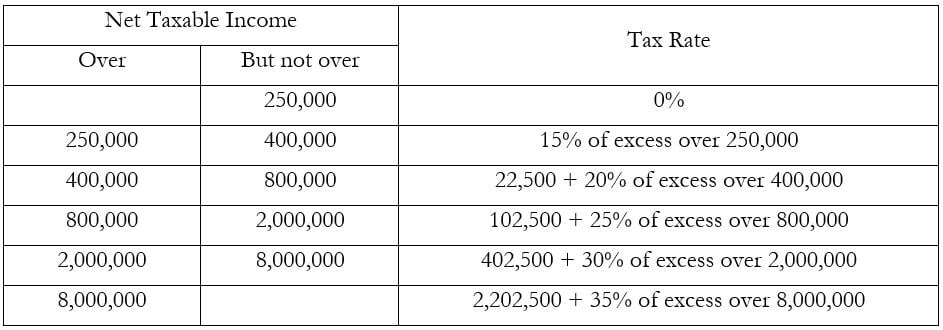

Bir Estate Tax Rate ESTATE TAX SEC 2 RATE OF ESTATE TAX The net estate of every decedent whether resident or non resident of the Philippines as determined in

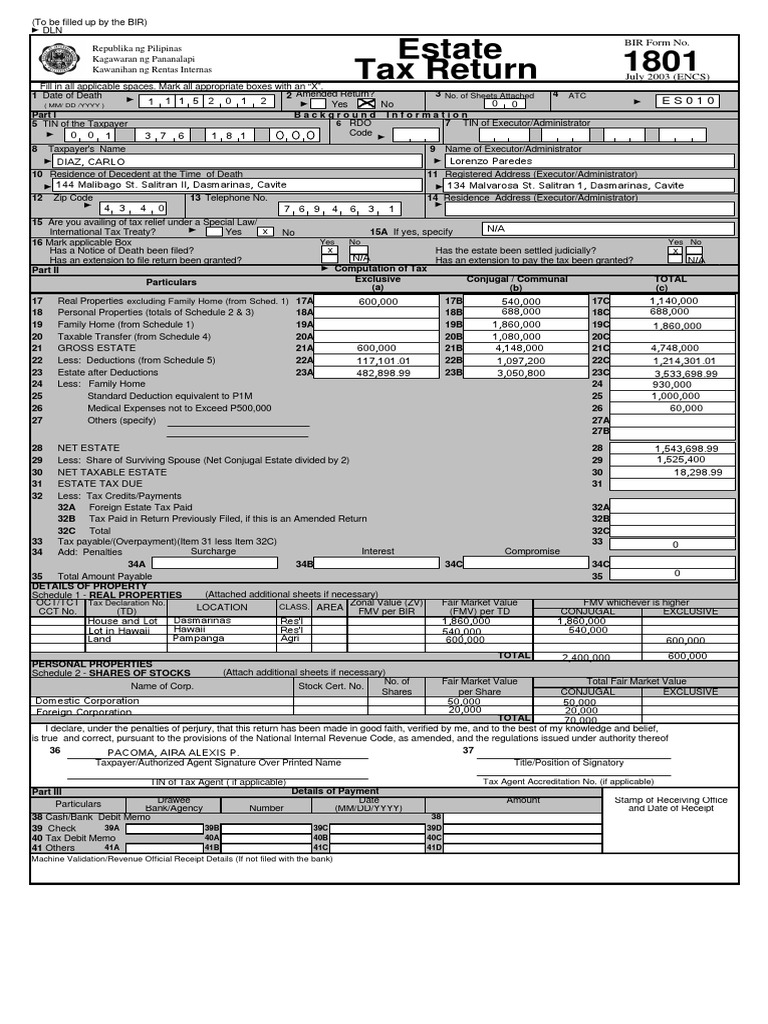

Since estate tax is 6 of your net estate multiply your 3 5 million by 0 06 You ll then get 210 000 which will be your estate tax Note The rate applicable will be When you ve determined the value of the property left behind you re ready to tackle the Estate Tax Return BIR Form 1801 and figure out your payment obligations

