Average Tax Rebate For Child Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under

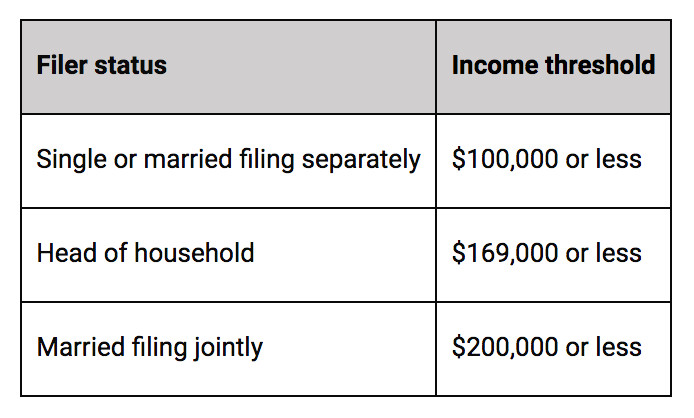

Web 28 avr 2021 nbsp 0183 32 Raising a child is pricey to the tune of almost a quarter of a million dollars over the first 18 years according to the USDA s most recent figures Luckily the IRS Web 9 d 233 c 2021 nbsp 0183 32 Child Tax Credit CALCULATOR What is your filing status Single Married Head of household Estimated AGI for 2021 Number of dependents you are claiming Age 5 and under as of Dec 31 2021 Age

Average Tax Rebate For Child

Average Tax Rebate For Child

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

30 Child Care Tax Rebate 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/child-care-tax-rebate-payment-dates-2022-2022-carrebate.jpg

Net Personal Average Tax Rate For A Single Person With Two Children In

https://figure.nz/chart/JuJ61POrBwtF98lK-tDNjQOnYfrwIcNOO/download

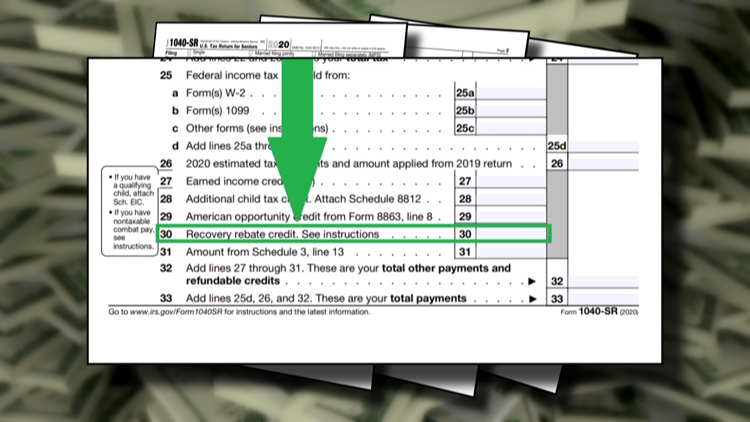

Web 5 juil 2017 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or Web 24 janv 2023 nbsp 0183 32 If you adopted a child in 2022 you may be able to qualify for a credit of up to 14 890 in adoption related expenses you incurred per child This could include adoption related attorney fees

