Ato Fuel Tax Rebate 2024 Note 4 Fuel tax credit rates change for gaseous fuels due to changes in the road user charge which increases by 6 each year over 3 years from 38 5 cents per

Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment Who is eligible for the 300 rebate The rebate will be credited to every Australian household s power bill The word household is key here

Ato Fuel Tax Rebate 2024

Ato Fuel Tax Rebate 2024

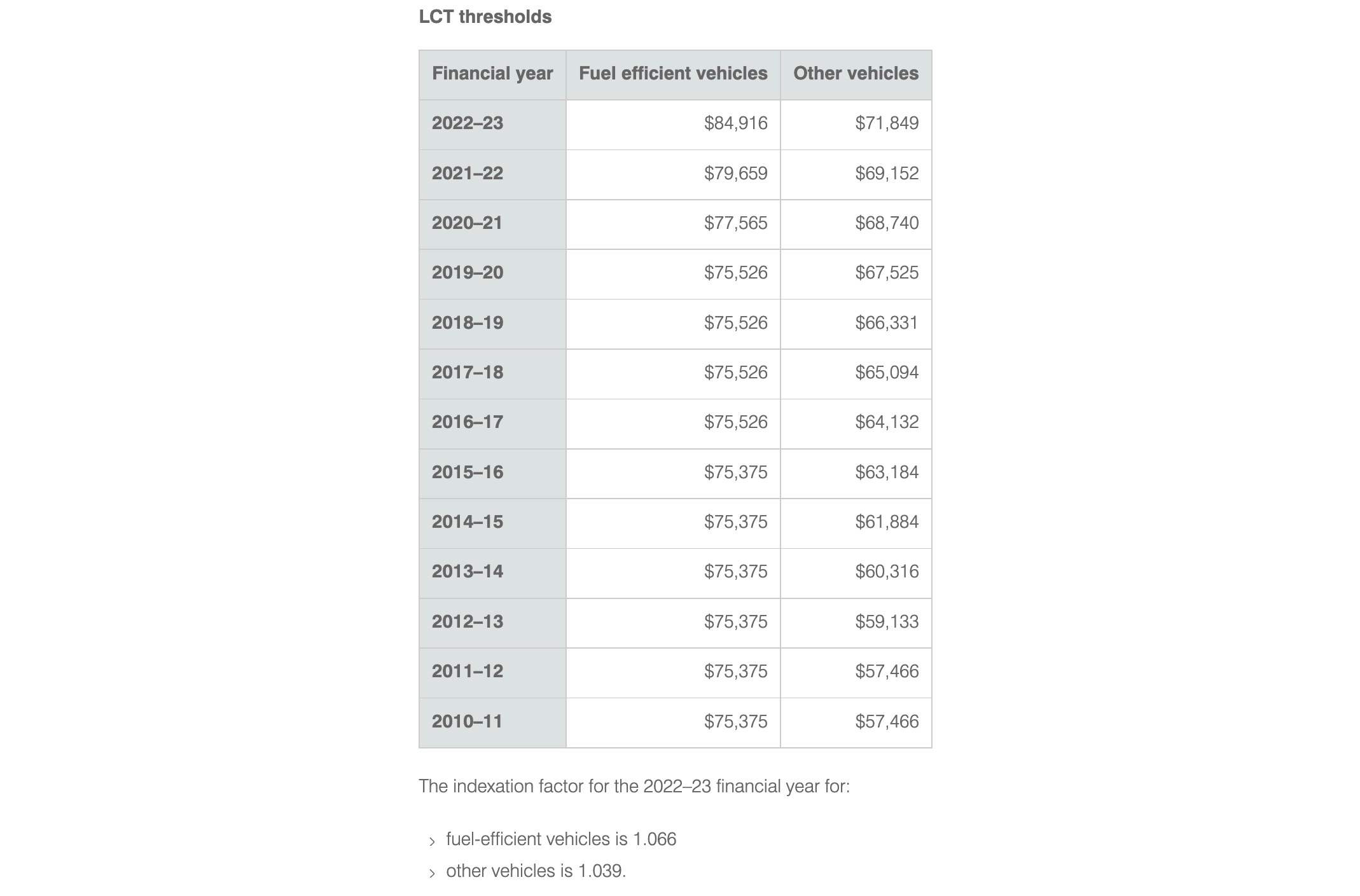

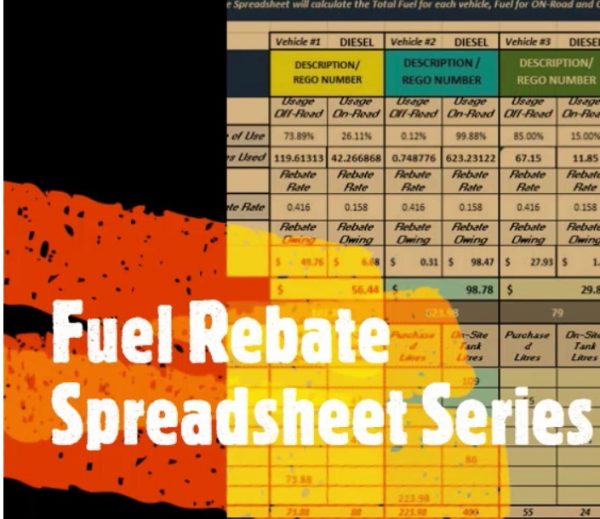

https://performancedrive.com.au/wp-content/uploads/2022/06/2022-2023-Luxury-Car-Tax-threshold-ATO-Australia.jpg

What Are ATO Fuel Tax Credits YouTube

https://i.ytimg.com/vi/abP2teHmXcs/maxresdefault.jpg

Missouri s Motor Fuel Tax Should You Claim A Refund Smith Patrick CPAs

https://smithpatrickcpa.com/wp-content/uploads/2022/03/motor-fuel-tax-rebate.jpg

The Australian Taxation Office ATO has released the updated fuel tax credit rates effective from 1 July 2024 to 04 August 2024 Here s a concise overview of the rates and how Last Updated 11 July 2024 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits

Check the full range of tables for fuel tax credit rates being applied from 1 July 2023 to 30 June 2024 on the ATO web page You can also find the archive of past rates Currently the road user charge reduces fuel tax credits for gaseous fuels to nil We encourage you to use the fuel tax credit calculator provided by the ATO to accurately

Download Ato Fuel Tax Rebate 2024

