Business Mileage Tax Rebate Web 28 mars 2014 nbsp 0183 32 To work out whether tax is due on mileage allowance payments multiply the number of business miles travelled by the employee by an approved rate This will be

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a Web 1 ao 251 t 2023 nbsp 0183 32 Mileage Allowance Relief MAR is a tax deduction for employees that have incurred business mileage and are not fully reimbursed by their employer Keep in mind

Business Mileage Tax Rebate

Business Mileage Tax Rebate

https://i.pinimg.com/originals/74/27/72/74277222a9d4830d0a5d5265e743fb9c.jpg

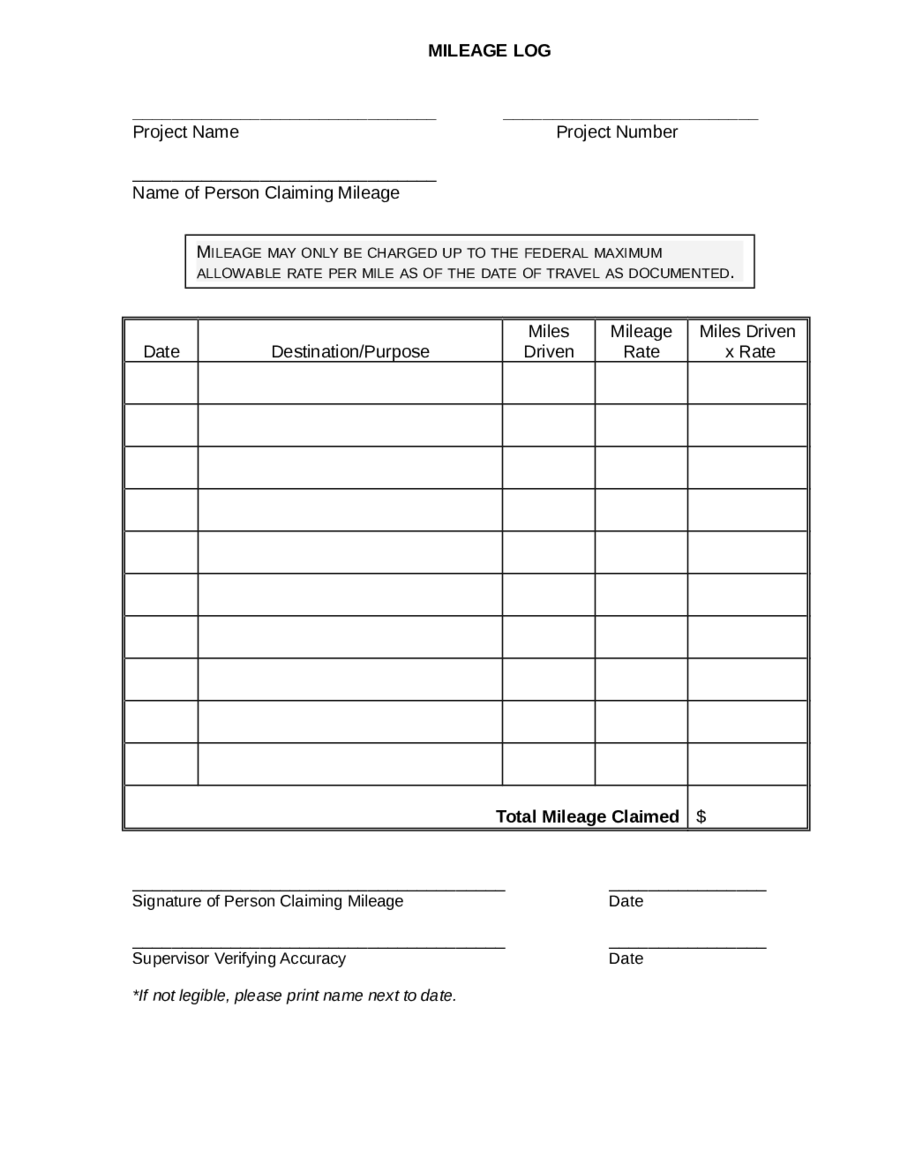

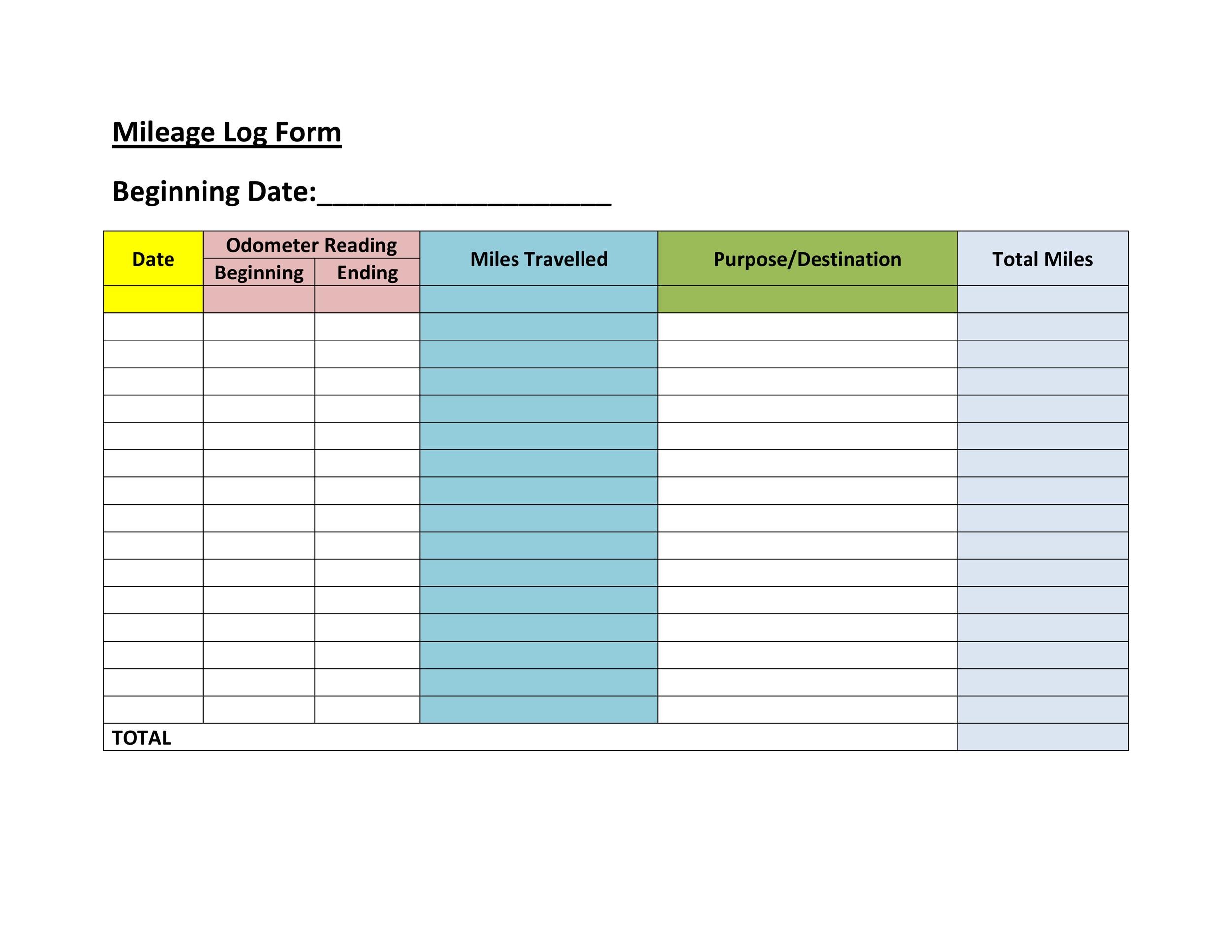

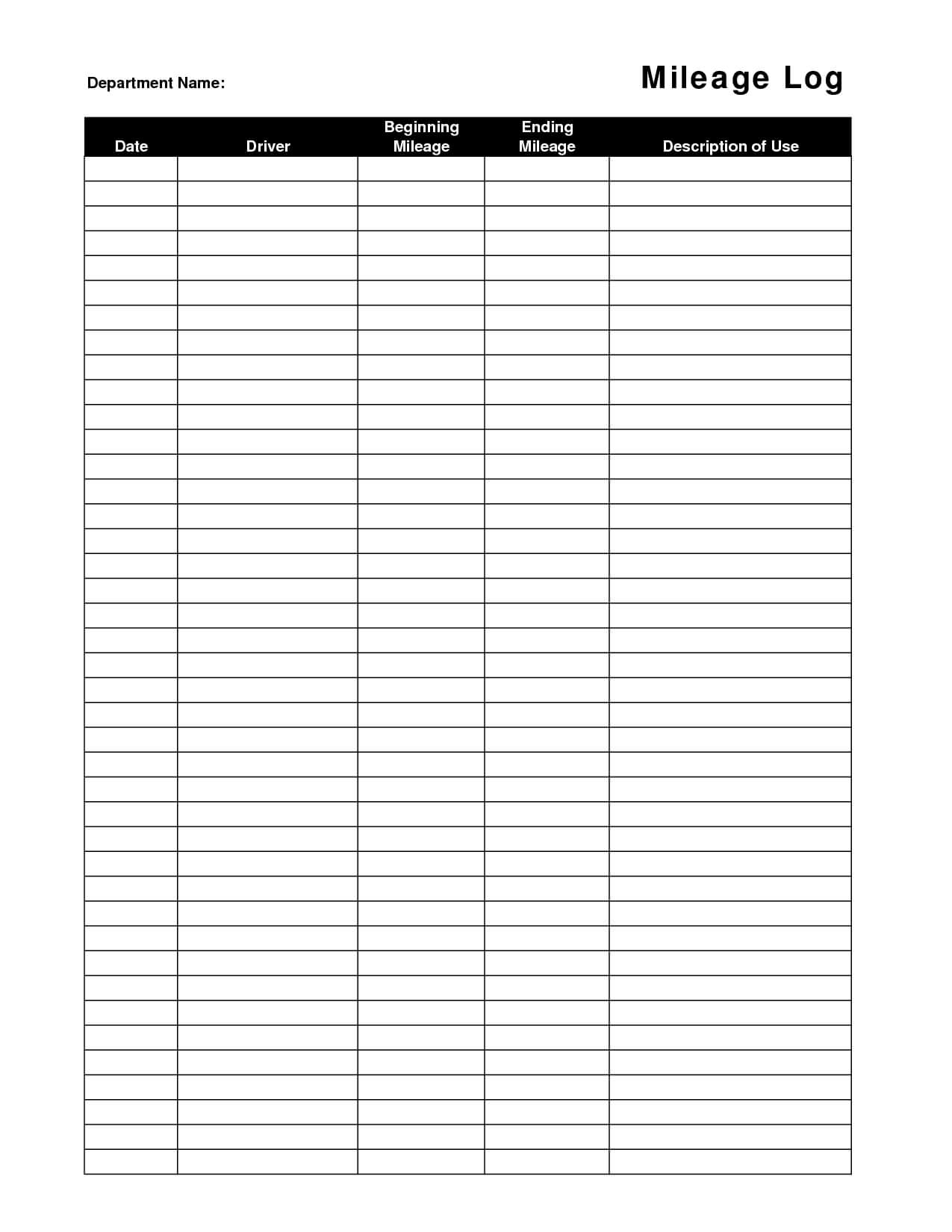

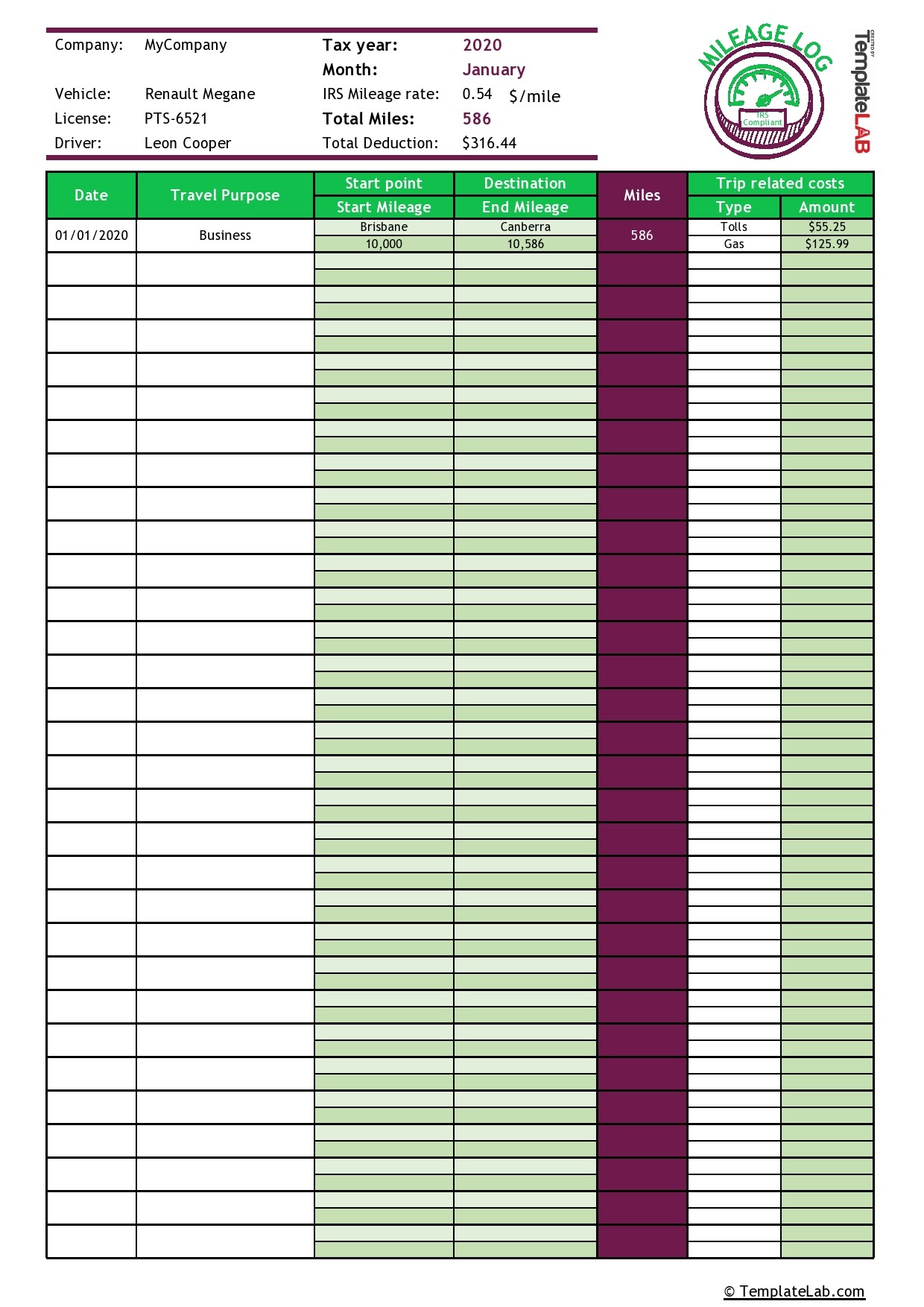

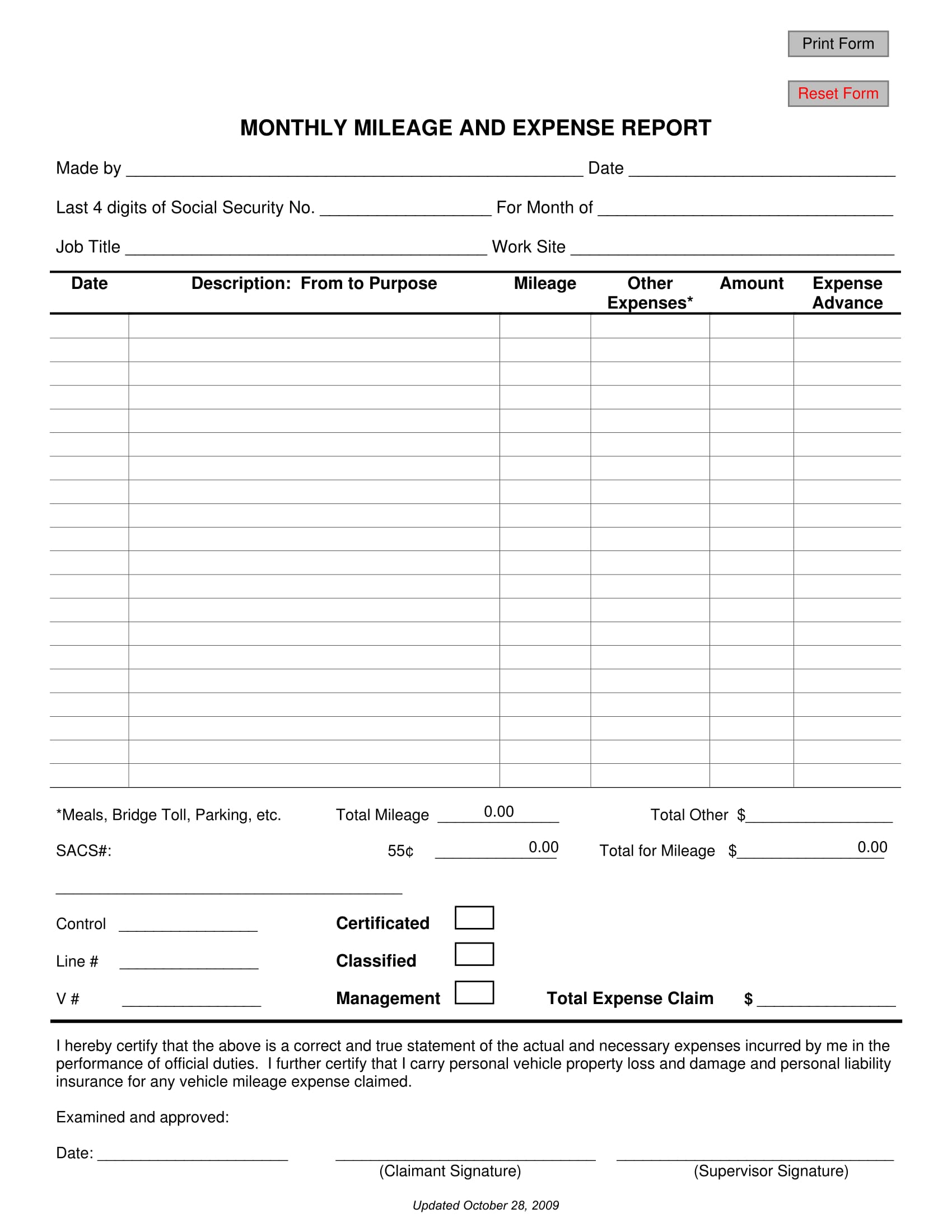

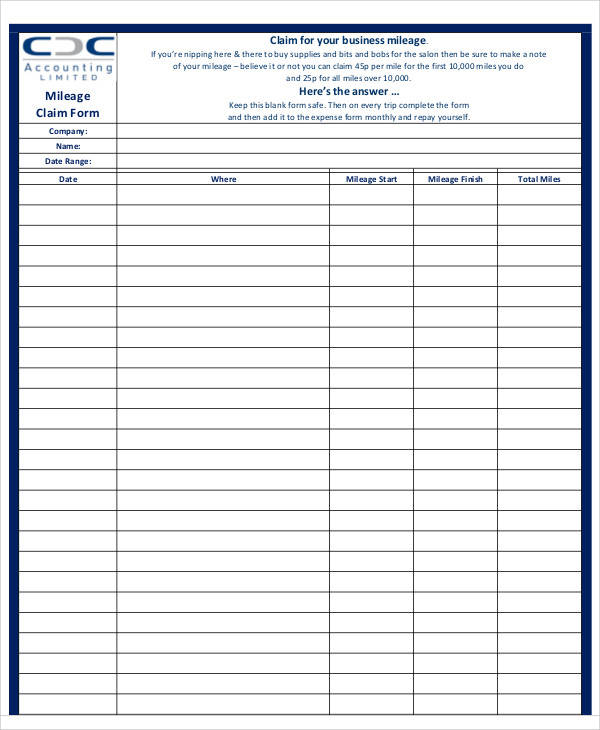

Mileage Report Template 7 TEMPLATES EXAMPLE TEMPLATES EXAMPLE

https://i.pinimg.com/originals/ee/78/ae/ee78ae46ff484bf00520b01501a99ac4.png

Mileage Log With Reimbursement Form MS Excel Excel Templates Excel

https://i.pinimg.com/originals/89/1b/0a/891b0ad37c9259795ebb74fa88dbb1e0.png

Web 9 juin 2023 nbsp 0183 32 You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey UK mileage rates can differ however HMRC advisory fuel rates state that in most Web Mileage allowance rebate works by reducing your taxable pay based the total number of business miles travelled in the year multiplied by specific Approved Mileage Rates by

Web The current mileage allowance rate is 45p per mile for the first 10 000 miles and 25p per mile for any additional miles Note that if you count mileage from two different Web 27 janv 2023 nbsp 0183 32 Just to make things a tad more confusing the IRS also announced that beginning in January the standard mileage rate for business use is going up again to 65 5 cents per mile driven for

Download Business Mileage Tax Rebate

More picture related to Business Mileage Tax Rebate

Mileage Reimbursement Spreadsheet MS Excel Templates

https://handypdf.com/resources/formfile/images/yum/mileage-log-form-0266145.png

![]()

25 Printable Irs Mileage Tracking Templates Gofar In Mileage Report

https://pray.gelorailmu.com/wp-content/uploads/2020/01/25-printable-irs-mileage-tracking-templates-gofar-in-mileage-report-template-2048x1448.jpg

