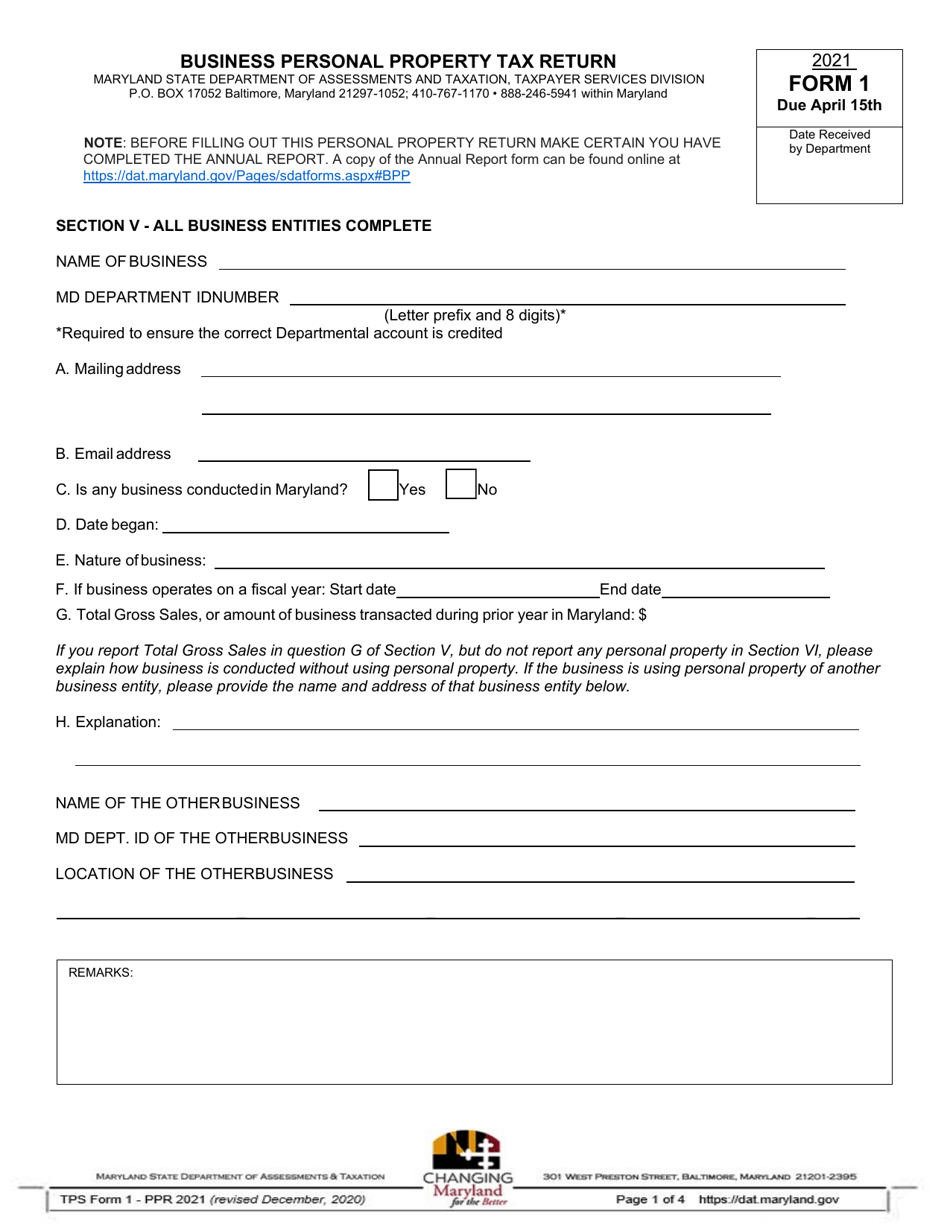

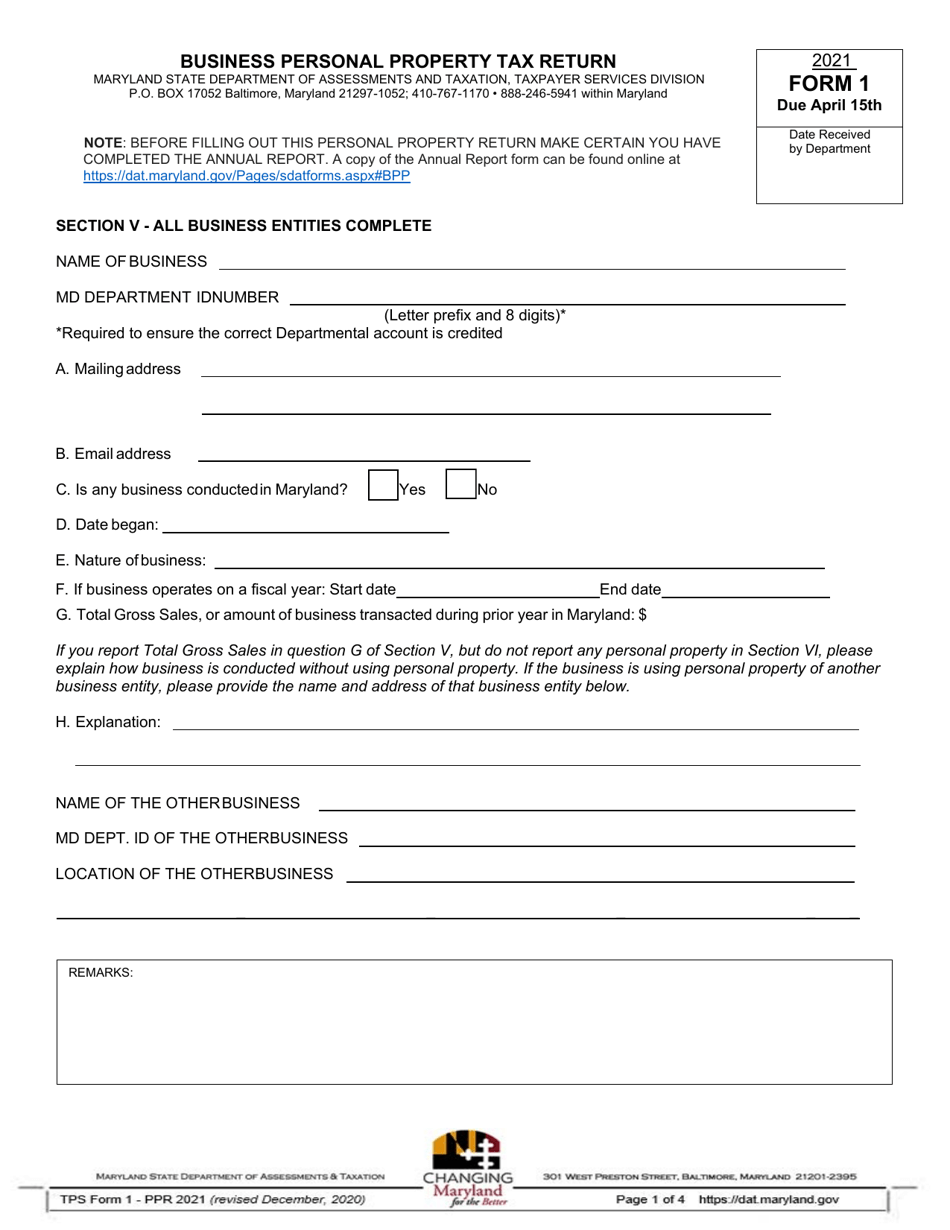

Business Personal Property Tax Return Maryland Business Personal Property Taxes In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments Responsibility for the

