Belgium Tax Deductions The tax free allowance is EUR 10 160 tax year 2024 income 2023 tax year 2025 income 2024 EUR 10 570 This tax free allowance may increase depending on personal circumstances for

To obtain your net taxable professional income professional expenses must be deducted There are two possible methods the legal fixed rate or your actual expenses If you failed to mention Use our Belgium Salary Calculator to find out your net income after deducting all taxes from your gross salary Income Tax Social Contributions Regional Tax

Belgium Tax Deductions

Belgium Tax Deductions

https://i.pinimg.com/originals/e6/97/88/e697885c772ebc04e72ebb01c99fd6ae.jpg

Belgian Tax Authorities Hunting Down Cryptocurrency Speculators

http://bitcoinist.com/wp-content/uploads/2018/03/ss-belgium-taxes.jpg

Tax Deductions For Charitable Donations

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17y0HM.img?w=3000&h=2000&m=4&q=100

Residents of Belgium are taxable on their worldwide income while non residents are only taxable on Belgian source income Personal income tax PIT is calculated by Example of a standard personal income tax calculation in Belgium

The income tax rates follow a progressive scale ranging from 25 for individuals earning under 15 200 and reaching 50 for those surpassing 46 440 Furthermore municipal taxes usually deduct a portion of your The Salary Tax Calculator for Belgium Income Tax calculations Updated for 2024 with income tax and social security Deductables The Belgium Tax Calculator includes tax years from 2019 to 2024 with full salary deductions and tax

Download Belgium Tax Deductions

More picture related to Belgium Tax Deductions

Tax Deductions Armstrong Economics

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-2048x1536.jpg

The Belgian Tax Reform Brussels Express

https://brussels-express.eu/wp-content/uploads/2017/12/Vennootschapsbelasting.jpg

Your 2017 Tax Preparation Checklist The Motley Fool

https://g.foolcdn.com/editorial/images/436027/tax-form_tax-deductions_gettyimages-515708887.jpg

In principle the payer has to deduct 26 75 tax and pay that to the tax office unless Belgium must exempt the maintenance paid under the double tax treaty between Belgium and the country where the beneficiary lives Belgian tax law provides for a general thin capitalisation rule 5 1 debt equity ratio according to which interest payments or attributions in excess of a 5 1 debt equity ratio are not

As a general rule expenses are tax deductible in Belgium if they are incurred in order to maintain or to increase taxable income they are incurred or have accrued during the Enter your employment income into our salary calculator above to estimate how taxes in Belgium may affect your finances You ll then get your estimated take home pay an estimated

Dividend Tax In Belgium

https://www.lawyersbelgium.com/uploads/default/files/dividend_tax_in_belgium.jpg

Declaring Your UK Income In Your Belgian Tax Return BritCham Blog

https://britishchamber.files.wordpress.com/2020/06/unnamed.jpg

https://finance.belgium.be/.../tax-rates

The tax free allowance is EUR 10 160 tax year 2024 income 2023 tax year 2025 income 2024 EUR 10 570 This tax free allowance may increase depending on personal circumstances for

https://www.belgium.be/en/taxes/income_tax

To obtain your net taxable professional income professional expenses must be deducted There are two possible methods the legal fixed rate or your actual expenses If you failed to mention

