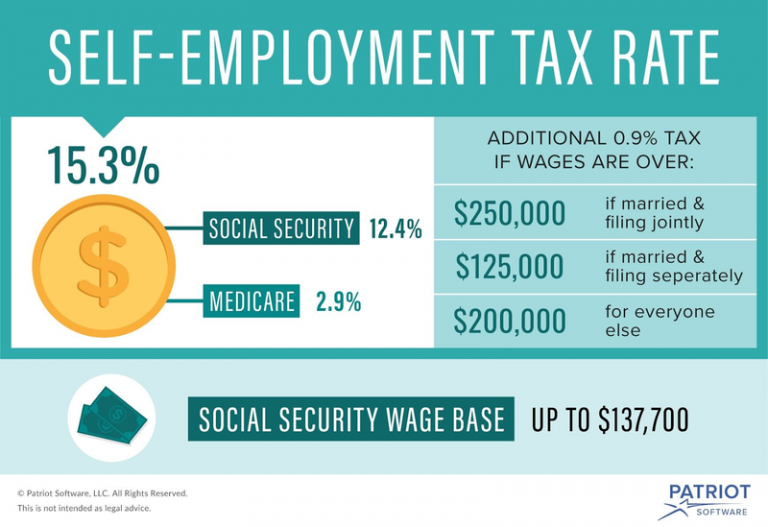

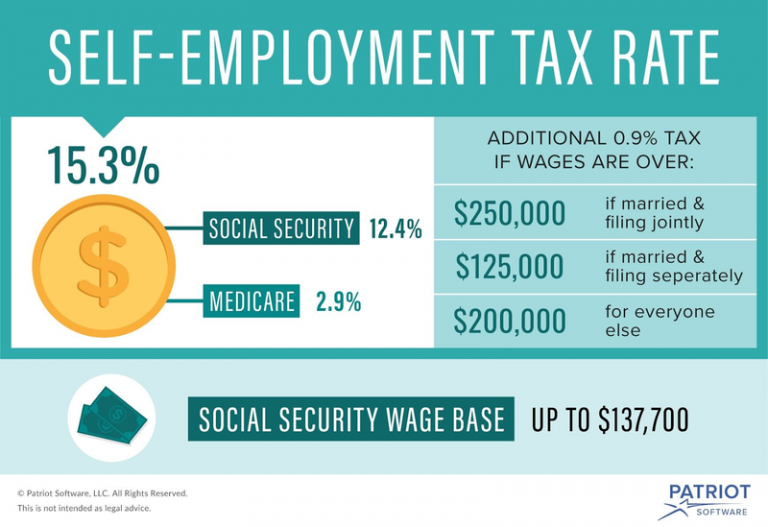

Average Tax Rate For Self Employed SE tax is calculated based on a person s net self employment income The current rate for SE tax is 15 3 which is split 12 4 for Social Security and 2 9 for Medicare This rate is the same

If you have a self employment here and the customer who pays you is Finnish you are receiving income from a source in Finland However your country of If you do not have a tax card your employer must apply 60 as the withholding rate Conversely if you are self employed and your work is based on an

Average Tax Rate For Self Employed

Average Tax Rate For Self Employed

https://taxleopard.com.au/wp-content/uploads/how-much-tax-self-employed-tax-leopard.jpg

What Is Better 8 Or Graduated Income Tax Rate For Self employed

https://i.ytimg.com/vi/n1FfUkEUarc/maxresdefault.jpg

Calculate Self Employment Tax Deduction ShannonTroy

https://images.squarespace-cdn.com/content/v1/5e94adbc25a0ae61d843b475/1631660630025-G3GPPIMYRC8BMWX8LPIM/how_to_calculate_federal_tax_liability_self_employed_example

The self employment tax rate is 15 3 The rate consists of two parts 12 4 for social security old age survivors and disability insurance and 2 9 for Medicare hospital The self employment tax rate is 15 3 with 12 4 for Social Security and 2 9 for Medicare However the Social Security portion may only apply to a part of your business income That s because of the Social Security

