Australia Child Care Tax Rebate Web 10 juil 2023 nbsp 0183 32 Assistance to help you with the cost of child care To get Child Care Subsidy CCS you must care for a child 13 or younger who s not attending secondary school unless an exemption applies use an approved child care service be responsible for paying the child care fees meet residency and immunisation requirements

Web Centrelink online account through myGov Express Plus Centrelink mobile app Some payments won t prefill when telling us you don t need to lodge a tax return online They also won t appear on your Centrelink payment summary You must include the amount you got in your taxable income so we can balance your payments correctly Web 10 juil 2023 nbsp 0183 32 This is a Services Australia payment that helps with the cost of approved child care This payment has changed Who can get it How to get it You may also be eligible for Help in your language Services Australia pays the subsidy to your child care provider to reduce the fees you pay

Australia Child Care Tax Rebate

Australia Child Care Tax Rebate

https://www.carrebate.net/wp-content/uploads/2022/08/t778-fill-19e-pdf-clear-data-child-care-expenses-fill-out-and-sign.png

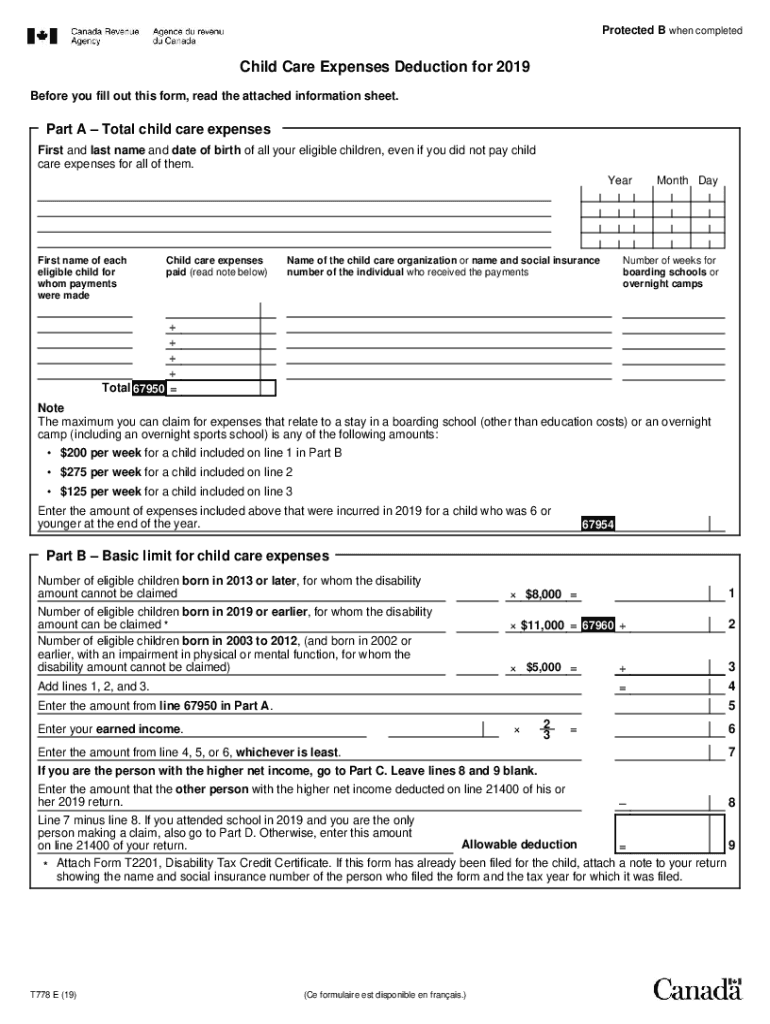

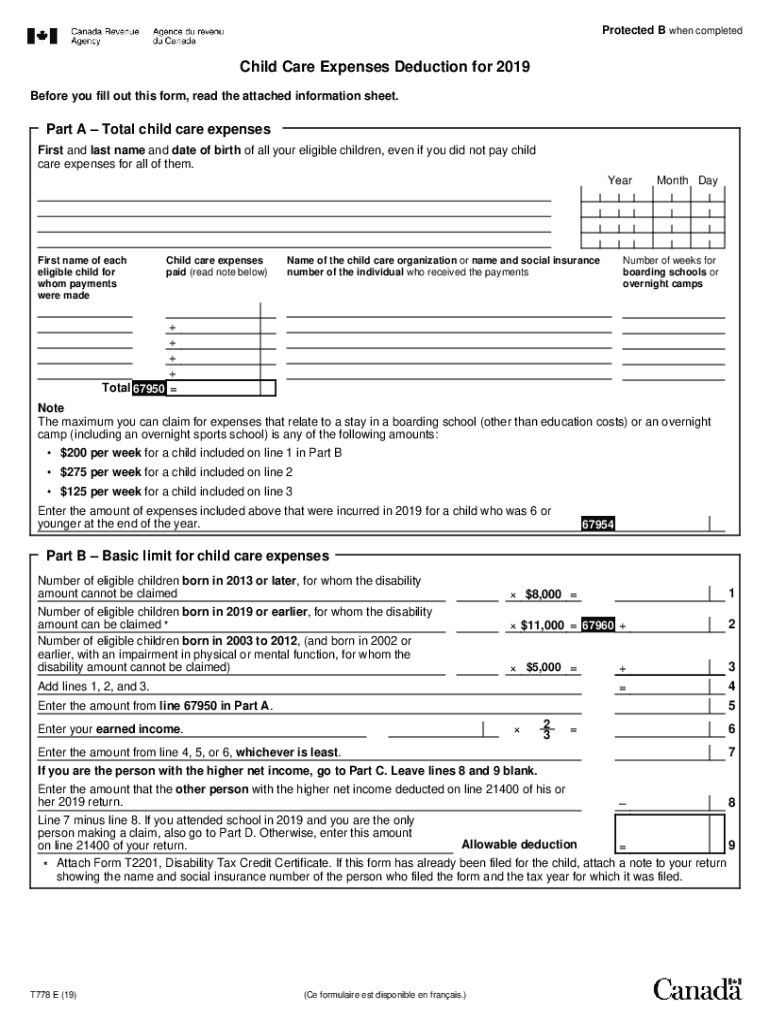

50 Child Care Tax Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/cash-gifts-to-a-shared-vision-qualify-for-50-child-care-tax-credit-a.png

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-622x1024.jpg

Web 10 juil 2023 nbsp 0183 32 From today about 1 2 million Australian families are in line for a childcare rebate boost Here s what the new federal government changes could mean for you What is changing from July 10 Web 3 juin 2009 nbsp 0183 32 The Child Care Tax Rebate CCTR will provide 4 4 billion over four years to assist working families with their out of pocket child care costs The Child Care Benefit CCB will deliver 8 4 billion over four years to reduce child care fees For more information on changes to benefits rates please visit the mychild website

Web 30 juin 2021 nbsp 0183 32 Annual cap Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not have their CCS capped From July 2022 we re removing the annual cap Web WHAT IS THE 30 CHILD CARE TAX REBATE This tax rebate helps families with the cost of approved child care The rebate is 30 of your out of pocket expenses for approved child care you had to pay in the previous year of income

Download Australia Child Care Tax Rebate

More picture related to Australia Child Care Tax Rebate

Promise The Children 2016 Child Care For All Promise The Children

http://www.promisethechildren.org/wp-content/uploads/child-care-tax-credit-1024x607.png

CHAPTER TWO Parliament Of Australia

http://www.aph.gov.au/~/media/Committees/Senate/committee/eet_ctte/childcare/report/c02_3.gif?la=en

