Australia Wet Tax Rebate Web International travellers including Australians might be able to claim a GST Goods and Services Tax and WET Wine Equalisation Tax refund for some goods bought in

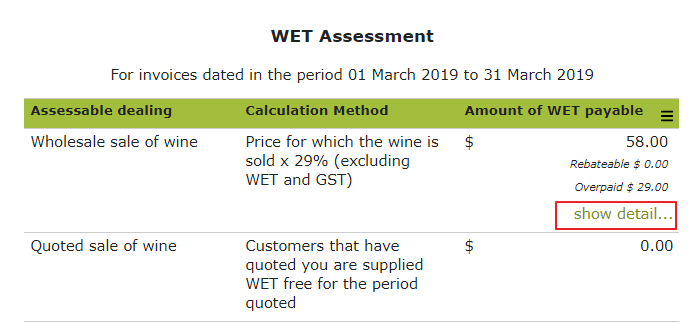

Web 7 lignes nbsp 0183 32 To calculate and claim your rebate Work out 29 of the taxable value of your Web WET credits When you are and aren t entitled to a wine equalisation tax WET credit paid WET in error or overpaid WET for example a wholesaler sells wine and pays WET but

Australia Wet Tax Rebate

Australia Wet Tax Rebate

https://www.ato.gov.au/uploadedImages/Content/SME/Images/39720_05.jpg?n=5095

Wine Bodies Seek 44 Million WBM Online

https://wbmonline.com.au/wp-content/uploads/2017/05/Australian-Wine-Bodies-Seek-44-Millio.jpg

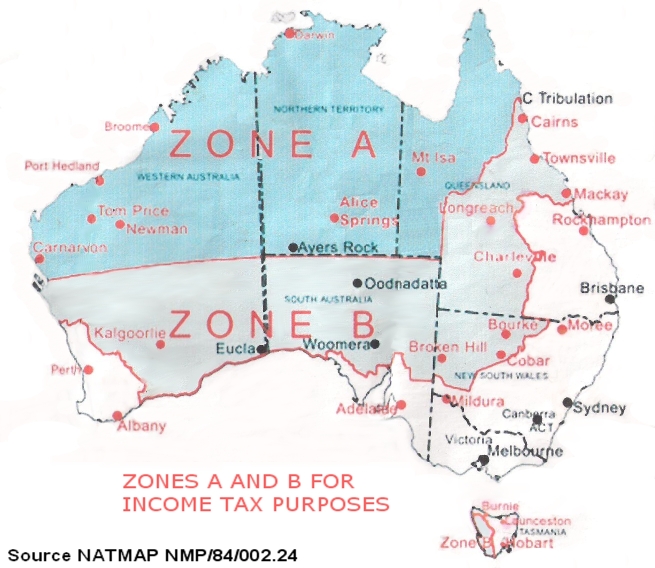

Australian Tax Rebate Zones In 1945 Source NATMAP NMP 84 002 24

https://www.researchgate.net/profile/Lex-Fullarton/publication/310952943/figure/fig2/AS:433972418224137@1480478495792/Western-Australias-average-daily-maximum-temperature-for-January-Source-Australian_Q640.jpg

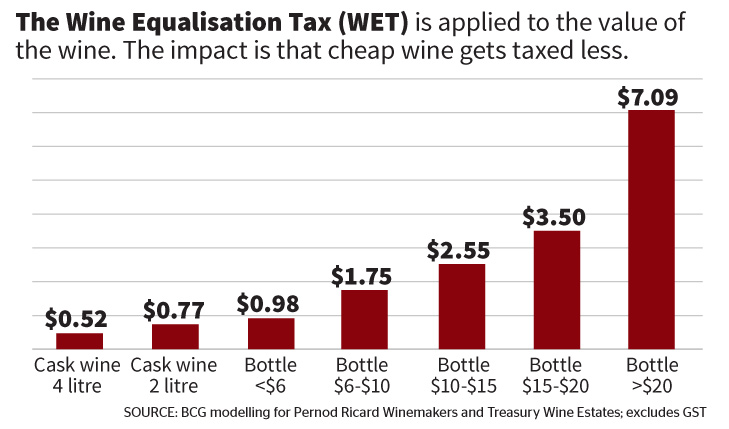

Web 31 juil 2023 nbsp 0183 32 As per the ATO Australian Taxation Office any individual who produces wine imports wine into Australia or sells wine wholesale is liable to pay wine Web To be eligible to claim the WET rebate ownership of the grapes will mean that some form of contract must be in place at the weighbridge prior to crushing This may take the form of an exchange of letters but a more

Web WET was paid You must make your claim within four years from when you became entitled to your rebate Your claim must total at least A 200 Claims can be aggregated to reach Web 11 mai 2021 nbsp 0183 32 Fortunately however the Australian Tax Office ATO does allow a producer rebate If you re new to the sale and purchasing of wine the system can seem quite confusing So we ve decided to breakdown

