Atm Rebates Report On Taxes Web 23 ao 251 t 2010 nbsp 0183 32 Answer The refunding of your bank s fees is not reportable as income It isn t interest under a 1099 INT and you d have to pay 600 or more for a 1099 MISC

Web Rebates Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on Web 4 juin 2019 nbsp 0183 32 1 Best answer JohnW15 Intuit Alumni June 4 2019 4 53 PM No they re not The rebates basically represent a return to you of your own money View solution

Atm Rebates Report On Taxes

Atm Rebates Report On Taxes

https://help.cubase.org/cubase/images/full/UATMSCRP-01.gif

How To Get Unlimited ATM Fee Rebates And Never Pay Surcharges Again

https://tonytravels.com/wp-content/uploads/2020/05/schwab-investor-checking-atm-fee-rebate.png

Admin Dashboard Wise Pay

https://wisepay.com.my/app/assets/info/zWisePay Image Check Rebates Report.jpeg

Web 24 ao 251 t 2008 nbsp 0183 32 However I just realized that it s not really quot free quot unless used at a PNC bank ATM That s because the fee reimbursement is disclosed to the IRS as taxable interest Web 20 mai 2020 nbsp 0183 32 The total cost to supermarkets and other stores with ATMs inside like post offices and convenience stores would have been 163 430 million Today s unanimous

Web 16 nov 2022 nbsp 0183 32 En r 233 alit 233 cette ann 233 e l Etat en conservera un peu moins de 25 milliards d euros Par ailleurs la hausse des prix du carburant n a pas seulement pouss 233 l Etat a Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking

Download Atm Rebates Report On Taxes

More picture related to Atm Rebates Report On Taxes

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

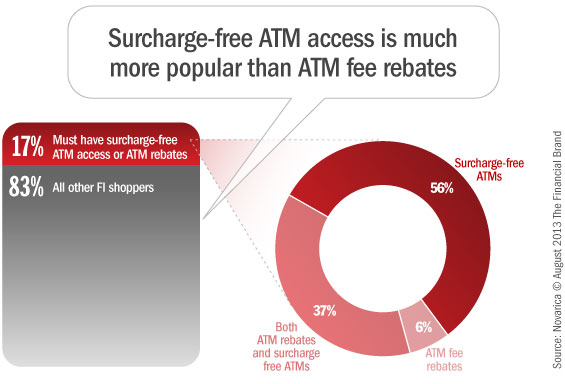

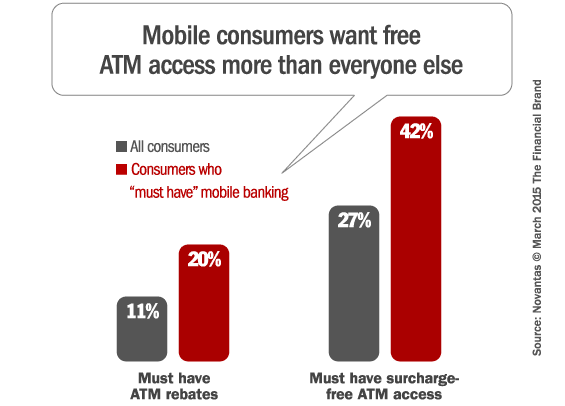

People Love Free ATMs and What Small Banks Need To Do

https://thefinancialbrand.com/wp-content/uploads/2013/09/surcharge_free_atms_fee_rebates.jpg

ATM Service Charge Rebate Code Selection

https://help.cubase.org/cubase/images/full/WINSCRPC-01.gif

Web 13 oct 2022 nbsp 0183 32 Banks and credit unions that reimburse some or all ATM fees are taking another step toward making everyday transactions less costly for consumers Here are Web 10 f 233 vr 2023 nbsp 0183 32 Among the many unusual things that happened during the COVID 19 pandemic perhaps the most unusual was states rebating tax money to their citizens In

Web 20 janv 2022 nbsp 0183 32 The more ATM fees that you get the less likely your bank may be to refund them You won t win the full refund amount every time If your bank doesn t offer Web 9 oct 2018 nbsp 0183 32 Short answer Yes Long answer Maybe Eventually Technically anything you receive is taxable unless the tax code says that it isn t 26 U S Code 167 61

