Ato Fuel Rebate Rates Note 4 Fuel tax credit rates change for gaseous fuels due to changes in the road user charge which increases by 6 each year over 3 years from 38 5 cents per kilogram in 2023 24 to 40 8 cents per kilogram in 2024 25 and to 43 2 cents per kilogram in 2025 26

Fuel tax credit rates are indexed twice a year in February and August in line with the consumer price index CPI The CPI indexation factor for rates from 5 August 2024 is 1 020 Fuel excise duty was temporarily reduced from 30 March 2022 to 28 September 2022 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits and how to make a claim

Ato Fuel Rebate Rates

Ato Fuel Rebate Rates

https://i.ytimg.com/vi/gTEQWeXsEOg/maxresdefault.jpg

National Fuel Rebate Form 2023 Printable Forms Free Online

https://fuelingtomorrowtoday.com/wp-content/uploads/2021/12/Residential-appliance-chart-1.jpg

National Fuel Rebate Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/11/National-Fuel-Rebate-Form.png

Fuel tax credits when you lodge your claim You can claim fuel tax credits for fuel you purchase manufacture or import for business use Work out if you are eligible for fuel tax credits with the ATO s fuel tax credit eligibility tool The updated August 2023 Fuel Tax Credit rates are as follows per the ATO website Fuel Acquired 1 August 2023 to 4 February 2024 Eligible Fuel Type Used in heavy vehicles for travelling on public roads All other business uses including to power auxiliary equipment of a heavy vehicle

You can claim fuel tax credits for any taxable fuel you acquired manufactured or imported to use in your business Fuel is generally considered taxable fuel if an excise or excise equivalent customs duty is required to be paid on it Examples of taxable fuels are diesel petrol The ATO s fuel tax credit calculator can be used to ensure the correct rates are claimed Rates for fuel acquired from 1 July 2021 to 30 June 2022 Updated tables for periods 1 July 2021 to 30 June 2022

Download Ato Fuel Rebate Rates

More picture related to Ato Fuel Rebate Rates

National Fuel Rebate Form 2022 Application Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/National-Fuel-Rebate-Form-2022-768x719.png

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

http://bhaskara.in/wp-content/uploads/2019/02/87A-Rebate-Provisions-1.jpeg.001-1.jpeg

Fuel Excise Rates Reduced For The Next 6 Months VIEWTRACK

https://viewtrack.com.au/wp-content/uploads/2022/04/ATO-Fuel-Budget.jpg

The Australian Taxation Office ATO generally updates the fuel tax credit rates twice a year in February and August based on increased in the consumer price index That said not every fuel tax credit rate may increase they may often stay the same The temporary reduction of fuel excise duty rates ended on 28 September 2022 For business related fuel purchases from 29 September 2022 onwards an increased fuel tax credit will apply Fuel tax credit rates are indexed twice a year once in February and again in August

The ATO will request invoices detailing the fuel purchases and your claim methodology Excise rates and claim rates have increased with indexation occurring on 1 February and 1 August each year The CPI indexation factor for rates from 1 Off public road rates are generally higher increasing the credits you can claim on your Business Activity Statement BAS The ATO s fuel tax credit calculator is a useful tool for determining these amounts

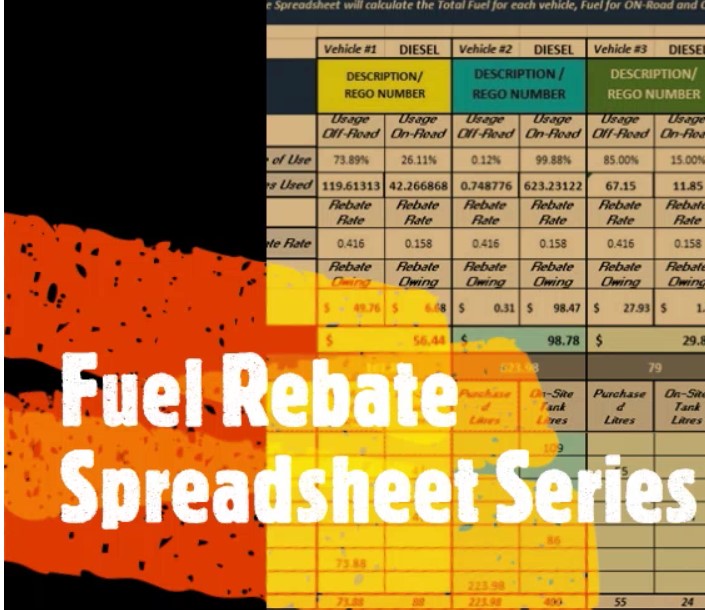

Fuel Rebate Spreadsheet Series Chews Learning Space

https://chewslearningspace.com/wp-content/uploads/2020/05/Fuel-Rebate-Series-Spreadsheet.jpg

ATO Update Fuel Tax Credit Increase DynamicFM

https://dynamicfm.net.au/wp-content/uploads/2024/03/Website-Images-2.png

https://www.ato.gov.au/businesses-and...

