Average Property Tax In New Hampshire Effective property tax rates are property taxes paid as a percentage of home value The table below shows the average effective property tax rate for every New Hampshire

New Hampshire Department of Revenue Administration Municipality U Unincorporated Place Date Valuation Valuation Including Utilities Municipal Tax Rate County Tax Rate The highest Property Tax Rate in New Hampshire is 2 63 in Sullivan County The lowest Property Tax Rate is 1 16 in Carroll County New Hampshire 1 89 has a 85 3

Average Property Tax In New Hampshire

Average Property Tax In New Hampshire

https://i0.wp.com/realestateinvestingtoday.com/wp-content/uploads/2017/04/property-tax-rates-in-every-state.jpeg

My Property Taxes Are What Understanding New Hampshire s Property

https://static.twentyoverten.com/5afae91ee233a94fd2b8b963/JZGE9b6X-SR/Property-Tax-blog.jpg

Alaska Property Taxes Ranked Alaska Policy Forum

https://alaskapolicyforum.org/wp-content/uploads/Property-taxes_22.jpg

Tax Rate County Tax Rate State Education Tax Rate Local Education Tax Rate Total Tax Rate 116 858 500 7 81 2 31 1 55 11 26 22 93 128 636 412 2 21 1 03 1 70 According to the ATTOM data New Hampshire s effective tax burden in New Hampshire in 2022 increased by 2 percent over 2021 Total property taxes

Attom reported that New Hampshire s effective tax rate calculated using the average annual property tax expressed as a percentage of the average estimated The median property tax in New Hampshire is 4 636 00 per year based on a median home value of 249 700 00 and a median effective property tax rate of 1 86

Download Average Property Tax In New Hampshire

More picture related to Average Property Tax In New Hampshire

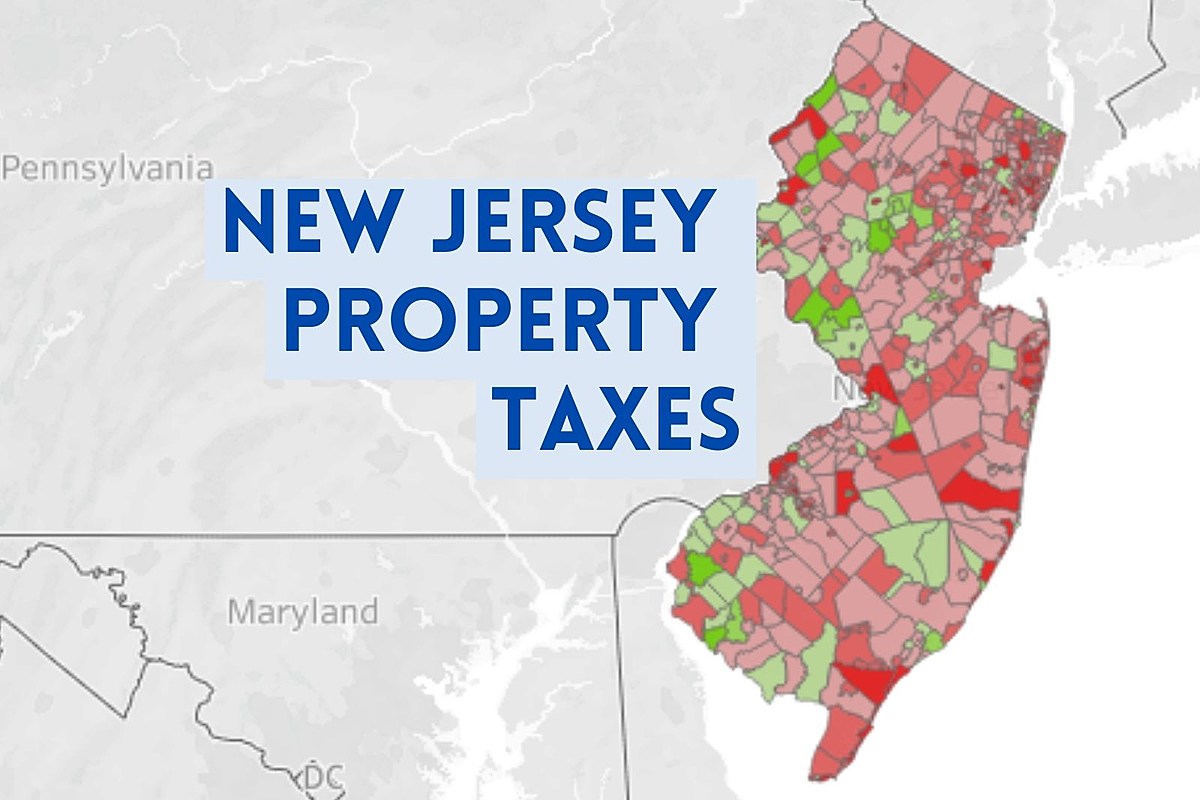

Average NJ Property Tax Bill Near 9 300 Check Your Town Here

https://townsquare.media/site/385/files/2022/01/attachment-New-Jersey-property-taxes.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

