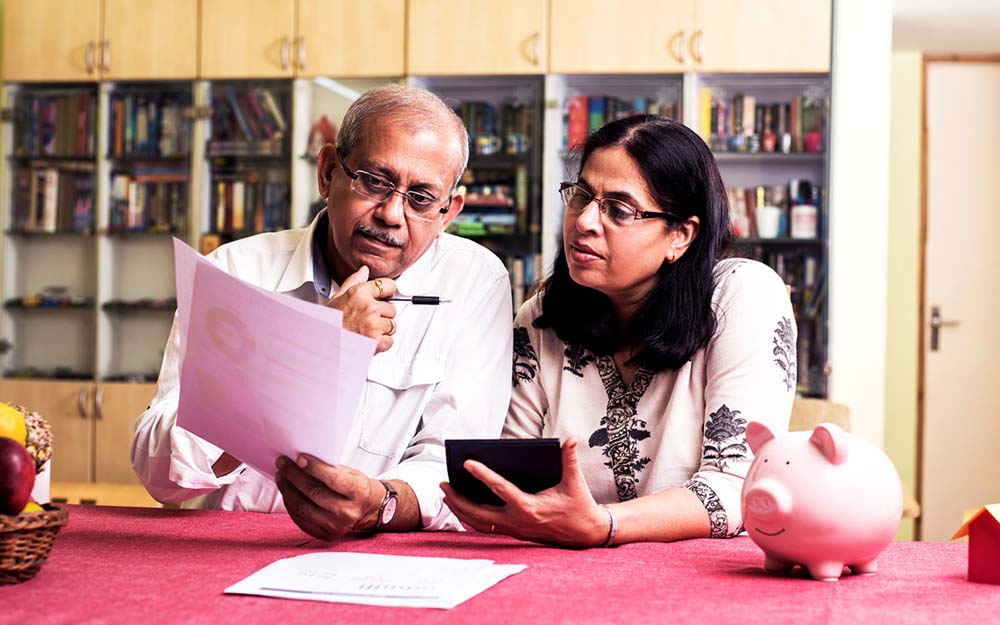

Bank Interest Rebate In Income Tax For Senior Citizens Section 80TTB of the Income Tax Act allows tax benefits on interest earned from deposits with banks post office or co operative banks The deduction is allowed for a maximum interest income of up to 50 000 earned by the Senior Citizen

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest earned from fixed deposits an recurring deposits Section 80TTB is a provision under the Indian Income Tax Act that offers tax benefits to senior citizens on their interest income Introduced in the Union Budget of 2018 this section aims to provide relief to senior citizens who

Bank Interest Rebate In Income Tax For Senior Citizens

Bank Interest Rebate In Income Tax For Senior Citizens

https://i.ytimg.com/vi/XQDCOVLK05g/maxresdefault.jpg

6 Benefits In Income Tax For Senior Citizens TaxAdda

https://taxadda.com/wp-content/uploads/Benefits-inIncome-Tax-For-Senior-Citizens.png

