Ato Fuel Rebate Rates 2024 Note 3 Fuel tax credit rates change for fuel used in a heavy vehicle for travelling on a public road due to changes in the road user charge The road user charge will increase by 6 each year from 2023 24 to 2025 26

The road user charge rate for gaseous fuels per kilogram rate will increase from 38 5 cents per kilogram in 2023 24 to 40 8 cents per kilogram in 2024 25 to 43 2 cents per kilogram in 2025 26 Currently the road user charge Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel Table 1 1 February 2023 to 30 June 2023 Table 2 29 September 2022 to 31 January 2023 Table 3 1 August 2022 to 28 September 2022 Table 4 1 July 2022 to 31 July 2022

Ato Fuel Rebate Rates 2024

Ato Fuel Rebate Rates 2024

https://news.cardnotpresent.com/hubfs/CNP Report 2022/081122-twilio-breach-could-provide-more-ato-fuel.jpg

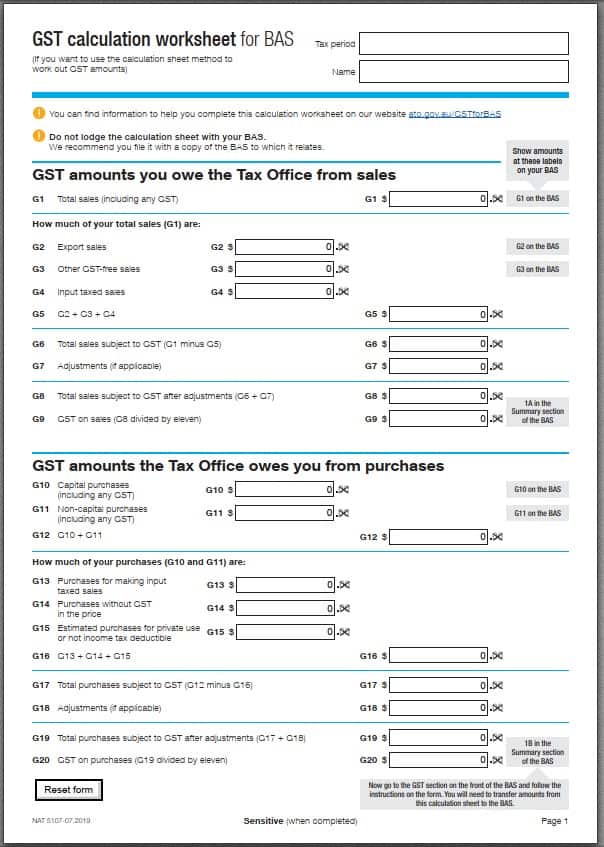

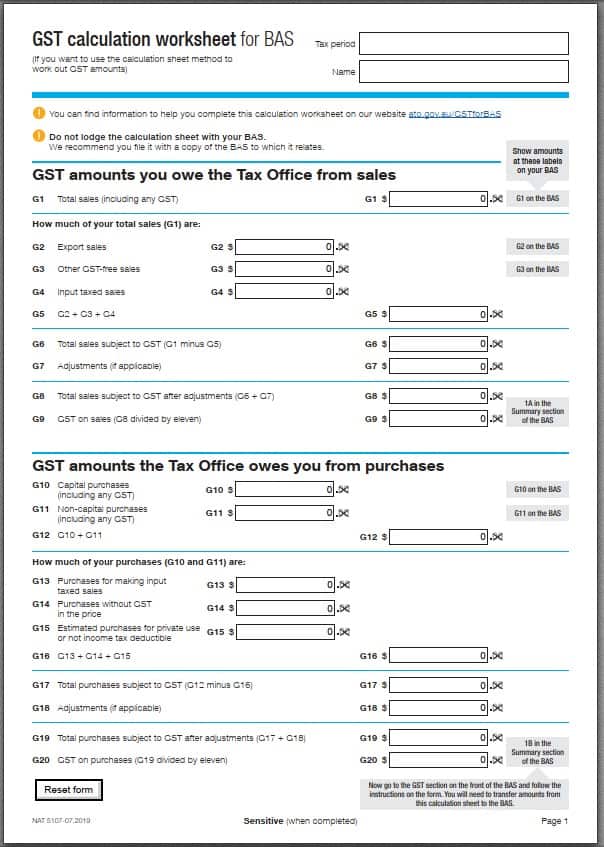

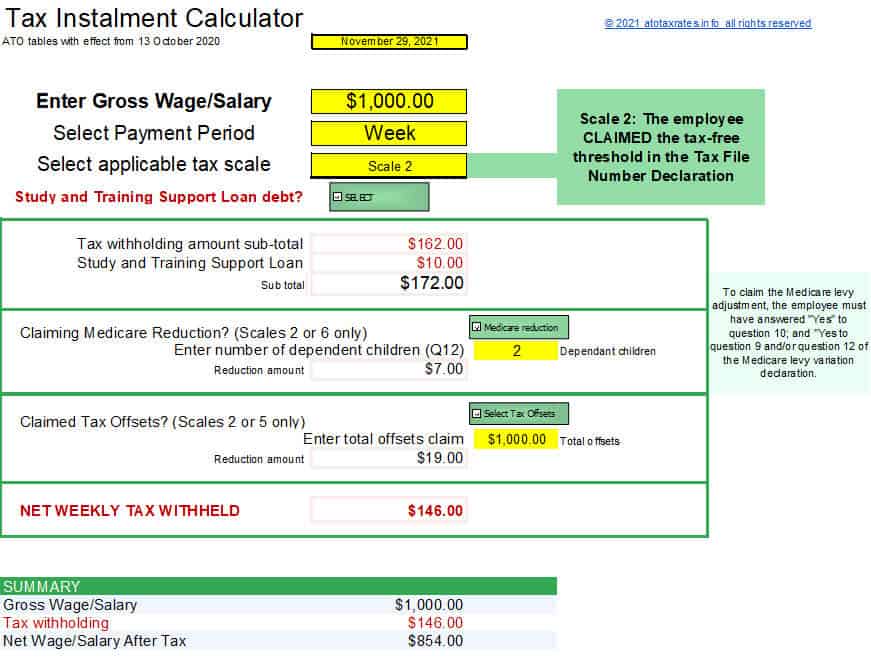

Tip 90 About Gst Australia Calculator Latest NEC

https://atotaxrates.info/wp-content/uploads/2021/06/interactive-bas-calculation-worksheet.jpg

