Az State Rebate 2024 Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return For validation purposes please select the filing status used on the tax year 2021 return

Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income In the state of Arizona full year resident or part year resident individuals must file a tax return if they are ARIZONA FAMILIES TAX REBATE FORM 1099 MISC 2024 by visiting azdor gov arizona families tax rebate and clicking on View my 1099 MISC January 2024 Page 2 602 255 3381 or toll free at 800 352 4090 www azdor go

Az State Rebate 2024

Az State Rebate 2024

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

New Mexico Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Mexico-Renters-Rebate-2023.jpg

Mobil One Offical Rebate Printable Form Printable Forms Free Online

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

Howard Fischer Capitol Media Services January 26 2024 The Internal Revenue Service has no right to force 750 000 Arizona families who got a state income tax rebate last year to now pay federal taxes on the funds Attorney General Kris Mayes said Thursday And she said if the agency doesn t back off and soon she may sue saying Arizona Attorney General Kris Mayes shown in May 2023 said Thursday Jan 25 2023 that the IRS has no right to force Arizona families to pay federal tax on their 2023 state rebate

Geo resource failed to load A new tax rebate worth up to 750 is now available to hundreds of thousands of Arizona families By AZFamily Digital News Staff Published Oct 31 2023 at 12 34 PM There is no state tax the state Department of Revenue said Taxpayers should deduct the rebate from their federally adjusted gross income when filing their Arizona tax form the agency said The

Download Az State Rebate 2024

More picture related to Az State Rebate 2024

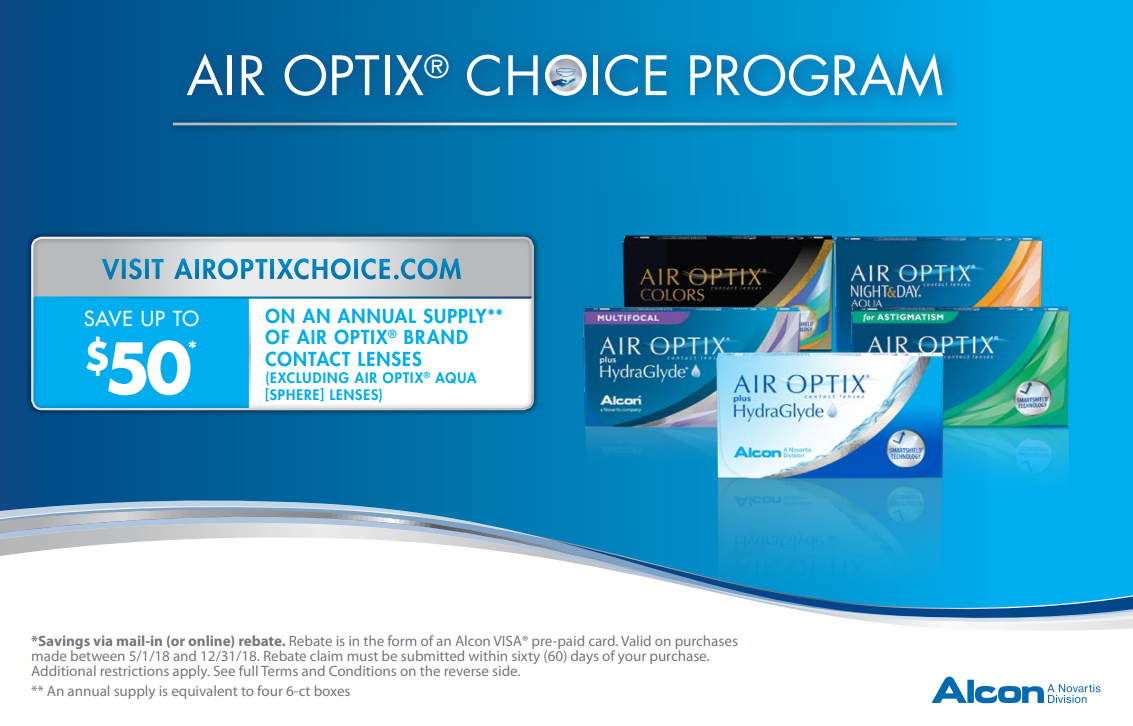

Printable Alcon Rebate Form 2023 Printable Forms Free Online

https://s3.amazonaws.com/VisionSource/Promos/June2023-AlconUpgradeRebate-A.jpg

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

https://images.squarespace-cdn.com/content/v1/58c880d7893fc0f2350b0bbd/1671046938649-FD50N05XDSCYNJTD97B7/2023-01+to+2023-06-30+B%26L+Rebate+Form+Front.jpg

The state Department of Revenue estimates more than 740 000 Arizona families will benefit All rebates should be issued by Nov 15 just as the holiday season is about to kick off Do Not 1 19 Leer en espa ol Almost three quarters of a million Arizona families will see more money in their pockets in the next few weeks thanks to a tax rebate plan that Republican lawmakers inked

YUMA Ariz KYMA KECY Arizona Governor Katie Hobbs recently signed off on a new Arizona Family Tax Rebate The rebate will put money back into the pockets of taxpayers and is for anyone who ARIZONA STATE SENATE Fifty Sixth Legislature First Regular Session FACT SHEET FOR S B 1734 taxation 2023 2024 2024 to claim the rebate by filing an online claim application in a form and manner prescribed by ADOR and requires the claim application to include the claimant s name address taxpayer identification number and IIT filing