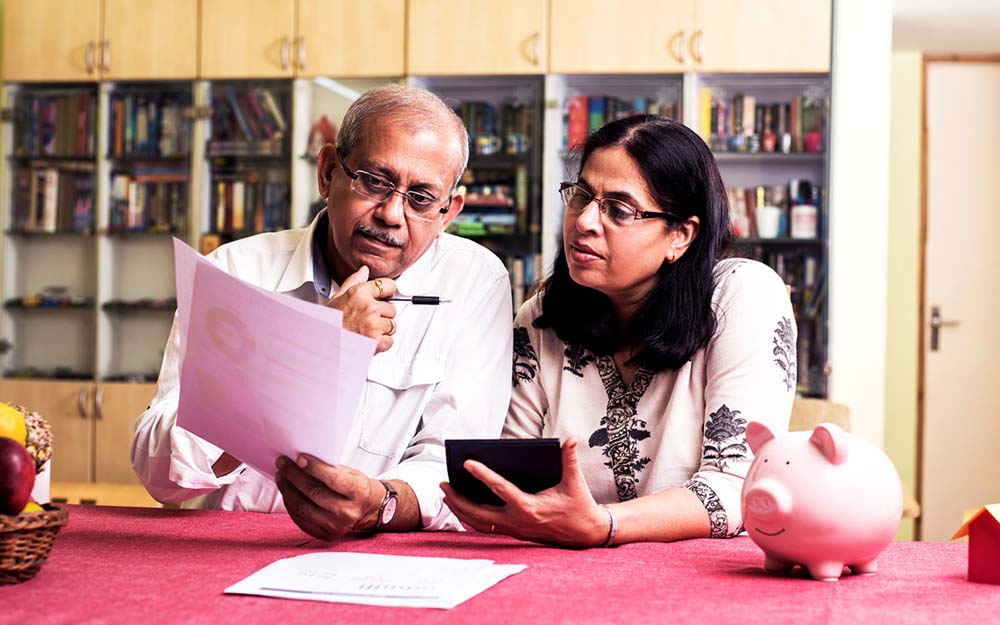

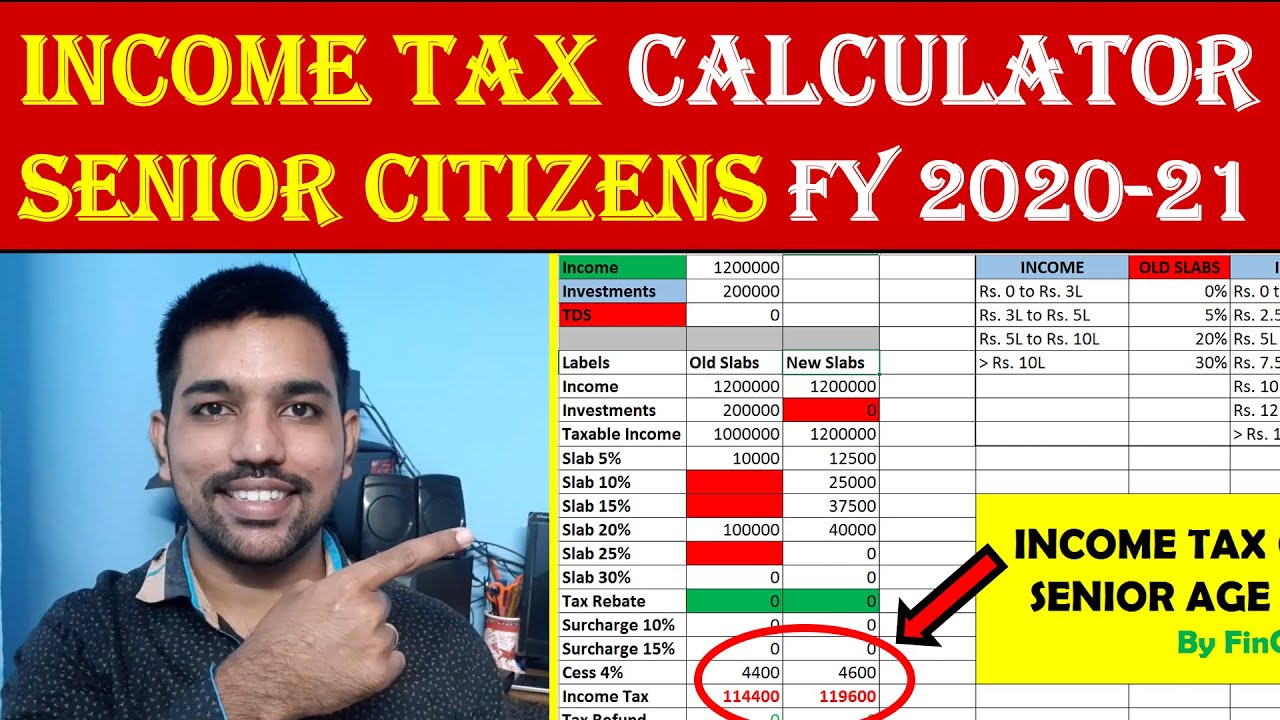

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator

https://i.ytimg.com/vi/Ww-ESeJgiP8/maxresdefault.jpg

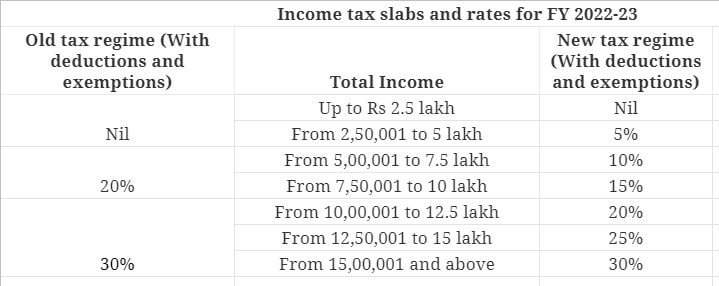

Income Tax Slab For Super Senior Citizen Super senior citizens over 80 years of age can also avail the benefit of old and new tax regime as they have the choice to opt between the two whichever is more beneficial Deductions Under Section 80TTB Section 80TTB of the Income Tax Act the Act allows senior citizens to claim a savings deduction of up to Rs 50 000 per year on interest earned from

Senior citizens can avail a tax rebate under Section 87A Under the Old Tax Regime Available for total income up to Rs 5 lakh Under the New Tax Regime Available for total income up to Rs 7 lakh In the old tax regime the basic exemption limit for senior citizens is Rs 3 00 000 and for super senior citizens it is Rs 5 00 000 In the new tax regime no income tax is payable upto the total income of Rs 7 lakh 9 Is there any difference in tax rebate under section 87A in old and new tax regime

Download Bank Interest Rebate In Income Tax For Senior Citizens

More picture related to Bank Interest Rebate In Income Tax For Senior Citizens

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

Income Tax Slab For Senior Citizens After Budget 2022 All You Need To Know

https://images.news18.com/ibnlive/uploads/2022/02/in-2.jpg

Income Tax Slab For Senior Citizens 2023 Rtaes

http://instafiling.com/wp-content/uploads/2023/01/Income-Tax-Slab.jpg

What are the Deduction U S 80TTB The maximum deduction under Section 80TTB is the lower of these following The total interest amount earned Maximum of Rs 50 000 For instance if the interest accrued on deposits is less than Rs 50000 then as per this provision the entire interest earnings are allowed as deductions For senior citizens to diminish their taxes Section 80TTB of Income Tax Act is a potent tool This provision gives financial assistance to those who rely upon their savings for regular living by providing a deduction of up to 50 000 on interest income

[desc-10] [desc-11]

All About Income Tax For Senior Citizens Pensioners

https://paytmblogcdn.paytm.com/wp-content/uploads/2023/08/Blog_Paytm_Income-Tax-for-Pensioners_-A-Comprehensive-Guide.jpg