More picture related to Ato Fuel Tax Rebate 2024

Missouri Gas Tax Refund Form Veche info 16

https://i2.wp.com/data.formsbank.com/pdf_docs_html/255/2552/255274/page_1_thumb_big.png

The Fuel Tax Credit Guide For Australian Business

https://creditte.com.au/wp-content/uploads/2023/01/blog-fuel-tax-credit.jpg

Free 29 Vehicle Maintenance Log Templates Excel Sheet Car Truck Vehicle Service Log Book Temp

https://i.pinimg.com/originals/ba/a6/92/baa692c0facae9d6f8b442775ad8554b.jpg

Here is a listing of the fuel tax credit rates as they currently stand 5 February 2024 to 30 June 2024 Fuel tax credit rates for prior years If you are looking to claim fuel tax The fuel tax credit is a calculation of No of eligible litres x cents per litre rate The cents per litre rate is generally the rate applicable on the date of purchase however

You can check the rates with the ATO but we have also created this handy fuel tax credit calculator so you can quickly determine what kind of fuel tax rebate you might be For the 2021 22 year Fuel Tax Credits will cost the Government a hefty 8 billion the biggest fossil fuel subsidy in Australia By 2024 25 it is estimated to grow to

Fuel Excise Rates Reduced For The Next 6 Months VIEWTRACK

https://viewtrack.com.au/wp-content/uploads/2022/04/ATO-Fuel-Budget.jpg

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell County News

https://www.howellcountynews.com/sites/default/files/field/image/afront-gas rebate.jpg

https://www.ato.gov.au/businesses-and...

