Ato Diesel Fuel Rebate Form Web Step 1 Work out the eligible quantity Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which fuel tax credit rate applies To

Web Fuel tax credits business Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant Web 7 mars 2023 nbsp 0183 32 Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for

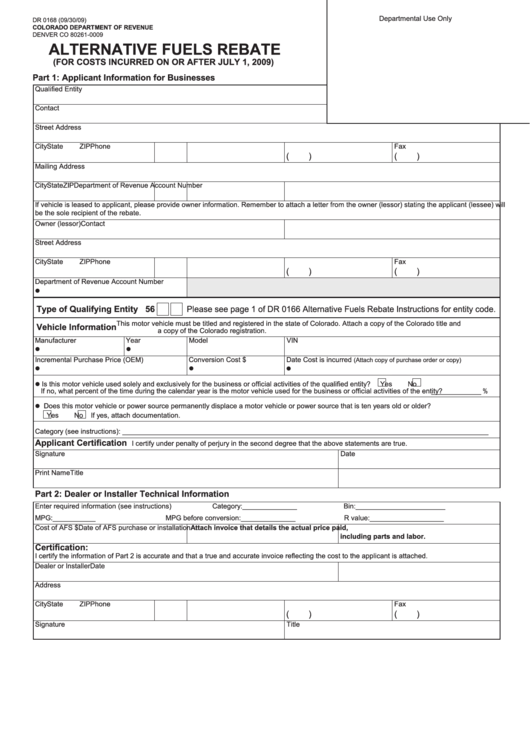

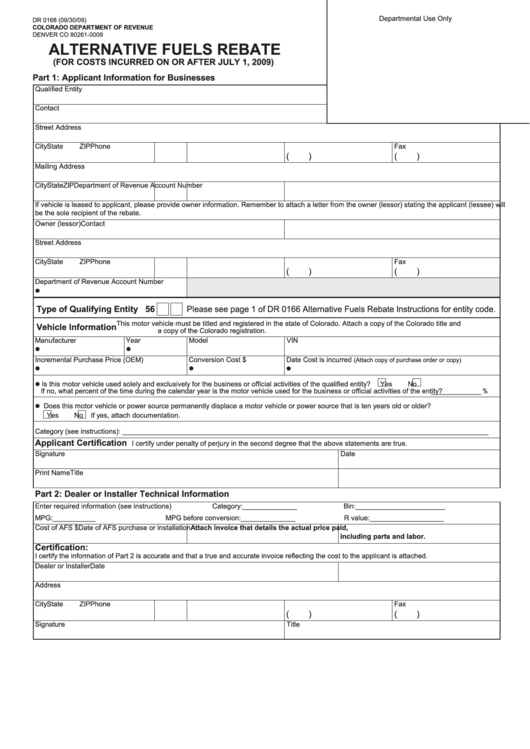

Ato Diesel Fuel Rebate Form

Ato Diesel Fuel Rebate Form

https://data.formsbank.com/pdf_docs_html/172/1728/172849/page_1_thumb_big.png