Self employment tax consists of Social Security and Medicare taxes for individuals who work for themselves Employees who receive a W 2 only pay half of the total Social Use the Self Assessment tax calculator to estimate your Self Assessment tax bill for the 2024 to 2025 tax year This service is also available in Welsh Cymraeg Enter your

Download Average Tax Rate For Self Employed

More picture related to Average Tax Rate For Self Employed

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/63499ed84e321d5d15e2132d_self-employment-tax-rate-calculator.png

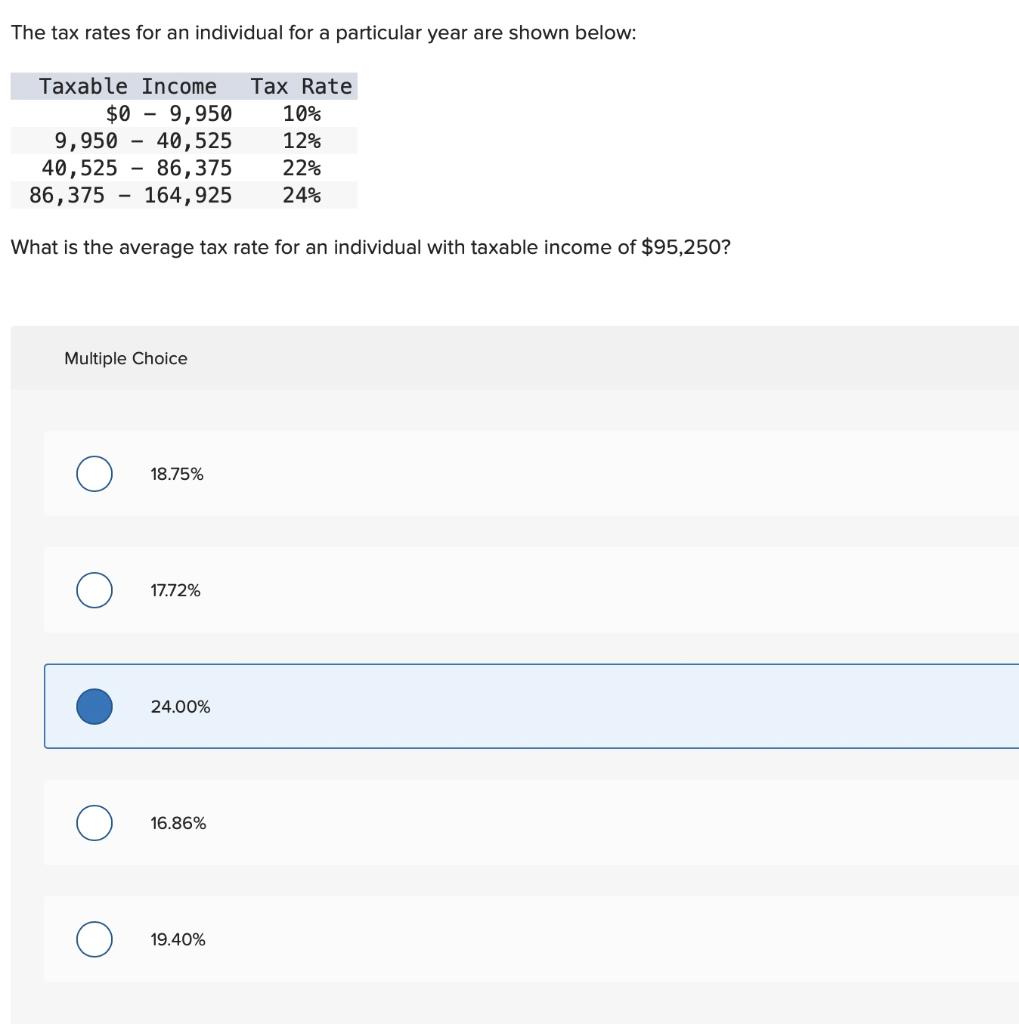

Solved The Tax Rates For An Individual For A Particular

https://media.cheggcdn.com/media/535/53518689-27a0-40ab-b593-7cb28edc894b/phplOviWy

