Australia Sales Tax Rebate Web Before you buy International travellers including Australians might be able to claim a GST Goods and Services Tax and WET Wine Equalisation Tax refund for some goods bought in Australia that you then take out of the country with you on a plane or ship

Web The TRS allows Australians and overseas visitors to claim a refund subject to certain conditions of the goods and services tax GST and wine equalisation tax paid on goods bought in Australia and then taken out of Australia Web The Tourist Refund Scheme TRS allows you to claim a refund of the Goods and Services Tax GST and Wine Equalisation Tax WET that you pay on certain goods purchased in Australia The TRS located in T2 departures is after customs in the main tax and duty

Australia Sales Tax Rebate

Australia Sales Tax Rebate

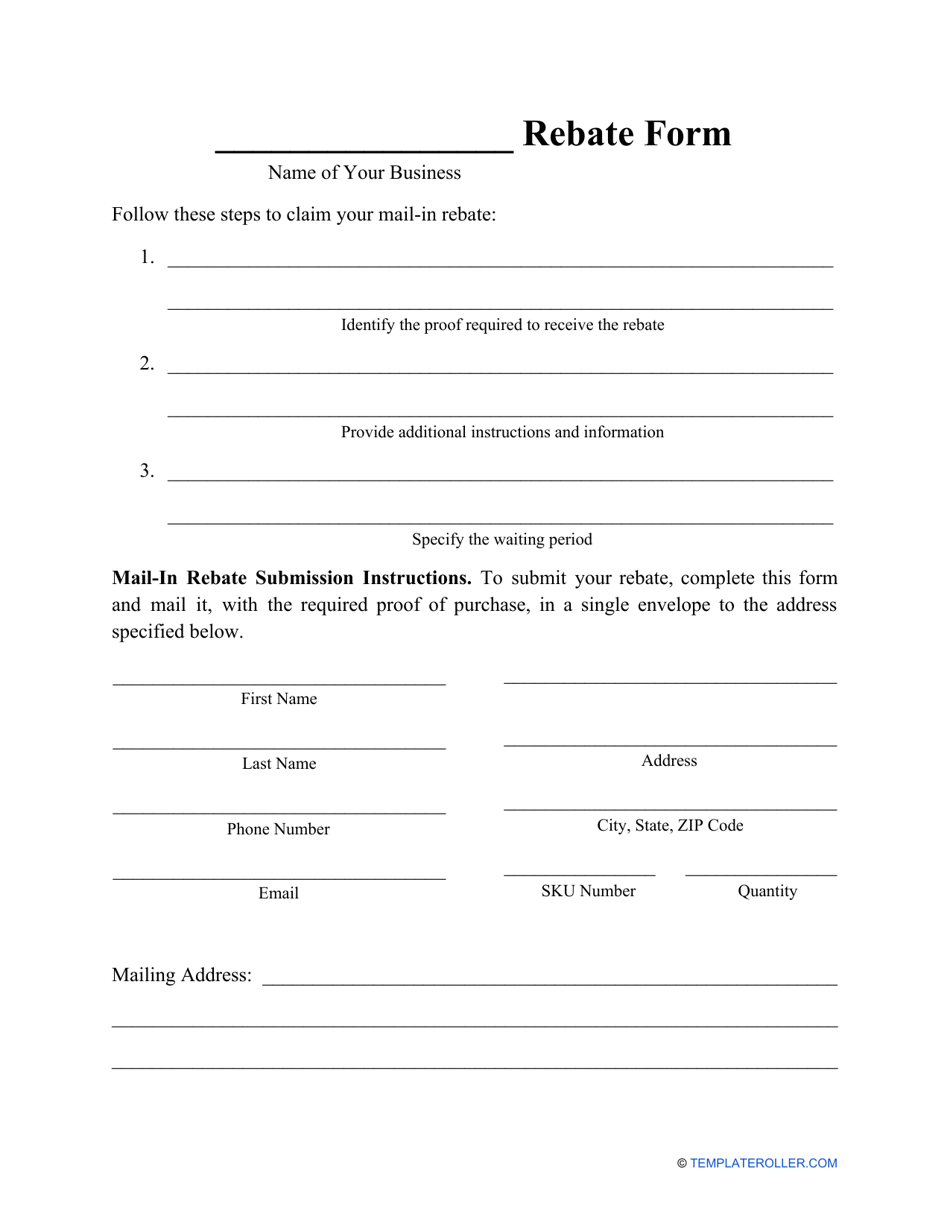

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

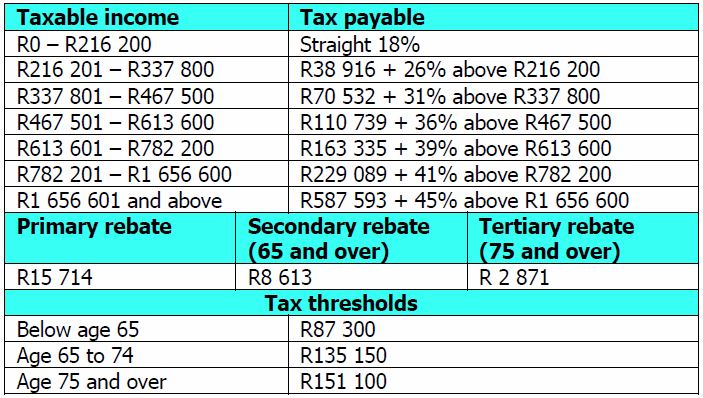

Budget Highlights For 2021 22 Nexia SAB T

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Weekly E Update

https://files.constantcontact.com/4ec08e3e101/88d25955-5fd5-4f7e-85ea-94e96b5f374d.png

