Ato Fuel Tax Rebate 2023 Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

Web 7 mars 2023 nbsp 0183 32 Taxation Claim fuel tax credits Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price Web The updated February 2023 Fuel Tax Credit rates are as follows per the ATO website Fuel Acquired 1 February 2023 30 June 2023 What records are required to claim Fuel Tax Credits Businesses must keep a

Ato Fuel Tax Rebate 2023

Ato Fuel Tax Rebate 2023

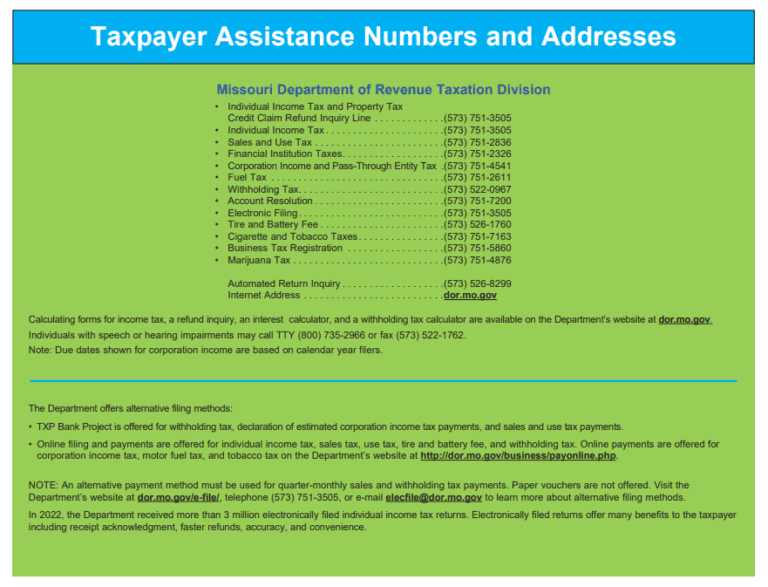

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

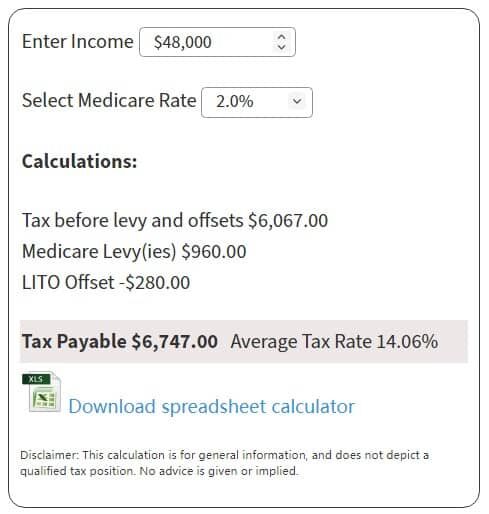

ATO Tax Rates 2023 Find Out The Amount That You Have To Pay

https://jkdsd.org/wp-content/uploads/2023/02/ATO-Tax-Rates.png

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

https://printablerebateform.net/wp-content/uploads/2023/04/Michigan-Tax-Rebate-2023-768x675.png

Web 22 nov 2022 nbsp 0183 32 Fuel Tax Credits Fuel tax credits for businesses that use fuel Last Updated 22 November 2022 Fuel Tax Credits provide businesses who have purchased Web 28 juil 2023 nbsp 0183 32 Simplified Fuel Tax Calculations Since BAS period ending on 31 March 2016 businesses claiming less than 10 000 credits annually can use the BAS period end rate

Web Step 1 Work out your eligible quantities Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which rate applies for the fuel Fuel Web Fuel Tax Changes Fuel tax related measures in the 2023 24 Budget include increasing the Heavy Vehicle Road User Charge rate from 27 2 cents per litre of diesel by six per

