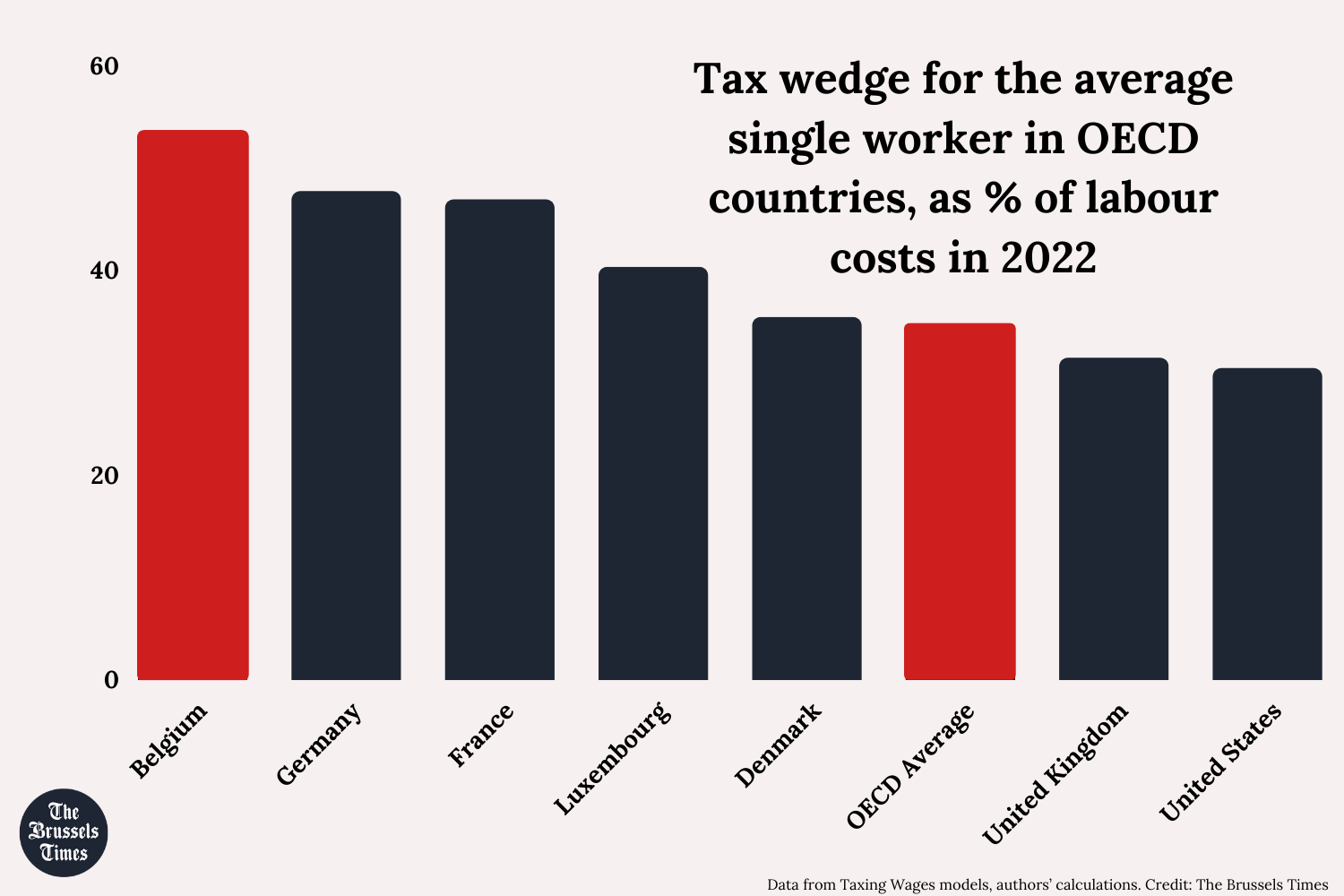

Belgium Tax Advantages Belgium is known for having some of the highest tax rates for individuals in Europe with personal income tax reaching 50 of earnings In contrast the country s corporate tax rates are in line with other European countries

The Belgian government has limited tax benefits for expats Businesses and employees must adjust to new rules from 1 January 2022 The change is due to the increasing number of expats who benefit from the favourable tax regulations in Belgium The Ecovis experts in Belgium explain what is changing Benefits Normal residency rules apply Cost proper to the employer related to employment in Belgium On top of the remuneration Exempted from personal income taxes and Belgian social security contributions Limited to 30 of the gross remuneration Capped at 90 000 EUR per year

