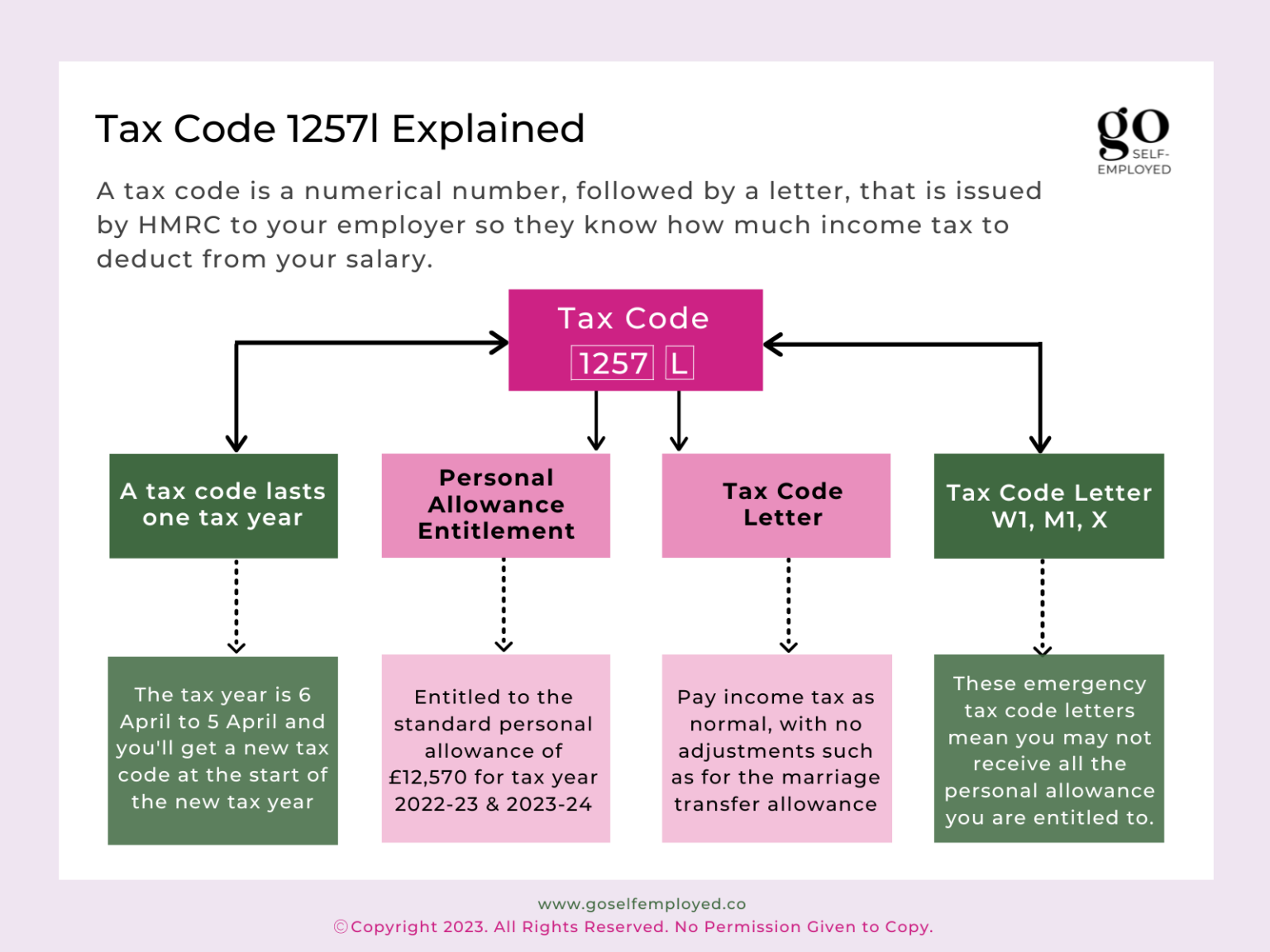

Basic Tax Code 23 24 Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension HM Revenue and Customs HMRC will tell them which code to