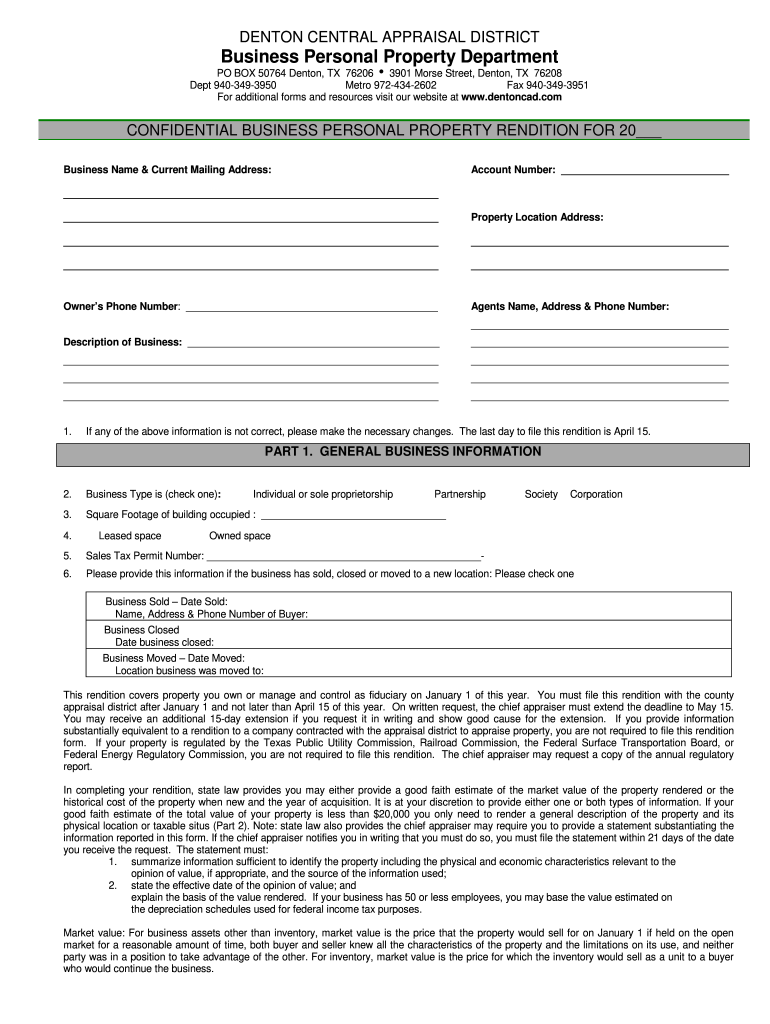

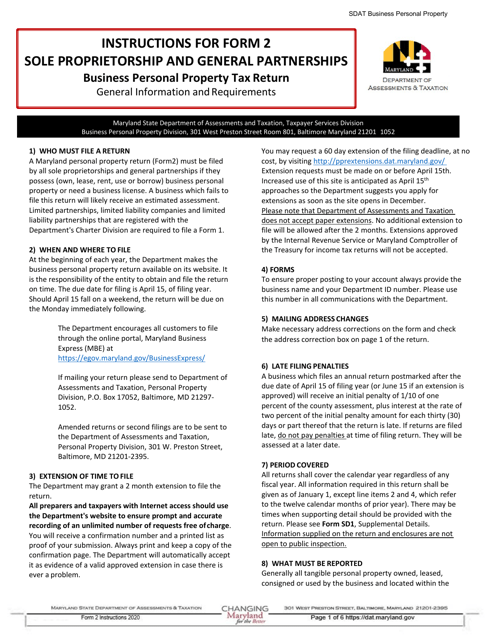

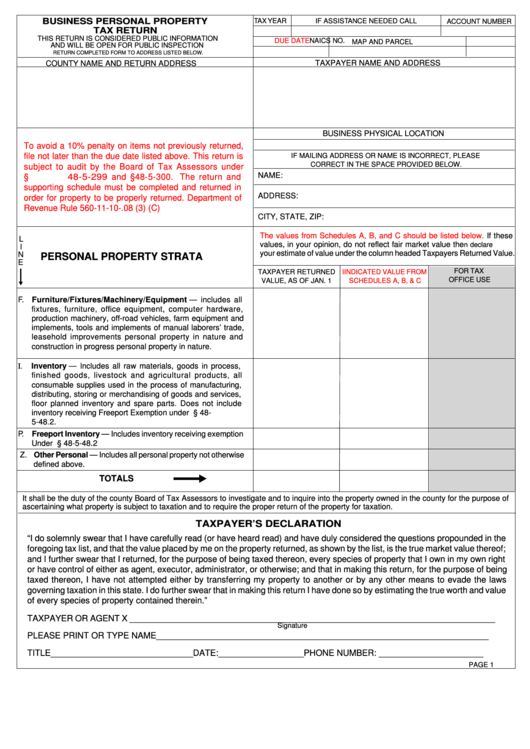

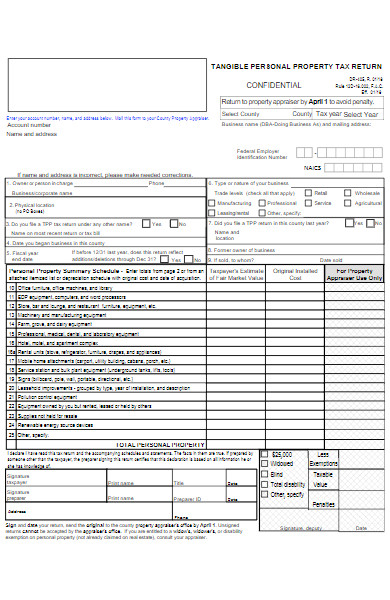

ABOUT THE BUSINESS PERSONAL PROPERTY TAX RETURN WHAT MUST BE REPORTED Generally all tangible personal property owned leased consigned or used by BUSINESS PERSONAL PROPERTY TAX RETURN MARYLAND STATE DEPARTMENT OF ASSESSMENTS AND TAXATION TAXPAYER SERVICES DIVISION P O BOX 17052

