Ato Is Income Protection Insurance Tax Deductible Web The premiums you pay to protect against the loss of your employment income are deductible see Income protection insurance PAYG withholding tax on income

Web The ATO rules Everything you should know about income protection insurance and tax There is no tax deduction for most types of life insurance in Australia The reason for Web 25 Mai 2022 nbsp 0183 32 You must show as income at item 24 on your tax return a reimbursement in 2021 22 of any election expenses that you have claimed as a deduction in 2021 22 or

Ato Is Income Protection Insurance Tax Deductible

Ato Is Income Protection Insurance Tax Deductible

https://static.vecteezy.com/system/resources/previews/003/429/699/original/income-protection-insurance-protect-money-or-investment-wealth-vector.jpg

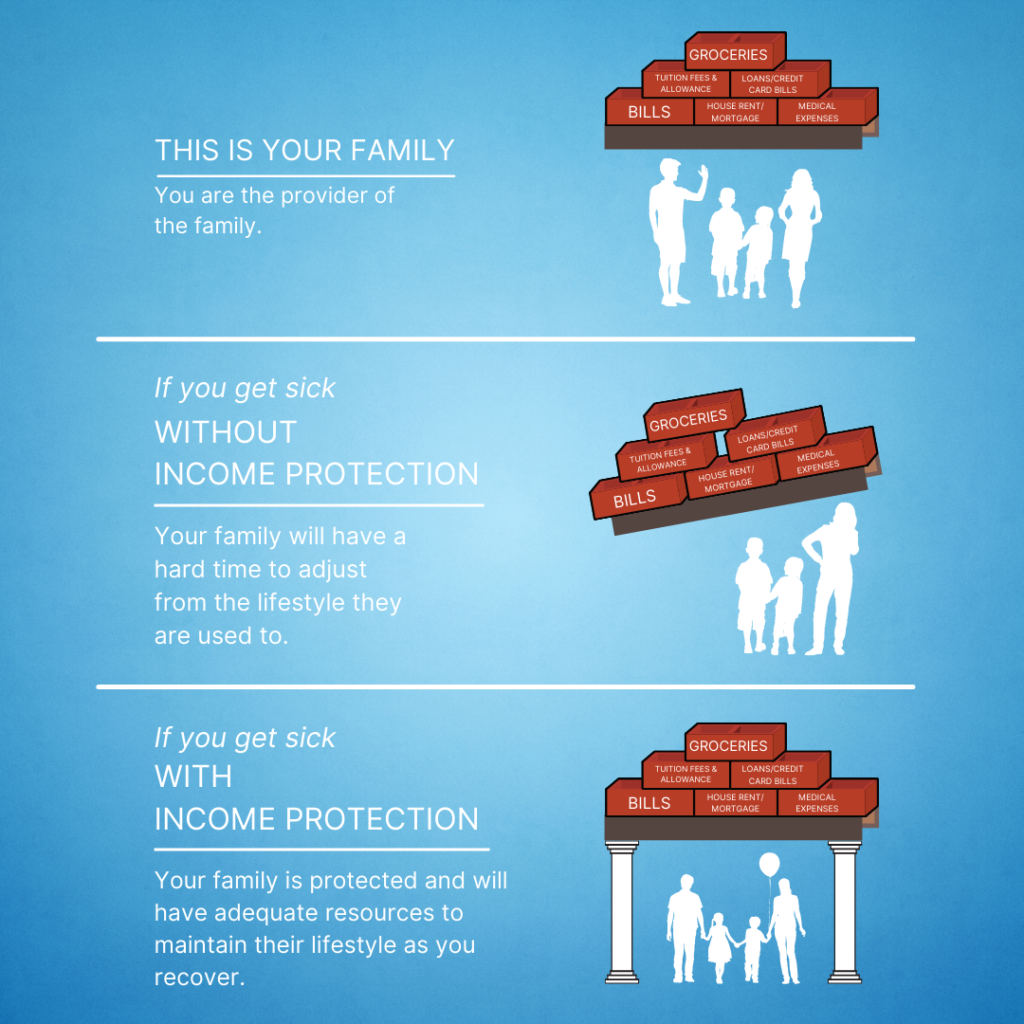

Income Protection Insurance What Is It And Do You Need It Stisi Group

https://stisi.co.uk/wp-content/uploads/2020/05/Income-Protection-Explained-V2.jpg

Income Protection Insurance SMART

https://smartbrokers.co.nz/wp-content/uploads/2017/03/Income-Protection-Insurance.jpg

