Ato Fuel Tax Credit Rates Find the current past and historical fuel tax credit rates for business in Australia The rates are indexed twice a year based on the CPI and may change for

Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel Table 1 1 February 2023 to 30 June 2023 Table 2 29 September Fuel tax credit rates non business Check fuel tax credit rates for non businesses from 1 July 2022 to 30 June 2023 Table 1 1 February 2023 to 30 June

Ato Fuel Tax Credit Rates

Ato Fuel Tax Credit Rates

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

Fuel Tax Credit Rates Increase

https://static.wixstatic.com/media/nsplsh_544e7664516d365831756b~mv2_d_3000_4500_s_4_2.jpg/v1/fill/w_667,h_1000,al_c,q_85,usm_0.66_1.00_0.01/nsplsh_544e7664516d365831756b~mv2_d_3000_4500_s_4_2.jpg

Fuel Tax Credit Rates Have Changed RA Advisory Business Accountants

https://raadvisory-1a683.kxcdn.com/wp-content/uploads/2022/04/fuel-tax-credit-rates-have-changed.jpg

Claim fuel tax credits Last Updated 18 January 2024 6 Check the fuel tax credit rates 1 Check if you re eligible for fuel tax credits Businesses can claim credits for the Fuel tax credit rates non business Check fuel tax credit rates for non businesses from 1 July 2023 to 30 June 2024 For more information on non profit

The following tables contain fuel tax credit rates for non businesses from 1 July 2019 to 30 June 2020 Table 1 Rates for fuel acquired from 3 February to 30 June As a business fuel tax credits provide you with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant

Download Ato Fuel Tax Credit Rates

More picture related to Ato Fuel Tax Credit Rates

Fuel Tax Credits Update February 2023 Plus 1 Group

https://plus1group.com.au/wp-content/uploads/2022/09/shutterstock_526636831.jpg

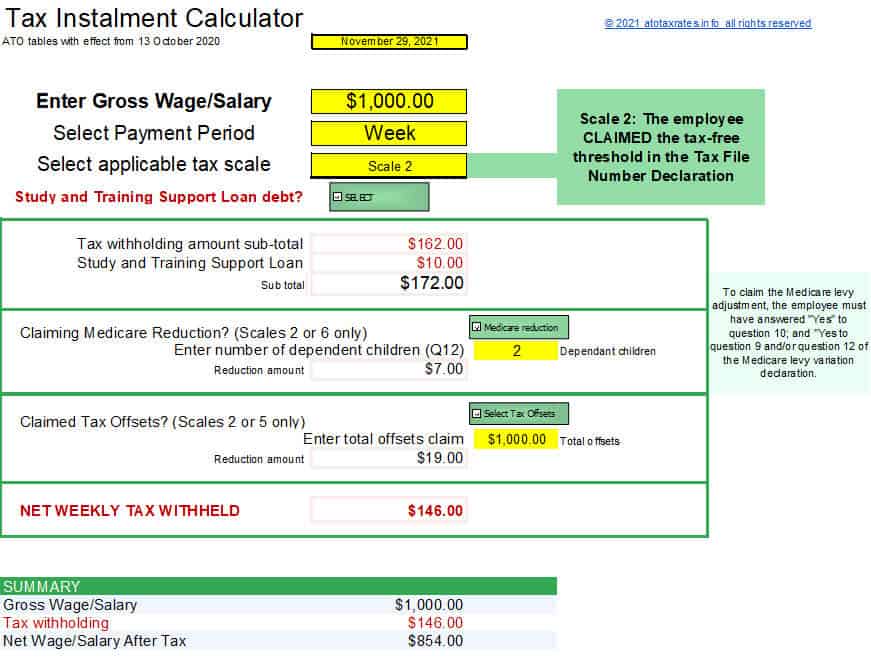

ATO Tax Tables 2023 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2021/11/tidw2022a.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/Artboard-1@2x-100-768x1024.jpg

Average 3 out of 5 Get more fuel tax credits 10 February 2021 There is now a simpler way to calculate your fuel tax credits for diesel used in heavy vehicles If you claim less than Simplified Fuel Tax Calculations Since BAS period ending on 31 March 2016 businesses claiming less than 10 000 credits annually can use the BAS period end rate if the rate has changed during the

Fuel tax credit rates The following tables contain the fuel tax credit rates for businesses from 1 July 2021 to 30 June 2022 The fuel tax credit calculator includes the The updated August 2023 Fuel Tax Credit rates are as follows per the ATO website Fuel Acquired 1 August 2023 to 4 February 2024 What records are required to claim

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Reminder Fuel Tax Credit Rates Have Increased Custom Accounting Pty Ltd

https://customaccounting.com.au/wp-content/uploads/2019/05/Fuel-tax-credits-have-increased.png

https://www.ato.gov.au/.../rates-business

Find the current past and historical fuel tax credit rates for business in Australia The rates are indexed twice a year based on the CPI and may change for

https://www.ato.gov.au/.../rates-business/from-1-july-2022-to-30-june-2023

Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel Table 1 1 February 2023 to 30 June 2023 Table 2 29 September

Fuel Tax Credit Rates Have Changed Small Business Minder

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Fuel Tax Credit Services KPMG AU

Barris Accounting Tax Accountants

Sentrika Blog Fuel Tax Credit Changes

Fuel Tax Credit Rates Have Increased Business Wise

Fuel Tax Credit Rates Have Increased Business Wise

Changes To Fuel Tax Credit Rates Paris Financial Accounting And

Add A New Fuel Tax Rate Agrimaster

.png)

Fuel Tax Credit Rates Have Changed DG Business Services

Ato Fuel Tax Credit Rates - How to claim More information This provides you with general information on fuel tax credits including eligibility rates how to claim where to get more information