Business Personal Property Tax Return Maryland

Business Personal Property Tax Return Maryland

https://data.templateroller.com/pdf_docs_html/2143/21438/2143853/page_1_thumb_950.png

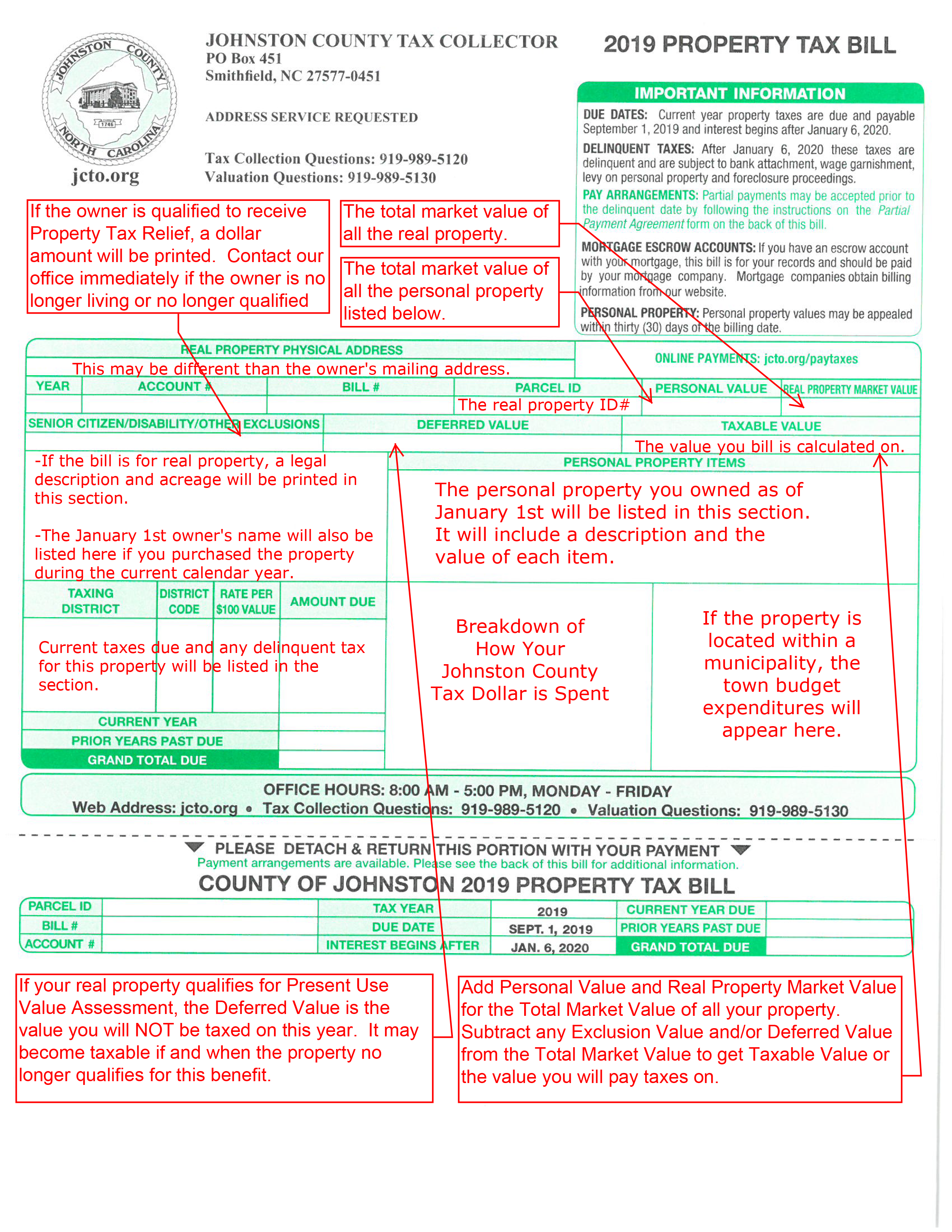

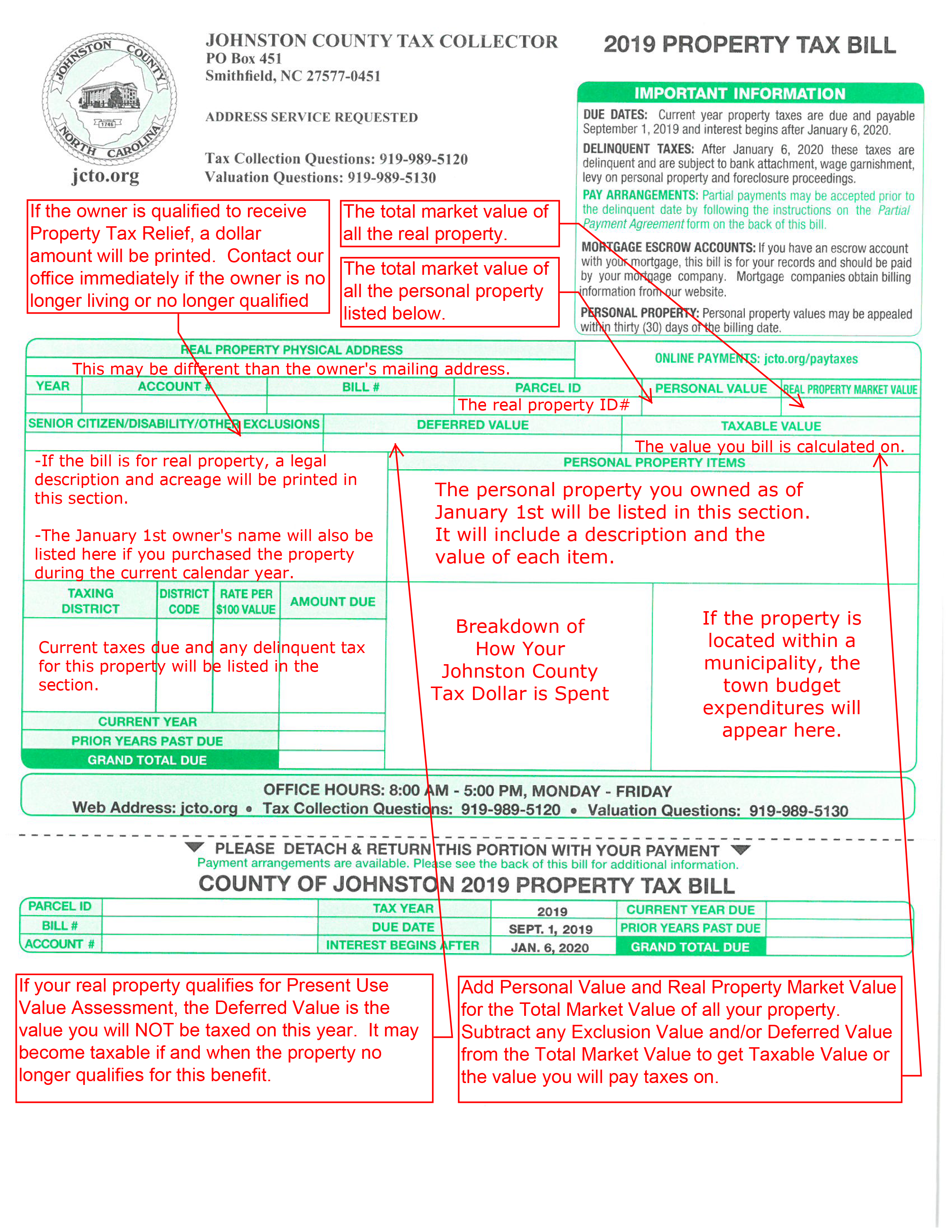

Deposit Your Due Property Tax Latest By 31st December 2019 Don T Ignore

https://www.johnstonnc.com/tax2/images/blanktaxbill.png