Web 29 juin 2023 nbsp 0183 32 A rebate is available to a wine producer of 29 of the wholesale price excluding WET or GST for wholesale sales and of 29 of the notional wholesale selling price for retail sales and applications for own use up to a maximum rebate of AUD Web 17 mars 2022 nbsp 0183 32 A 3 000 rebate for EVs bought for less than 68 740 limited to the first 4 000 vehicles to claim the rebate A 100 registration fee discount per year More than half of the rebates had been claimed as of March 2022 but the Victorian government says

Web 16 juil 2021 nbsp 0183 32 The average Australian tax refund is 2 800 here are some ways you could use the extra cash ABC News ABC Radio Melbourne By Matilda Marozzi Posted Fri 16 Jul 2021 at 4 33pm Web 15 of the taxed element or 10 of the untaxed element The tax offset amount available to you on your taxed element will be shown on your payment summary There is now a limit on the amount of tax offset you re entitled to on your untaxed element This is generally

Download Australia Sales Tax Rebate

More picture related to Australia Sales Tax Rebate

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

https://i1.wp.com/struggleville.net/wp-content/uploads/2019/10/MenardsPriceAdjustmentRebate8502.jpg

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/27/773/27773189/large.png

How Much Tax Do Aussies Pay INFOGRAPHIC Infographic List

https://infographiclist.files.wordpress.com/2013/07/how-much-tax-do-aussies-pay_50529f6cab12b.jpg