Bir Estate Tax Rate

Bir Estate Tax Rate

http://buyingph.com/wp-content/uploads/2018/02/Tax-Rate-from-2018-to-2022.png

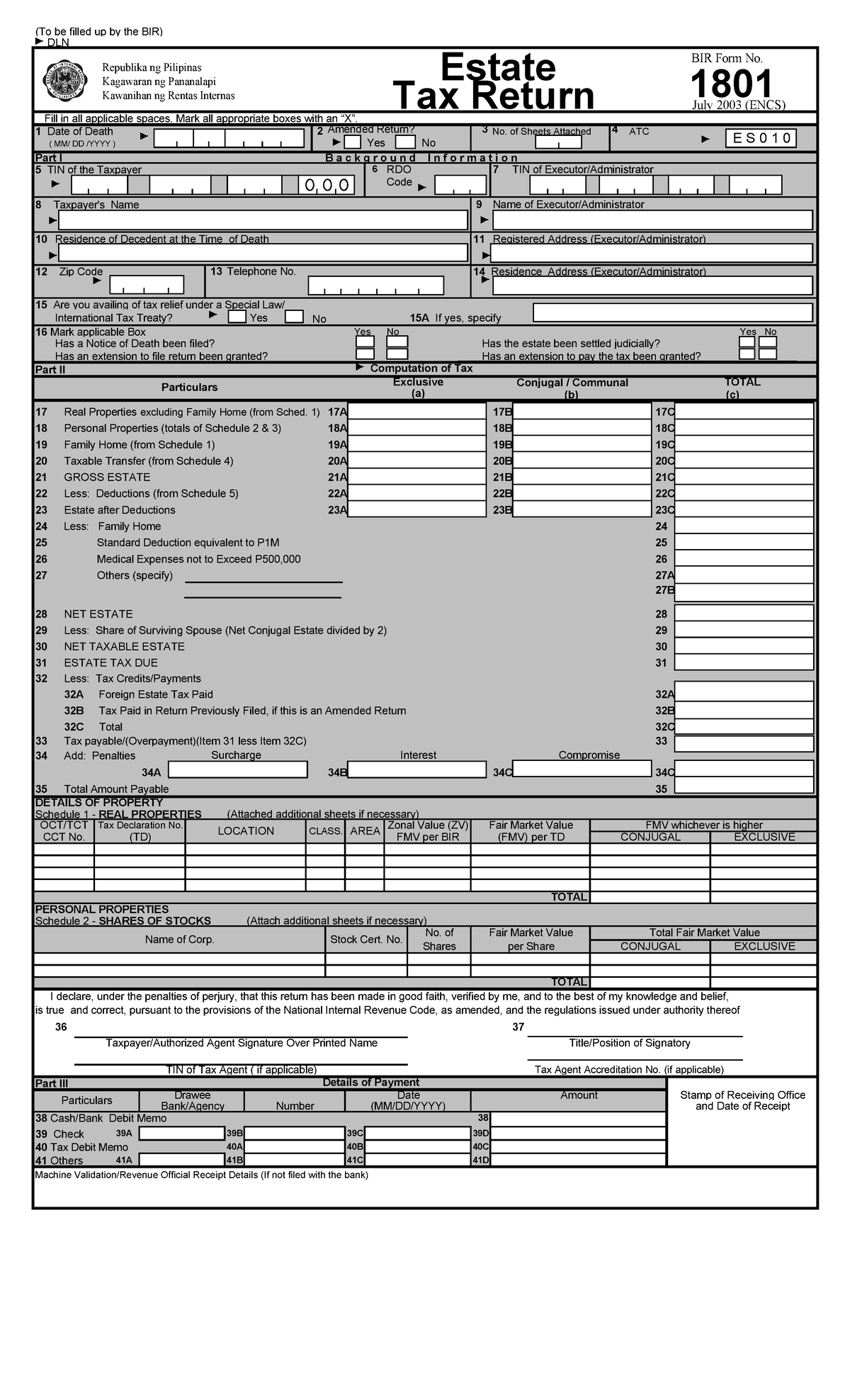

Bir Form 1801 Estate Tax Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/608/933/608933401/large.png