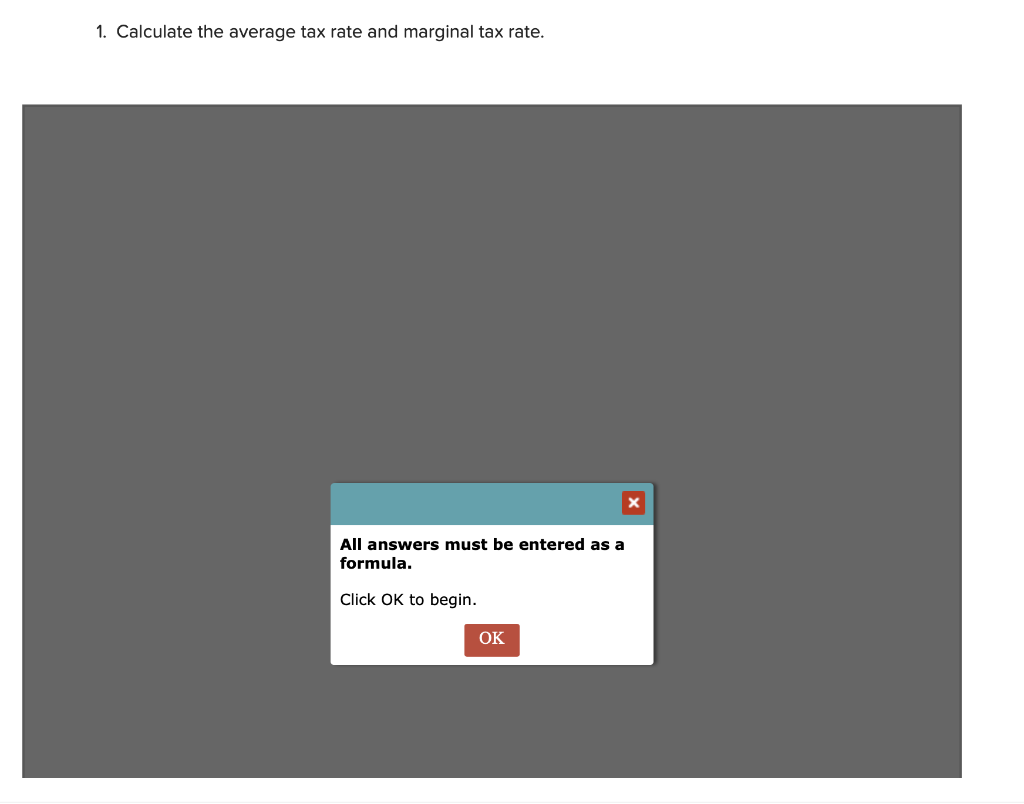

Solved 1 Calculate The Average Tax Rate And Marginal Tax Chegg

https://media.cheggcdn.com/media/241/241ac8b7-dddf-40b9-af25-e49baebc3738/phpwVkA0w

The law sets the self employment tax rate as a percentage of your net earnings from self employment This rate consists of 12 4 for Social Security and 2 9 for Medicare The self employment tax rate is 15 3 of net earnings That rate is the sum of a 12 4 Social Security tax and a 2 9 Medicare tax on net earnings Self employment tax is not the same as income

Self employed workers pay self employment tax This 15 3 tax covers Medicare and Social Security taxes Let s break down how it s calculated and when Here s how you d calculate your self employment taxes Determine your self employment tax base Multiply your net earnings by 92 35 0 9235 to get your

How To Calculate Tax Liability For Your Business

https://kominosolutions.com/wp-content/uploads/2020/11/BB1aHvs7-768x527.png

How To Calculate Self Employment Tax Best Free Calculators

https://i0.wp.com/taxmarmot.com/wp-content/uploads/2023/04/Self-Employed-Social-Security-Tax-Calculation.jpg?resize=1200%2C800&ssl=1

https://turbotax.intuit.com › tax-tips › self...