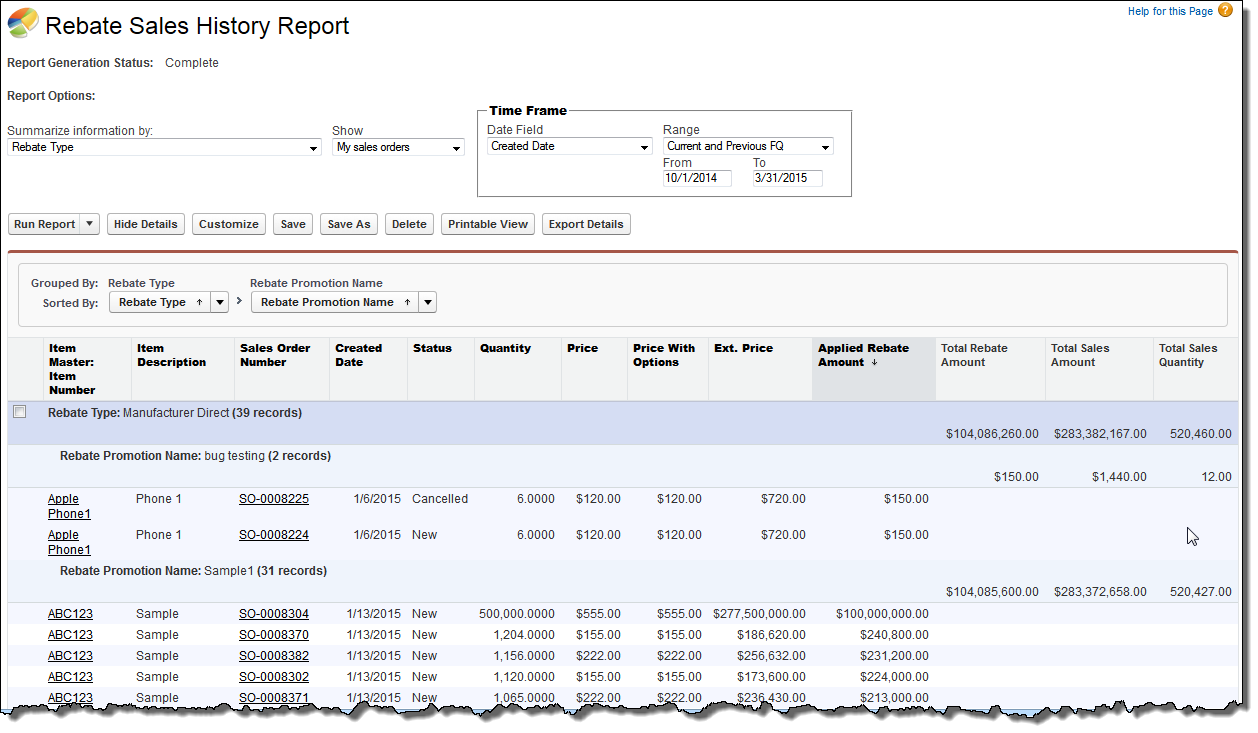

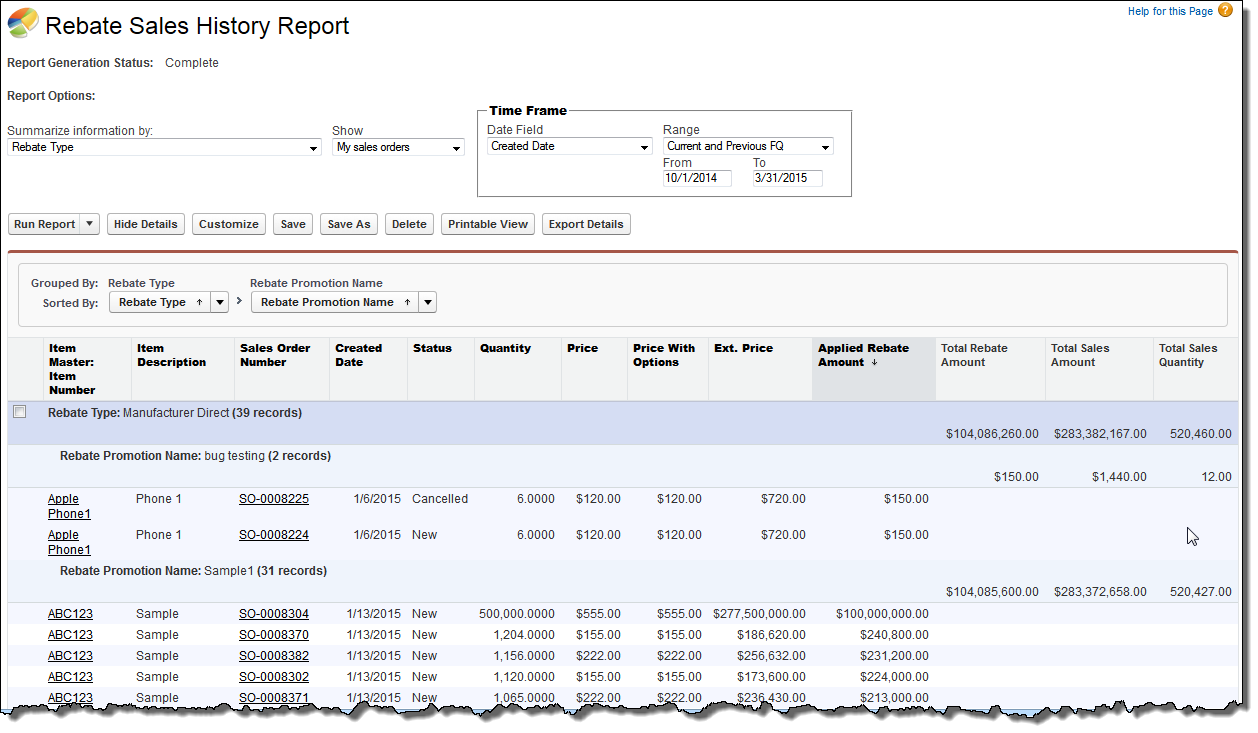

Rebate Reports

https://help.financialforce.com/main/2023.1/Content/Resources/Images/SCM_Core/Reports/RebateSalesHistoryReport.png

Banks Unprepared For Online Shoppers Mobile Bankers

https://thefinancialbrand.com/wp-content/uploads/2015/03/mobile_banking_atm_access_fees_rebates-565x406.png

https://www.bankersonline.com/qa/atm-fee-refunds-and-irs-reporting

Web 23 ao 251 t 2010 nbsp 0183 32 Answer The refunding of your bank s fees is not reportable as income It isn t interest under a 1099 INT and you d have to pay 600 or more for a 1099 MISC