Note 4 Fuel tax credit rates change for gaseous fuels due to changes in the road user charge which increases by 6 each year over 3 years from 38 5 cents per kilogram in 2023 24 to 40 8 cents per kilogram in 2024 25 and to 43 2 cents per kilogram in 2025 26

https://www.ato.gov.au/.../rates-business

Fuel tax credit rates are indexed twice a year in February and August in line with the consumer price index CPI The CPI indexation factor for rates from 5 August 2024 is 1 020 Fuel excise duty was temporarily reduced from 30 March 2022 to 28 September 2022

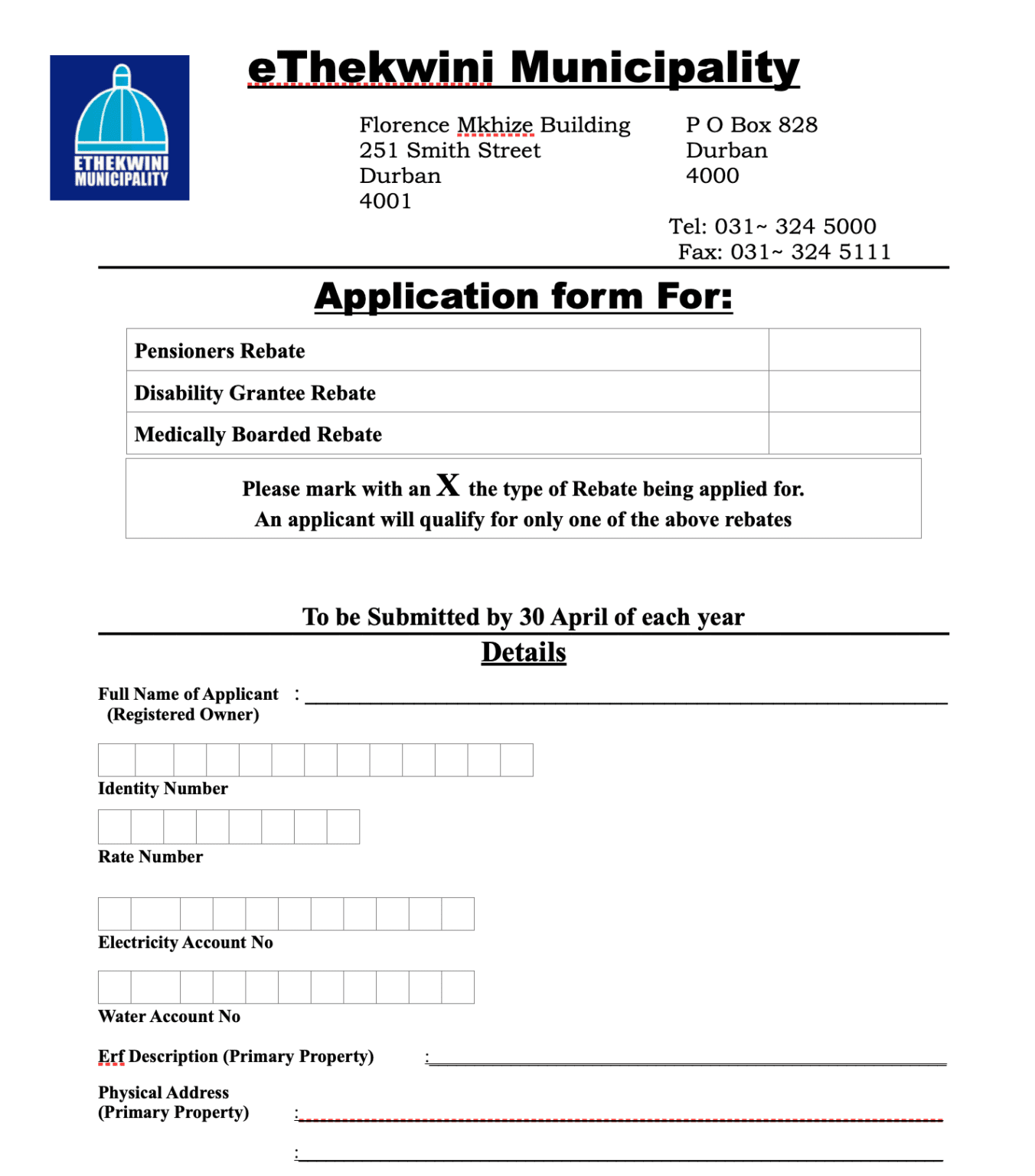

Rates Rebate Form For Pensioners Durban 2022 Application

Fuel Rebate Spreadsheet Series Chews Learning Space

Diesel Fuel Credit Subsidy Or Rebate Farm Online ACT