Download Ato Fuel Tax Rebate 2023

More picture related to Ato Fuel Tax Rebate 2023

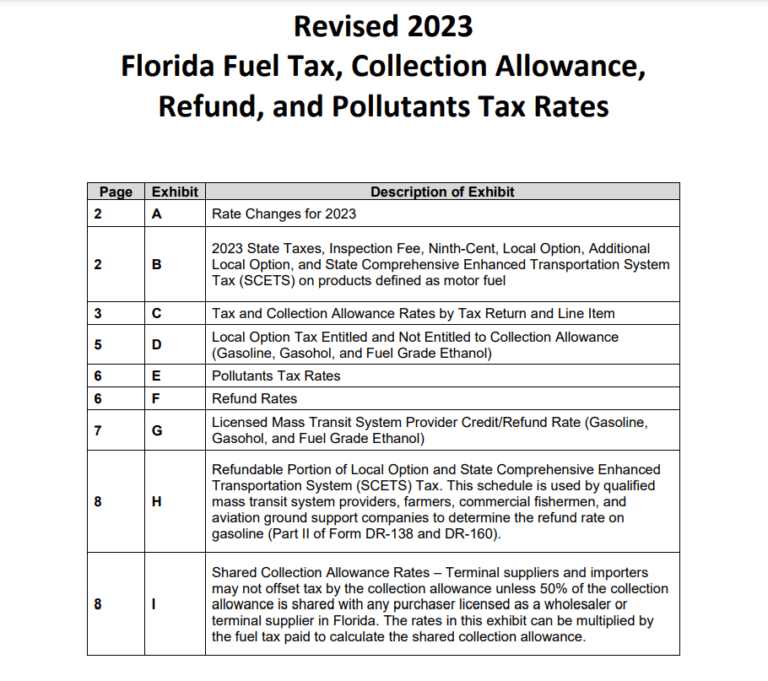

Florida Tax Rebate 2023 Get Tax Relief And Boost Economic Growth

https://printablerebateform.net/wp-content/uploads/2023/03/Florida-Tax-Rebate-2023-768x681.png

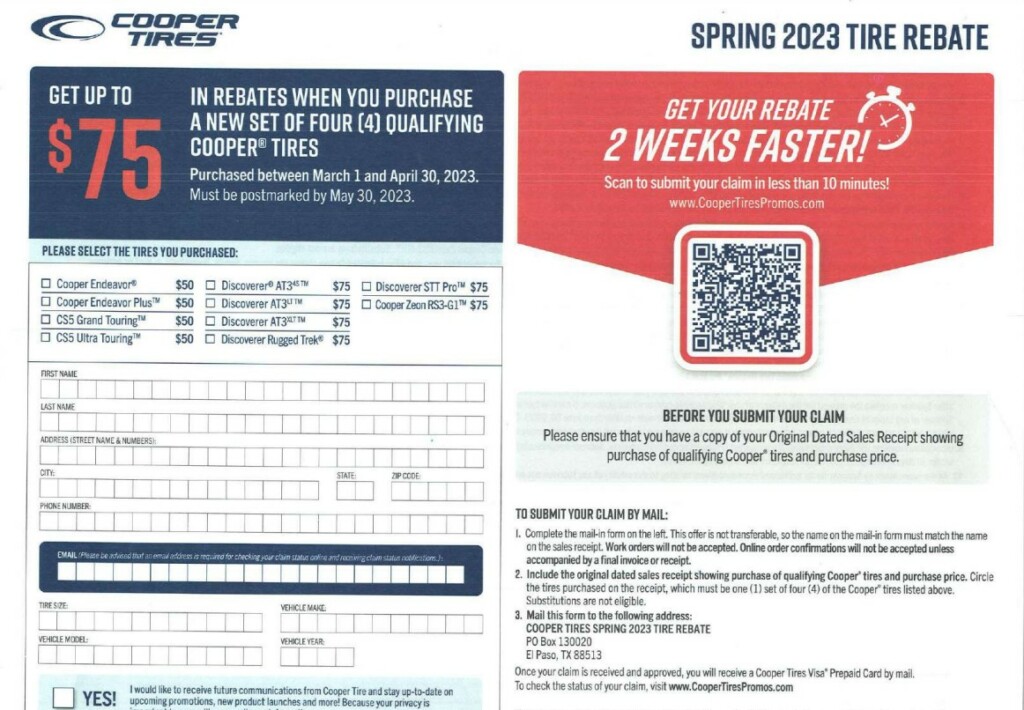

Cooper Tire Rebate 2023 TireRebate

https://www.tirerebate.org/wp-content/uploads/2023/03/Cooper-Tire-Rebate-2023-1024x710.jpg