https://www.hackyourtax.com/taxing-rebates-points-rewards

Web Rebates Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on

PAcast

Rebate Reports

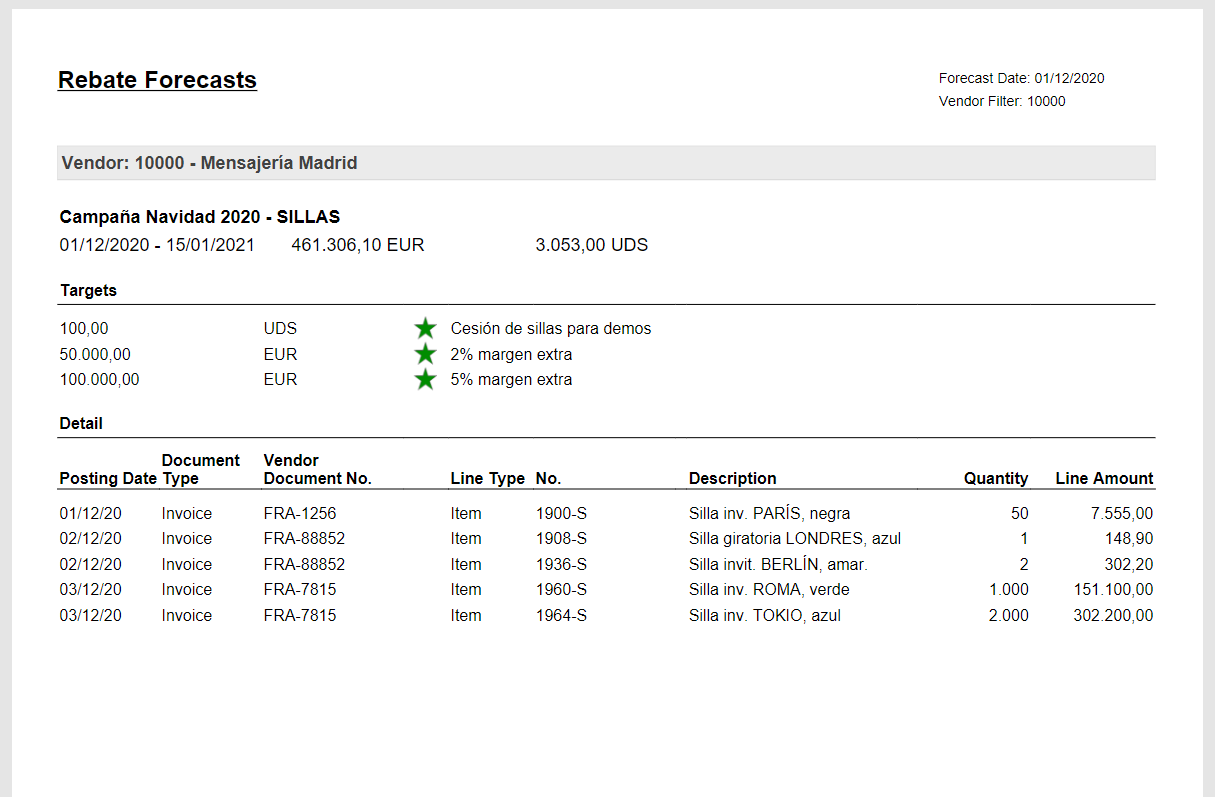

Rebate Forecast Report IDynamics Purchase Rebates

DNAappstore ATM Rebate

Vendor Rebate Report RRB

CA No Monthly Fee Checking Account ATM Fee Rebates SFPCU

CA No Monthly Fee Checking Account ATM Fee Rebates SFPCU

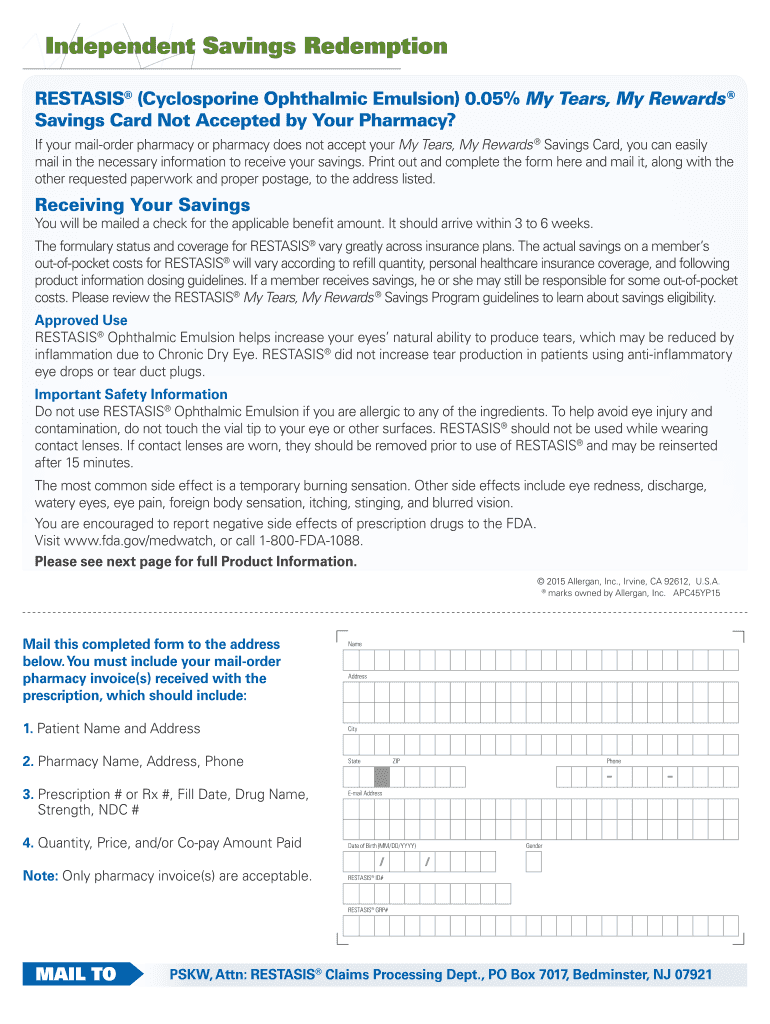

Rebate Form Fill And Sign Printable Template Online US Legal Forms

Volume Rebate Agreement Template

First Republic 800 For New ATM Rebate Checking Account

Atm Rebates Report On Taxes - Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking