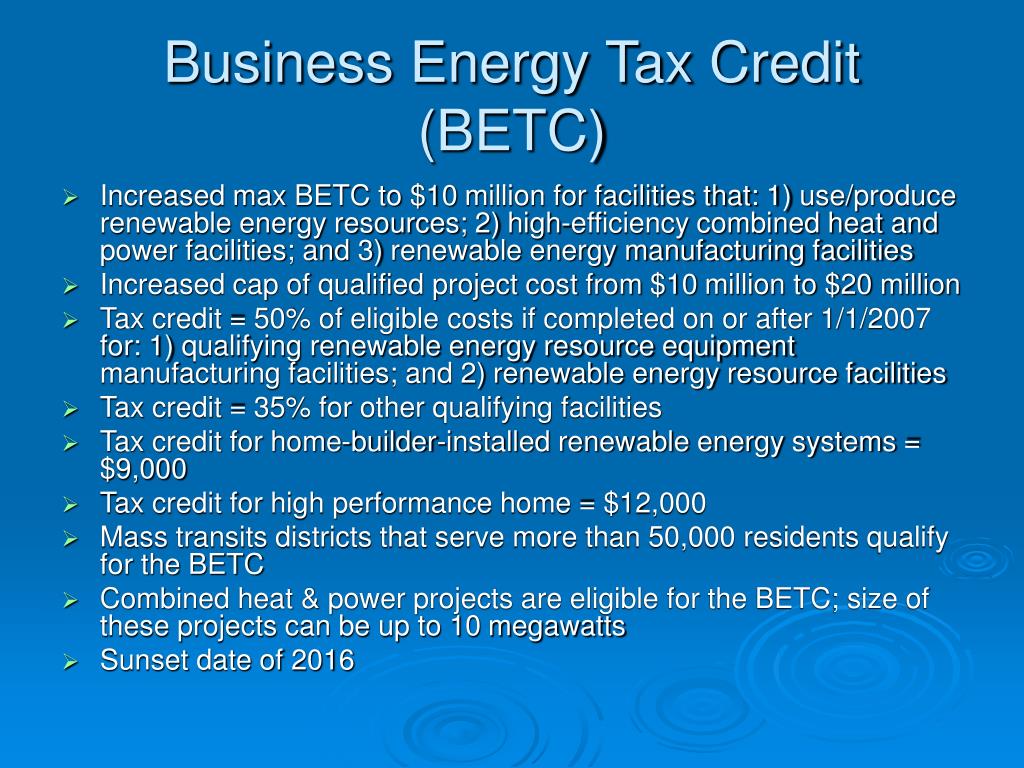

Business Energy Tax Credit The Business Energy Investment Tax Credit ITC is a U S federal corporate tax credit that is applicable to commercial industrial utility and agricultural sectors Eligible technologies for the ITC are solar water heat solar space heat solar thermal electric solar thermal process heat photovoltaics wind biomass geothermal electric fuel cells geothermal heat pumps CHP cogeneration solar hybrid lighting microturbines and geothermal direct use

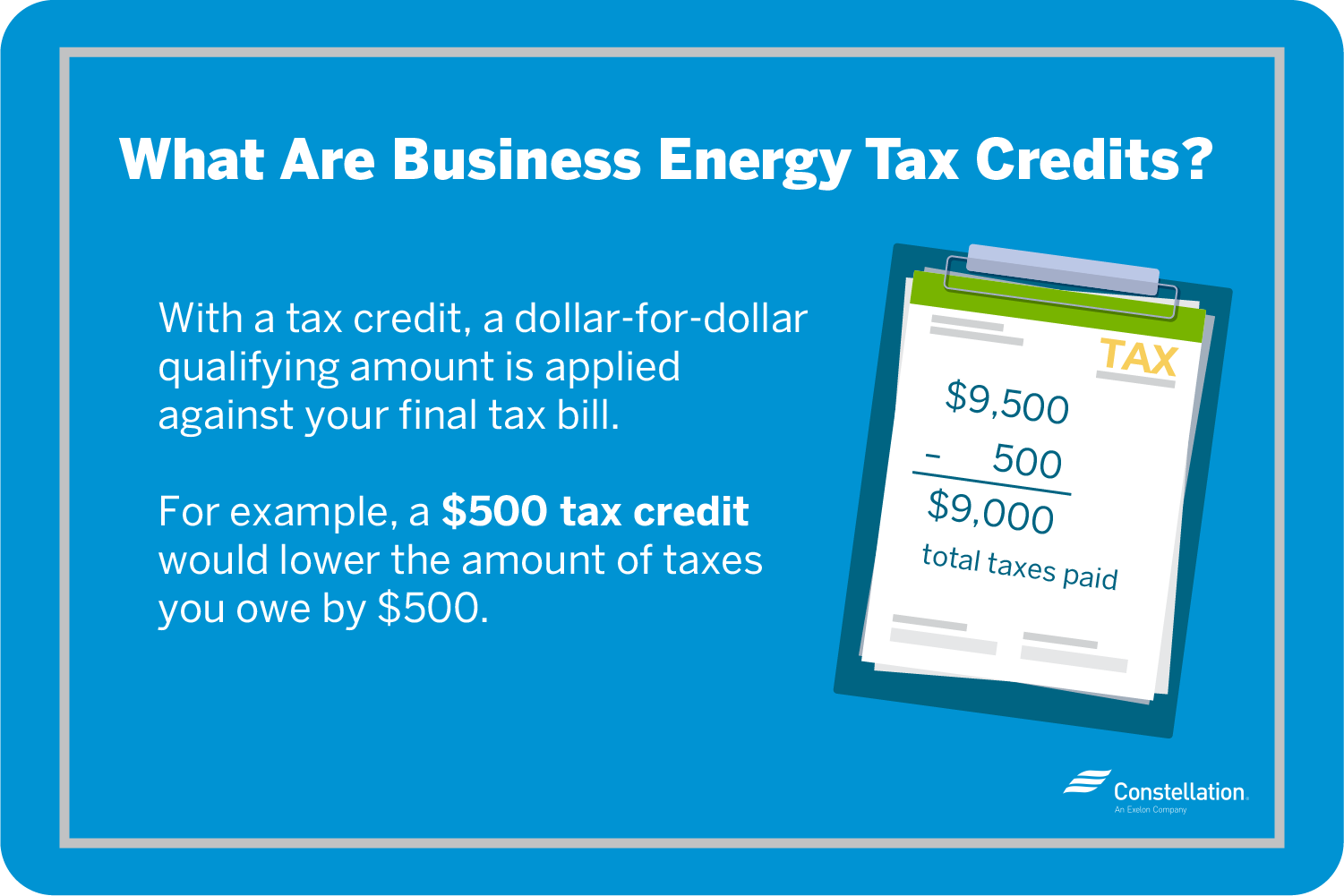

Technology neutral tax credit for investment in facilities that generate clean electricity and qualified energy storage technologies Replaces 48 for facilities that begin construction and An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum owed to

Business Energy Tax Credit

Business Energy Tax Credit

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

Residential Energy Tax Credit Use Eye On Housing

https://i1.wp.com/eyeonhousing.org/wp-content/uploads/2014/12/res-energy-credits_09_12.jpg

Finding Small Business Energy Tax Credits Constellation

https://blog.constellation.com/wp-content/uploads/2020/12/what-are-business-energy-credits.png

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many of the provisions WASHINGTON The U S Department of Treasury the Internal Revenue Service and the U S Department of Energy announced today that they received over 800 concept

There are two tax credits available for businesses and other entities like nonprofits and local and tribal governments that purchase solar energy systems see the Homeowner s Guide to the Spurred in large part by the tax credits over 215 billion in private sector clean energy manufacturing investments have been announced under the Biden Harris Administration

Download Business Energy Tax Credit

More picture related to Business Energy Tax Credit

New Residential Energy Tax Credit Estimates Eye On Housing

https://i0.wp.com/eyeonhousing.org/wp-content/uploads/2017/04/image009.png?resize=700%2C483

Business Tax Credits Saga Continues Subsidies To Film Industry May

https://www.oregonlive.com/resizer/OXUVgJcmwKoMcG6mKvZOqjBg7FU=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.oregonlive.com/home/olive-media/width2048/img/business_impact/photo/13012606-large.jpg

Independent Investigation Of Business Energy Tax Credit Program

https://cascadebusnews.com/wp-content/uploads/2016/09/soalr.jpg

Guidance to clarify underlying Investment Tax Credit critical for companies planning clean energy projects The Inflation Reduction Act also allows tax exempt and governmental entities to receive elective payments for 12 clean energy tax credits including the major Investment and

The Business Energy Investment Tax Credit ITC and Renewable Energy Production Tax Credit PTC allow businesses to deduct a percentage of the cost of renewable energy systems from their federal taxes There are two tax credits available for businesses and other entities like nonprofits and local and tribal governments that purchase solar energy systems see the Homeowner s Guide to the

HVAC Tax Credits For Energy Efficiency AccuTemp

https://accutempaz.com/wp-content/uploads/2023/06/William-Potter-shutterstock_2210573383-1.jpg

Residential Energy Tax Credits Overview And Analysis UNT Digital Library

https://digital.library.unt.edu/ark:/67531/metadc817554/m1/1/high_res/

https://en.wikipedia.org/wiki/Business_Energy...