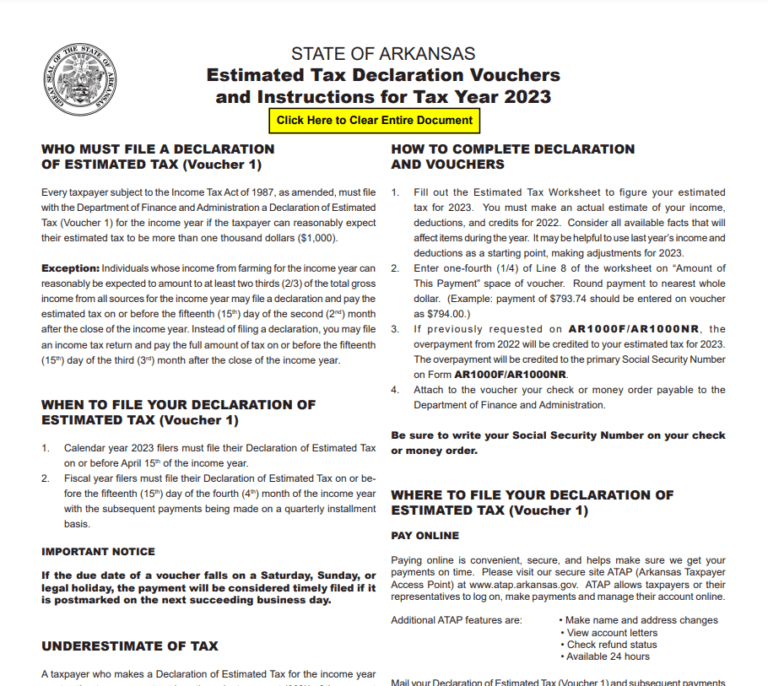

Arkansas Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Arkansas-Tax-Rebate-2023-768x686.png

Web 27 oct 2022 nbsp 0183 32 The fuel tax credit rebate is one of the top 20 most expensive programs rebating the fuel excise tax to businesses that consume diesel off public roads For 2022 23 7 8 billion worth of fuel Web Fuel tax credits for business This provides you with general information on fuel tax credits including eligibility rates how to claim where to get more information Fuel tax credits

Web 1 juil 2022 nbsp 0183 32 Both the duty and FBT exemptions are restricted to cars costing less than the Luxury Car Tax threshold for fuel efficient vehicles for which the current 2022 23 Web 26 juin 2023 nbsp 0183 32 ATO Community Tax amp Super for Business Business Deductions What is the ATO cents per km re imbursement rate for 2023 2024 financial year NSS2023

Missouri Rent Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

ATO Tax Rates 2024 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2021/11/tax-calculator-2023-24-e1685186686733.jpg

https://www.ato.gov.au/.../GST-and-excise/Changes-to-fuel-tax-credit-rates

Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

https://business.gov.au/finance/taxation/claim-fuel-tax-credits

Web 7 mars 2023 nbsp 0183 32 Taxation Claim fuel tax credits Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

