Bc Sales Tax Claim The B C PST is a retail sales tax that applies when taxable goods software or services are acquired in B C or brought into B C for use in B C unless a specific

The BC sales tax credit is a refundable credit that helps low income individuals and families in British Columbia offset the provincial sales tax The maximum credit is 75 for individuals and 150 for couples How to claim the BC sales tax credit If you re eligible you may claim the credit through the British Columbia Credits form BC479 when you file your T1 Income Tax Return You can claim the BC sales

Bc Sales Tax Claim

Bc Sales Tax Claim

https://s.hdnux.com/photos/01/23/23/22/21836949/6/rawImage.jpg

How To Qualify For The BC Sales Tax Credit Gateway Tax

https://www.gatewaytax.ca/wp-content/uploads/2022/01/BC-Sales-Tax-Credit-Featured-Image-2048x1152.png

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

If you are not filing your rebate application electronically you can file a paper application by filling out and sending Form GST495 Rebate Application for Provincial Part of British Columbia BC Sales Tax Credit Meant to help out low income Canadians in British Columbia the refundable BC Sales Tax Credit can be claimed if you were a resident of

The BC sales tax credit is a refundable tax credit available to eligible British Columbia residents It is designed to provide financial relief to low and moderate income individuals and families to offset the cost of provincial Fill out the following forms to register to collect provincial sales tax PST FIN 418 Application for Registration for Provincial Sales Tax PST Online eTaxBC

Download Bc Sales Tax Claim

More picture related to Bc Sales Tax Claim

Top 3 Which States Do Not Collect Sales Tax In 2022 G u y

https://www.taxjar.com/wp-content/uploads/TAX_States-Without-Sales-Tax_Blog_L1R1-copy.jpg

Sales Tax Finevolution

https://finevolution.com.ua/wp-content/uploads/2021/11/sales_tax_finevolution_article-2.jpg

Gross McGinley Online Sales Subject To Sales Tax

https://www.grossmcginley.com/wp-content/uploads/2019/05/collect-sales-tax.jpg

The buyer must provide the seller with their BC PST number or complete an exemption certificate for the PST to not be charged on the sale If a BC PST number is The BC sales tax credit is a tax benefit designed to help low income individuals and families offset the provincial sales tax they pay on eligible goods and services You can claim the BC sales tax credit if you

The BC sales tax credit is a dollar for dollar income tax reduction for Canadians in British Columbia You may claim up to 75 for yourself and 75 for your Use this form to calculate your British Columbia credits

