Ato Diesel Tax Rebate Web 7 mars 2023 nbsp 0183 32 Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for

Web Fuel tax credit rate when you acquired the fuel cents per litre kilogram Use the rates Step 2 Fuel tax credit amount Amount must be converted to dollars Step 3 Step Web 8 mai 2021 nbsp 0183 32 Australian taxpayers could save 7 8bn a year if diesel fuel rebates scheme was wound back Energy The Guardian Fortescue Metals recently announced it would

Ato Diesel Tax Rebate

Ato Diesel Tax Rebate

https://s3.a8se.com/images/WhatsApp_Image_2022-03-16_at_16.32.48.max-2220x1000.jpg

Bolsonaro Rebate Pablo Villa a E Comete Ato Falho Ao Cham lo De Pablo

https://publisher-publish.s3.eu-central-1.amazonaws.com/pb-brasil247/swp/jtjeq9/media/20220519090536_132186a97cce43c670765b43b4207d1e18d330a4151151053fc8be02c4e9949b.jpg

Ciro Gomes Agredido Em Ato Contra Bolsonaro E Rebate fascistas De

https://costanorte.com.br/image/policy:1.345126.1633280896/image.jpg?f=2x1

Web 22 nov 2022 nbsp 0183 32 heavy vehicles light vehicles travelling off public roads or on private roads Tax credits are available based on the fuel tax credit rate when you bought the fuel the Web 28 juil 2023 nbsp 0183 32 Since BAS period ending on 31 March 2016 businesses claiming less than 10 000 credits annually can use the BAS period end rate if the rate has changed

Web 10 February 2021 There is now a simpler way to calculate your fuel tax credits for diesel used in heavy vehicles If you claim less than 10 000 each year you can use the new Web Fuel Tax Rebates and Rates from the ATO It is important to be able to calculate the potential Fuel Tax Credit rebate available to your organisation for Petrol or Diesel used

Download Ato Diesel Tax Rebate

More picture related to Ato Diesel Tax Rebate

Manifestantes Realizam Ato Contra O Passaporte Da Vacina Na Capital E

https://scc10.com.br/wp-content/uploads/2021/10/manifestantes.jpeg

Petition Reduce Diesel Tax For Commercial Vehicles Cap Petrol

https://assets.change.org/photos/0/ub/gp/emubgpKadQfsUKo-1600x900-noPad.jpg?1646942991

Ubiratan Leal Rebate Pedido De Desculpas De Apresentador De Programa

https://a3.espncdn.com/combiner/i?img=%2Fmedia%2Fimages%2F2022%2F0919%2FHu_220919_BR_futebol_espn_fc_real_madrid_vini_jr_apresentador_ato_racista_bira_leal_rebate_other%2FHu_220919_BR_futebol_espn_fc_real_madrid_vini_jr_apresentador_ato_racista_bira_leal_rebate_other.jpg

Web 21 juin 2022 nbsp 0183 32 Fuels eligible for fuel tax credit include petrol diesel kerosene and LPG This post explains how how rates are structured and provides current and historical rates Other posts in this series are Fuel Web 21 juin 2022 nbsp 0183 32 1 Replies Sort by Most helpful reply CaroATO Community Support 23 June 2022 Hi Rsutherl The halving of fuel excise is applicable for both petrol and diesel

Web The diesel fuel rebate rates depend on the use of the fuel You need to use the correct rates in your fuel rebate calculator Not Eligible for Diesel Fuel Rebate You cannot claim Web The Government has provided a range of options which should ensure any operator who maintains the emission related components of their vehicle in a reasonable manner will

ATO Tax Rebate Australians Are Using Extra 1080 To Pay Off Debt

https://content.api.news/v3/images/bin/d7b76491f683c09e32e01a98f6e1a054

ATO Issues Stern Warning Over Work from home Tax Rebate Claims Inside

https://insidesmallbusiness.com.au/wp-content/uploads/2021/04/bigstock-Australian-Individual-Tax-Retu-59709716-e1621487831111.jpg

https://business.gov.au/finance/taxation/claim-fuel-tax-credits

Web 7 mars 2023 nbsp 0183 32 Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for

https://www.ato.gov.au/forms/fuel-tax-credits-calculation-worksheet

Web Fuel tax credit rate when you acquired the fuel cents per litre kilogram Use the rates Step 2 Fuel tax credit amount Amount must be converted to dollars Step 3 Step

Tax Return Deadline 2022 Australia With Accountant Latest News Update

ATO Tax Rebate Australians Are Using Extra 1080 To Pay Off Debt

Bonus Tax Rate 2018 Museumruim1op10 nl

Reginald George Roberts Stands Trial Over ATO Fuel Rebate Rort The

O Otimista

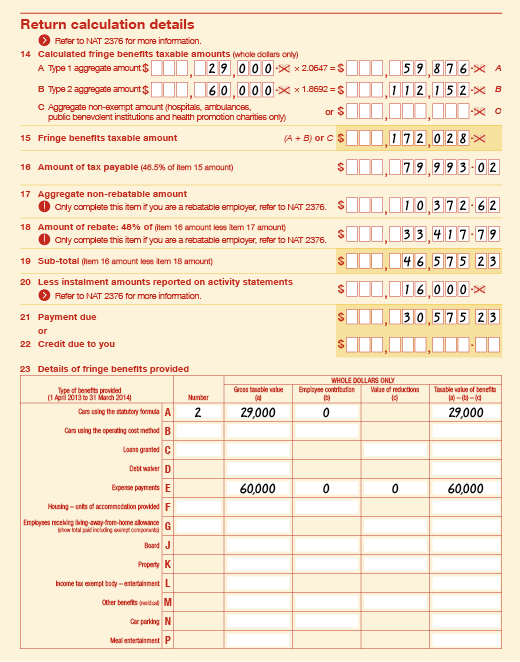

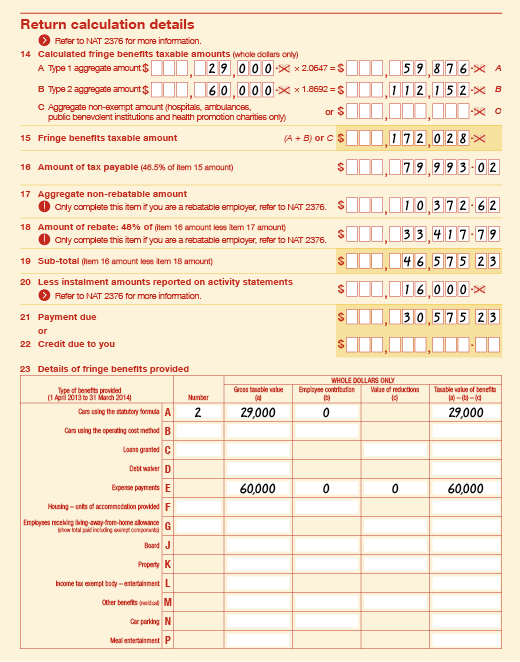

Are Fringe Benefits Taxable Income

Are Fringe Benefits Taxable Income

HSS Last Chance To Prep For Red Diesel Tax Hike

Jurista Rebate Planalto E Diz Em Ato Da Oposi o Que Crime Sem

Minnesota Property Tax Refund Fill Out And Sign Printable PDF

Ato Diesel Tax Rebate - Web 21 juin 2022 nbsp 0183 32 You can claim ATO fuel tax credits within four years of the due date of the Business Activity Statement This is not considered to be a mistake Retrospective