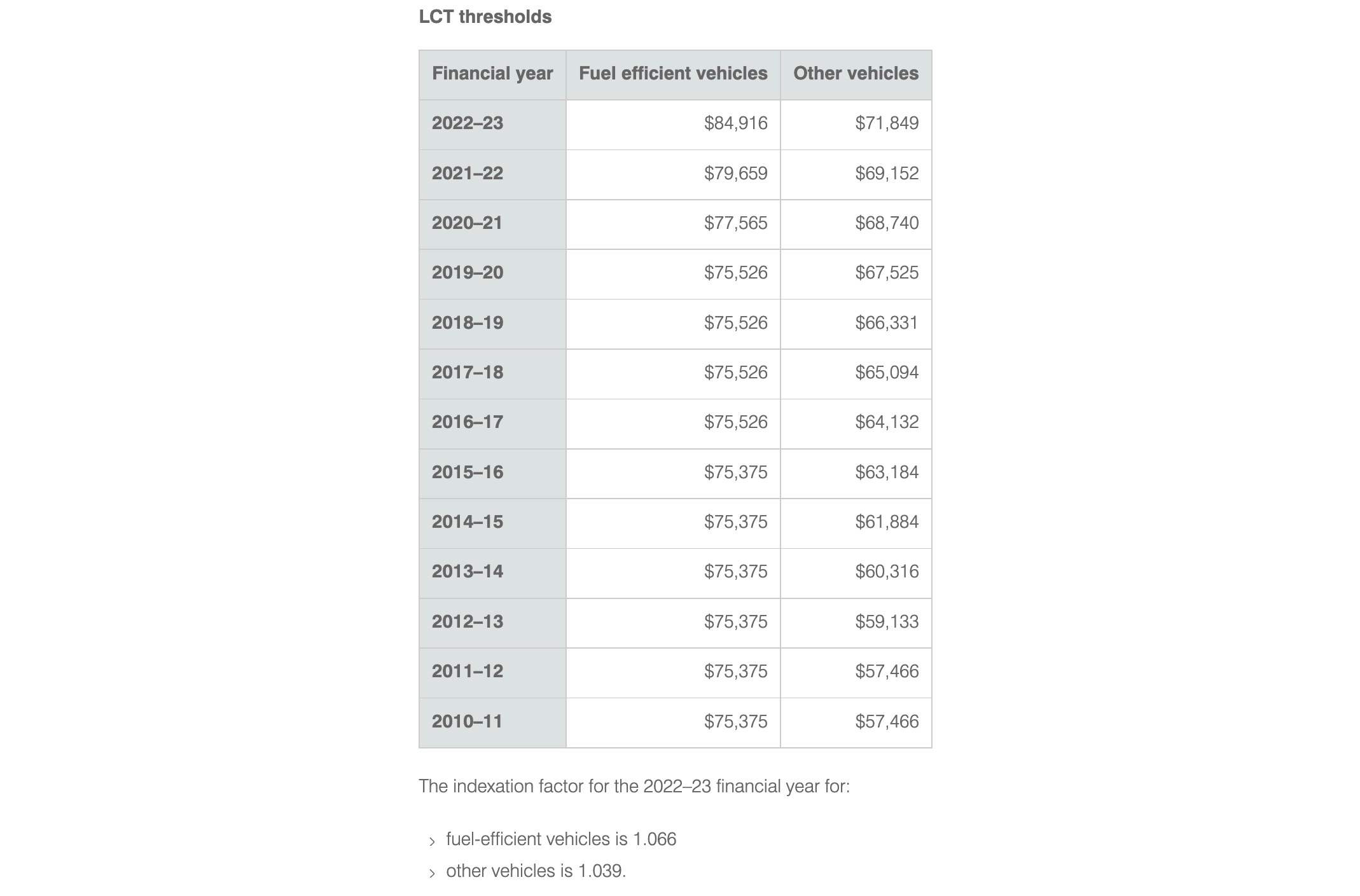

Explained ATO Luxury Car Tax Changes For 2022 2023 In Australia PerformanceDrive

https://performancedrive.com.au/wp-content/uploads/2022/06/2022-2023-Luxury-Car-Tax-threshold-ATO-Australia.jpg

Liquefied Natural Gas LNG or Compressed Natural Gas CNG duty paid Blended fuel E85 and B100 The updated February 2024 Fuel Tax Credit rates are as follows per the ATO website Fuel Acquired 5 February 2024 to 30 June 2024 The fuel tax credit calculator helps you work out the fuel tax credit amount to report on your business activity statement BAS adjustments for fuel tax credits from a previous BAS From 30 March 2022 until 28 September 2022 the fuel tax credit rate temporarily reduced

PCG 2021 2 Fuel tax credits basic method for heavy vehicles Fuel tax credits apportioning taxable fuel used in a heavy vehicle with auxiliary equipment PCG 2016 11 under review FTD 2016 1 Fuel used for idling and Fuel tax credits rates change regularly so it s important to check the rates each time you do your BAS Before you can make a claim you must be registered for GST and fuel tax credits Next step

