Business Energy Credits 2023 Federal Solar Tax Credits for Businesses Department of Energy Solar Energy Technologies Office About the Solar Energy Technologies Office SETO Goals Events Teams Careers Fellowships Contact SETO

What Qualifies for Business Energy Tax Credits January 26 2024 New Energy Eficient Homes Credit 45L Energy Eficient Commercial Buildings Deduction 179D Provides a tax credit for construction of new energy eficient homes

Business Energy Credits 2023

Business Energy Credits 2023

https://sportsinclusionconference.com/2021/wp-content/uploads/2021/02/logo.png

IAACON 2023

https://iaacon2023.com/img/logo.png

![]()

Machine Translation Summit 2023

https://files.sciconf.cn/meeting/2023/15680/image/20230630/2023063016475774856102913.jpg

Home Energy Tax Credits IRS gov homeenergy If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts The IRS in February 2023 provided guidance under this provision via Notice 2023 18 on how and when taxpayers can apply for the credits which include a base

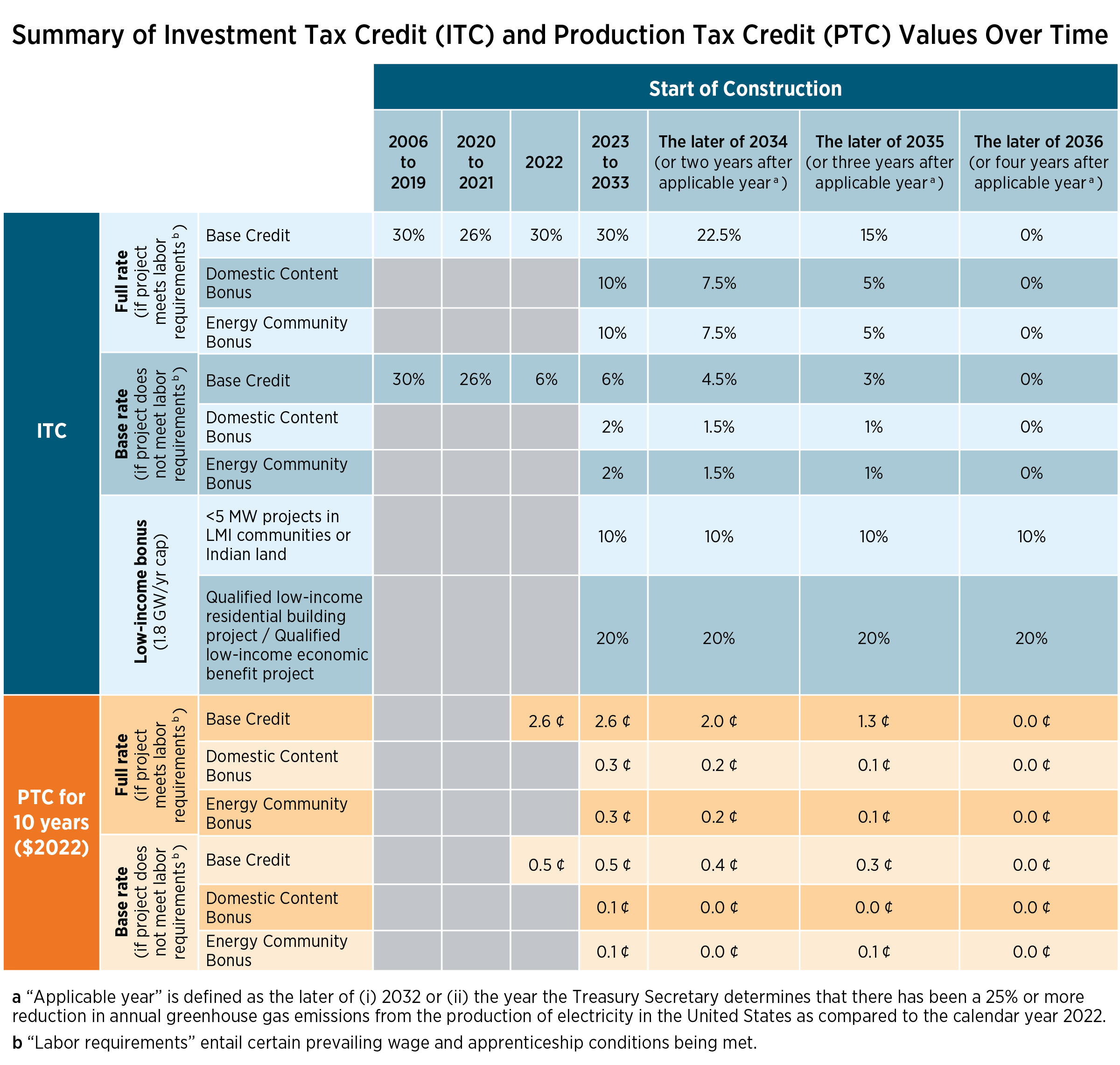

August 4 2023 Home energy audits may qualify for an Energy Efficient Home Improvement Credit August 7 2023 IRS Builders of qualified new energy Projects of more than 1 MW that begin construction on or after Jan 29 2023 and no later than Jan 1 2025 will receive a base tax credit of 6 percent

Download Business Energy Credits 2023

More picture related to Business Energy Credits 2023

Dossier 2023

https://www.bloom.be/uploads/images/Jaarhoroscoop.gif

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

2023 Emerging Leadership Conference

https://emergingconference.com/2023/wp-content/uploads/2021/09/logo.png

2020 Small business owners may deduct 26 of total paneling system costs compared to 30 for previous years 2021 Small business owners can deduct 22 of a system s costs from their taxes 2022 and on As of Back to Resources In this overview of business incentive and tax credits for 2023 year end planning we provide brief reviews of the Employee Retention Credit

Tax regulatory resources 2023 Tax alert IRS releases fact sheet regarding residential energy credits FAQs about Inflation Reduction Act changes Jan 10 2023 Business tax Policy Private client services Energy Tax Credits 2022 2023 H R Block Tax Information Center Filing Credits Claiming energy tax credits for 2022 and 2023 Making energy efficient updates to your

3M 2023

https://501438041880-zoomcatalog-assets.s3.amazonaws.com/598/4f28d4f8526541bcb8ae48ee3ce1e69a/preview.jpg

Department For Business Energy And Industrial Strategy BEIS On

https://media-exp1.licdn.com/dms/image/C4E22AQHAkJZrk9V4rQ/feedshare-shrink_2048_1536/0/1658147519526?e=2147483647&v=beta&t=Bi-6zxT18OO0mruAdMfbB5ead0nsPp6xxaJlfNayh7M

https://www.energy.gov/eere/solar/federal-sol…

Federal Solar Tax Credits for Businesses Department of Energy Solar Energy Technologies Office About the Solar Energy Technologies Office SETO Goals Events Teams Careers Fellowships Contact SETO

https://pro.bloombergtax.com/brief/business-energy-tax-credits

What Qualifies for Business Energy Tax Credits January 26 2024

Federal Solar Tax Credit What It Is How To Claim It For 2024

3M 2023

Federal Solar Tax Credits For Businesses Department Of Energy

2023

JEE Advanced 2023

EMT 2023 2 Person Accomodation EMT

EMT 2023 2 Person Accomodation EMT

2023 Calendar Planner Vector Hd Images 2023 Digital Calendar 2023

Lodging Workshop 2023

Five Ways To Reduce Energy Costs In Your Business Wiley

Business Energy Credits 2023 - Projects of more than 1 MW that begin construction on or after Jan 29 2023 and no later than Jan 1 2025 will receive a base tax credit of 6 percent