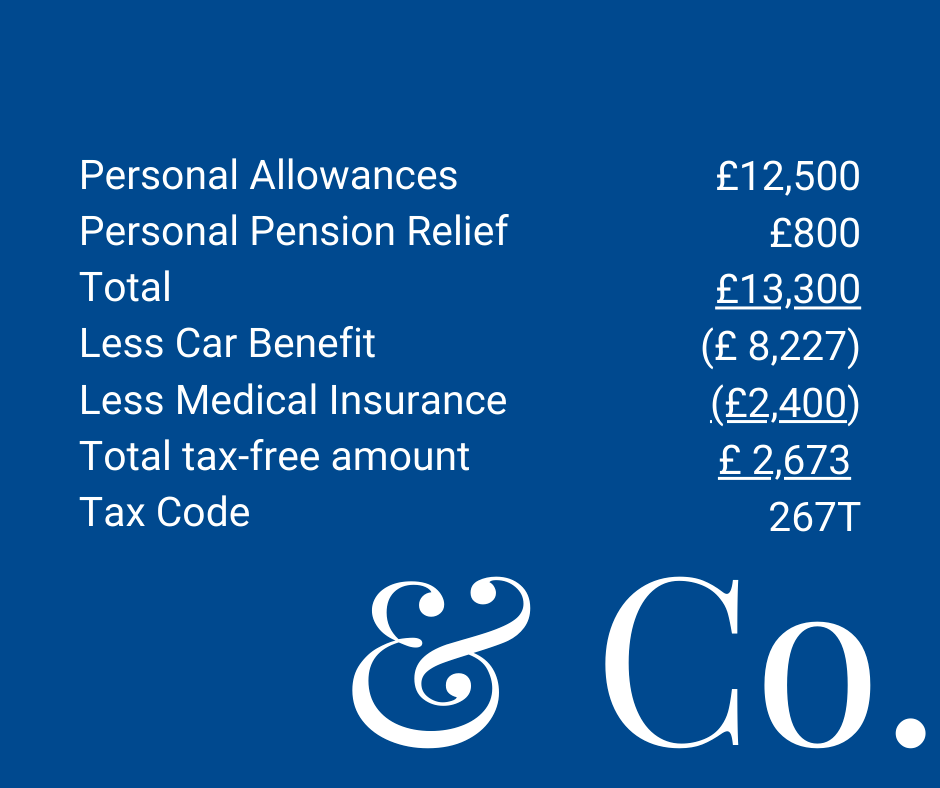

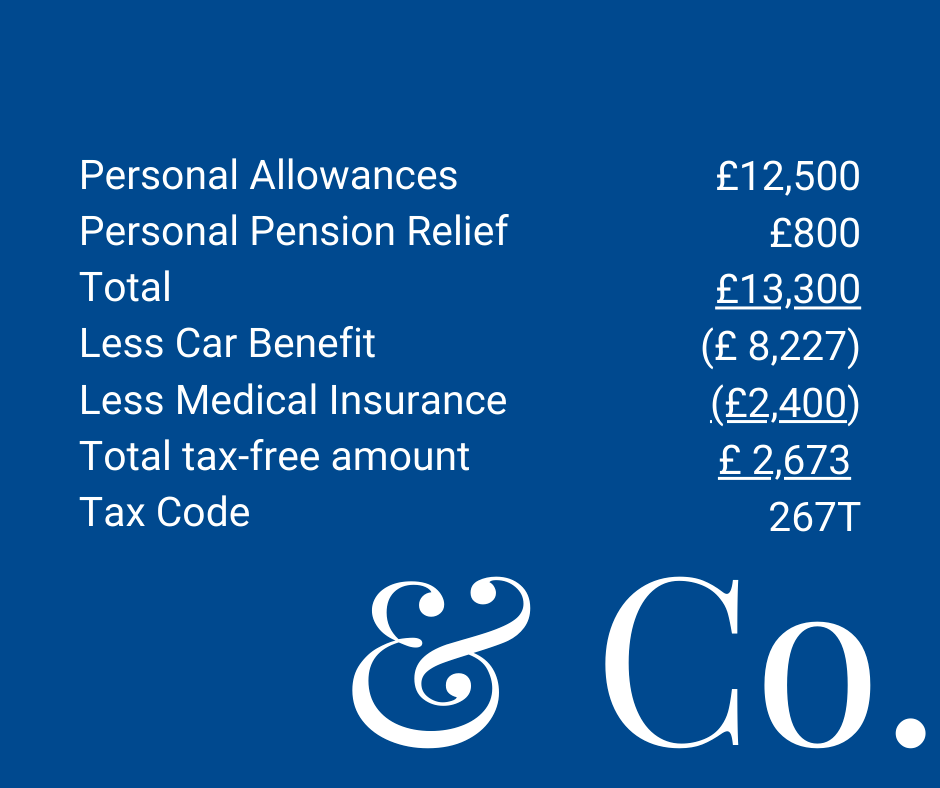

Check your Income Tax to see your Personal Allowance and tax code how much tax you ve paid in the current tax year how much you re likely to pay for the rest of the year Other allowances The basic 2023 24 tax code is set at 1257L It is the same standard tax code as the 2022 2023 tax year and it s expected to be kept in use until April 2026 The 1257L tax code reflects the

Basic Tax Code 23 24

Basic Tax Code 23 24

https://assets-global.website-files.com/635fd28860eb5a238eb1192e/6371ab8b4679d86a78571758_617c1ff9b7f9c113e5bff755_Suretax-Tax-Codes---Explained.jpeg

1257l Tax Code Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/01/1257l-Tax-Code-1536x1152.png

Check Your Tax Code Holden Associates

https://holdenassociates.co.uk/wp-content/uploads/2020/06/tax-code-1157x771.jpg

0 starting rate is for savings income only if your non savings income is above the starting band level the 0 rate will NOT apply and the basic rate percentage will be used instead Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2023 24 these three rates are 20 40 and 45 respectively Tax is charged on taxable income at the

Read our guide to UK tax rates and thresholds for sole traders limited companies partners and partnerships employers and other businesses When do tax rates change What is the tax free Personal Allowance How Tax rate tables for 2023 24 including income tax pensions annual investment limits national insurance contributions vehicle benefits and other tax rates

Download Basic Tax Code 23 24

More picture related to Basic Tax Code 23 24

Why You Can t Do Your Property Taxes Alone Property Tax Consultants