SE tax is calculated based on a person s net self employment income The current rate for SE tax is 15 3 which is split 12 4 for Social Security and 2 9 for Medicare This rate is the same

https://www.vero.fi › ... › working-in-finland-as-a-self-employed-person

If you have a self employment here and the customer who pays you is Finnish you are receiving income from a source in Finland However your country of

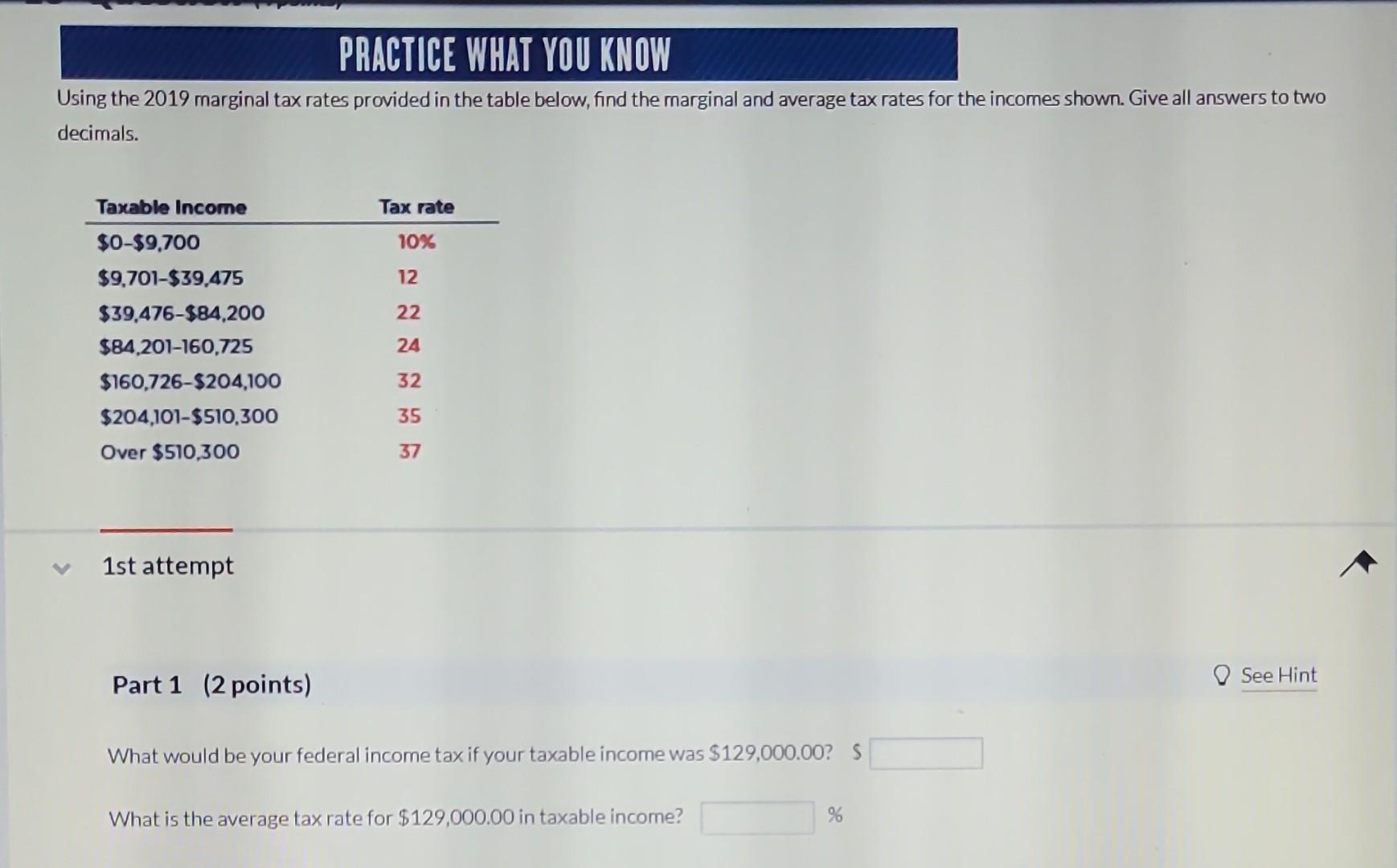

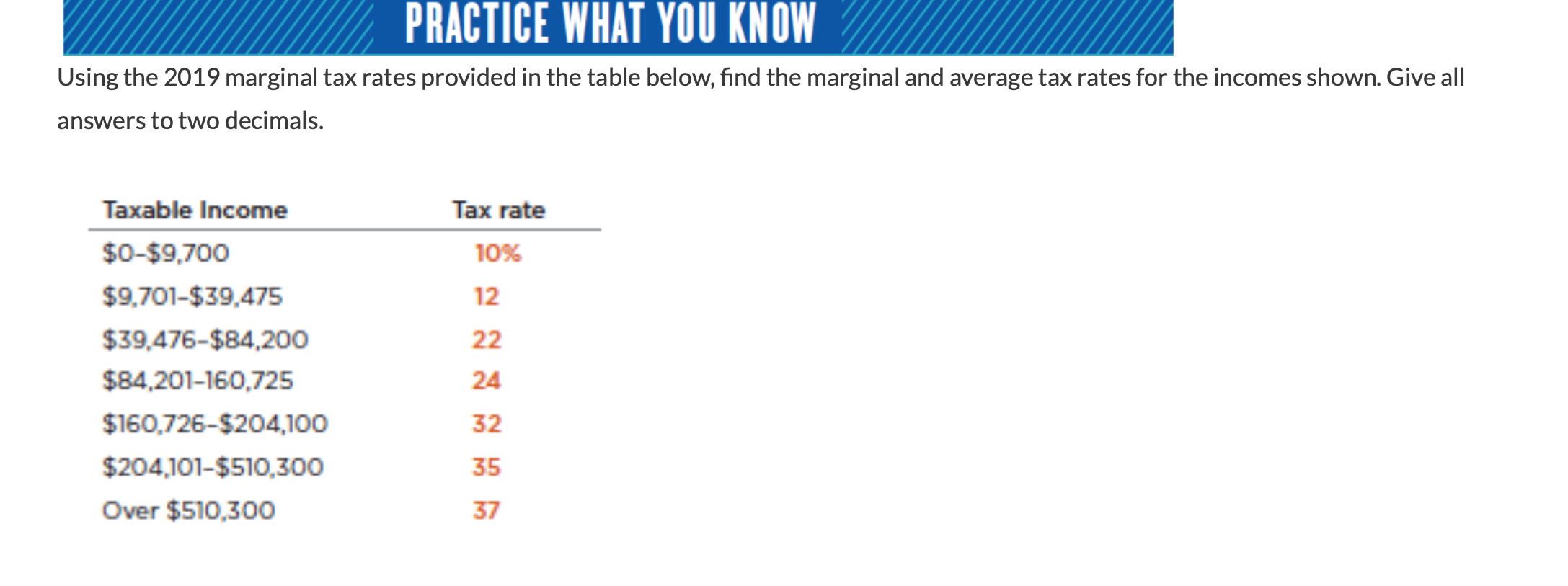

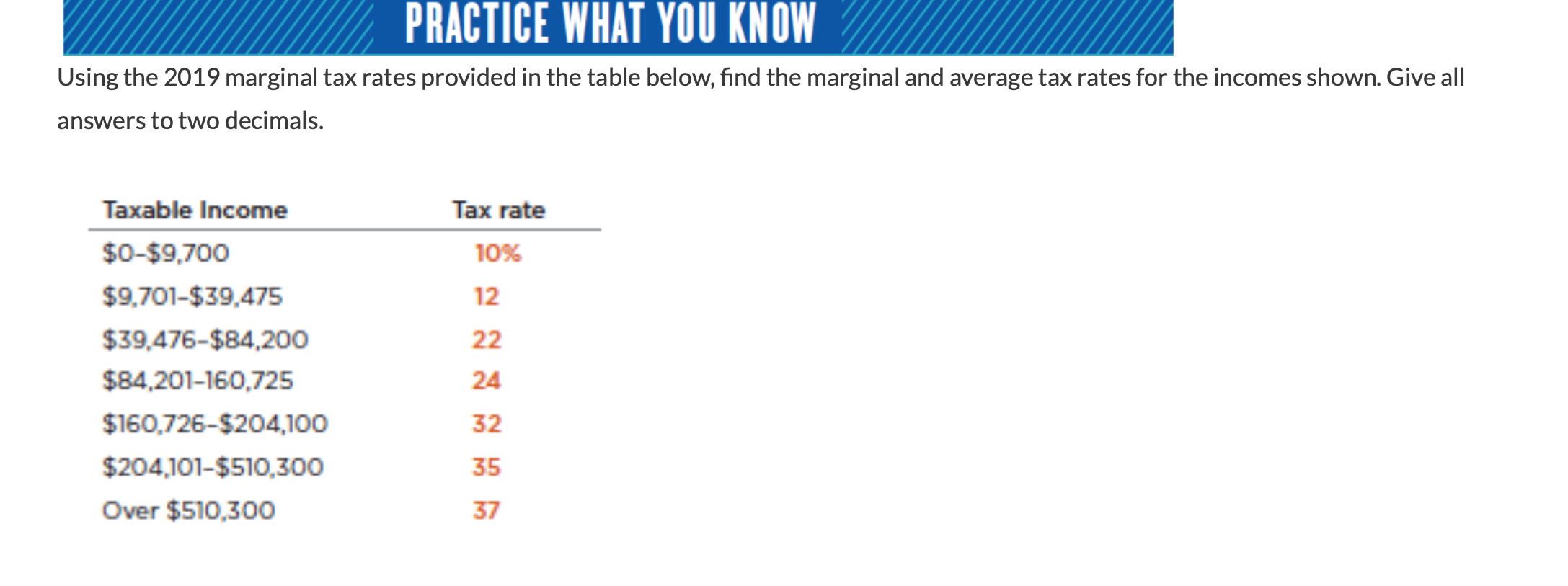