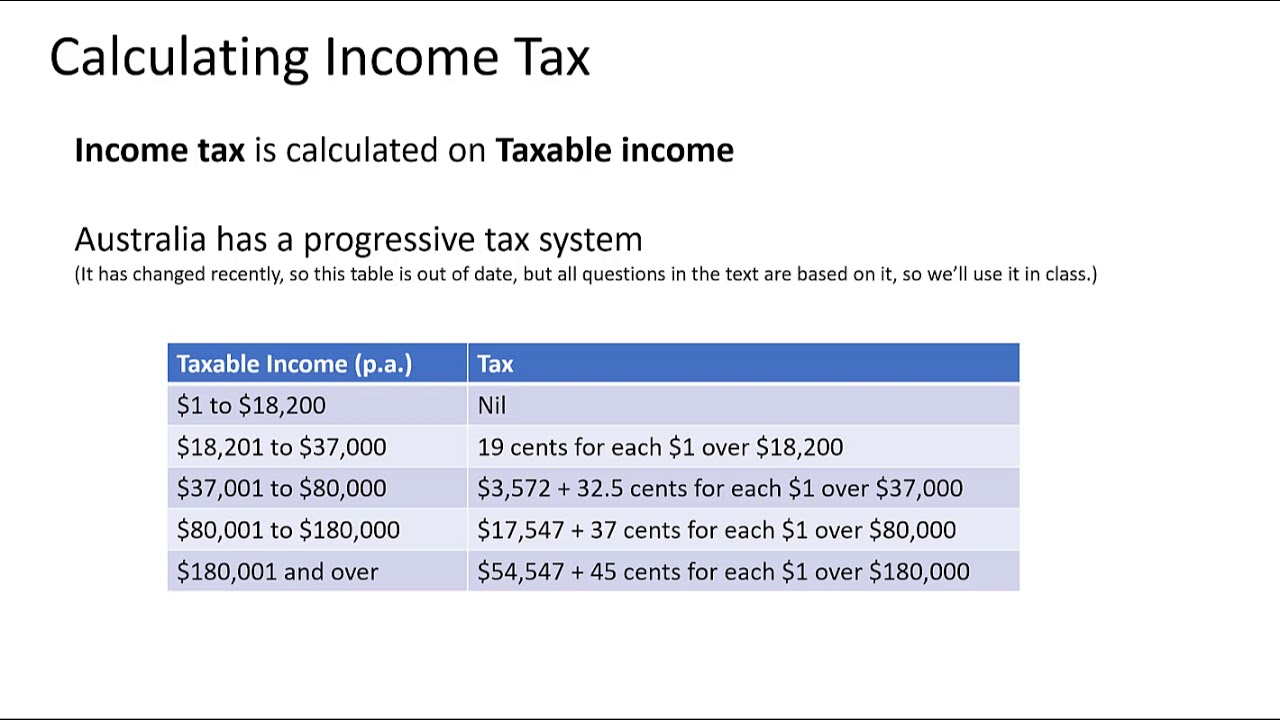

Web 6 mai 2022 nbsp 0183 32 What are the new tax rates for 2021 2022 One off cost of living tax offset In the 2022 federal budget Treasurer Josh Frydenberg announced a one off 420 cost of living tax offset for more than 10 million low and middle income earners Combined with Web Information about the tax allowances and rebates payable in Australia All taxpayers can claim allowances from their taxable income and rebates in addition to a credit for tax paid during the relevant financial year

Web VAT and Sales Tax Rates in Australia for 2023 Australia VAT Rate 10 00 About 10 tax on a 100 purchase Exact tax amount may vary for different items The current Australia VAT Value Added Tax is 10 00 Web 18 avr 2023 nbsp 0183 32 In Australia the R amp D Tax Incentive is delivered by a tax offset which can be refundable or non refundable and the rate can differ depending on the aggregated turnover of the R amp D entity In New Zealand the R amp D Tax Incentive is delivered by a tax credit

PW1023 PRE RECOREDED WEBINAR GST HST And NEW HOUSING REBATES

https://simplysalestax.com/wp-content/uploads/2021/09/2020-03-HOUSING-REBATES-a.jpg