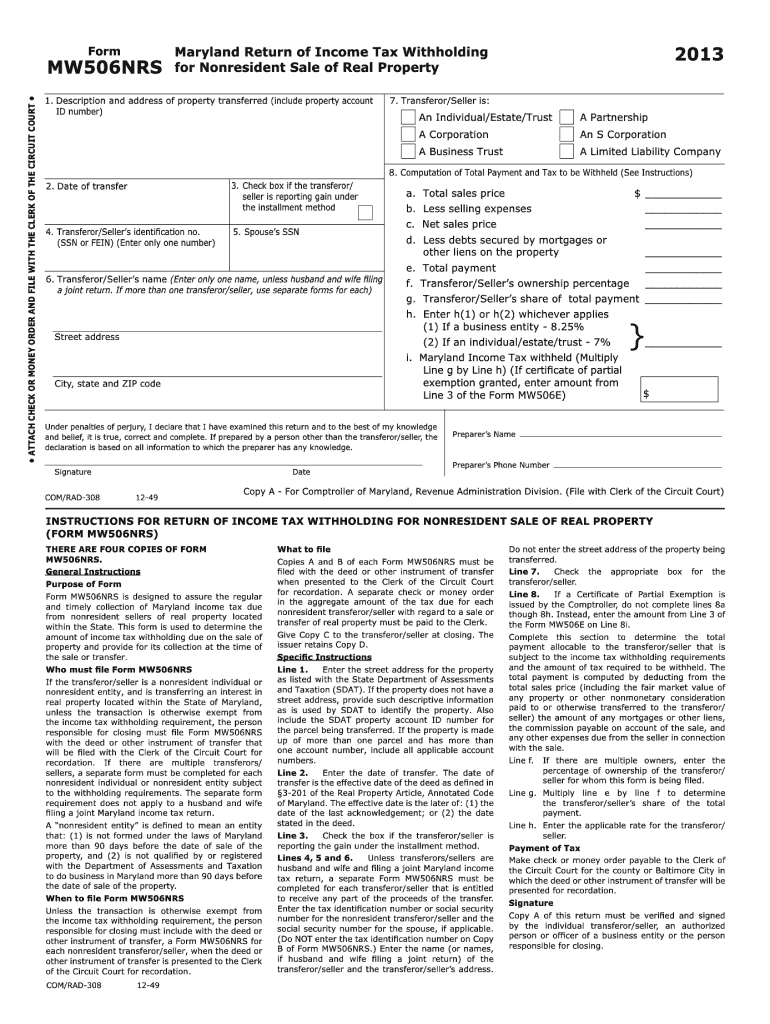

Md Return Tax Property Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/100/115/100115131/large.png

Maryland Annual Report You started a Annual Report and Personal Property Tax filing but failed to submit it within 90 days or by year end The filing has been deleted You will need to In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments including Worcester County

However in June 2022 Maryland raised the exemption of business personal property from 2 500 to 20 000 This means that an estimated 42 000 Maryland small Your Rights as a Taxpayer Accessibility Translate Disclaimer TTY 1 800 735 2258 TTY 7 1 1 in MD Comptroller of Maryland s www marylandtaxes gov all the information you need for your tax paying needs

