Az Tax Rebate 2024 Eligibility Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return For validation purposes please select the filing status used on the tax year 2021 return

Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income More than 700 000 families were eligible for this tax credit for roughly 250 per child up to three kids for a maximum rebate of around 750 How much of that will now go to taxes That

Az Tax Rebate 2024 Eligibility

Az Tax Rebate 2024 Eligibility

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

Home L4H Pro Life Arizona

https://pro-lifearizona.com/wp-content/uploads/2020/12/az-tax-credit-2.png

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

According to ADOR officials those eligible will get 250 for every claimed dependent who is under the age of 17 and 100 for every claimed dependent over the age of 17 based on their 2021 tax The Arizona Department of Revenue and Hobbs launched a site that allows Arizona residents to check their eligibility and status to receive up to 750 in tax rebates As someone who at

Per U S Department of Energy guidance if you began energy upgrades or retrofits to your home on or after Aug 16 2022 you may be eligible for a reimbursement However completion of these from the State of Arizona does not guarantee a rebate For more information please review this fact sheet The governor says eligible families will have an opportunity to receive up to 750 in tax rebates with funds made possible by the latest bipartisan budget State Senate and House Republicans

Download Az Tax Rebate 2024 Eligibility

More picture related to Az Tax Rebate 2024 Eligibility

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Get Up To 1 300 In Tax Rebates Eligibility Criteria

https://www.lamansiondelasideas.com/wp-content/uploads/2023/08/August-2023-1300-Tax-Rebate.jpg

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

https://humanresourcesonline-assets.b-cdn.net/images/hr-sg/content-images/priya_apr_2023_mofsingapore_gstusave_gstscc_payouts_mofsingaporefb.jpg?auto_optimize=medium

IRS says Arizona child tax rebate is taxable As Kiplinger reported Arizona faced a significant budget surplus of over 2 billion During state budget negotiations lawmakers allocated For dependents under 17 the rebate is 250 per child For dependents who are 17 and older the rebate is 100 When will rebates be processed and sent The Department of Revenue has a

If you are a year round resident of Arizona and claimed the state s tax credit for dependents on your 2021 tax return you may be eligible for the Arizona Families Tax Rebate A full year resident who filed an Arizona tax return in 2021 and claimed at least one dependent are potentially eligible for the Arizona Families Tax Rebate program To be eligible taxpayers must

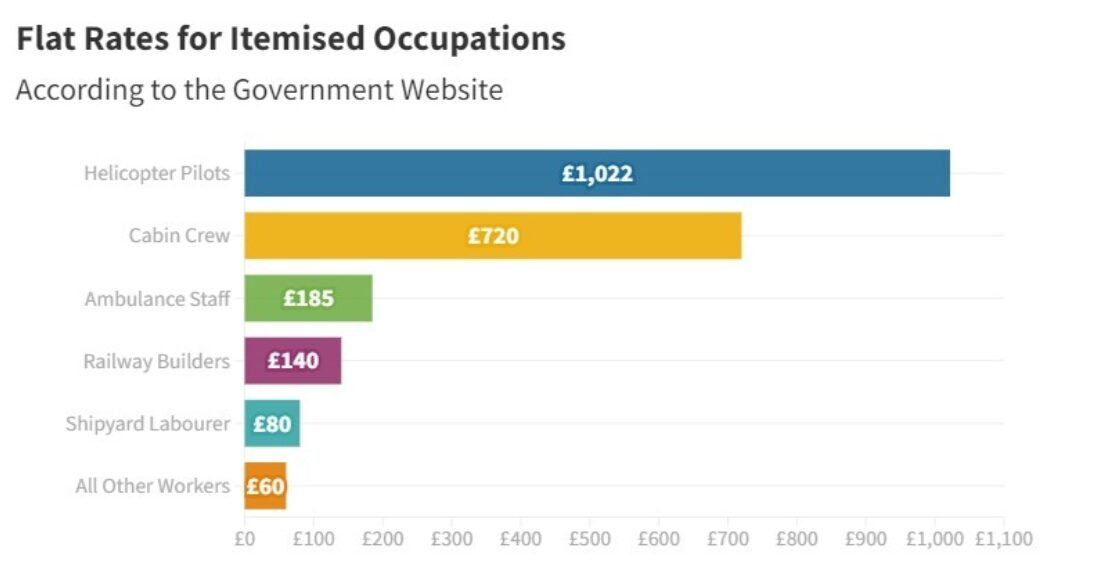

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Eligibility For Homeowners Tax Rebate YouTube

https://i.ytimg.com/vi/ZqmfXWRY6TA/maxresdefault.jpg

https://familyrebate.aztaxes.gov/

Instructions Enter the qualifying tax return information from tax year 2021 into each of the fields Fields marked with are required The primary taxpayer is the taxpayer listed first on the tax year 2021 return For validation purposes please select the filing status used on the tax year 2021 return

https://azdor.gov/news-center/arizona-families-rebate-recipients-will-need-report-rebate-income-tax-returns

Phoenix AZ The Arizona Department of Revenue ADOR is sending this information to assist taxpayers as the 2024 tax filing season begins The IRS has determined the Arizona Families Tax Rebate recently sent to eligible taxpayers is subject to federal income tax and is required to be reported as part of the federal adjusted gross income

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Income Tax Rebate Under Section 87A Eligibility Tax Deductions Exemptions Rebate Amount

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained Rebate2022

Property Tax Rebate Pennsylvania LatestRebate

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Tax Rebate For Uniform Process Times Money Back Helpdesk

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Az Tax Rebate 2024 Eligibility - January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to