Note 4 Fuel tax credit rates change for gaseous fuels due to changes in the road user charge which increases by 6 each year over 3 years from 38 5 cents per

https://www.ato.gov.au/.../fuel-schemes/fuel-tax-credits-business

Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment

Ato Tax Declaration Form Printable Printable Forms Free Online

Fuel Excise Rates Reduced For The Next 6 Months VIEWTRACK

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Tanzania And Kenya Collect Highest Taxes On Fuel The Citizen

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

2023 Tax Forms Bc Printable Forms Free Online

2023 Tax Forms Bc Printable Forms Free Online

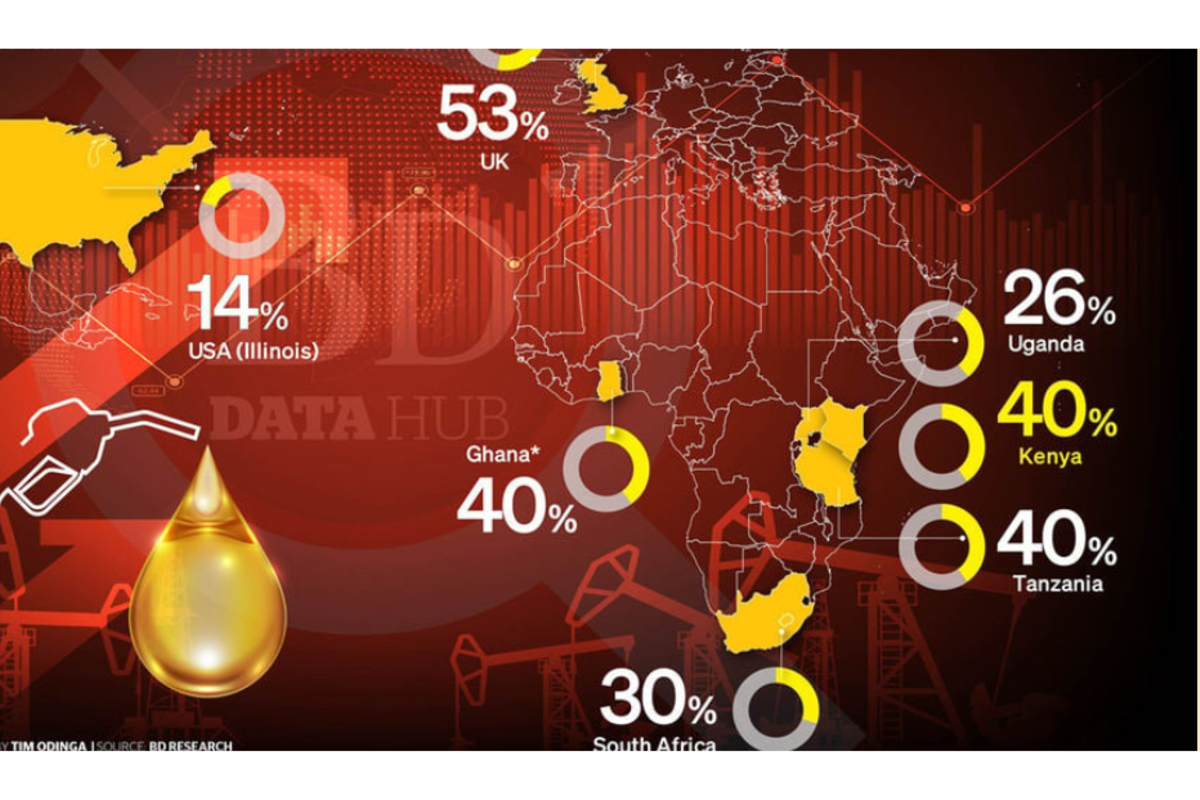

Fuel Rebate Spreadsheet Series Chews Learning Space

Fuel Tax Credit Calculation Worksheet

Vehicle Fuel Log Spreadsheet

Ato Fuel Tax Rebate 2024 - The Australian Taxation Office ATO has released the updated fuel tax credit rates effective from 1 July 2024 to 04 August 2024 Here s a concise overview of the rates and how