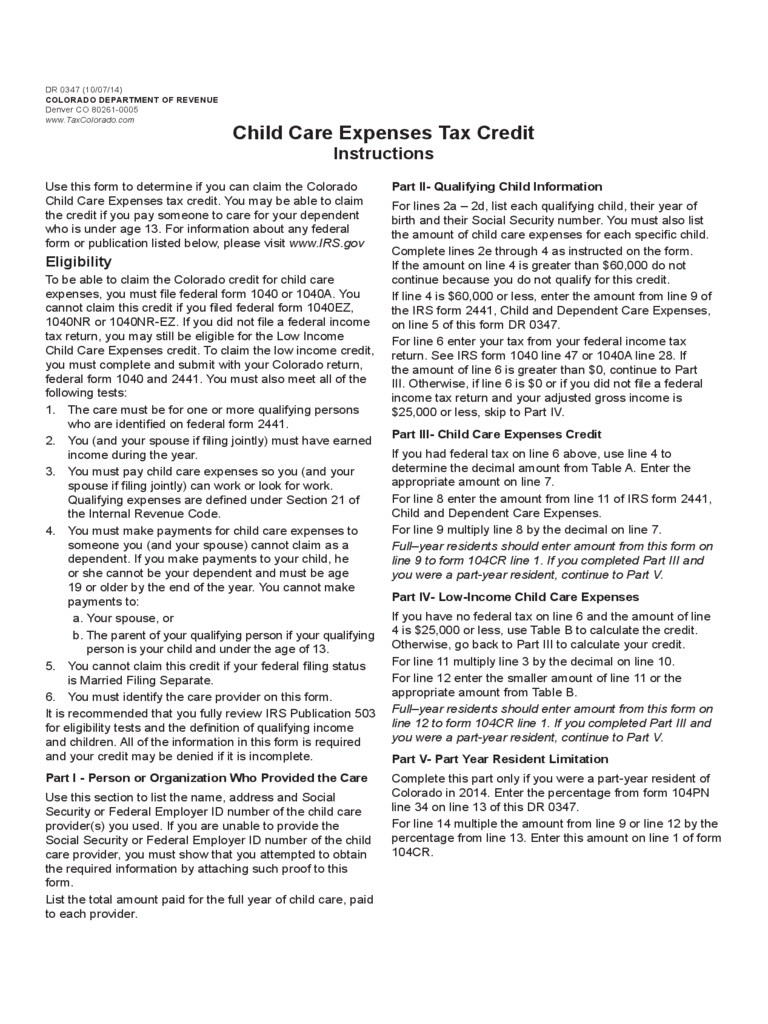

Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from Web 24 f 233 vr 2022 nbsp 0183 32 The average national cost for an infant in full time child care is 9 991 annually according to ValuePenguin research Generally the cost of care goes down as

Download Average Tax Rebate For Child

More picture related to Average Tax Rebate For Child

.png)

Monday Map Average Child Tax Credit Received Per Tax Return Tax

https://files.taxfoundation.org/legacy/docs/Child-Credit-Received-(Large).png

50 Child Care Tax Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/cash-gifts-to-a-shared-vision-qualify-for-50-child-care-tax-credit-a.png

Lamont Families Can Apply For The 2022 CT Child Tax Rebate Beginning

https://greenwichfreepress.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-19-at-12.17.52-PM.jpg

Web 27 janv 2023 nbsp 0183 32 The child tax credit available to working parents who meet certain income and other rules provided as much as 3 600 per child in 2021 More than 36 million Web 18 mai 2021 nbsp 0183 32 It increases the existing tax benefit from 2 000 up to 3 600 for younger kids and 3 000 for older ones for the 2021 tax year It also broadens the umbrella of who s eligible for the full refund

Web 3 f 233 vr 2023 nbsp 0183 32 The maximum tax credit per qualifying child is 2 000 for kids 5 and younger or 3 000 for those 6 through 17 Additionally you can t receive a portion of the credit in advance as was the Web 16 d 233 c 2022 nbsp 0183 32 The Child Tax Credit is available to custodial parents and is worth up to 2 000 per child but income limits apply The Child and Dependent Care Credit is a percentage of what you pay someone to

Family Tax Child Care Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/facsia-annual-report-2005-2006.gif

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

https://www.whitehouse.gov/child-tax-credit

Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under

https://www.forbes.com/advisor/taxes/5-tax-breaks-for-parents

Web 28 avr 2021 nbsp 0183 32 Raising a child is pricey to the tune of almost a quarter of a million dollars over the first 18 years according to the USDA s most recent figures Luckily the IRS

Average Tax Wedge For A Two earner Married Couple With Two Children In

Family Tax Child Care Rebate 2023 Carrebate

Province Of Manitoba School Tax Rebate

Are YOU Eligible For The CT Child Tax Rebate

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Child Care Rebate Income Tax Return 2022 Carrebate

Child Care Rebate Income Tax Return 2022 Carrebate

Child Tax Credits Calculator CALCULATORUK HJW

Doug Ford Child Care Rebate FordRebates

Child Tax Credit 2020 Changes Bezyah

Average Tax Rebate For Child - Web 24 f 233 vr 2022 nbsp 0183 32 The average national cost for an infant in full time child care is 9 991 annually according to ValuePenguin research Generally the cost of care goes down as