Az Rebate 2024 Eligibility Per U S Department of Energy guidance if you began energy upgrades or retrofits to your home on or after Aug 16 2022 you may be eligible for a reimbursement However completion of these from the State of Arizona does not guarantee a rebate For more information please review this fact sheet

Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return For validation purposes please select the filing status used on the tax year 2021 return For clarification please view the FAQs link below According to ADOR officials those eligible will get 250 for every claimed dependent who is under the age of 17 and 100 for every claimed dependent over the age of 17 based on their 2021 tax

Az Rebate 2024 Eligibility

Az Rebate 2024 Eligibility

https://humanresourcesonline-assets.b-cdn.net/images/hr-sg/content-images/priya_apr_2023_mofsingapore_gstusave_gstscc_payouts_mofsingaporefb.jpg?auto_optimize=medium

Grocery Rebate Canada 2024 Check Payment Date Eligibility Apply

https://cwccareers.in/wp-content/uploads/2023/12/Grocery-Rebate-Canada-2024-.jpg

Mobil One Offical Rebate Printable Form Printable Forms Free Online

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

The Arizona Department of Revenue and Hobbs launched a site that allows Arizona residents to check their eligibility and status to receive up to 750 in tax rebates As someone who at Those who qualify for the Arizona Families Tax Rebate could look forward to a rebate of up to 750 Here s what you need to know about who qualifies how much you can expect and when you

The governor says eligible families will have an opportunity to receive up to 750 in tax rebates with funds made possible by the latest bipartisan budget State Senate and House Republicans There is no state tax the state Department of Revenue said Taxpayers should deduct the rebate from their federally adjusted gross income when filing their Arizona tax form the agency said The

Download Az Rebate 2024 Eligibility

More picture related to Az Rebate 2024 Eligibility

NDA 1 2024 Eligibility Selection Process Vacancies Cut Off NDA 1 2024 Details Sumit Sir

https://i.ytimg.com/vi/5adMHzV8AOE/maxresdefault_live.jpg

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

https://images.squarespace-cdn.com/content/v1/58c880d7893fc0f2350b0bbd/1671046938649-FD50N05XDSCYNJTD97B7/2023-01+to+2023-06-30+B%26L+Rebate+Form+Front.jpg

Lensrebates Alcon Com

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

Who qualifies The rebate is available to year round residents who claimed Arizona s existing tax credit for dependents in 2021 on their tax returns which were due in 2022 and owed at least Arizona s Tax Rebate was a onetime income tax general welfare rebate available to taxpayers who paid Arizona taxes in 2019 2020 or 2021 and claimed at least one dependent in 2021 S B 1734 56th Leg 1st Reg Sess May 12 2023 The rebate was 250 for each dependent under age seventeen and 100 for dependents age seventeen or

The Arizona Families Tax Rebate Program is a new initiative aimed at providing tax rebates to nearly 750 000 Arizona families This program signed into law as part of the Fiscal Year 2024 state budget is the first of its kind with eligible families having the opportunity to receive up to 750 in tax rebates Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation