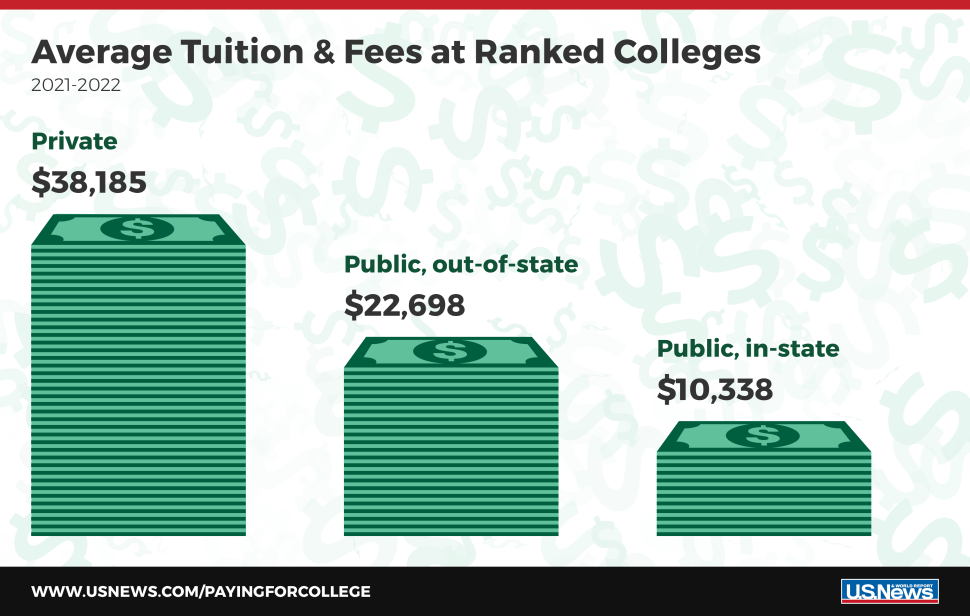

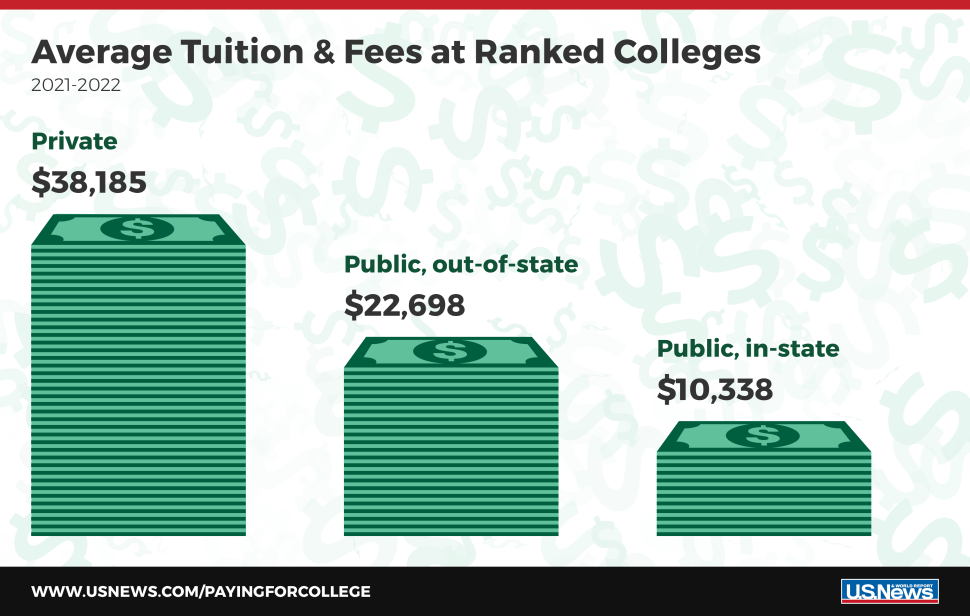

The Tax ABCs Of Scholarships JMF

https://jmf.com/wp-content/uploads/avgtuitioninfographic-graphic.png

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

https://www2.gov.bc.ca/gov/content/taxes/sales-taxes/pst

The B C PST is a retail sales tax that applies when taxable goods software or services are acquired in B C or brought into B C for use in B C unless a specific

https://turbotax.intuit.ca/tips/claiming-the...

The BC sales tax credit is a refundable credit that helps low income individuals and families in British Columbia offset the provincial sales tax The maximum credit is 75 for individuals and 150 for couples

How To Qualify For The BC Sales Tax Credit Gateway Tax

The Tax ABCs Of Scholarships JMF

Tax Sales Carroll County Tax Commissioner

-480a.jpg)

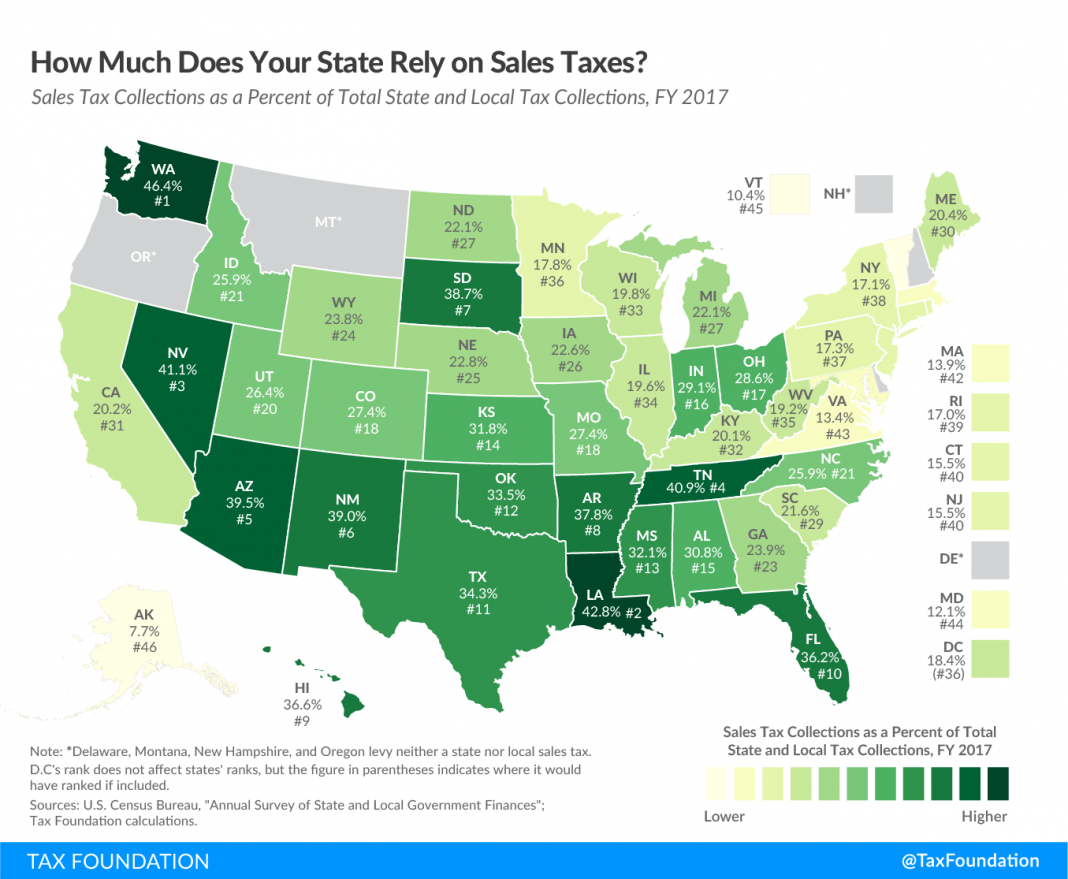

Visualizing Taxes By State

Tax Reduction Company Inc

Who Benefits When Sales Taxes Are Cut

Who Benefits When Sales Taxes Are Cut

TAX FOUNDATION To What Extent Does Your State Rely On Sales Taxes

OUCH Alabama Has 4th Highest Combined Sales Tax Rate In The Country

Sales Taxes In The United States Wikipedia

Bc Sales Tax Claim - If you are not filing your rebate application electronically you can file a paper application by filling out and sending Form GST495 Rebate Application for Provincial Part of