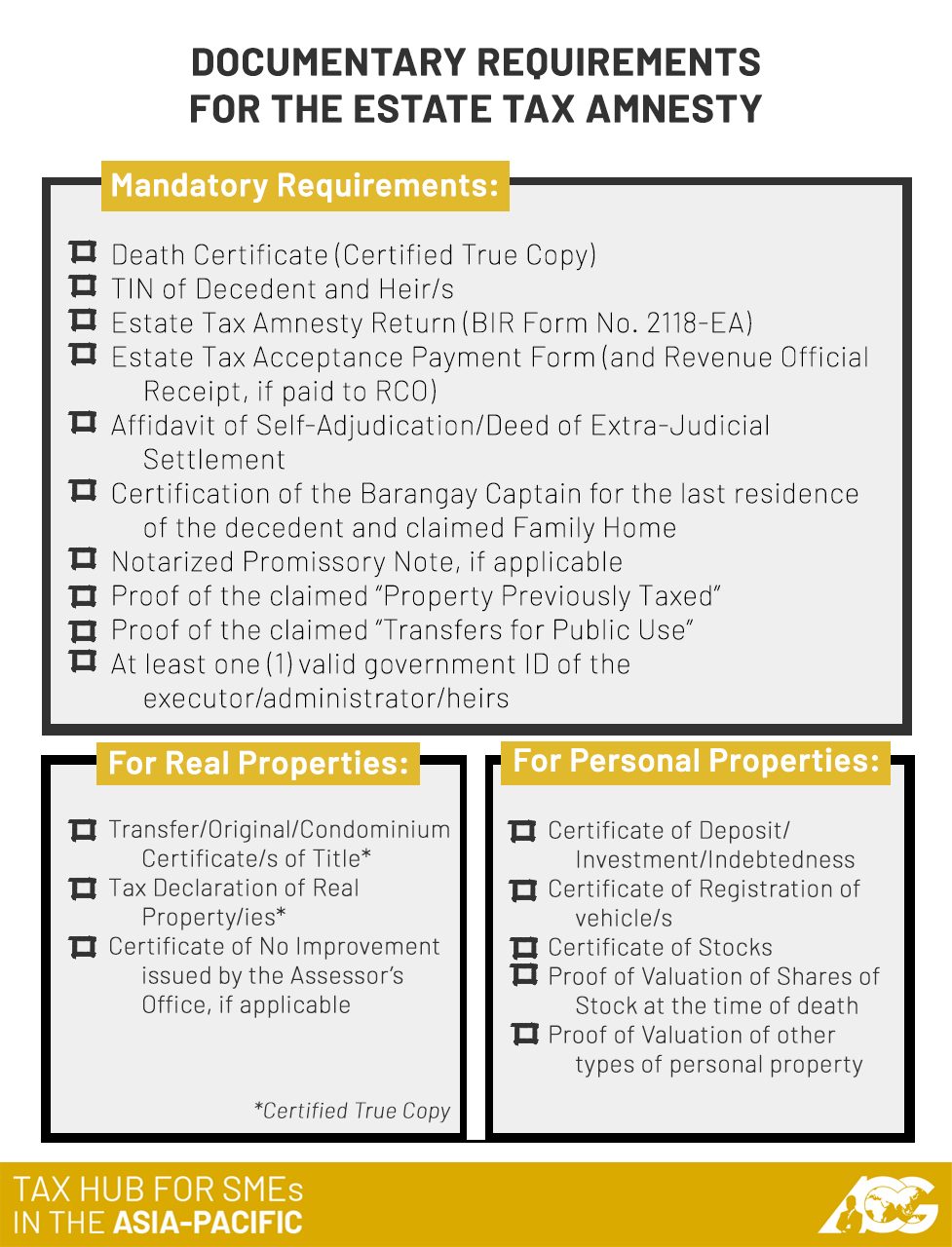

AskTheTaxWhiz How Do I Avail Of Estate Tax Amnesty

https://www.rappler.com/tachyon/r3-assets/9D203DECF61E4504A9504C863B8FCACA/img/5AC635DDE20142048B4DBA72C4D4EDC6/20190612-tax-whiz-1.jpg

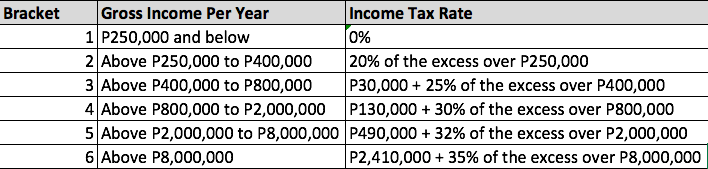

In 2018 under the TRAIN law Republic Act RA No 10963 2 the Philippines adjusted the estate tax rate to a flat rate of 6 The flat rate applies to a net An Estate Tax return must be filed if the estate consists of registered property vehicles stock shares or anything that requires a clearance from the Philippines Bureau

Estate tax amnesty A refresher Estate settlement entails huge tax payments Prior to the TRAIN Law the estate tax due was the aggregate of a specific There shall be imposed a rate of six percent 6 based on the decedent s NET TAXABLE ESTATE determined as of the time of death of decedent composed of all properties real