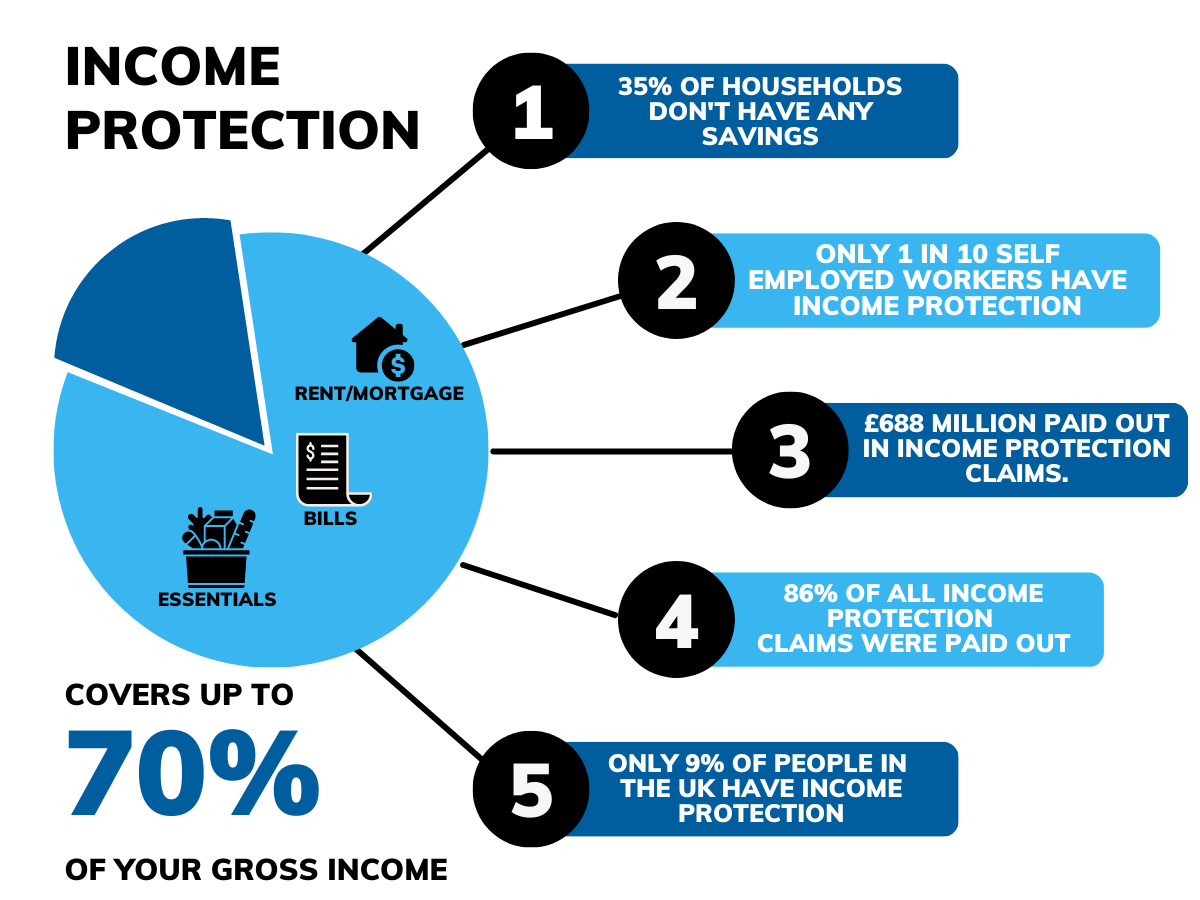

Web 21 Aug 2023 nbsp 0183 32 Yes income protection insurance is generally tax deductible when held inside a self managed super fund How long can you claim income protection Web In short if you hold an income protection insurance policy you are generally eligible for a tax deduction Your accountant can investigate the specifics of your policy to determine what level of deduction you may be

Web 20 Juni 2023 nbsp 0183 32 Only the insurance premiums you pay to protect your income are tax deductible You also must ensure you declare any payments you received under your income protection payout in your Web 24 Okt 2022 nbsp 0183 32 While income protection insurance premiums can generally be treated as a tax deduction any money you receive as part of an income protection insurance

Download Ato Is Income Protection Insurance Tax Deductible

More picture related to Ato Is Income Protection Insurance Tax Deductible

Is Income Protection Tax Deductible Compare The Market

https://www.comparethemarket.com.au/wp-content/uploads/2022/09/Couple-with-tax-deductible-income-protection.jpg

How Does Income Protection Insurance Help You

https://www.reginaldchan.net/wp-content/uploads/2021/11/Income-Protection-Insurance.jpg

The Importance Of Income Protection Insurance Brookfield Finance

https://brookfieldfinance.com/wp-content/uploads/2022/10/Untitled-design-1.jpg

Web 13 Feb 2023 nbsp 0183 32 Income protection insurance provides up to 70 of your regular income in monthly payments if you become ill or injured and the premiums you pay are tax Web Deductions for the premiums you pay for insurance against the loss of your employment income The ATO website is getting a refresh soon Try the updated ato gov au

Web 28 Mai 2021 nbsp 0183 32 Tax Deductions The general principal is that if the proceeds of the income protection policy would be assessable because the proceeds are designed to replace Web Find out how you may be able to claim income protection premiums as a tax deduction

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

Income Protection Insurance Do You Really Need It

https://madesimple.ie/wp-content/uploads/2021/07/Income-Protection-Blog-Post-Alans-Image-1024x1024.png

https://www.ato.gov.au/.../income-protection-insurance-payments

Web The premiums you pay to protect against the loss of your employment income are deductible see Income protection insurance PAYG withholding tax on income

https://www.aspectuw.com.au/insights/the-ato-rules-everything-you...

Web The ATO rules Everything you should know about income protection insurance and tax There is no tax deduction for most types of life insurance in Australia The reason for

Income Protection Insurance In Super Beware Of Offsets DFK Gray

Are Health Insurance Premiums Tax Deductible Triton Health Plans

Is Income Protection Tax Deductible LifeCovered

Is Income Protection Insurance Tax Deductible In The UK Small

SMSF Insurance Options Life TPD Income Protection Deductions More

Income Protection And Tax Deductions In Australia Lifebroker

Income Protection And Tax Deductions In Australia Lifebroker

Income Protection Insurance Australia Coverage Cost Business Blog

Income Protection Insurance Carew Co Solutions

Income Protection Insurance Australia Is Income Protection Insurance

Ato Is Income Protection Insurance Tax Deductible - Web 21 Aug 2023 nbsp 0183 32 Yes income protection insurance is generally tax deductible when held inside a self managed super fund How long can you claim income protection