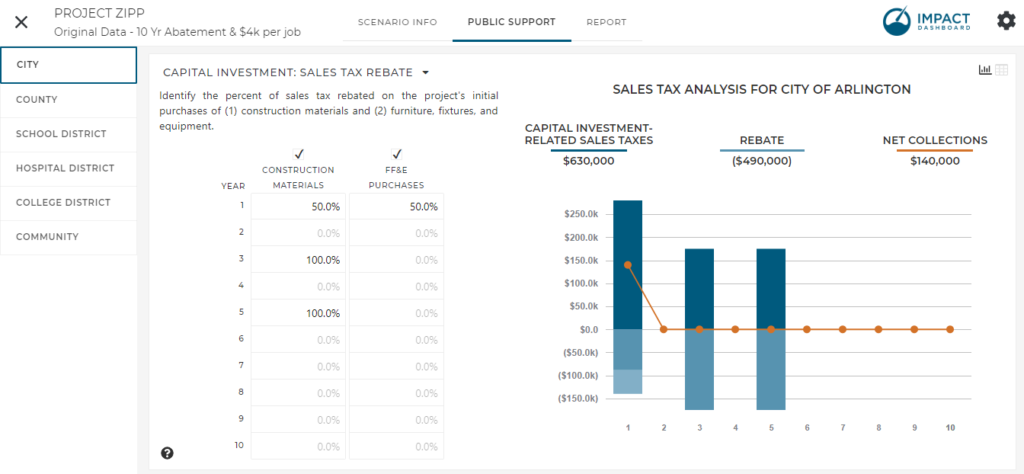

Impact DashBoard Update June 2019 Impact DataSource

https://impactdatasource.com/wp-content/uploads/2019/06/IDB-Sales-Tax-Rebate-Screenshot-1024x474.png

https://www.abf.gov.au/entering-and-leaving-australia/tourist-refund-scheme

Web Before you buy International travellers including Australians might be able to claim a GST Goods and Services Tax and WET Wine Equalisation Tax refund for some goods bought in Australia that you then take out of the country with you on a plane or ship

https://www.abf.gov.au/entering-and-leaving-australia/tourist-refund...

Web The TRS allows Australians and overseas visitors to claim a refund subject to certain conditions of the goods and services tax GST and wine equalisation tax paid on goods bought in Australia and then taken out of Australia

