 Claim the deductions available under Section 80CCD 2 now and secure your future with the National Pension Scheme or Atal Pension Yojana Don t miss out on these tax saving benefits E file your income tax returns now and avoid last minute stress or book eCA for stress free efiling of your ITR Web 23 Nov 2018 nbsp 0183 32 Atal Pension Yojana income tax benefits and other details 1 Contributions to the Atal Pension Yojana are eligible for the same income tax benefits as the National Pension System or NPS

Download Atal Pension Scheme Income Tax Benefit

More picture related to Atal Pension Scheme Income Tax Benefit

Atal Pension Yojana Tax Benefits Sec 80CCD 1 And Sec 80CCD 1B

https://www.basunivesh.com/wp-content/uploads/2017/09/APY-or-Atal-Pension-Yojana-Tax-Benefits.jpg

Atal Pension Yojana APY 2021 How To Apply And Register Monthly

https://bharatgyan.co.in/wp-content/uploads/2021/08/apy-1024x576.jpeg

Atal Pension Yojana Eligibility Income Tax Benefits FinacBooks

https://www.finacbooks.com/assets/img/blog/atal-pension-yojana.jpg

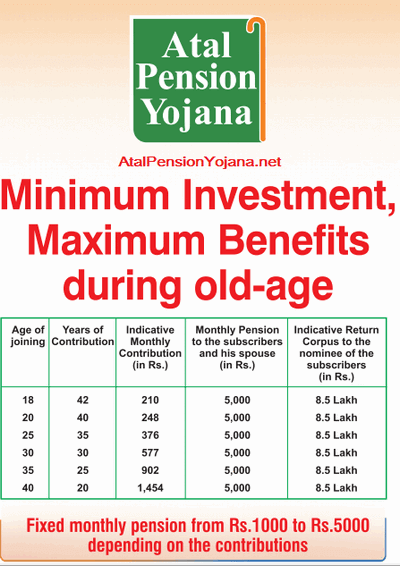

Web 24 M 228 rz 2023 nbsp 0183 32 The scheme guarantees you a fixed pension ranging from a minimum of Rs 1 000 per month Rs 2 000 per month Rs 3 000 per month Rs 4 000 per month to a maximum of Rs 5 000 per month It depends on the monthly contribution you make The monthly contribution will depend upon the amount of coverage and the age at which you Web The Atal Pension Yojana scheme is a retirement oriented saving scheme which promises a fixed amount of pension to individuals after they retire The scheme has been launched by the Government of India and it allows retirement savings for all types of individuals particularly those belonging to the unorganized sector

Web A subscriber of the Atal Pension Yojana account can enjoy tax benefits including the additional deduction of Rs 50 000 under Section 80CCD 1 of the Income Tax Act The savings earned through this scheme are exempted from tax Web Vor 4 Tagen nbsp 0183 32 Details Atal Pension Yojana APY is an old age income security scheme for a savings account holder in the age group of 18 40 years who is not an income tax payee The scheme helps in addressing the longevity risks among the workers in the unorganized sector and encourages the workers to voluntarily save for their retirement

Atal Pension Yojana APY Eligibility Contribution Amount Tax

https://static.toiimg.com/thumb/imgsize-23456,msid-63726955,width-600,resizemode-4/63726955.jpg

Atal Pension Yojana APY Features Benefits Tax Treatment And Review

https://www.personalfinanceplan.in/wp-content/uploads/2017/12/20171212-Atal-Pension-Yojana-APY-Scheme-Details-Tax-Benefits-New-PNG-Atal-Pension-Yojana-Age-chart-calculator.png?x61169

https://cleartax.in/s/section-80ccd

Web 11 Dez 2023 nbsp 0183 32 What is Section 80CCD Section 80CCD relates to the deductions available to individuals against contributions made to the National Pension Scheme NPS or the Atal Pension Yojana APY Contributions made by employers towards the NPS also come under this section Deductions Under 80CCD 1 and 80CCD 2

https://www.basunivesh.com/atal-pension-yojana-tax-benefits

Web 14 Sept 2017 nbsp 0183 32 2 APY or Atal Pension Yojana Tax Benefits under Sec 80CCD 1B This is the additional tax benefit of up to Rs 50 000 eligible for income tax deduction and was introduced in the Budget 2015 Introduced in Budget 2015 One can avail the benefit of this Sect 80CCD 1B from FY 2015 16

Atal Pension Yojana Benefits Chart Eligibility And Registration

Atal Pension Yojana APY Eligibility Contribution Amount Tax

Atal Pension Yojana Tax Benefits Sec 80CCD 1 And Sec 80CCD 1B

Atal Pension Yojana Pension Scheme For All

Atal Pension Yojana Features And Benefits Of APY How To Fill The

Atal Pension Yojana APY Govt Scheme Details Benefits

Atal Pension Yojana APY Govt Scheme Details Benefits

Atal Pension Yojna Features And Benefits Table Central Government

Atal Pension Yojana Scheme APY Eligibility Benefits Tax2win

Who Can Enrol In Atal Pension Yojana This Govt Scheme Offers Up To

Atal Pension Scheme Income Tax Benefit - Web 12 Dez 2017 nbsp 0183 32 Atal Pension Yojana Tax Benefits for Investment You are entitled to tax benefit under Section 80CCD 1 and Section 80CCD 1B for investment in Atal Pension Yojana Under Section 80CCD 1 you can avail tax benefit for investment in APY up to 20 of your annual income subject to a maximum of Rs 1 5 lacs per financial year