Download Ato Fuel Rebate Rates 2024

More picture related to Ato Fuel Rebate Rates 2024

Fuel Excise Rates Reduced For The Next 6 Months VIEWTRACK

https://viewtrack.com.au/wp-content/uploads/2022/04/ATO-Fuel-Budget.jpg

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

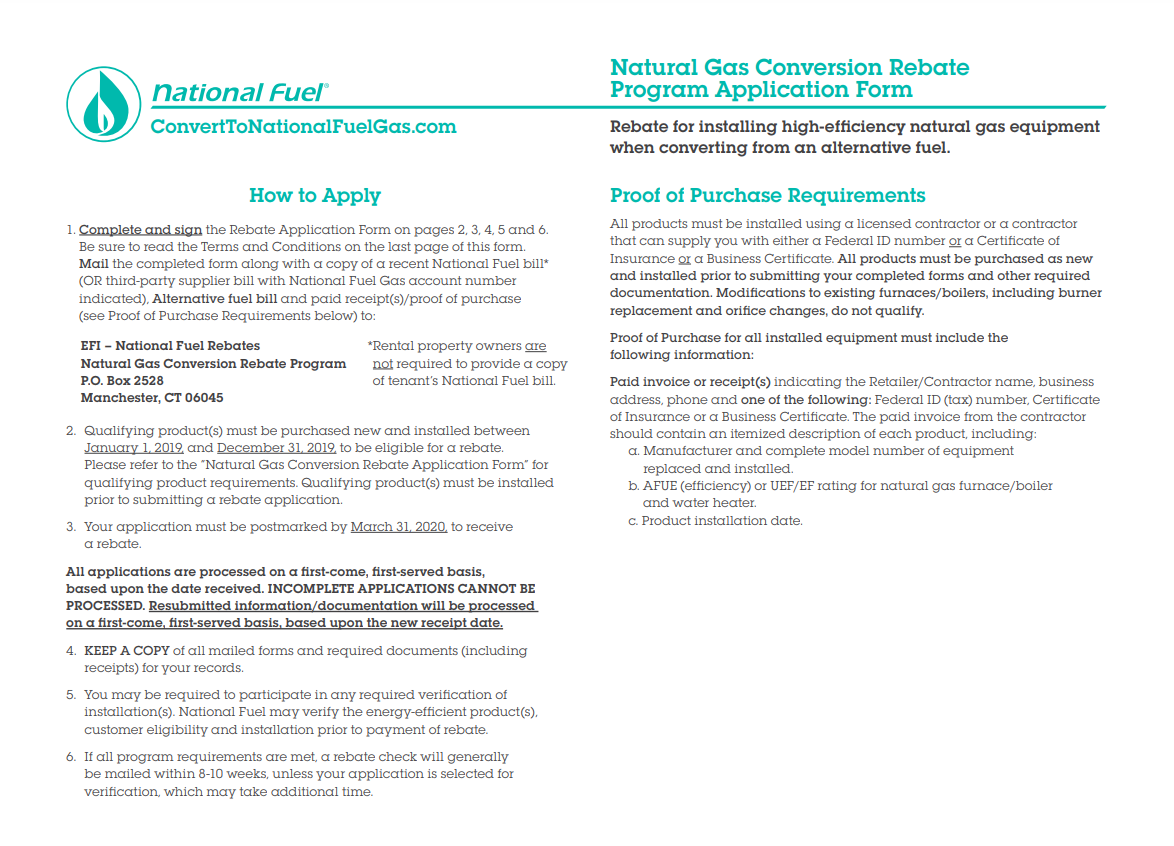

National Fuel Rebate Form 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/10/National-Fuel-Rebate-Form-2023.png

Last Updated 18 January 2024 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits and how to make a claim 1 Check if you re eligible for fuel tax credits Latest Fuel Tax Credit Rates for Businesses July 2023 June 2024 Update Need more help or information Click the link below to contact us at Plus 1 Contact Us Client Portal Unlock smarter investment strategies in 2024 with insights on franking credits fee impacts tax advantages and retirement planning to enhance your financial returns

Here is a listing of the fuel tax credit rates as they currently stand 1 August 2023 to 4 February 2024 Fuel tax credit rates for prior years If you are looking to claim fuel tax credits for prior periods you are able to do so for a maximum of 4 years after the purchase of the fuel Use the rates listed for each financial year to work out your fuel tax credit rates for business Eligibility Check your eligibility to claim fuel tax credits for fuel acquired and used in your business activities