Irs Refund Calculator 2022 AzwanMaymuna

PW1023 PRE RECOREDED WEBINAR GST HST And NEW HOUSING REBATES

Australian Income Tax YouTube

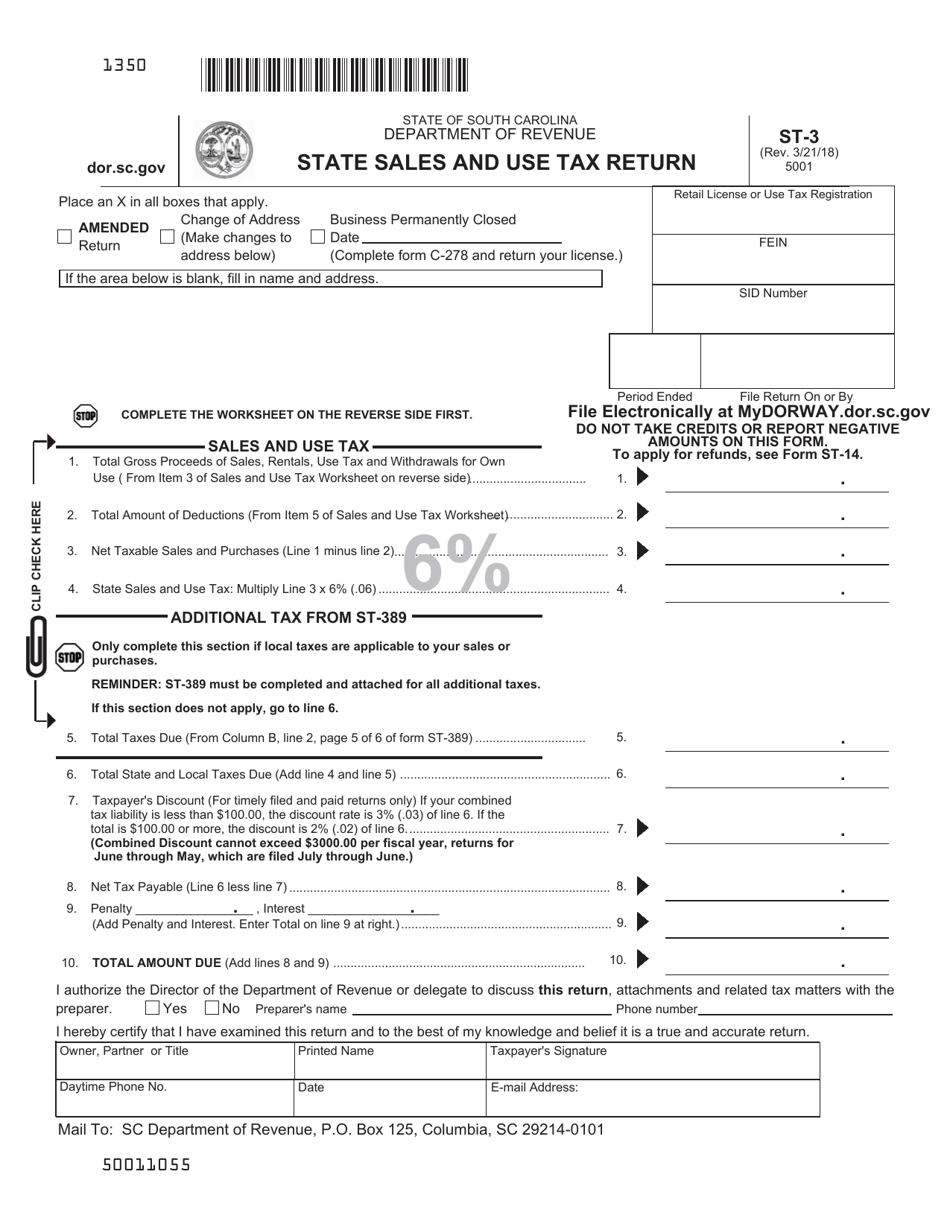

Sales And Use Tax Return Form St John The Baptist Parish Printable

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

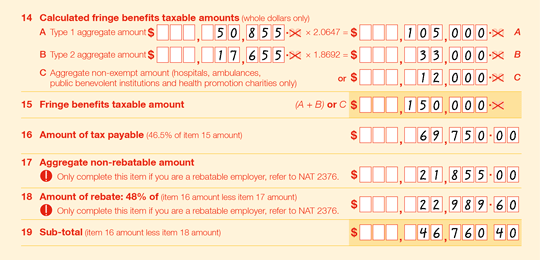

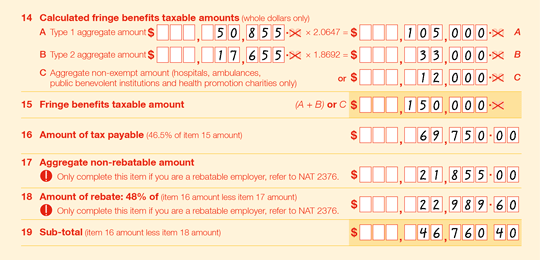

Non profit Organisations Operating An Eligible Public Benevolent

Non profit Organisations Operating An Eligible Public Benevolent