Download Bir Estate Tax Rate

More picture related to Bir Estate Tax Rate

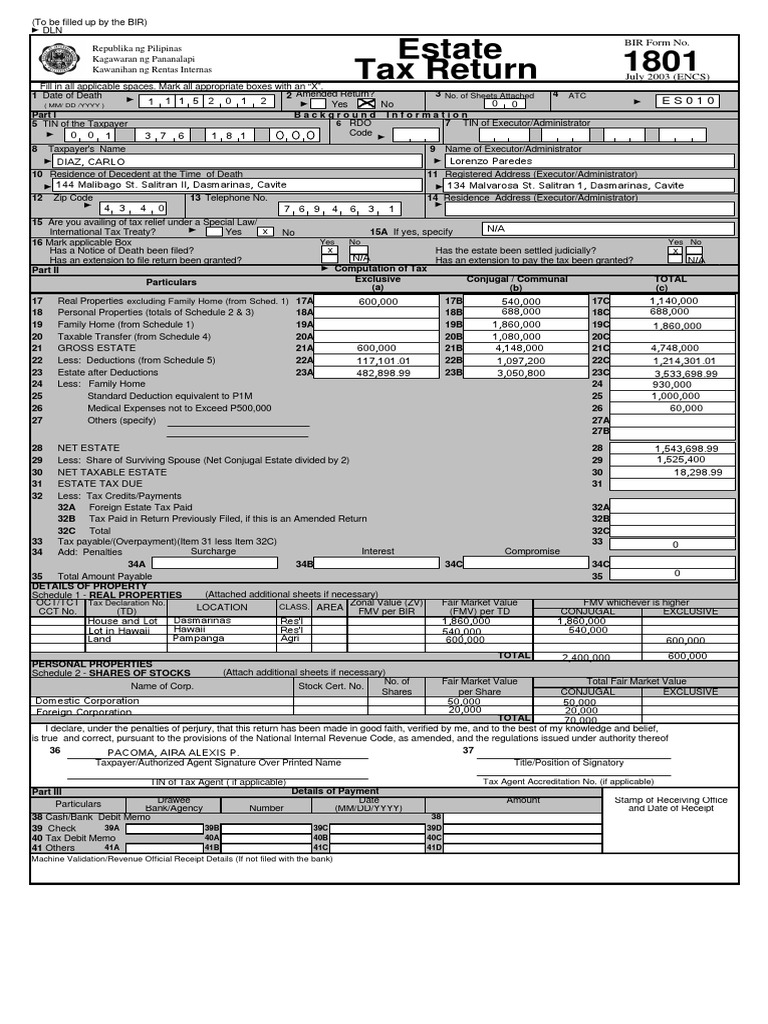

Exploring Financial Havens The World s Lowest Tax Rate Countries

https://flashlearners.com/wp-content/uploads/2023/09/tax-rate.jpg

Estate Tax In The Philippines An Easy to Understand Guide

https://25174313.fs1.hubspotusercontent-eu1.net/hubfs/25174313/assets_moneymax/What_is_Estate_Tax.png#keepProtocol