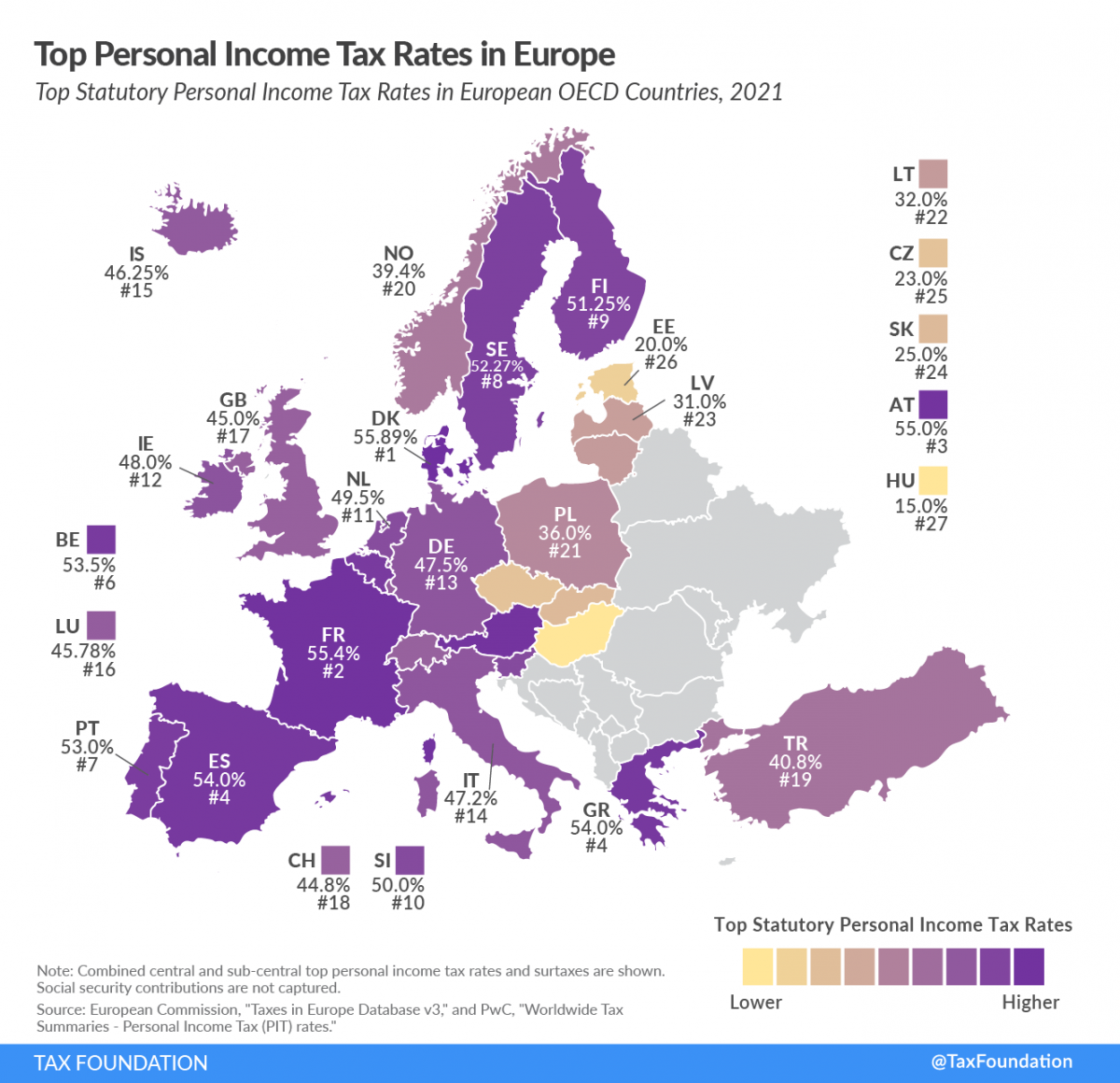

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Dividend Tax In Belgium

Lets Talk Tax Deductions Shellharbour Marina Real Estate

Tax Calculator Belgium Contractor Taxation

Tax Deductions And Credits Related To Education Expenses

CE Typeplaten Aluscreen

CE Typeplaten Aluscreen

The 5 Most Overlooked Tax Deductions

How To Fully Maximize Your 1099 Tax Deductions Steady

The Belgian Tax Reform Brussels Express

Belgium Tax Deductions - Residents of Belgium are taxable on their worldwide income while non residents are only taxable on Belgian source income Personal income tax PIT is calculated by