Gas Grocery Prices Are Hurting Americans Most Here Are 3 Ways To

Reginald George Roberts Stands Trial Over ATO Fuel Rebate Rort The

Tax Rates For The 2024 Year Of Assessment Just One Lap

Tax Rates For The 2024 Year Of Assessment Just One Lap

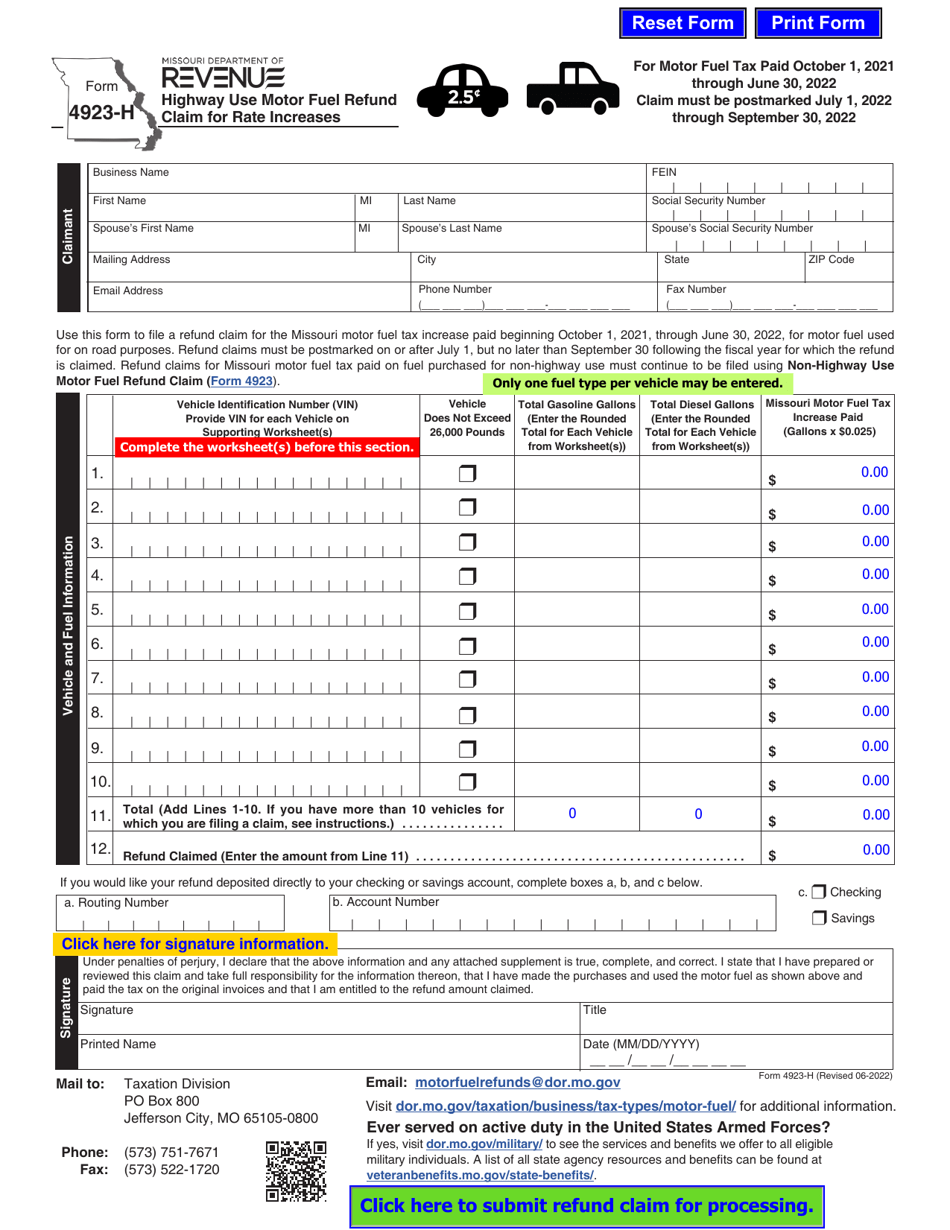

Form 4923 H Fill Out Sign Online And Download Fillable PDF Missouri

National Fuel Rebate Form 2023 Printable Forms Free Online

Rates Rebate Form For Pensioners Durban 2023 Printable Rebate Form

Ato Fuel Rebate Rates - The higher rate of fuel tax credits currently up to 42 7 cents per litre can be claimed from the Australian Tax Office ATO whenever your vehicles or equipment are idling driving or operating off a public road