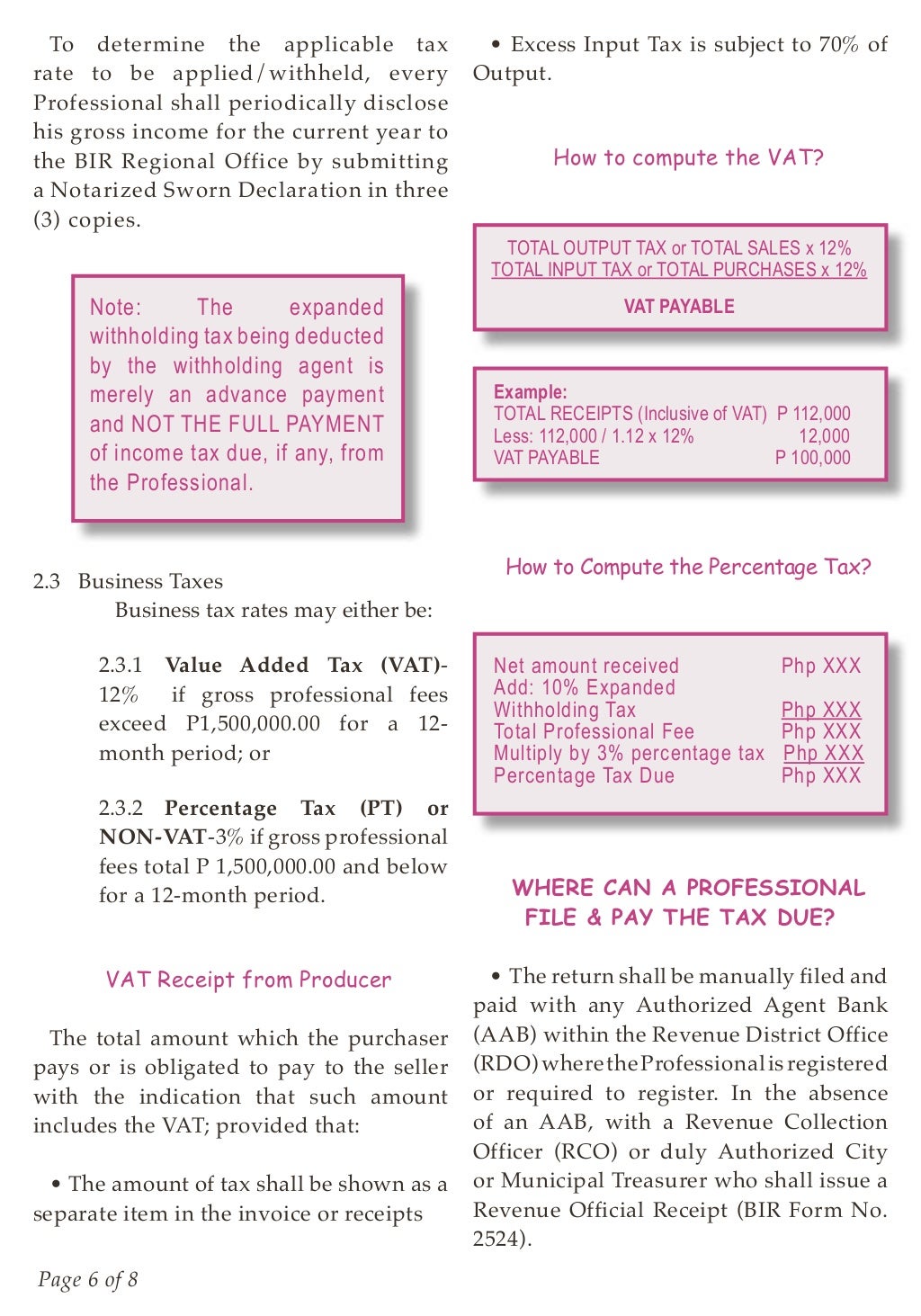

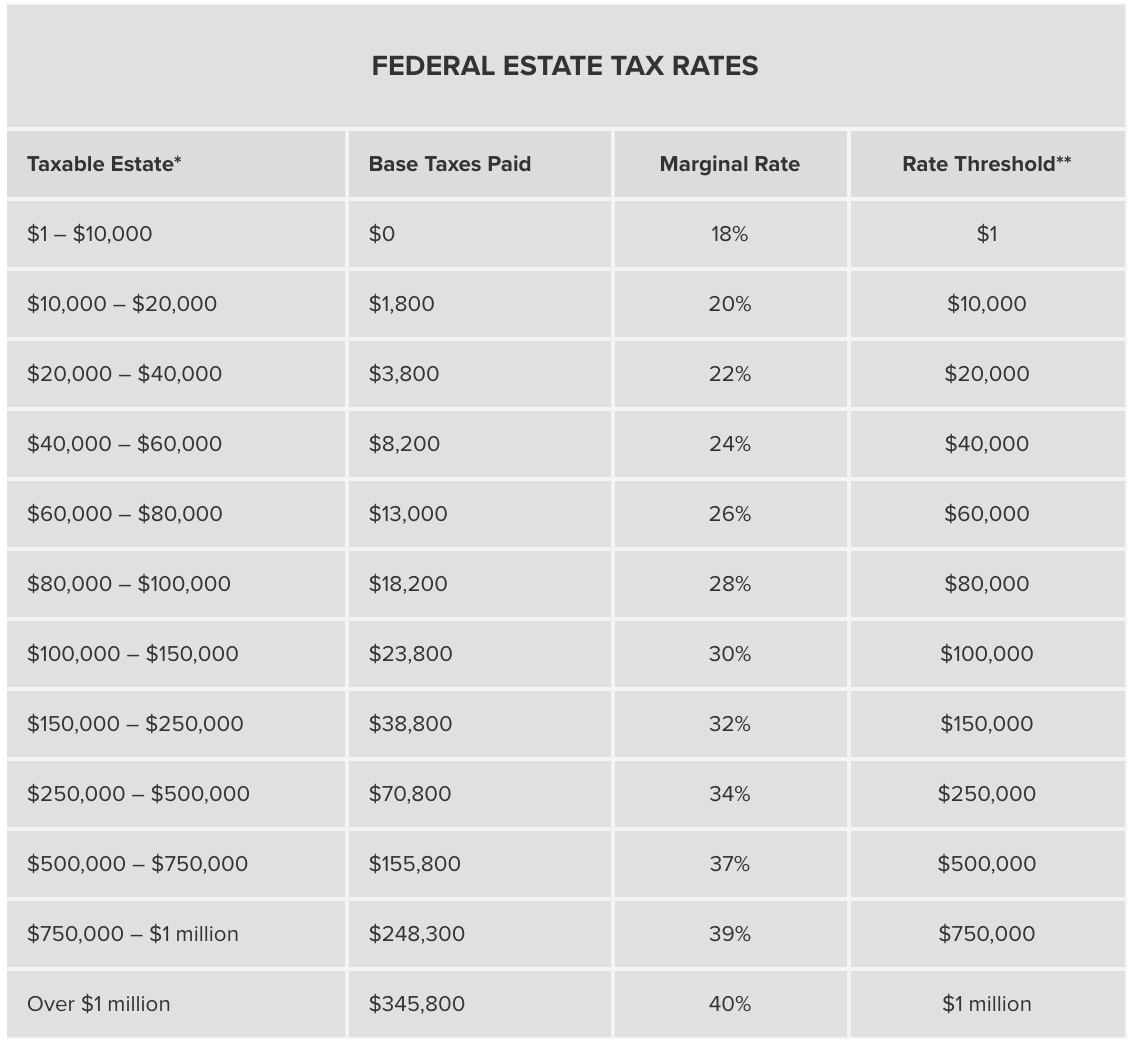

BIR Tax Guide

https://image.slidesharecdn.com/taxguide-150516092410-lva1-app6892/95/bir-tax-guide-6-1024.jpg?cb=1431768349