PA Rent Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-768x993.jpg

Rebate Air Optix Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/12/Air-Optix-Rebate-Form.png

https://familyrebate.aztaxes.gov/

Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return For validation purposes please select the filing status used on the tax year 2021 return

https://azdor.gov/news-center/arizona-families-rebate-recipients-will-need-report-rebate-income-tax-returns

Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

PA Rent Rebate Form Printable Rebate Form

New York State To Send STAR Rebate Checks To More Than 2 Million Homeowners This Fall Syracuse

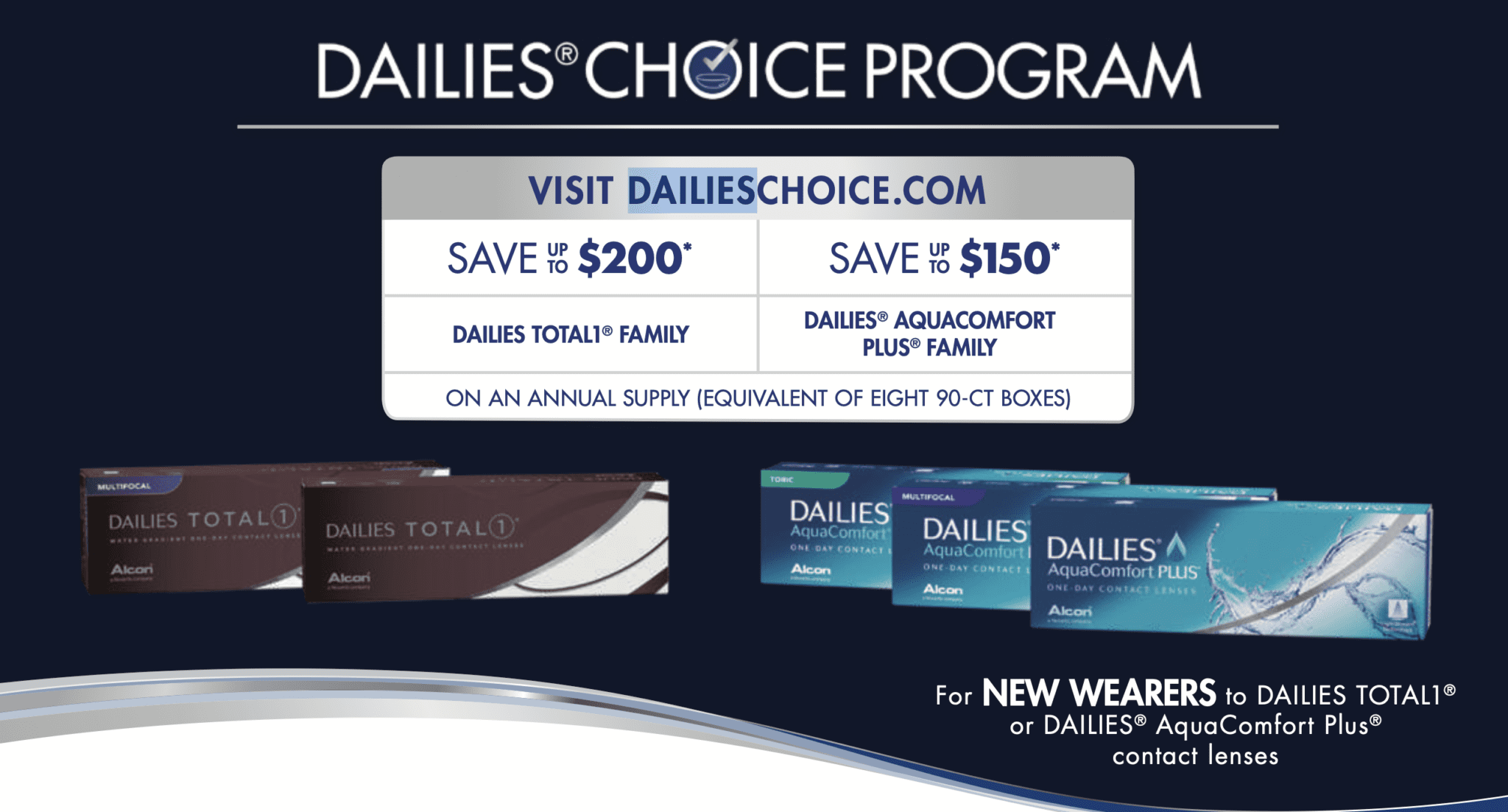

Dailies Total 1 Rebate Form Printable Rebate Form

Pensioner Rebate Doubled To Provide Support Bundaberg Now

Missouri State Tax Rebate 2023 Printable Rebate Form

Missouri State Tax Rebate 2023 Printable Rebate Form

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

Traderider Rebate Program Verify Trade ID

MN EBike Rebate

Az State Rebate 2024 - Howard Fischer Capitol Media Services January 26 2024 The Internal Revenue Service has no right to force 750 000 Arizona families who got a state income tax rebate last year to now pay federal taxes on the funds Attorney General Kris Mayes said Thursday And she said if the agency doesn t back off and soon she may sue saying