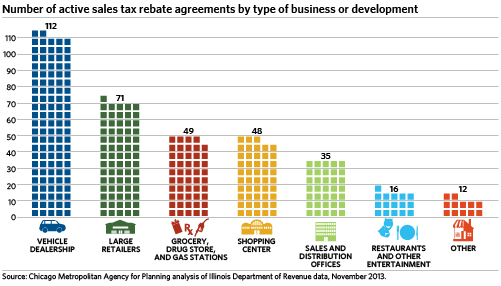

Sales Tax Rebate Database Analysis Highlights Prevalence Of Rebate

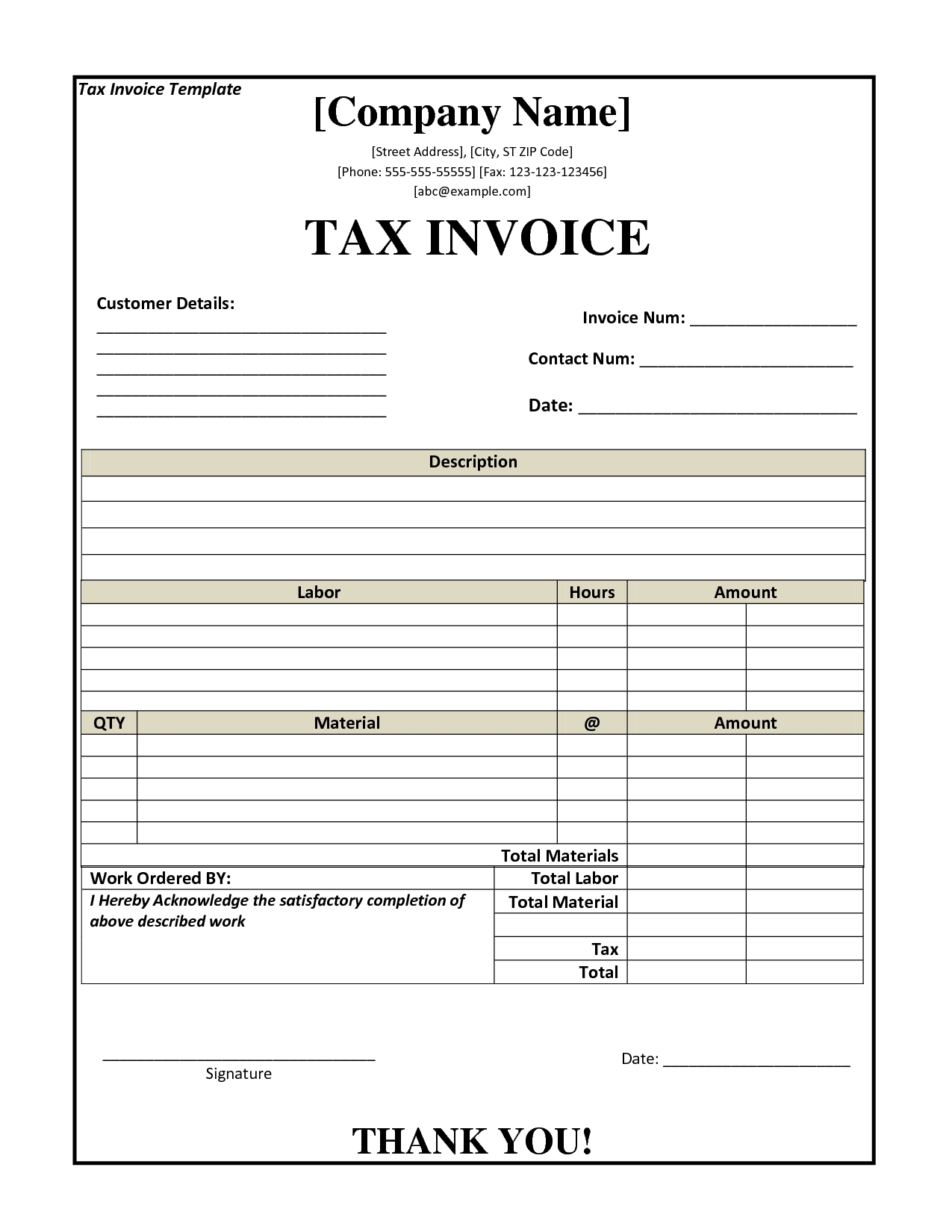

Tax Invoice Templates Invoice Template Ideas

Pin On Tigri

Australia Sales Tax Rebate - Web In 2021 22 the Australian company tax rate is 25 for companies with an aggregated turnover below 50 million and 30 for companies with an aggregated turnover of 50 million or more Note For more details see OECD R amp D Tax Incentive Compendium and