Every decedent s estate tax whether a resident or non resident of the Philippines is calculated by multiplying the net estate by six 6 percent The estate tax rate under the TRAIN Law is 6 Prior to the The BIR Bureau of Internal Revenue in the Philippines then applies a flat estate tax rate of 6 for net estates exceeding Php 200 000 By accurately grasping

However for the estate tax return previously filed with the Bureau of Internal Revenue BIR the estate tax rate of six percent 6 shall be based on net undeclared estate Calculating the estate tax in the Philippines involves a systematic process that adheres to the guidelines set forth by the Bureau of Internal Revenue BIR With

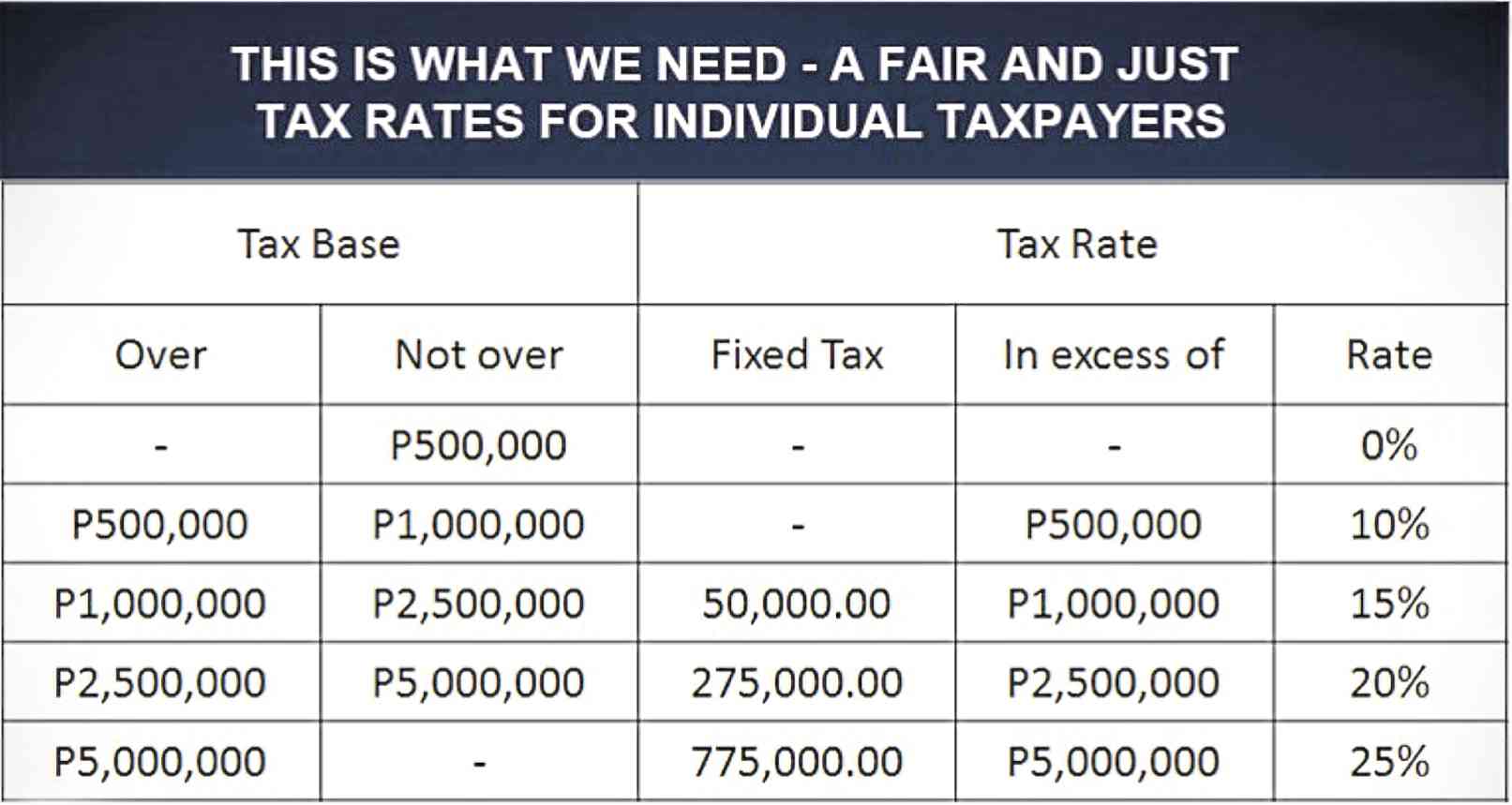

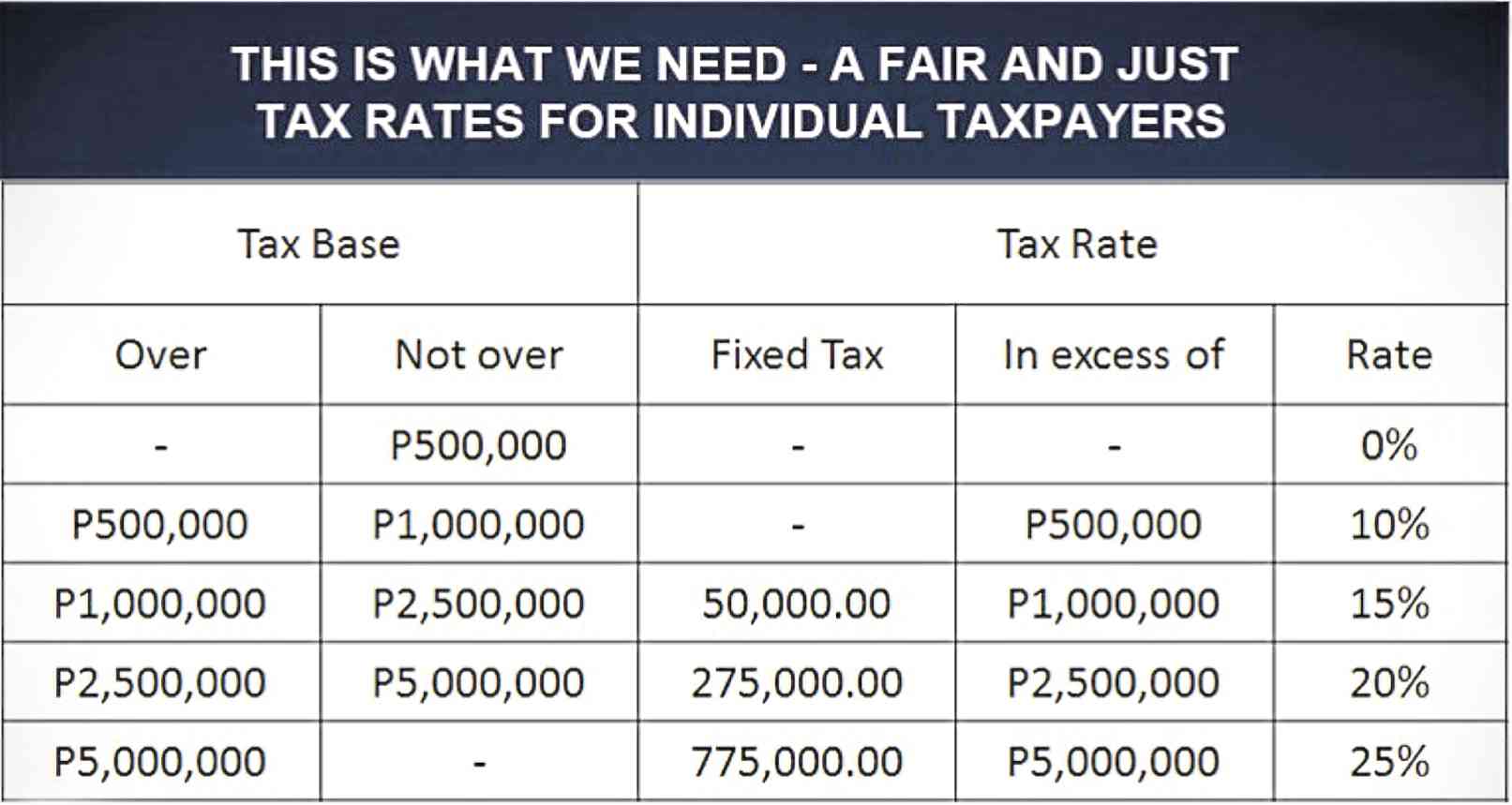

Key Steps Toward Genuine Tax Reform In PH Inquirer Business

http://business.inquirer.net/files/2016/08/tax-rates.jpg

BIR Form No 1801 Estate Tax Return Sample File To Be Filled Up By

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0d60c3eb099f56cdc0491ecbda17ec13/thumb_1200_1976.png

https://www. pinoymoneytalk.com /philippines-estate...