The Business Energy Investment Tax Credit ITC is a U S federal corporate tax credit that is applicable to commercial industrial utility and agricultural sectors Eligible technologies for the ITC are solar water heat solar space heat solar thermal electric solar thermal process heat photovoltaics wind biomass geothermal electric fuel cells geothermal heat pumps CHP cogeneration solar hybrid lighting microturbines and geothermal direct use

https://www.irs.gov/pub/irs-pdf/p5886.pdf

Technology neutral tax credit for investment in facilities that generate clean electricity and qualified energy storage technologies Replaces 48 for facilities that begin construction and

The Climate Benefits From Clean Energy Tax Credits Are About Four Times

HVAC Tax Credits For Energy Efficiency AccuTemp

PPT Green Energy Policies PowerPoint Presentation Free Download ID

Federal Solar Tax Credits For Businesses Department Of Energy

Giving Tax Credit Where Credit Is Due

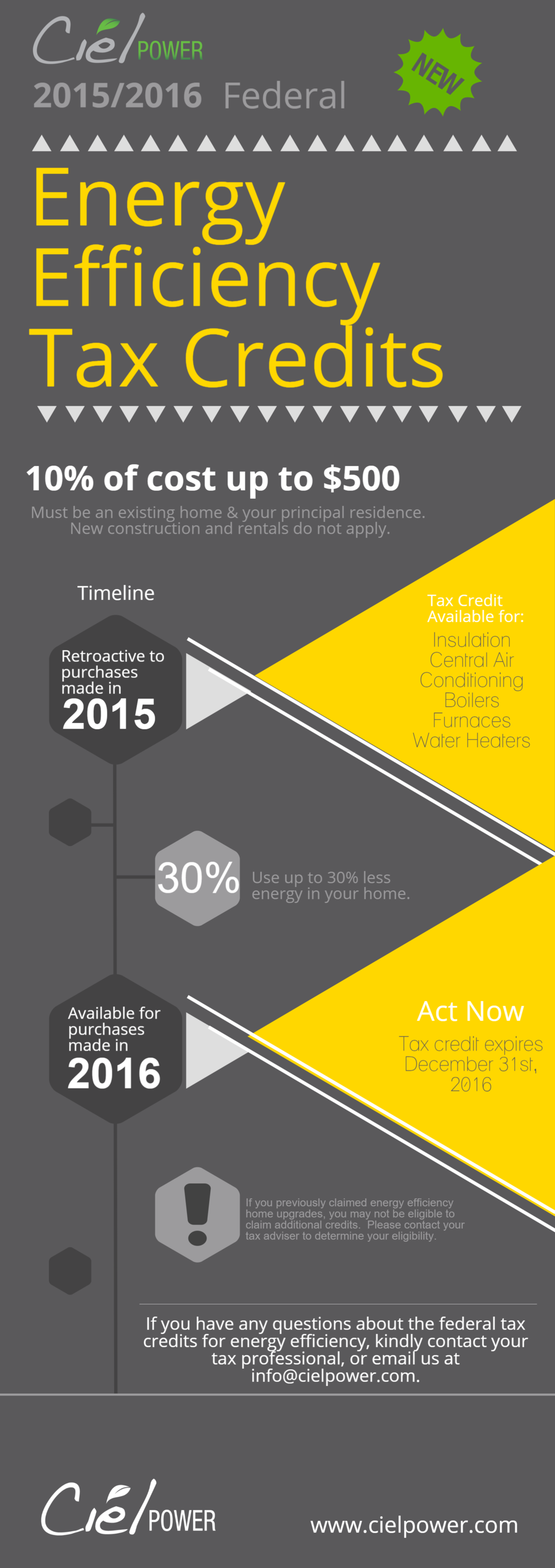

Equipment Tax Credits For Primary Residences About ENERGY STAR

Equipment Tax Credits For Primary Residences About ENERGY STAR

Estimate Your Tax Credit Deduction Alliantgroup

Tax Credit Universal Credit Impact Of Announced Changes House Of

Simplifying The Complexities Of R D Tax Credits TriNet

Business Energy Tax Credit - The 2022 tax and climate law ushered in new green energy tax credits designed to encourage corporate taxpayers to cut carbon emissions Now is the time for businesses to