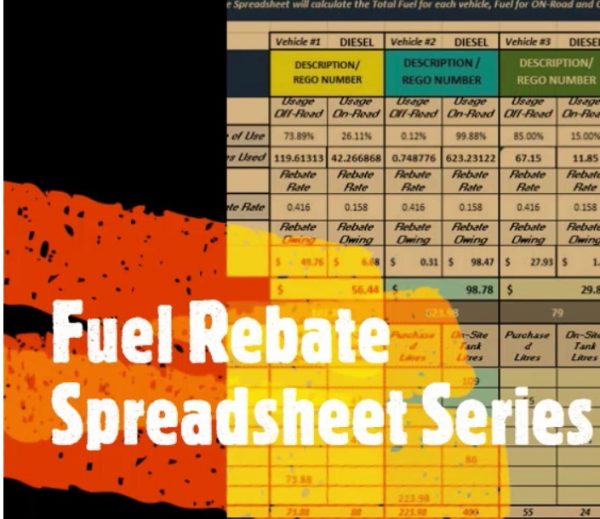

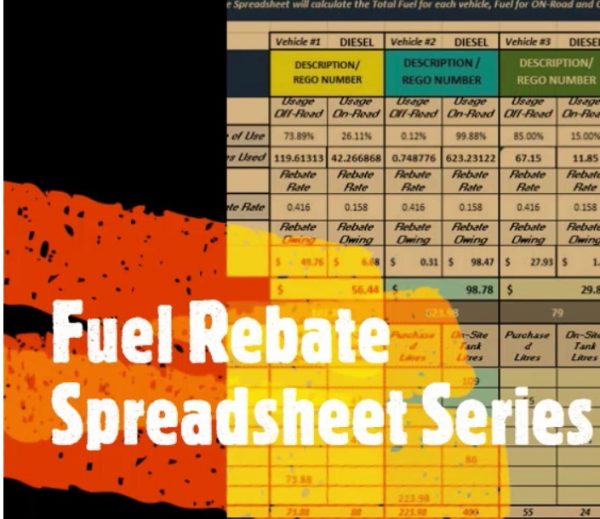

Fuel Rebate Spreadsheet Series Chews Learning Space

https://chewslearningspace.com/wp-content/uploads/2020/05/Fuel-Rebate-Series-Spreadsheet-600x519.jpg

National Fuel Rebate Form 2023 Printable Forms Free Online

https://fuelingtomorrowtoday.com/wp-content/uploads/2021/12/Residential-appliance-chart-1.jpg

www. ato.gov.au /businesses-and...

Note 3 Fuel tax credit rates change for fuel used in a heavy vehicle for travelling on a public road due to changes in the road user charge The road user charge will increase by 6 each year from 2023 24 to 2025 26

www. ato.gov.au /.../rates-business

The road user charge rate for gaseous fuels per kilogram rate will increase from 38 5 cents per kilogram in 2023 24 to 40 8 cents per kilogram in 2024 25 to 43 2 cents per kilogram in 2025 26 Currently the road user charge

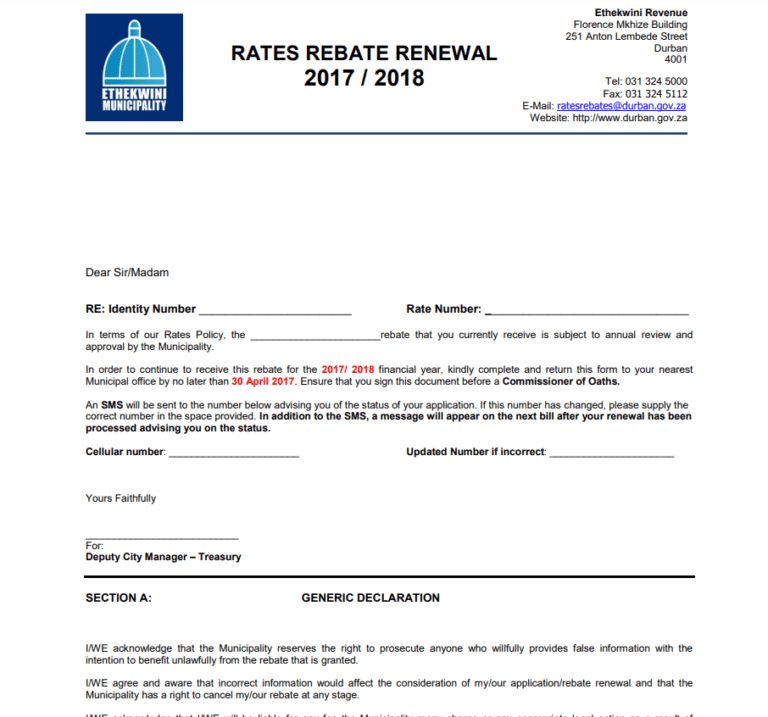

Ethekwini Pensioners Printable Rebate Form

Fuel Rebate Spreadsheet Series Chews Learning Space

New Federal Tax Brackets For 2023

National Fuel Furnace Rebate 2023 Rebate2022

National Fuel Rebate Form 2022 Printable Rebate Form

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

ATO Tax Tables 2023 Atotaxrates info

National Fuel Rebate Form 2023 How To Fill Out The Form Printable Rebate Form

Ato Fuel Rebate Rates 2024 - From 1 July 2022 to 30 June 2023 Check fuel tax credit rates for non businesses from 1 July 2022 Last updated 26 January 2023 Print or Download Fuel tax credit rates non business Check fuel tax credit rates for non businesses from 1 July 2022 to 30 June 2023 Table 1 1 February 2023 to 30 June 2023