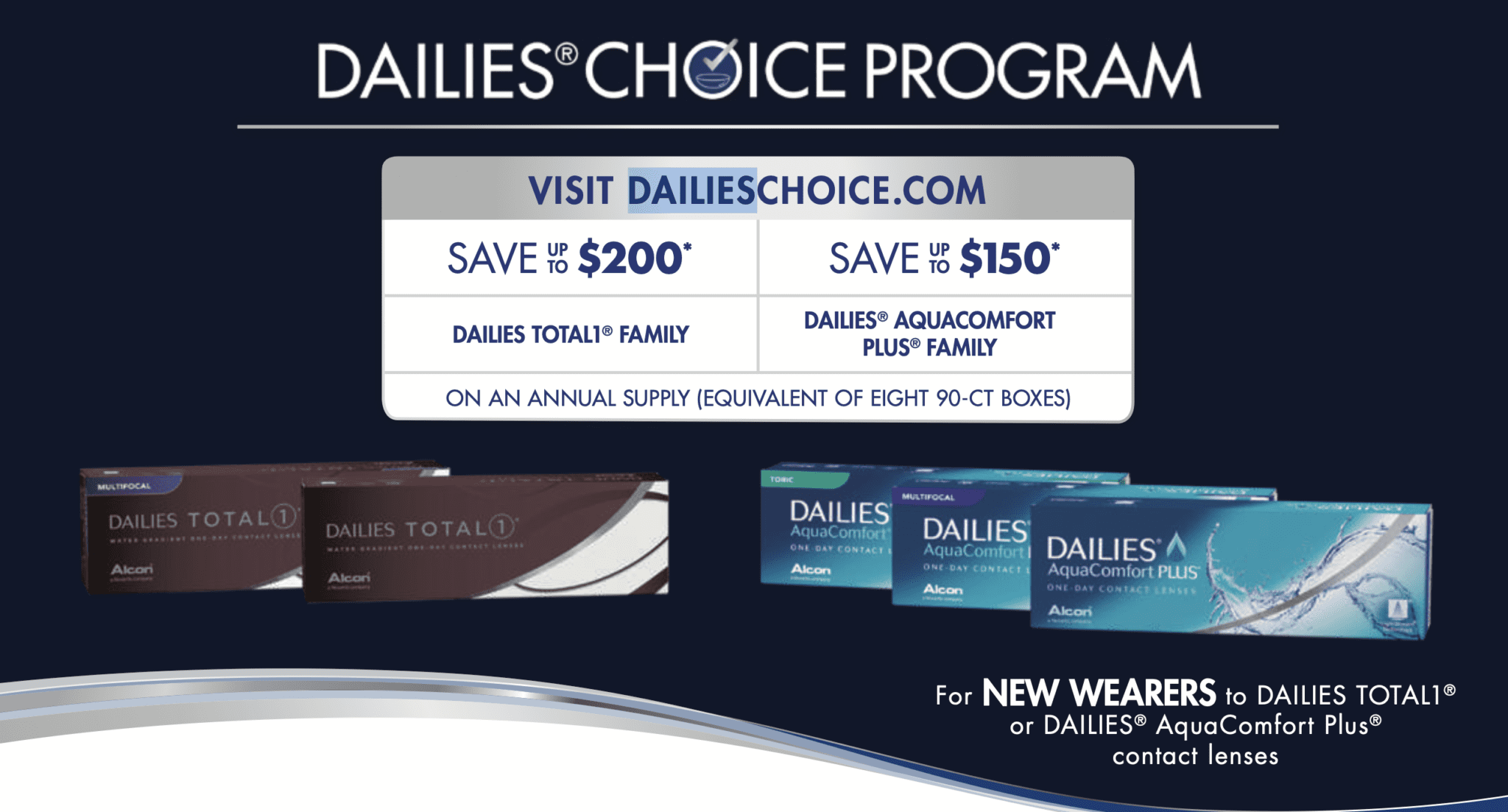

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEimxxHMVm4XxeDkVaSMSFoj9CX2XqGBjiPWj49fhO8klFSJrHN4Rbr5b3-zi4xSiAaa58C9r_f4Fc9AdeFh2CA51yQPsKTignpJ4wQvAhC7rp8drJR7xe5CxkmwSkVk1nWyZPNxWcqS2tVks6h4fP0QiW59YCZUG37lxHpjiqBAgggUng7A4gFgvhWK/s958/RRR.jpg

https://resilient.az.gov/resiliency-programs/energy-programs/energy-affordability/efficiency-rebates

Per U S Department of Energy guidance if you began energy upgrades or retrofits to your home on or after Aug 16 2022 you may be eligible for a reimbursement However completion of these from the State of Arizona does not guarantee a rebate For more information please review this fact sheet

https://familyrebate.aztaxes.gov/

Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return For validation purposes please select the filing status used on the tax year 2021 return For clarification please view the FAQs link below

Pensioner Rebate Doubled To Provide Support Bundaberg Now

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Government Solar Rebate QLD Everything You Need To Know

Dailies Total 1 Rebate Form Printable Rebate Form

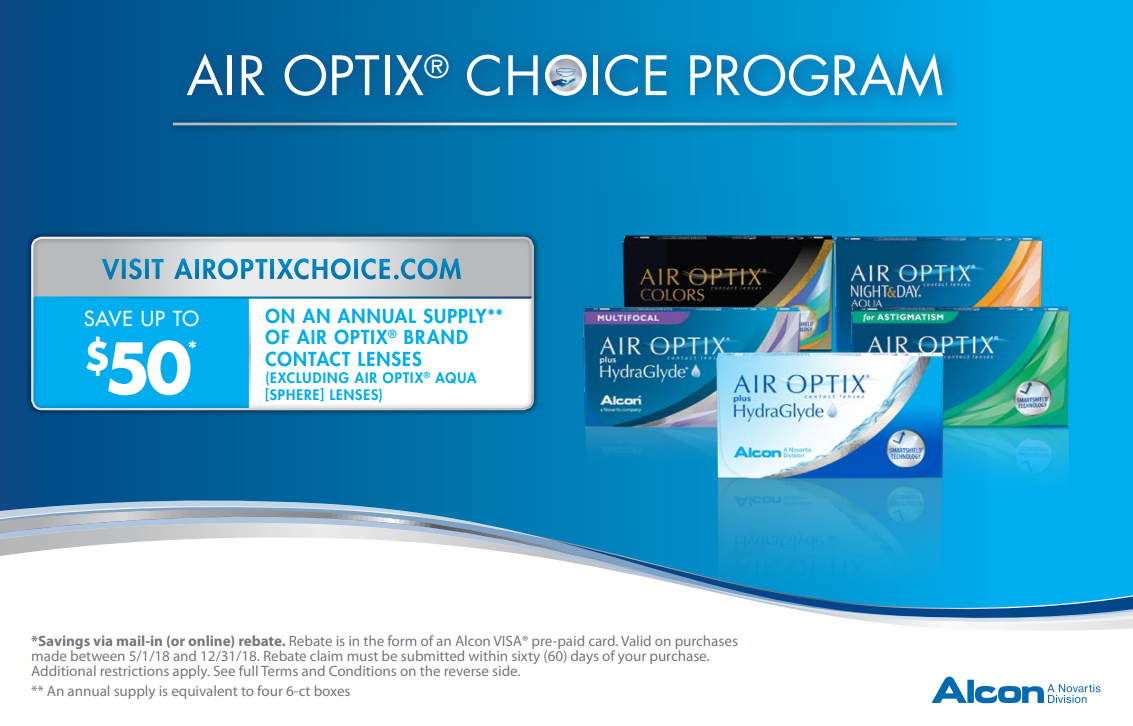

Air Optix Printable Rebate Form

2022 2023 Income Eligibility Guidelines CDPHE WIC

2022 2023 Income Eligibility Guidelines CDPHE WIC

Traderider Rebate Program Verify Trade ID

NWC Tryouts 2023 2024 NWC Alliance

Rebate Bonus In 22Bet Return Up To 80 000 INR Weekly

Az Rebate 2024 Eligibility - The governor says eligible families will have an opportunity to receive up to 750 in tax rebates with funds made possible by the latest bipartisan budget State Senate and House Republicans