Which NJ Towns Have The Highest Property Taxes 2023 Suburbs 101

https://suburbs101.com/wp-content/uploads/2022/01/qtq80-smw9AB.jpeg

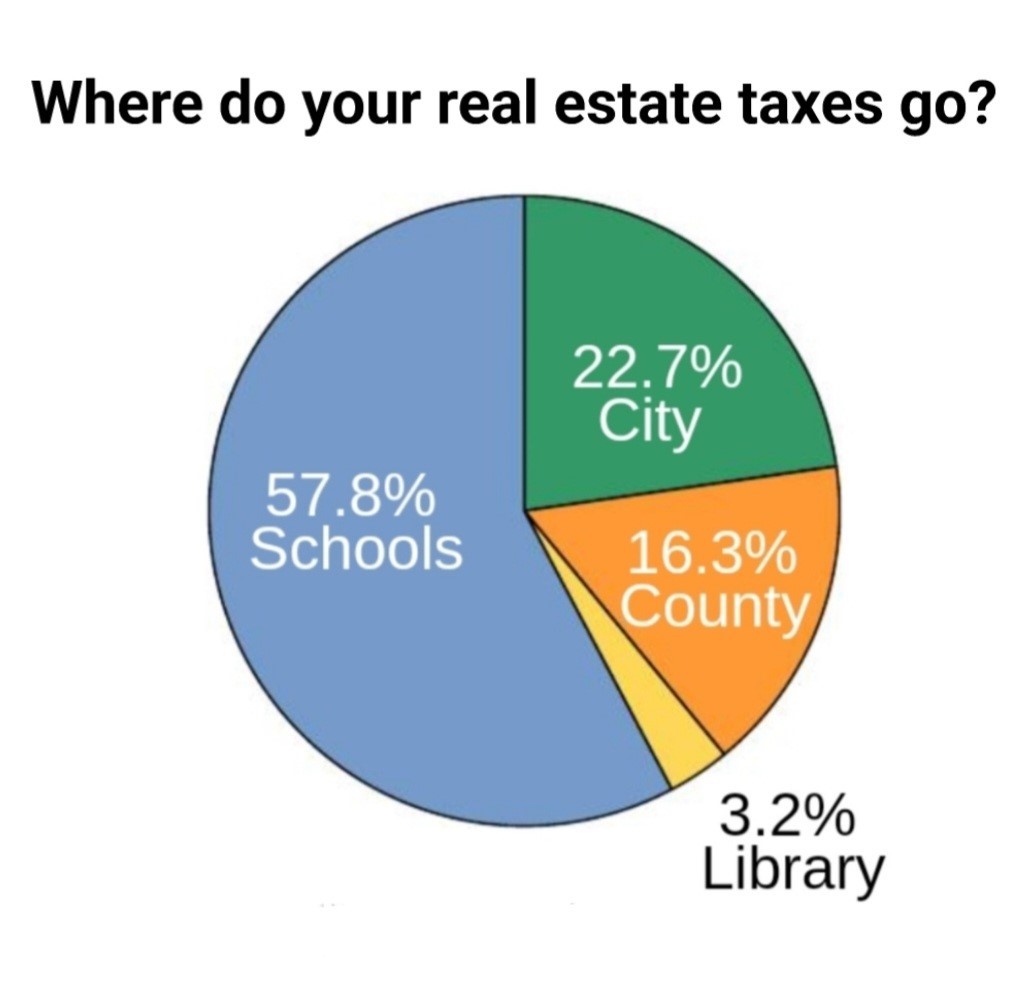

Property Tax Willowick Ohio

https://www.cityofwillowick.com/sites/default/files/imageattachments/finance/page/2305/pie_chart_2022-1.jpg

Use the table below to sort NH towns by tax rate and easily view the highest and lowest rates for 2023 In New Hampshire the real estate tax levied on a property According to the latest census data New Hampshire homeowners pay a median property tax bill of nearly 4 500 on a 205 000 home the median priced home

Tax Rates New Hampshire Median property tax is 4 636 00 This interactive table ranks New Hampshire s counties by median property tax in dollars percentage of home value and percentage of median income The list is sorted by median property tax in dollars by default

KY State Legislature Makes Changes To Property Tax In House Bill 6

https://deandorton.com/wp-content/uploads/2022/05/Property-Tax-1.jpg

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

https://smartasset.com/taxes/new-hampshire-property-tax-calculator

Effective property tax rates are property taxes paid as a percentage of home value The table below shows the average effective property tax rate for every New Hampshire

https://www.revenue.nh.gov/sites/g/files/ehbemt736/...