https://www.hegwoodgroup.com/wp-content/uploads/2017/03/propertytaxdallas-768x512.jpg

Political Calculations 2011 The Number Of Pages In The U S Tax Code

https://4.bp.blogspot.com/-vefjI5r2lt4/Tg3TjmFeNXI/AAAAAAAAENQ/ndZQecRf9vY/s1600/2011-cch-std-fed-tax-reporter-number-of-pages-us-tax-code.png

Tax Code Changes May Be On The Horizon Kennan Law Offices Cape Cod

https://www.estateplanningcapecod.com/wp-content/uploads/2021/03/18124-Tax.jpg

Details of the PAYE codes for 2023 24 are as follows The basic PAYE tax code is set at 1257L for employees This gives an employee a personal allowance of 12 570 for the For the 23 24 tax year the standard tax code for people with only one employment or pension income is 1257L This is because most people have a tax free personal allowance

Qualifying purchases in Freeport tax sites are eligible for full relief from SDLT R D tax credit rate on the surrendable loss for SMEs Payable tax credit in a year exceeding Income is taxed in a specific order with savings and dividend income taxed last There are three main bands basic rate BR higher rate HR and additional rate AR There is also a

Tax Code All You Need To Know Stewart Co

http://www.stewartco.co.uk/content/uploads/2020/04/Tax-code-table.png

Income Tax Payment Code Una Avery

https://i.pinimg.com/564x/1c/fc/43/1cfc43d6acc1bf19c82d6b468586ff33.jpg

https://www.gov.uk › tax-codes

Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension HM Revenue and Customs HMRC will tell them which code to

https://www.gov.uk › income-tax-rates

Check your Income Tax to see your Personal Allowance and tax code how much tax you ve paid in the current tax year how much you re likely to pay for the rest of the year Other allowances