Download Australia Wet Tax Rebate

More picture related to Australia Wet Tax Rebate

Australian Wine Industry Body Welcomes Reforms To WET Tax VINEX

https://en.vinex.market/files/2638_31wet_tax_graph.jpg

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

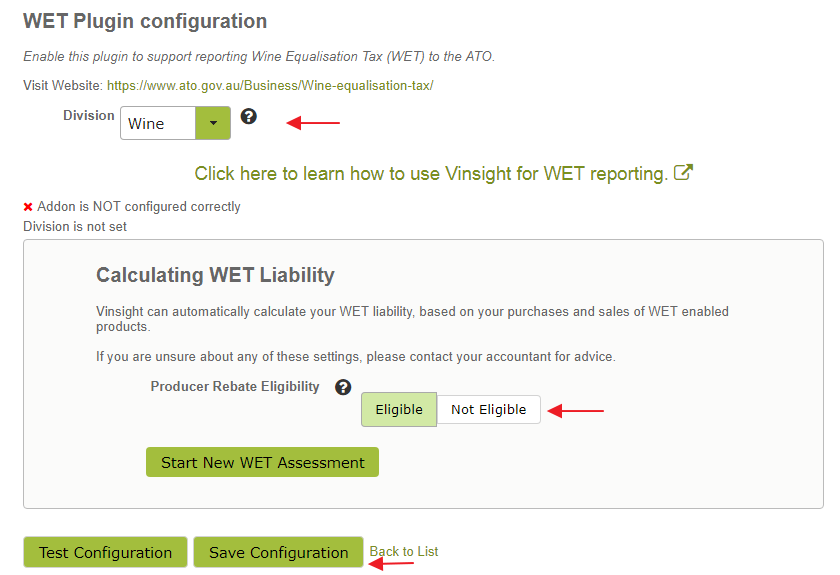

Calculating WET Tax With Vinsight Vinsight Documentation Vinsight

https://docs.vinsight.net/wp-content/uploads/2019/03/img_5c9826bdc95c9.png

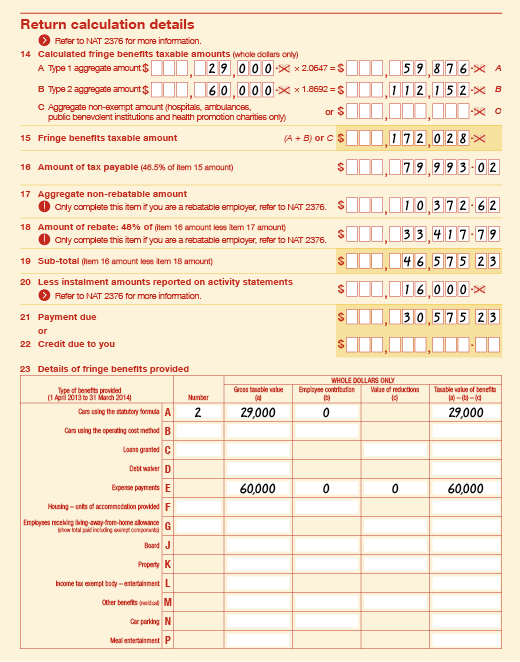

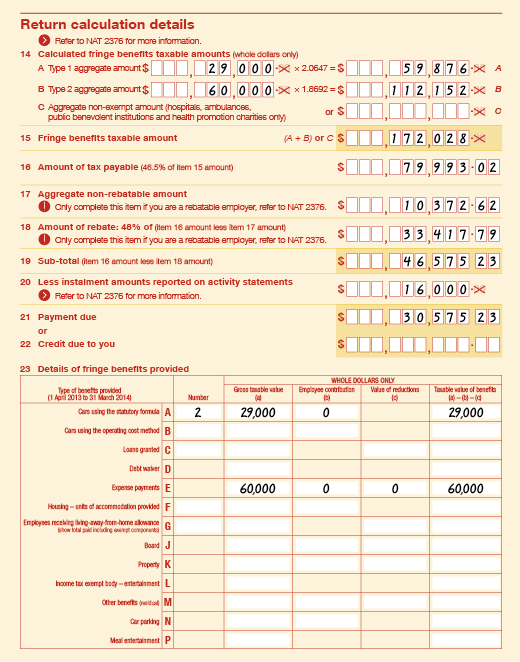

Web On 5 May 2015 the Assistant Treasurer announced the release of a discussion paper on the wine equalisation tax rebate WET rebate This discussion paper forms part of the Tax Web from 1 July 2017 reduce the WET rebate cap from 500 000 to 350 000 and from 1 July 2018 to 290 000 and from 1 July 2019 apply tightened eligibility criteria where a wine

Web 8 oct 2018 nbsp 0183 32 Date Written September 25 2018 Abstract Australia s indirect tax policies for wine the Wine Equalisation Tax WET and the WET rebate are very different to the Web Wine equalisation tax rebate In this section Budget Review 2016 17 Index Rob Dossor Wine is taxed differently to other alcoholic beverages in Australia It has its own tax the

Australian Government Moves To Cut Wine Equalisation Tax WET Rebate

https://www.theadvocate.com.au/images/transform/v1/crop/frm/wHYHMmAn7bhNPtaAR3pUhR/712451f0-2c99-4006-878c-c900c0fe41f7.JPG/r0_391_5520_3289_w1200_h630_fmax.jpg

Wine Tax Paper Released Good Fruit Vegetables Australia

https://www.goodfruitandvegetables.com.au/images/transform/v1/crop/frm/silverstone-agfeed/2143467.jpg/r0_0_1333_1000_w1200_h678_fmax.jpg

https://www.abf.gov.au/entering-and-leaving-australia/tourist-refund-scheme

Web International travellers including Australians might be able to claim a GST Goods and Services Tax and WET Wine Equalisation Tax refund for some goods bought in

https://www.ato.gov.au/Business/Wine-equalisation-tax/Producer-rebate/...