New Hampshire Department of Revenue Administration Municipality U Unincorporated Place Date Valuation Valuation Including Utilities Municipal Tax Rate County Tax Rate

Taxpayers Ask Court To NH Education Property Tax

KY State Legislature Makes Changes To Property Tax In House Bill 6

The Rise Of Residential Property Tax In Arizona Klauer Law

In depth Look At The Property Tax Reform Delano News

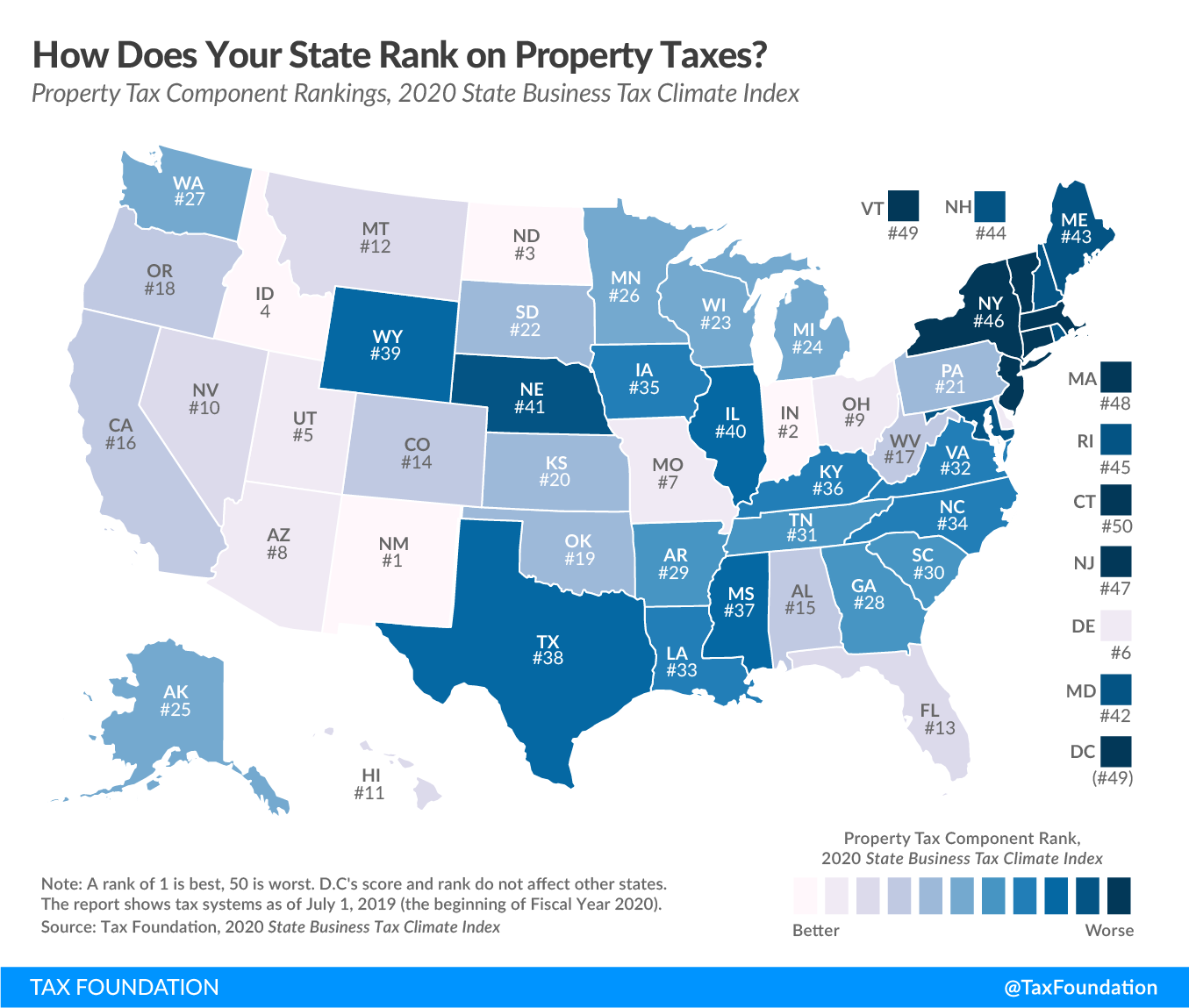

Ranking Property Taxes On The 2020 State Business Tax Climate Index

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

How NEW HAMPSHIRE Taxes Retirees YouTube

Understanding Low Level State Capacity Property Tax Collection In

Does New Hampshire Love The Property Tax NH Business Review

Average Property Tax In New Hampshire - The median property tax in New Hampshire is 4 636 00 per year based on a median home value of 249 700 00 and a median effective property tax rate of 1 86