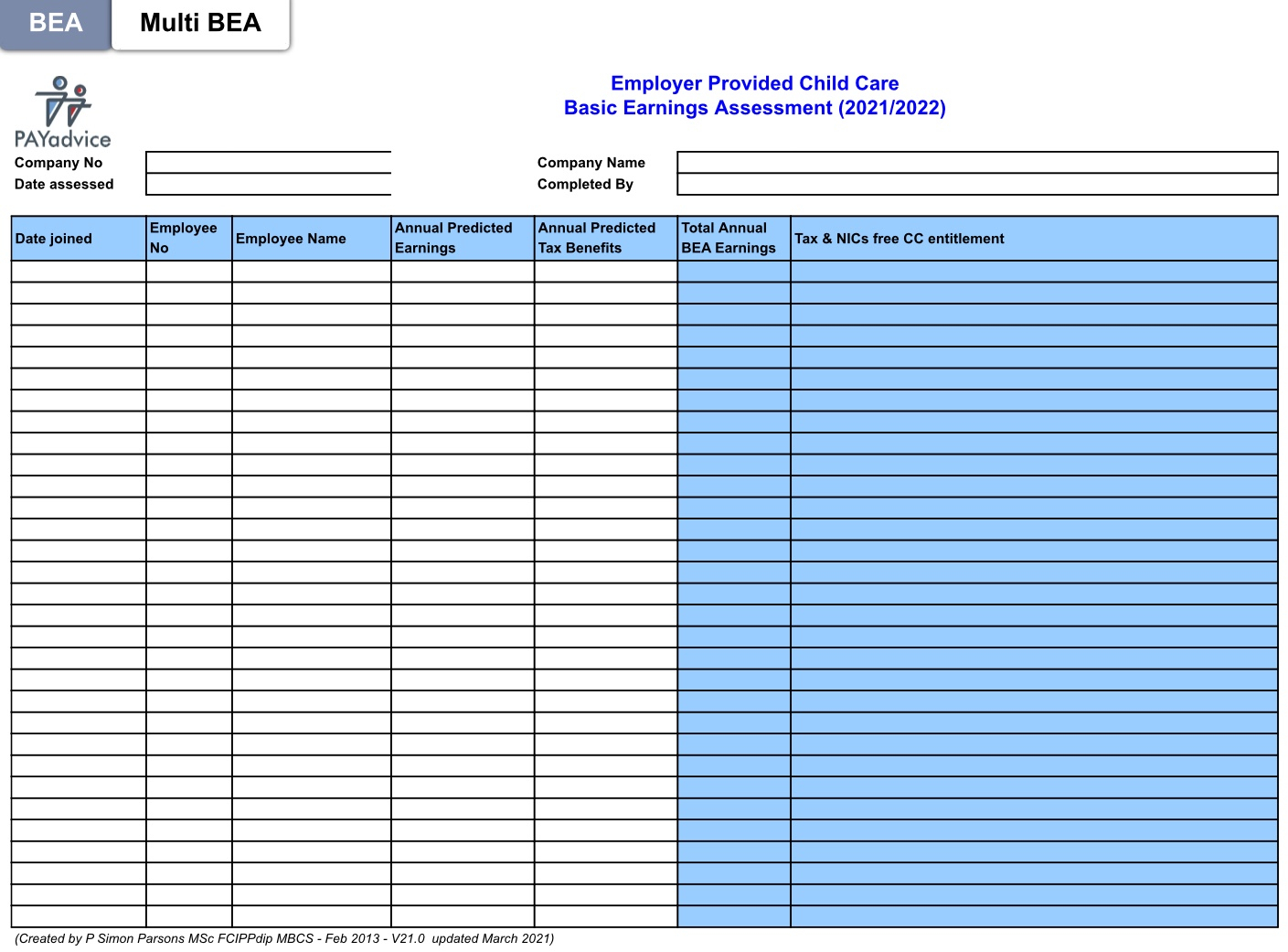

Child Care Tax Rebate 2022 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-vouchers-2021-2022-basic-earnings-assessment-calculator.jpg

Web Understand how we work out your Child Care Subsidy rate using your income and the number of children in your care The type of child care you use affects it The amount of Child Care Subsidy you can get depends on the type of approved child care you use It also depends on the age of your child Web You can find out more about gross income and allowable deductions on the Australian Taxation Office ATO website You might get some payments from us that aren t taxable This means they re not included as taxable income Some examples are Family Tax Benefit Child Care Subsidy Additional Child Care Subsidy

Web If you are using approved child care for the purposes of Child Care Benefit CCB for work training or study related reasons the Government will provide you with 50 per cent of your out of pocket child care costs up to the annual limit For the 2014 2015 income year the CCR annual limit is 7500 per child per year Web 13 juil 2020 nbsp 0183 32 Paul Karp The 1 million Australians who have already completed their tax returns will start to receive refunds this week but for families with children in childcare Monday also marks the return

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022.png

Childcare Tax Rebate Google Docs

https://lh3.googleusercontent.com/docs/AOD9vFr_UKhK8qduqUufb1KgrPjWuQgA9bQz6e_fB4Id6GSAU9bertsDMt_QDKuWXxNyOwyWifG2KNWPFPPizPhVuqSffuQxD5RfFL3awCjHxPMH=w1200-h630-p

https://www.servicesaustralia.gov.au/child-care-subsidy

Web 10 juil 2023 nbsp 0183 32 Assistance to help you with the cost of child care To get Child Care Subsidy CCS you must care for a child 13 or younger who s not attending secondary school unless an exemption applies use an approved child care service be responsible for paying the child care fees meet residency and immunisation requirements

https://www.servicesaustralia.gov.au/balancing-child-care-subsidy

Web Centrelink online account through myGov Express Plus Centrelink mobile app Some payments won t prefill when telling us you don t need to lodge a tax return online They also won t appear on your Centrelink payment summary You must include the amount you got in your taxable income so we can balance your payments correctly

Child Care And Early Childhood Learning Future Options PC News And

Are YOU Eligible For The CT Child Tax Rebate

Rebate Australia Child Means Test Logo PNG 882x570px Rebate Area

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Child Tax Credits Calculator CALCULATORUK HJW

Child Care Rebate Application Form Edit Fill Sign Online Handypdf

Child Care Rebate Application Form Edit Fill Sign Online Handypdf

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

Child Care Rebate

Child Care Benefit Claim Form Notes Australia Free Download

Australia Child Care Tax Rebate - Web 14 ao 251 t 2023 nbsp 0183 32 Note that changes to the Paid Parental Leave scheme made by the Paid Parental Leave Amendment Improvements for Families and Gender Equality Act 2023 and Paid Parental Leave Amendment Improvement for Families and Gender Equality Rules 2023 have commenced for births and adoptions on or after 1 July 2023