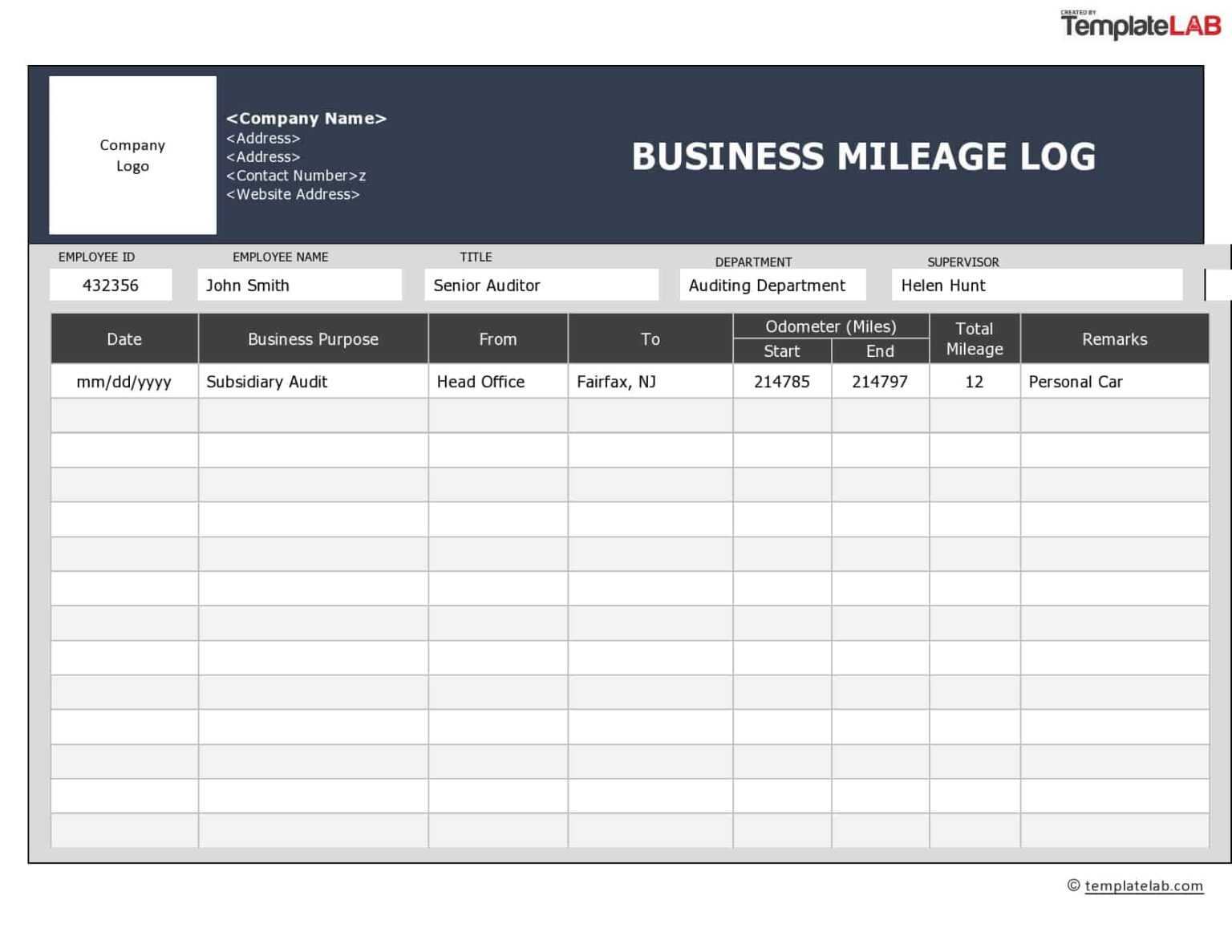

31 Printable Mileage Log Templates Free TemplateLab

http://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-10.jpg?w=320

Web For the tax year 2022 2023 the mileage rates are as follows 45p per mile for the first 10 000 miles for business purposes 25p per mile for each business mile after the initial Web From tax year 2011 to 2012 onwards First 10 000 business miles in the tax year Each business mile over 10 000 in the tax year Cars and vans 45p 25p Motor cycles 24p

Web 17 d 233 c 2021 nbsp 0183 32 Beginning Jan 1 2022 employees can claim 58 5 cents mile for business use 18 cents for medical or military moves and 14 cents for charitable mileage Web Using an IRS tax deduction rate as a business mileage reimbursement in 2022 This inequity of rate could easily cause low mileage employees like Driver 1 to attempt to

Mileage Reimbursement Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/58/810/58810479/large.png

Mileage Log Mileage Tracker For Tax Purposes Printable Etsy Mileage

https://i.pinimg.com/originals/f8/d9/9a/f8d99ab7e9c144e310820bd1d9ef80b4.jpg

https://www.gov.uk/guidance/business-journeys-tax-relief-490-chapter-5

Web 28 mars 2014 nbsp 0183 32 To work out whether tax is due on mileage allowance payments multiply the number of business miles travelled by the employee by an approved rate This will be

https://www.taxrebateservices.co.uk/tax-guides/mileage-allowance...

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

Printable Mileage Log Template Templates Templates With Regard To

Mileage Reimbursement Form Fill Out Sign Online DocHub

Business Mileage Tracking Log Business Mileage Mileage Reimbursement

Mileage Report Template Professional Plan Templates

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

31 Printable Mileage Log Templates Free TemplateLab

FREE 5 Mileage Report Forms In MS Word PDF Excel

FREE 47 Claim Forms In PDF

Business Mileage Tax Rebate - Web The average mileage expenses rebate made with RIFT Tax Refunds is worth 163 3 000 Many people don t realise that it s not something HMRC will automatically give back to you you