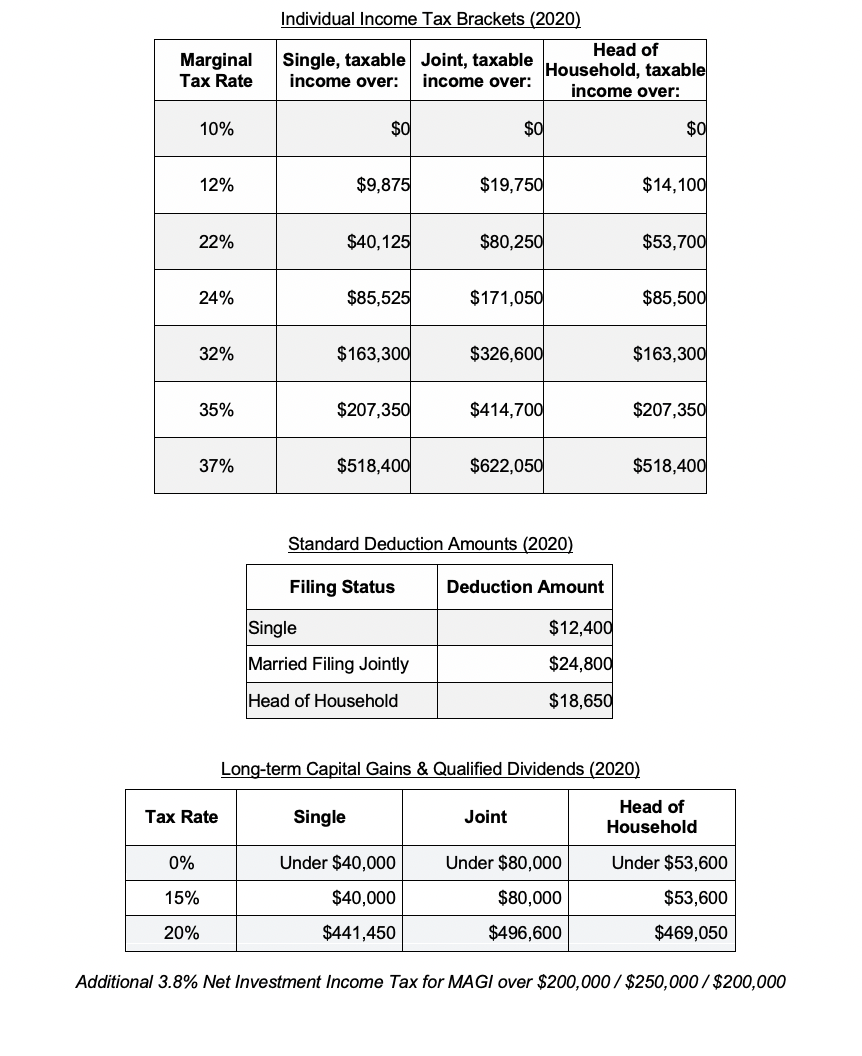

Solved Using The 2019 Marginal Tax Rates Provided In The Chegg

How To Calculate Tax Liability For Your Business

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Self employed 5 Things You Need To Know About Tax Reform MediaFeed