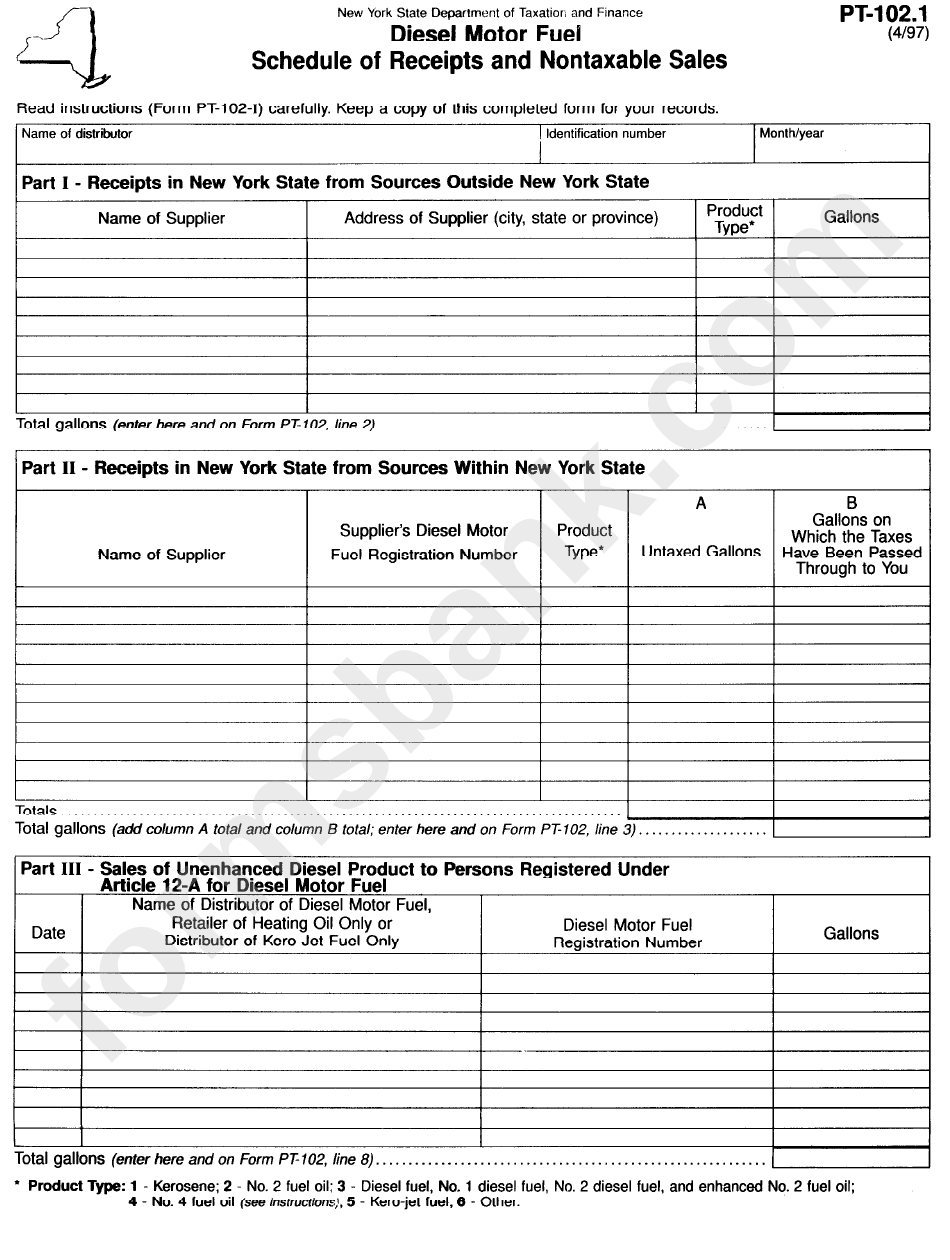

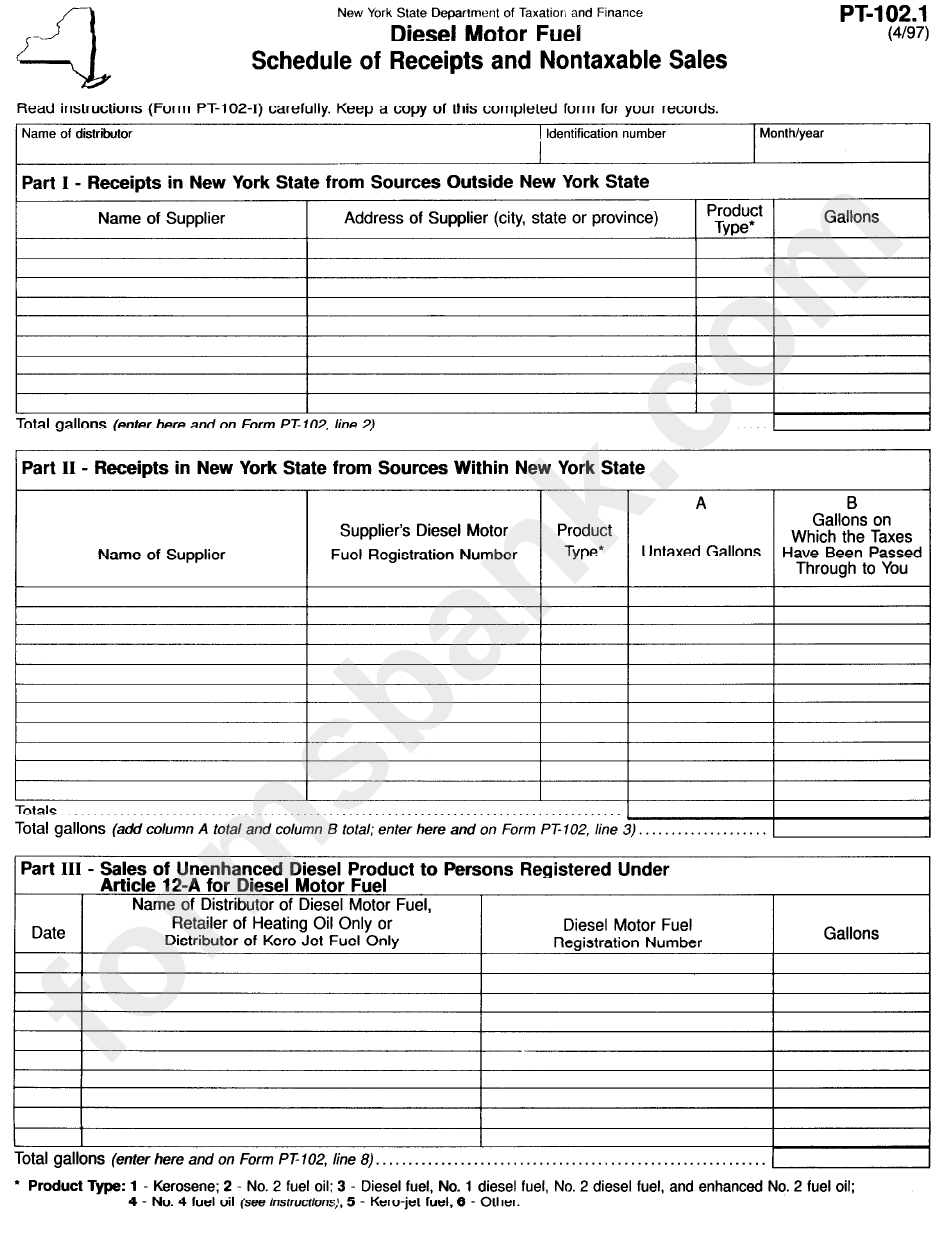

Form Pt 102 1 Diesel Motor Fuel Schedule Of Receipts And Nontaxable

https://data.formsbank.com/pdf_docs_html/274/2749/274917/page_1_bg.png

Diesel Rebate Scheme Complete Fuel Card Notification YouTube

https://i.ytimg.com/vi/v0xoFsaXbNs/maxresdefault.jpg

Web The following tools will help you check if you re eligible for fuel tax credits and work out the amount of fuel tax credits you can claim Eligibility tool check if you can claim fuel tax Web For businesses managing a vehicle fleet or using fuel for business activities the Fuel Tax Credits scheme can be an excellent route for operators to claim full or partial credits for the fuel tax excise or customs

Web 21 juin 2022 nbsp 0183 32 1 Manual Process The simplest approach is to do everything manually Collect your heavy vehicle fuel receipts and assume all on road usage Then use the low Web 12 oct 2022 nbsp 0183 32 What are Fuel Tax Credits Fuel tax credits provide your business with a credit for the fuel tax excise included in the fuel price The excise is paid at the pump and subject to certain conditions refunded by