Explaining HMRC Tax Codes

Tax Code All You Need To Know Stewart Co

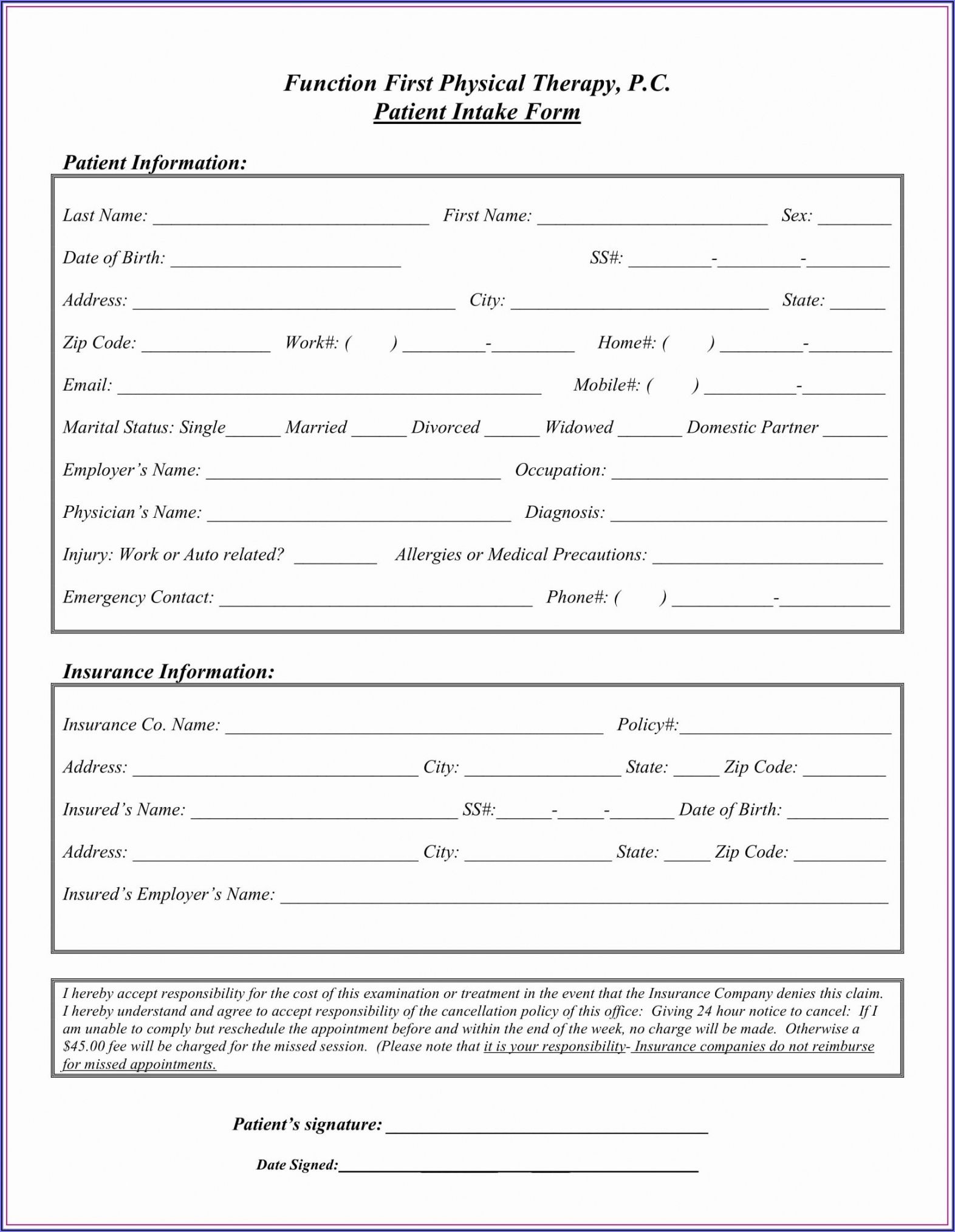

Editable Tax Client Intake Form Template Excel Sample Minasinternational

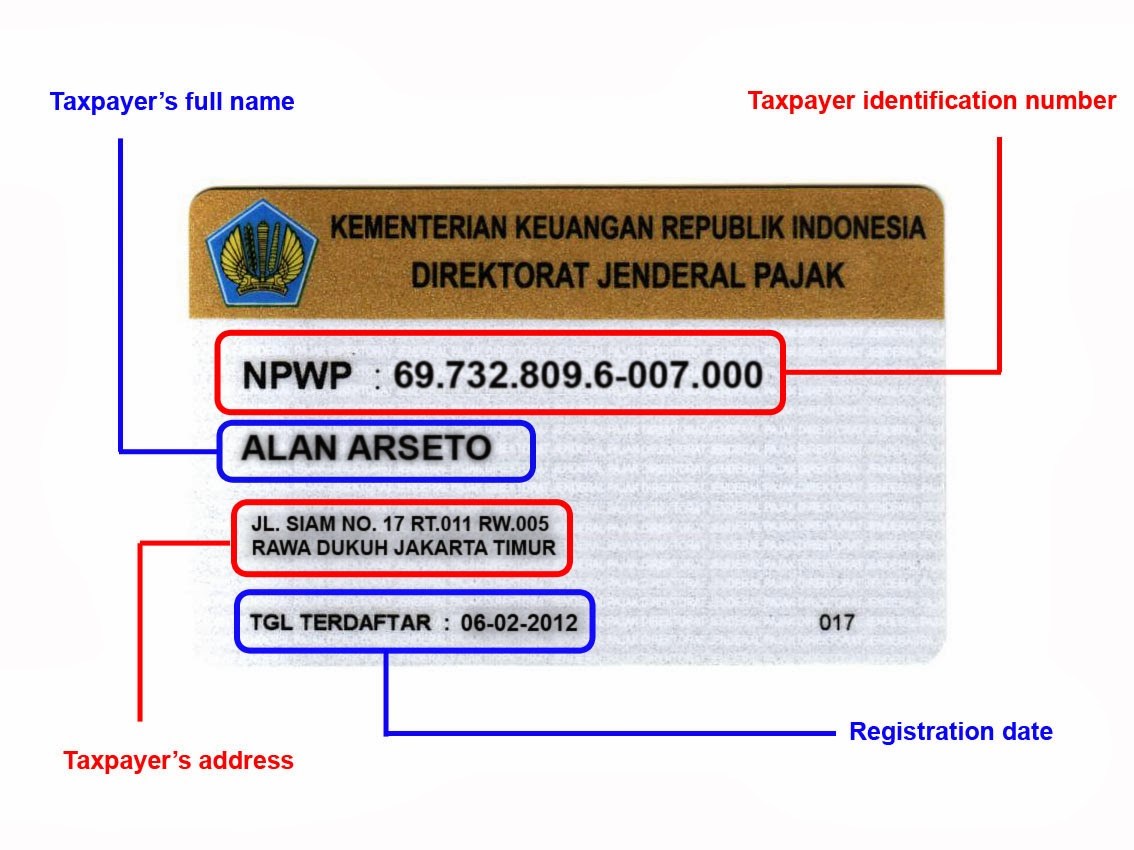