Web 7 lignes nbsp 0183 32 To calculate and claim your rebate Work out 29 of the taxable value of your

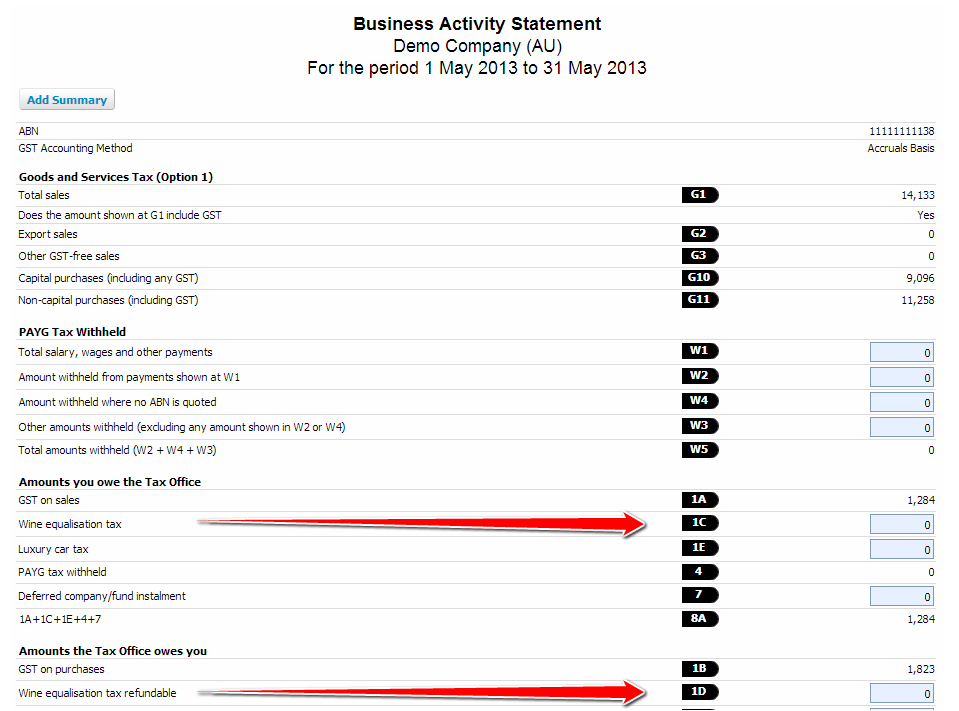

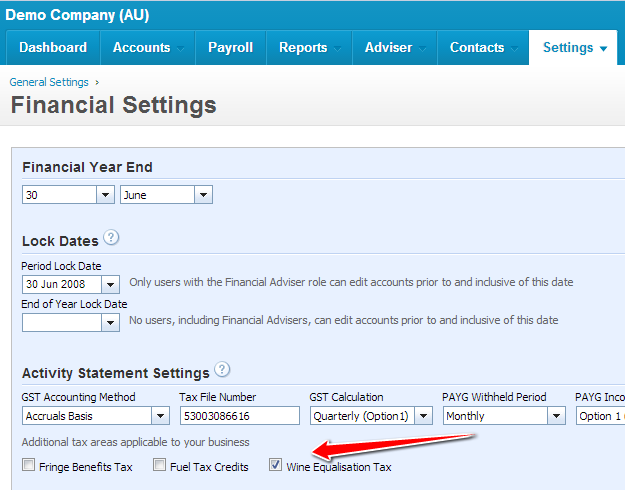

Vinsight Documentation Configuring Xero For WET Tax Vinsight

Australian Government Moves To Cut Wine Equalisation Tax WET Rebate

Changes To The Zone Tax Offset Rules RSM Australia

Vinsight Documentation Calculating WET Tax With Vinsight Vinsight

What Is Australian Government Rebate On Private Health Insurance

Council Tax Rebate Single Person

Council Tax Rebate Single Person

Residents Urged To Cash Energy Rebate Cheques Rotherham Metropolitan

How To Register For The Australian Government Rebate YouTube

Vinsight Documentation Configuring Xero For WET Tax Vinsight

Australia Wet Tax Rebate - Web 11 mai 2021 nbsp 0183 32 Fortunately however the Australian Tax Office ATO does allow a producer rebate If you re new to the sale and purchasing of wine the system can seem quite confusing So we ve decided to breakdown