ESTATE TAX SEC 2 RATE OF ESTATE TAX The net estate of every decedent whether resident or non resident of the Philippines as determined in

https://www. moneymax.ph /personal-finance/articles/estate-tax-philippines

Since estate tax is 6 of your net estate multiply your 3 5 million by 0 06 You ll then get 210 000 which will be your estate tax Note The rate applicable will be

What s Your Tax Rate R PoliticalSatire

Key Steps Toward Genuine Tax Reform In PH Inquirer Business

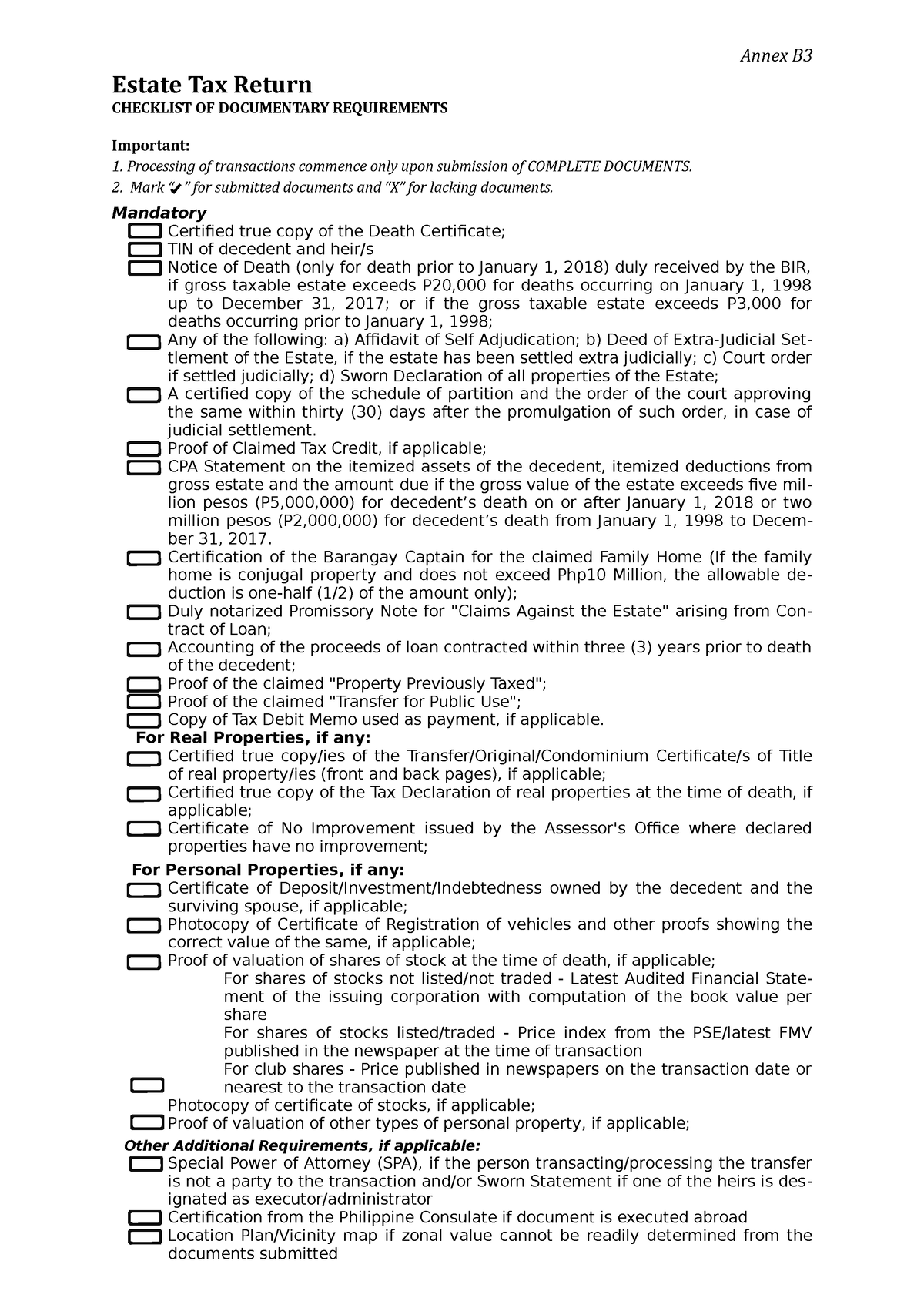

Annex B3 2022 Form Very Useful Annex B Estate Tax Return CHECKLIST OF

Simplified Estate Tax Train Law 2018 TaxationGuro

Tax Rate Table Cabinets Matttroy

BIR Form 1701A Annual Income Tax Return For Individuals

BIR Form 1701A Annual Income Tax Return For Individuals

BIR 2307 Philippines Encs System

Tax Computation For Company Private Limited Company Tax Rate 2017

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Bir Estate Tax Rate - The Tax Reform for Acceleration and Inclusion TRAIN Law sets the estate tax rate at 6 of the net estate value exceeding PHP 5 000 000 Estates worth PHP