Missouri Rent Rebate 2023 Printable Rebate Form

Maine Tax Relief 2023 Printable Rebate Form

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

P G Rebate 2023 Get The Best Deals On Eligible Products Save Big

Montana Tax Rebate 2023 Benefits Eligibility How To Apply

Montana Tax Rebate 2023 Benefits Eligibility How To Apply

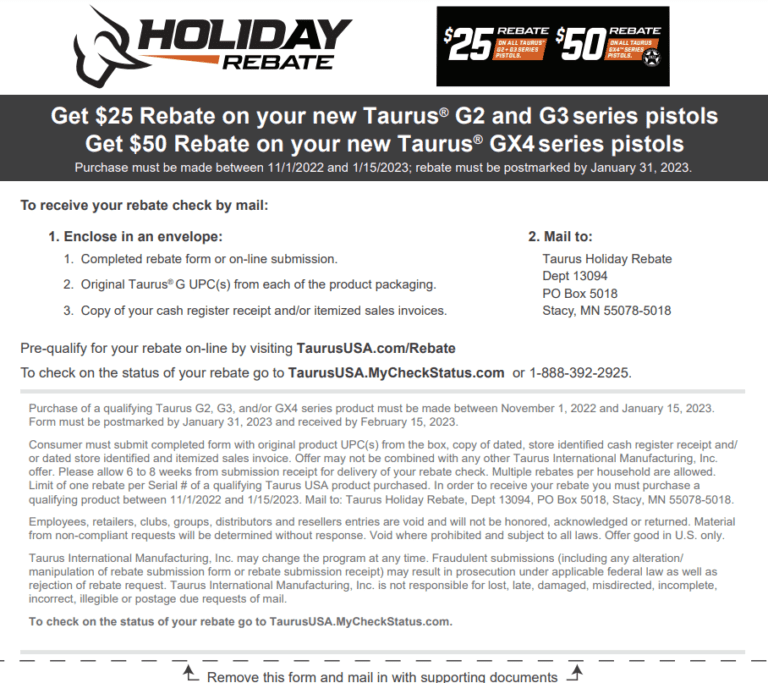

Taurus Rebate 2023 Printable Rebate Form

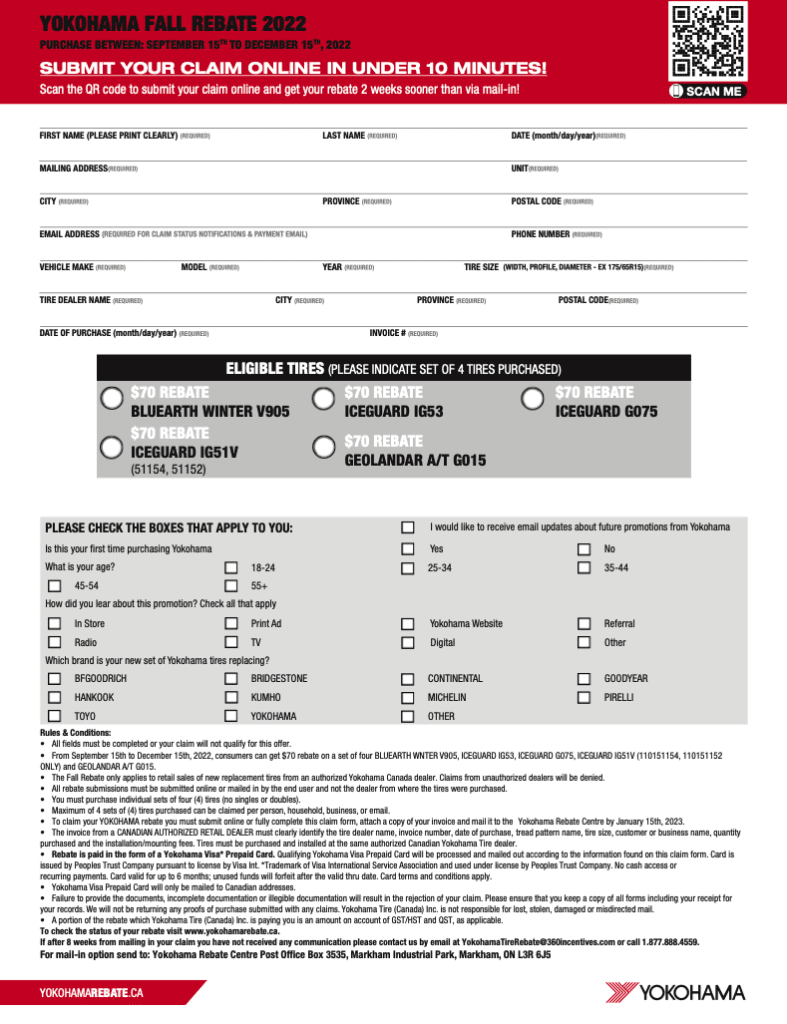

Yokohama Tire Rebate Form 2023 Printable Rebate Form

2023 Equinox Rebates Printable Rebate Form

Ato Fuel Tax Rebate 2023 - Web Sept 11 2023 3 22 a m PT 5 min read Federal tax credits can help you cover the cost of insulation saving you money on energy and keeping your home more comfortable