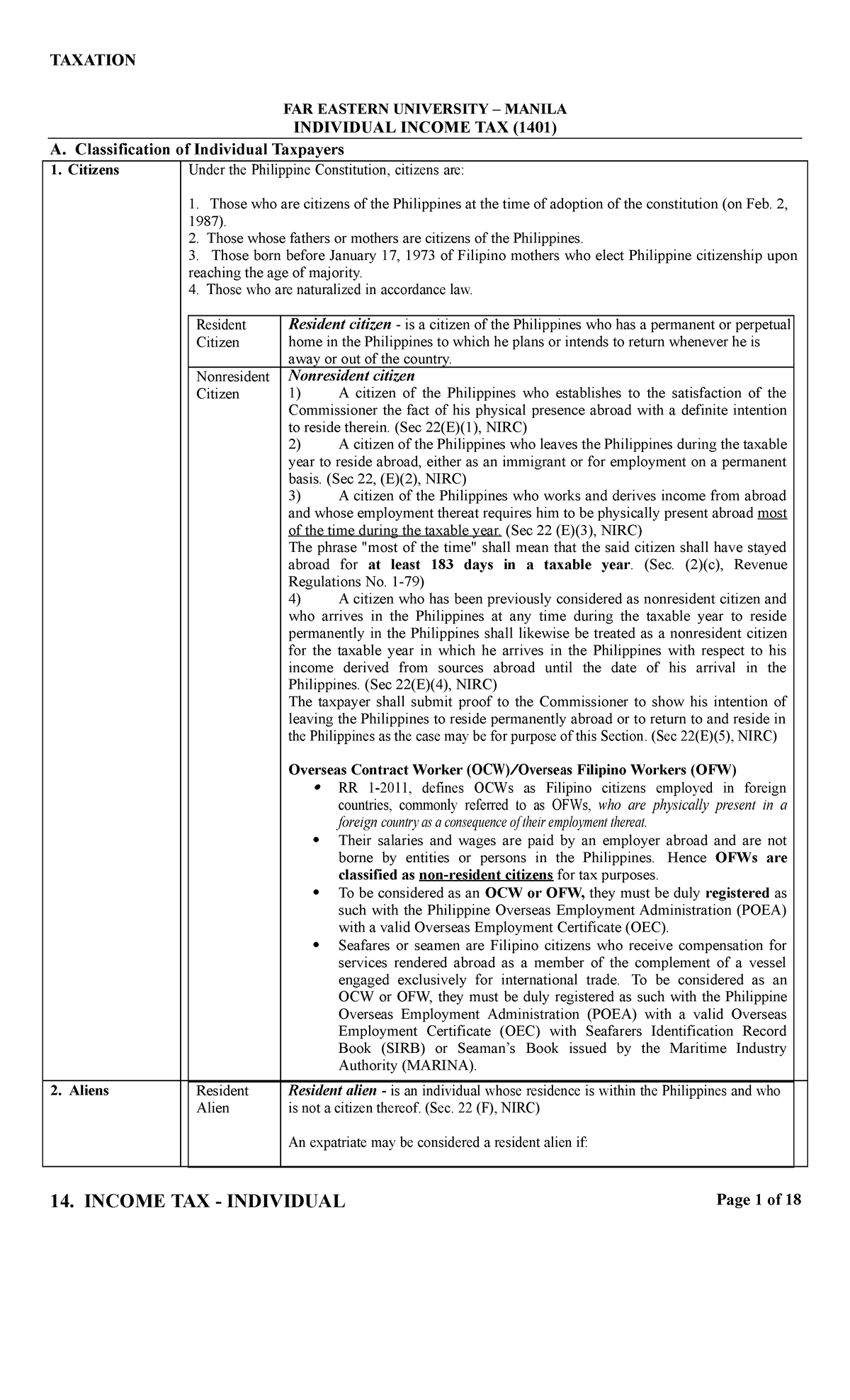

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

https://www.incometax.gov.in/iec/foportal/help/individual/return...

Section 80TTB of the Income Tax Act allows tax benefits on interest earned from deposits with banks post office or co operative banks The deduction is allowed for a maximum interest income of up to 50 000 earned by the Senior Citizen

https://cleartax.in/s/claiming-deduction-on-interest-under-section...

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest earned from fixed deposits an recurring deposits

Income Tax For Senior Citizens

All About Income Tax For Senior Citizens Pensioners

Interest Income Formula And Calculation

Income Tax India On Twitter RT nsitharamanoffc As Announced In

Income Tax Slabs Rates And Exemptions For Senior Citizens Know How

INCOME TAX CALCULATOR Income Tax For Senior Citizens

INCOME TAX CALCULATOR Income Tax For Senior Citizens

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

Rebate In Income Tax Ultimate Guide

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Bank Interest Rebate In Income Tax For Senior Citizens - [desc-14]