Download Ato Diesel Fuel Rebate Form

More picture related to Ato Diesel Fuel Rebate Form

Tom Chesson On Twitter Labor Looking To Scrap The Fuel Tax Credits

https://pbs.twimg.com/media/FoKu6CGaMAEmesO.jpg

2014 Form MO DoR 4923 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/468/470/468470575/large.png

OK Natural Gas Rebate Application Fill And Sign Printable Template

https://www.pdffiller.com/preview/250/319/250319623/large.png

Web 21 juin 2022 nbsp 0183 32 Infographic Video Diesel Fuel Rebate Rates 2022 You can claim tax credits when you use fuel for business activities The diesel fuel rebate rates depend on the Web 1 juil 2017 nbsp 0183 32 Eligible fuel type Used in heavy emergency vehicles for travelling on public roads Used in heavy emergency vehicles to power auxiliary equipment emergency

Web If you are unsure whether you fall within an impacted postcode or are entitled to claim using the simplified method phone us on 1800 806 218 On this page Simplified methods for Web 1 juil 2022 nbsp 0183 32 Table 1 Rates for fuel acquired from 1 February 2023 to 30 June 2023 Eligible fuel type Used in heavy vehicles for travelling on public roads see note 1 All other

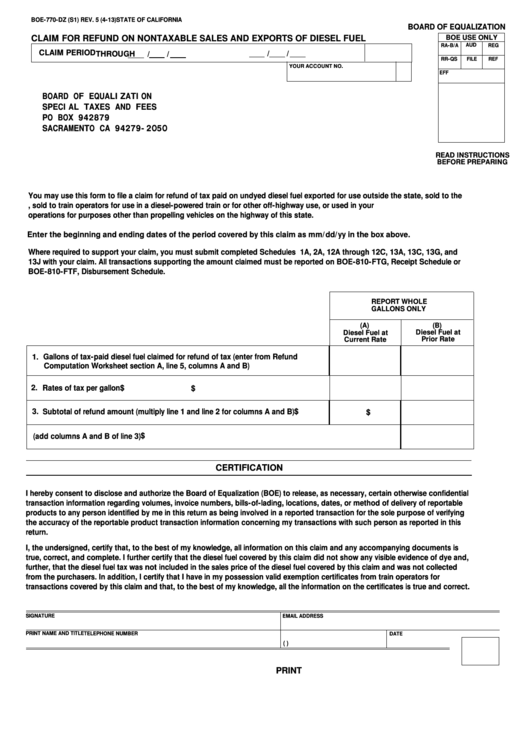

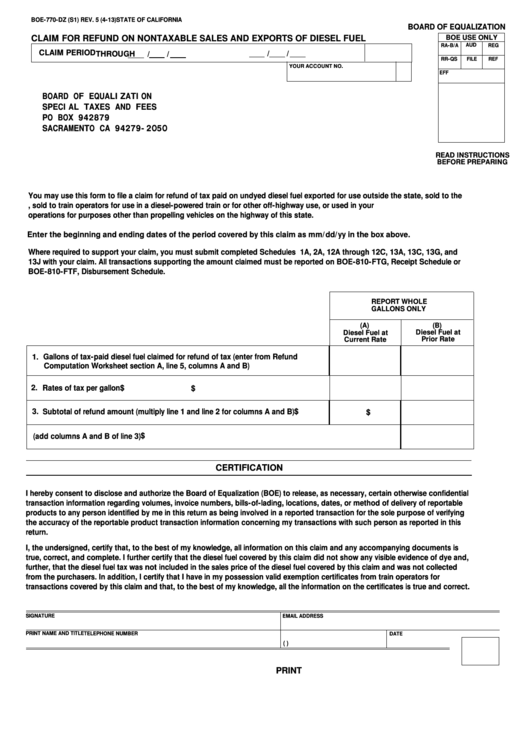

Fillable Claim For Refund On Nontaxable Sales And Exports Of Diesel

https://data.formsbank.com/pdf_docs_html/81/819/81975/page_1_thumb_big.png

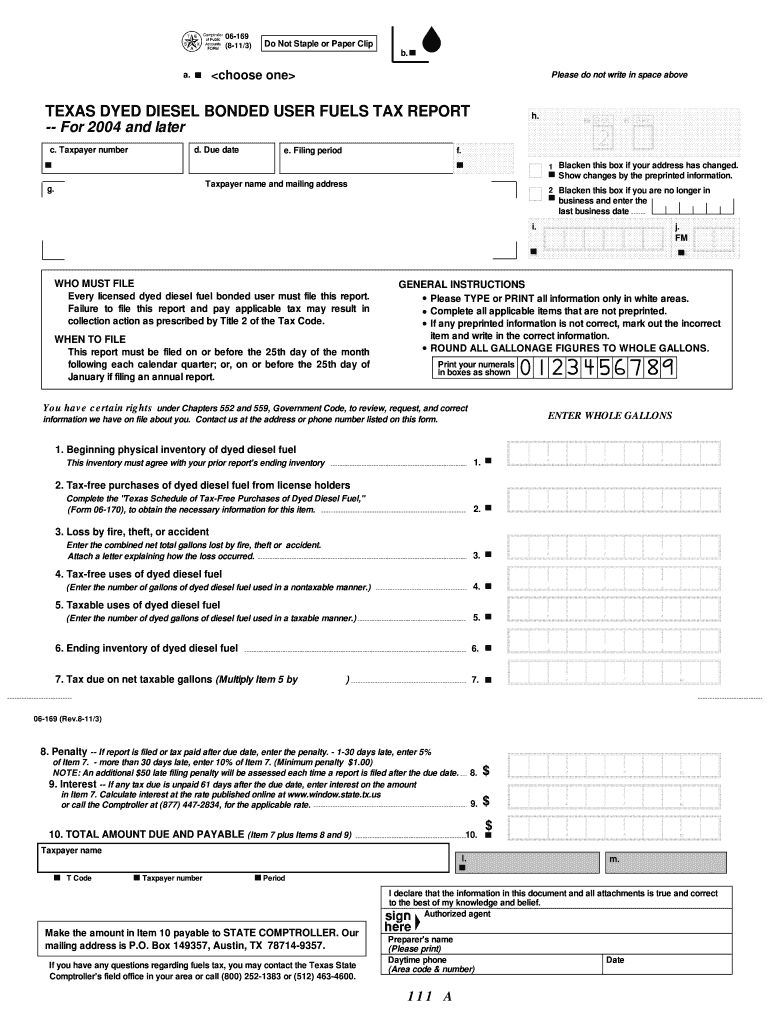

Texas Dyed Diesel Bonded User Fuels Tax Report Fill Out And Sign

https://www.signnow.com/preview/100/289/100289841/large.png

https://www.ato.gov.au/uploadedFiles/Content/ITX/download…

Web Step 1 Work out the eligible quantity Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which fuel tax credit rate applies To

https://www.ato.gov.au/Business/Fuel-schemes/Fuel-tax-credits---busin…

Web Fuel tax credits business Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant

