Business Moving Expenses Tax Deduction 2022 You can easily tax deduct all business moving expenses if your business is a state registered LLC or corporation including location scouting transportation and loading and unloading costs against your

Moving expenses If you moved your business in 2022 you might be able to deduct any expenses associated with the move Percentage deductible 100 Eligibility The costs Only businesses can claim moving expenses as a tax deduction If you re upgrading from an apartment to a house or you have to move to a different state for your new job

Business Moving Expenses Tax Deduction 2022

Business Moving Expenses Tax Deduction 2022

https://www.allaroundmoving.com/wp-content/uploads/2019/02/women-box-1.jpg

Tax Deductible Moving Expenses Moving Expenses Tax Deductions Deduction

https://i.pinimg.com/736x/5d/d0/00/5dd000eecedf3e70430f4c04fcebf718--moving-expenses-tax-deductions.jpg

Sales Tax Deduction 2021

https://1044form.com/wp-content/uploads/2020/08/5-popular-itemized-deductions-8.jpg

How much of my moving expenses can I deduct If you move because of a permanent change of station you can deduct the reasonable unreimbursed You must first determine if you qualify to deduct moving expenses either as an individual who is employed or self employed or as a full time student If you qualify you can claim

Businesses can deduct an employee s moving expenses as a business expense if they re included in an employee s standard W 2 wages Barring further Information for those who moved to or from Canada or between two locations outside Canada Completing your tax and benefit return How to calculate and claim your

Download Business Moving Expenses Tax Deduction 2022

More picture related to Business Moving Expenses Tax Deduction 2022

Moving Expenses During And After College

https://byeuni.com/wp-content/uploads/2021/10/taxes.jpeg

IRS Moving Expense Tax Deduction Guide Moving Expenses Deduction

https://i.pinimg.com/originals/58/2a/de/582ade01e6d62ac9790027d0bdf27d7d.jpg

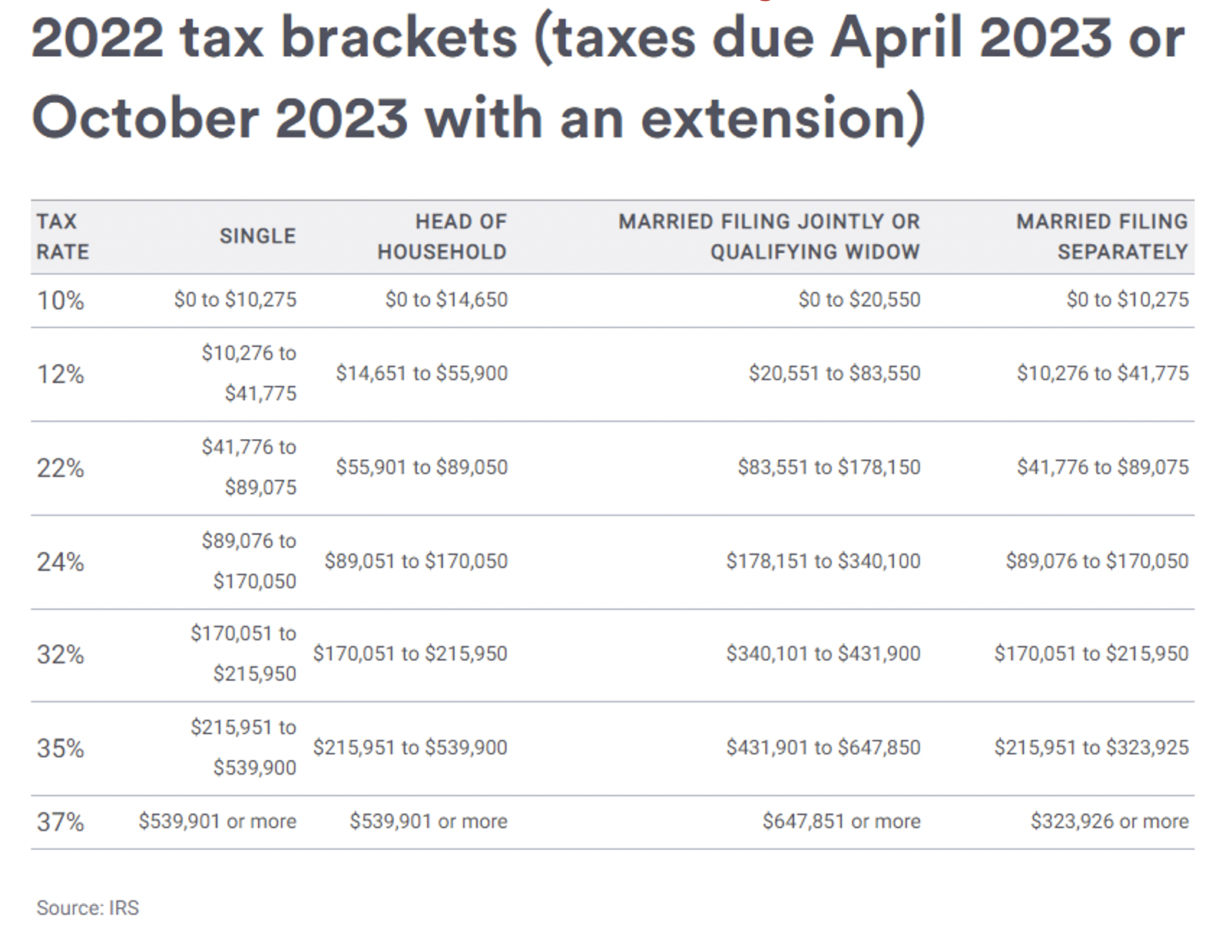

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM.png

In This Article Who Can Deduct a Move on Their Taxes What Can They Deduct Business Moving Expenses and Employees What You May Not Deduct as This guide will help you navigate the moving expenses tax deduction explaining who qualifies which expenses are deductible and how to properly claim them whether

The IRS has announced a midyear increase in the standard mileage rates for business and medical use of an automobile and for deducting moving expenses For 21 Small business tax deductions All of these deductions can be claimed by sole proprietorships as well as C corps and S corps partnerships and LLCs although

Moving Expenses Spreadsheet Budget Excel Template Office Relocation

https://dremelmicro.com/wp-content/uploads/2020/09/moving-expenses-spreadsheet-budget-excel-template-office-relocation-budget-template-pdf.png

Miami Moving Tax Deduction Terms I Orange Movers Miami

http://orangemover.com/wp-content/uploads/2017/09/moving-expenses-tax-deduct-orig.jpg

https://enterpriseleague.com/blog/busin…

You can easily tax deduct all business moving expenses if your business is a state registered LLC or corporation including location scouting transportation and loading and unloading costs against your

https://quickbooks.intuit.com/accounting/small...

Moving expenses If you moved your business in 2022 you might be able to deduct any expenses associated with the move Percentage deductible 100 Eligibility The costs

Tax Rates Absolute Accounting Services

Moving Expenses Spreadsheet Budget Excel Template Office Relocation

Are Moving Expenses Tax Deductible Next Moving

Tax Deductions Excel Spreadsheets Budgeting Tracking Finance Spending

Are Moving Expenses Tax Deductible Tax Deductible Moving Expenses

Are Moving Expenses Tax Deductible 2023 Guidelines Home Bay

Are Moving Expenses Tax Deductible 2023 Guidelines Home Bay

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Self Employed Tax Prep Checklist Download 2022 TurboTax Canada Tips

Qualified Business Income Deduction And The Self Employed The CPA Journal

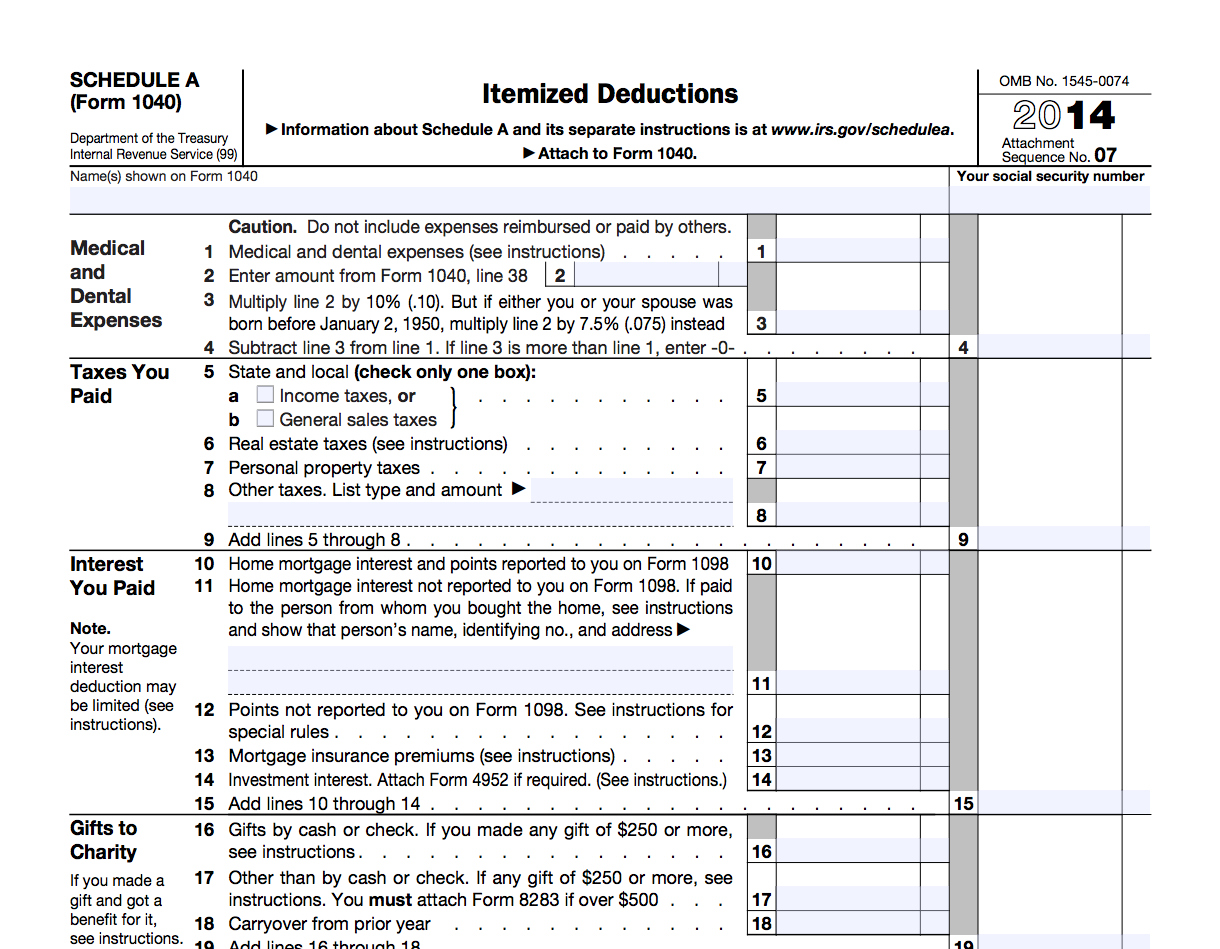

Business Moving Expenses Tax Deduction 2022 - Your moving expenses can be claimed on Form 3903 regardless of employment requirements or the distance of the move For example your moving deductions are