Langkah Demi Langkah Panduan Mendapatkan NPWP Nomor Pokok Wajib

Tax Codes Sri Software

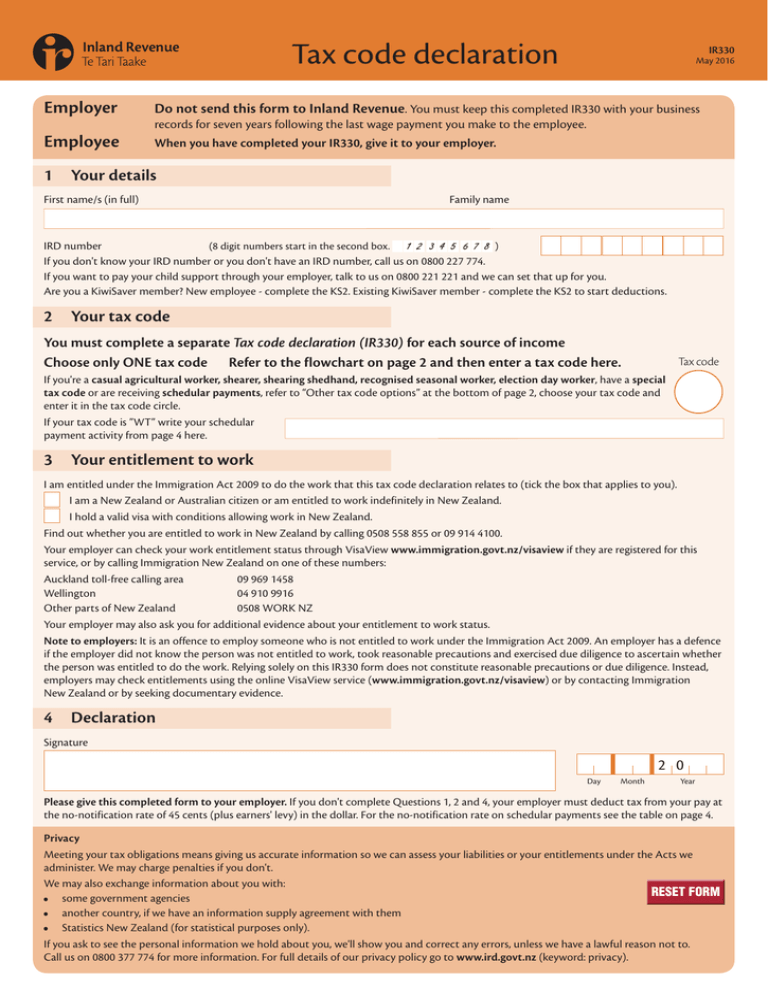

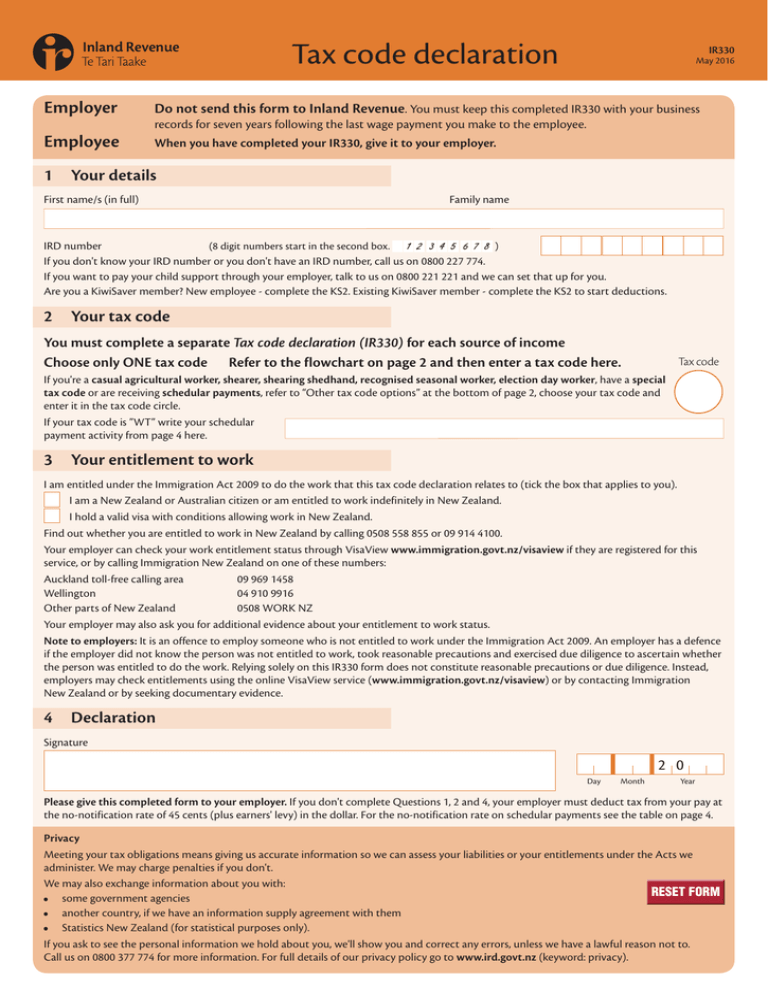

Tax Code Declaration

Tax Code Declaration

Group Home Riches

Taxes For Filipino Freelancers and How To Compute Them

A Basic Tax Guide For Freelancers The Balance Sheet Inc

Basic Tax Code 23 24 - Tax rate tables for 2023 24 including income tax pensions annual investment limits national insurance contributions vehicle benefits and other tax rates