Belgium Tax Advantages

Belgium Tax Advantages

https://www.expat.com/upload/guide/1535113618-buying-a-property-in-belgium-news_item_slider-t1535113618.jpg

BELGIUM

https://www.designfootball.com/images/joomgallery/originals/football_kits_120/belgium_20180913_1443951301.png

Belgian Tax Authorities Hunting Down Cryptocurrency Speculators

http://bitcoinist.com/wp-content/uploads/2018/03/ss-belgium-taxes.jpg

Common Benefits VISA Remote Working VAT Version History Questions Answers Contribution Employer taxes Highest Lowest Employee taxes 30th Aug 2021 There are many different kinds of taxes in Belgium In this article we explain the most important ones Taxes in Belgium are levied at two levels the more important taxes such as income and corporate tax or VAT are collected by the government whereas others are levied locally property taxes

Innovation Park Belgium s Federal Government implemented a new Expat Tax Regime which came into effect on 1 January 2022 The updated legislation completely overhauls the 38 year old expat tax regime providing legal clarity and adapting Belgium s tax rules to the present day s legal and tax needs Local income taxes For residents of Belgium communal taxes are levied at rates varying from 0 to 9 of the income tax due The average rate being 7 For non residents a flat surcharge of 7 is due In some cases communal taxes may also be levied on exempted foreign source income Contacts News Print

Download Belgium Tax Advantages

More picture related to Belgium Tax Advantages

Tax Calculator Belgium Contractor Taxation

https://contractortaxation.com/wp-content/uploads/2023/02/Tax-Calculator-Series-White-background-scaled.jpeg

How To Claim Tax Back From Your Working Holiday Hostelworld

https://www.hostelworld.com/blog/wp-content/uploads/2016/08/Belgium.jpg

Belgium Cooperative Tax Compliance Program DReport In English

https://www.dreport.cz/en/wp-content/uploads/sites/4/2018/12/dreamstime_s_83478571.jpg

The tax free allowance is EUR 10 160 tax year 2024 income 2023 tax year 2025 income 2024 EUR 10 570 This tax free allowance may increase depending on personal circumstances for example if dependent children In the example above the tax reduction for the tax free allowance is 10 160 x 25 EUR 2 540 The Belgian expatriate tax regime was introduced to attract foreign investments in Belgium by decreasing the wage costs for employers Given that the expatriate tax regime benefits the employer it is important for employers to make sure that Belgian income tax returns for expatriates are pr epared filed and followed up in accordance with

Check the different rates and learn how to file your taxes Belgium introduced attractive special tax regimes for inbound taxpayers and inbound researchers offering significant benefits and decreasing the cost of employing individuals in Belgium Although similar both regimes are not identical The regime for inbound taxpayers requires a minimum annual gross salary but has no degree requirements

Meetlatten Aluscreen

https://www.aluscreen.be/wp-content/uploads/2022/05/Made-in-BE.png

Belgium Tax And Financial Measures Associated With COVID 19

https://hlb-poland.global/wp-content/uploads/2020/04/Belgium-1170x550.jpg

https://www.expatica.com/be/finance/taxes/taxes-in-belgium-100073

Belgium is known for having some of the highest tax rates for individuals in Europe with personal income tax reaching 50 of earnings In contrast the country s corporate tax rates are in line with other European countries

https://www.ecovis.com/global/tax-benefits-for...

The Belgian government has limited tax benefits for expats Businesses and employees must adjust to new rules from 1 January 2022 The change is due to the increasing number of expats who benefit from the favourable tax regulations in Belgium The Ecovis experts in Belgium explain what is changing

Dividend Tax In Belgium

Meetlatten Aluscreen

.jpg)

File Poland Vs Belgium 2009 Rugby 2 jpg Wikimedia Commons

Propos De Nous IDS Belgium

Belgium Continues To Have Highest Tax Burden On Wages

Conditions G n rales De Vente ZX1 Belgium

Conditions G n rales De Vente ZX1 Belgium

Belgium Tax Income Taxes In Belgium Tax Foundation

Belgium Ratifies Controversial Treaty Vacation Apartment News

Download Free Belgium Map Resume Sample

Belgium Tax Advantages - By CT Corporation Staff Belgium s prime location in Western Europe open economy skilled and multilingual workforce and established infrastructure make it an attractive option for companies looking to expand This article covers Advantages of doing business in Belgium Risks of doing business in Belgium