Diesel Rebates Elogger

Fillable Claim For Refund On Nontaxable Sales And Exports Of Diesel

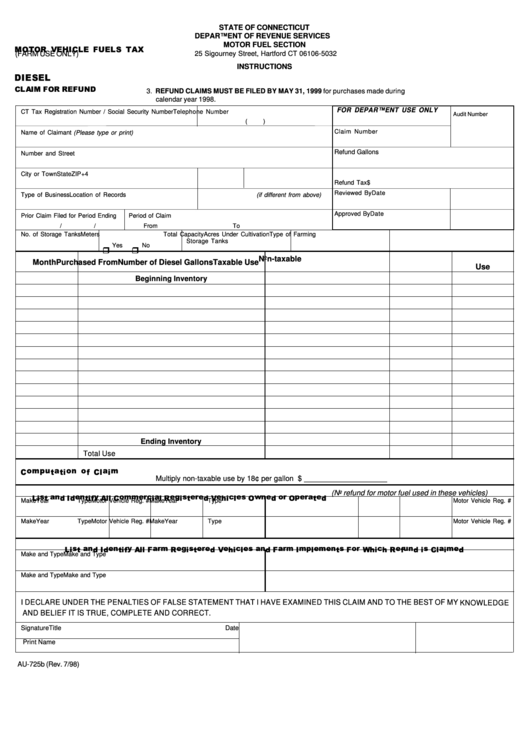

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

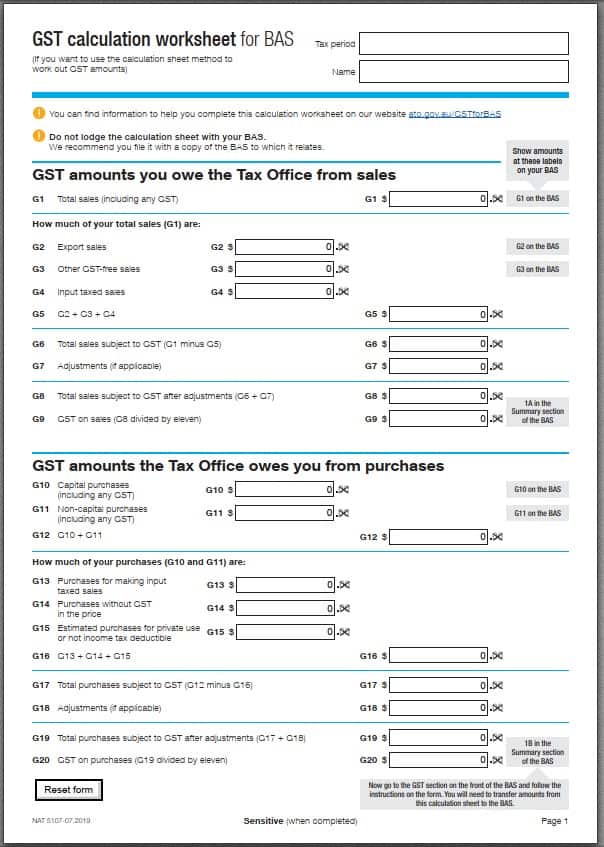

Kalamita Hovor Hlasno Zamestnanci Gst Calculation Sheet Odovzda Hlbok

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

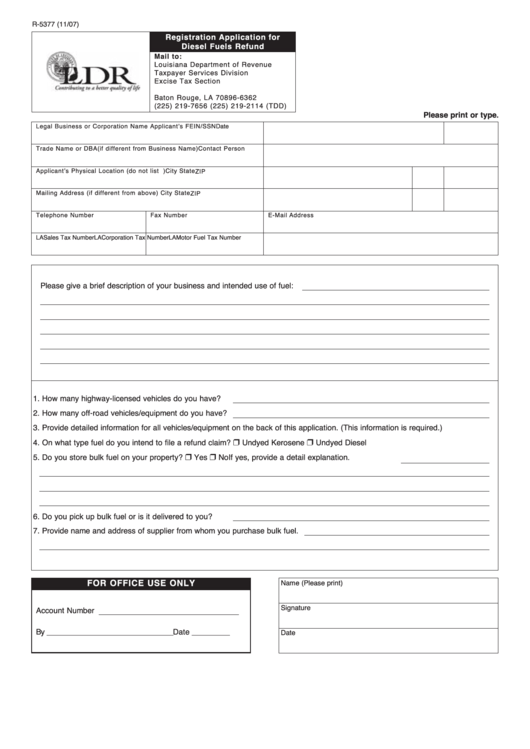

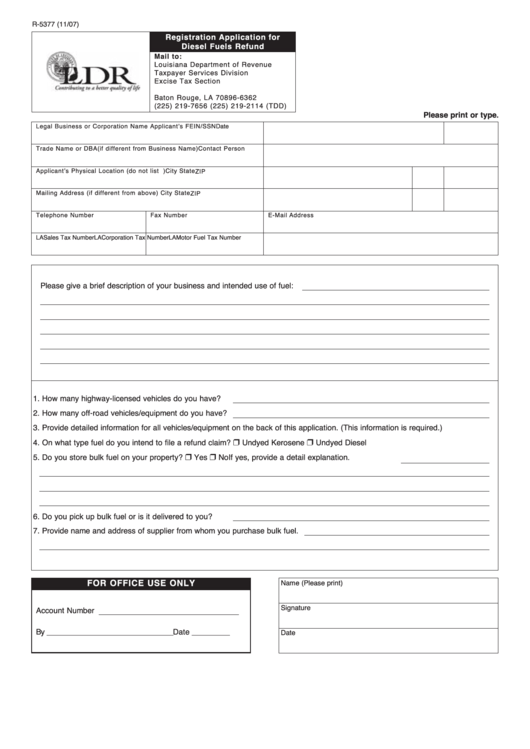

Fillable Form R 5377 Registration Application For Diesel Fuels Refund