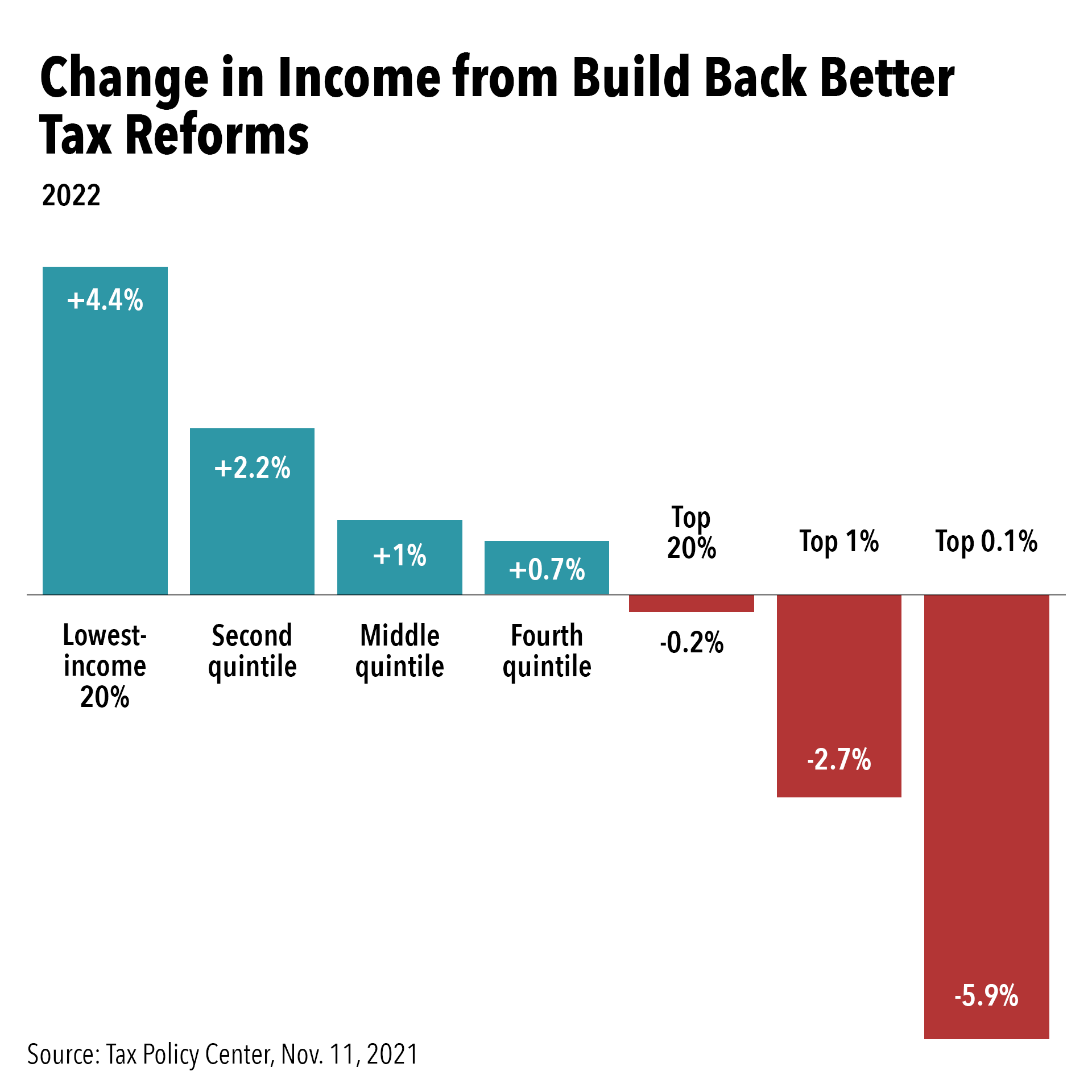

BUILD BACK BETTER ACT WILL RAISE TAX RATES ON MILLIONAIRES Americans

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

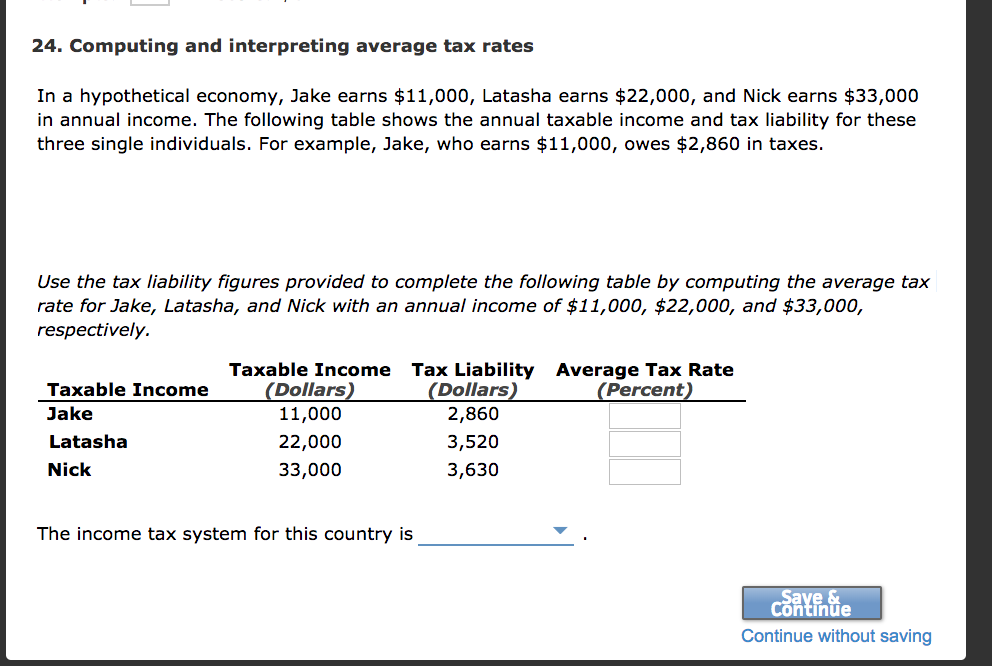

Solved 24 Computing And Interpreting Average Tax Rates In A Chegg

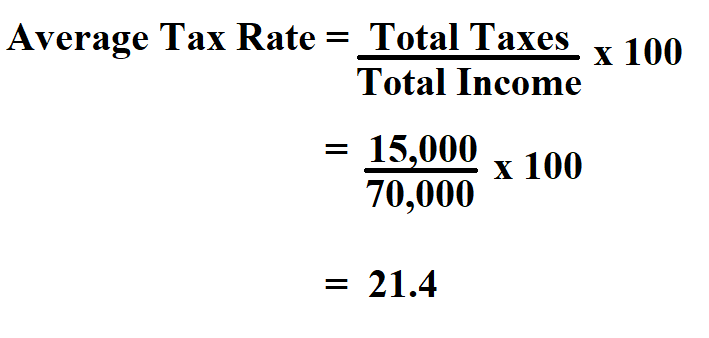

How To Calculate Average Tax Rate

Calculate The Federal Income Tax Liability Marginal Chegg

Average Tax Rate For Self Employed - Use the Self Assessment tax calculator to estimate your Self Assessment tax bill for the 2024 to 2025 tax year This service is also available in Welsh Cymraeg Enter your