Fillable Form R 5377 Registration Application For Diesel Fuels Refund

Diesel Rebates Elogger

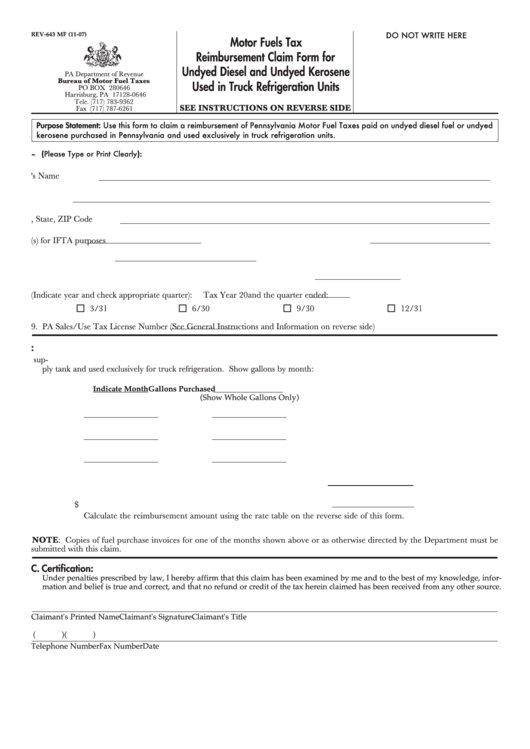

Form Rev 643 Mf Motor Fuels Tax Reimbursement Claim Form For Undyed

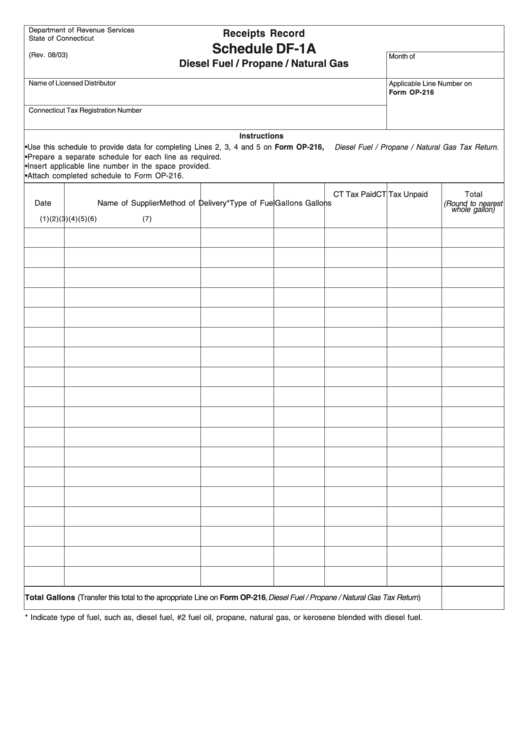

Schedule Df 1a Receipt Record Diesel Fuel propane natural Gas

Ato Diesel Fuel Rebate Form - Web The following tools will help you check if you re eligible for fuel tax credits and work out the amount of fuel tax credits you can claim Eligibility tool check if you can claim fuel tax