Download Business Personal Property Tax Return Maryland

More picture related to Business Personal Property Tax Return Maryland

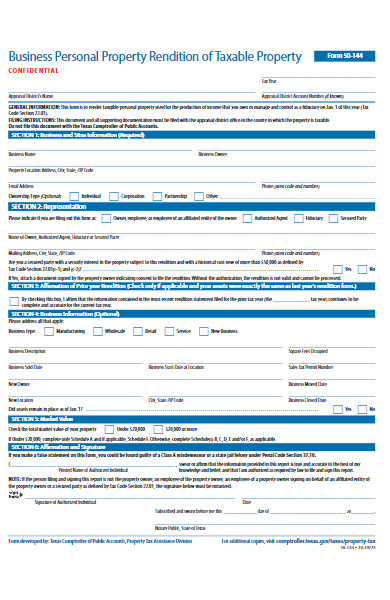

FREE 50 Property Forms In PDF MS Word MS Excel

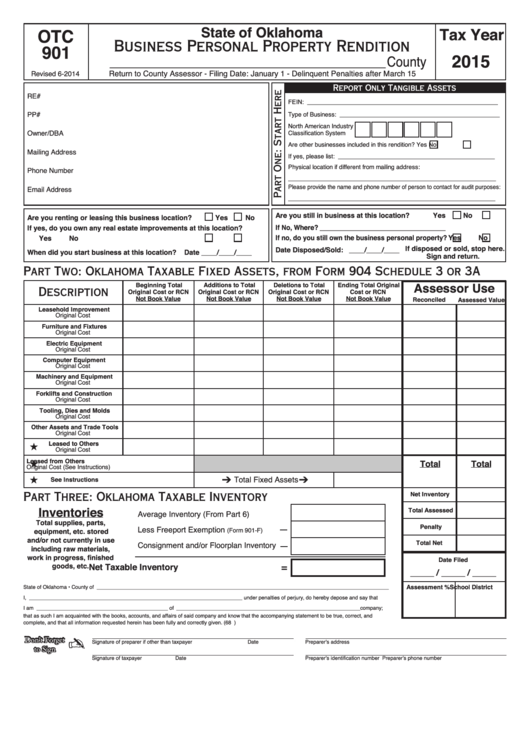

https://images.sampleforms.com/wp-content/uploads/2020/04/Business-Personal-Property-Rendition-Form.jpg

Denton County Business Personal Property Tax Rendition 2020 2022 Fill

https://www.pdffiller.com/preview/214/770/214770554/large.png

Which States Have Business Personal Property Tax

https://lyallcpa.com/media/k2/items/cache/e2bf3b11df0b872112757f1c2fee6e32_XL.jpg

For general assistance with the Annual Report contact the Maryland State Department of Assessments Taxations office at 410 767 1330 or sdat cscc maryland gov For questions Note If you answered No and you reported property on the previous year s return or received an assessment you must complete the Form SD 1 to report the sale transfer or disposal of

In an effort to strengthen Maryland s economy the Maryland State Department of Assessments and Taxation SDAT has raised the exemption for personal property Businesses must file a return by April 15 reporting personal property located in Maryland on January 1 or the date of finality This is the date used to determine ownership value and

Fillable Business Personal Property Tax Return Form Printable Pdf

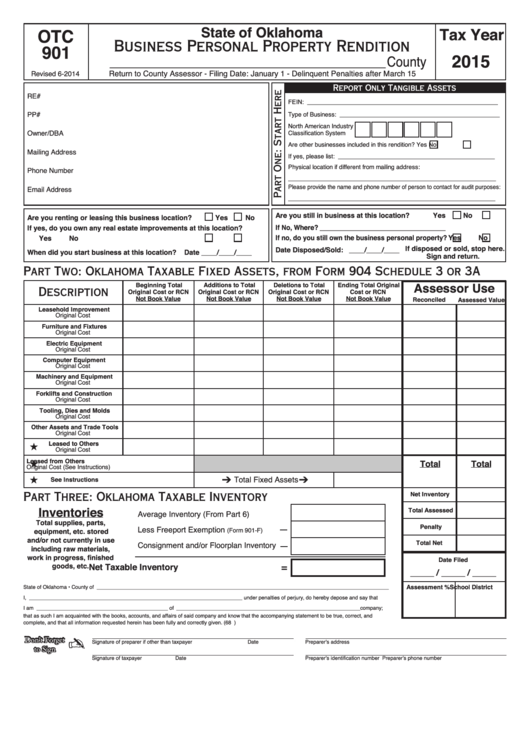

https://www.countyforms.com/wp-content/uploads/2022/09/fillable-form-otc-901-business-personal-property-rendition-2015.png

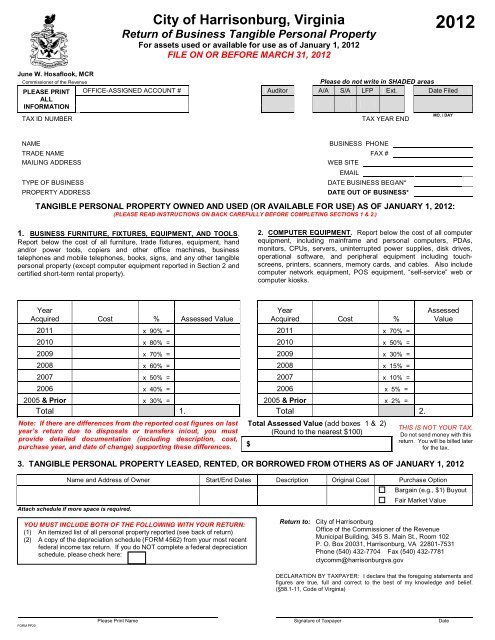

Virginia Vehicle Personal Property Tax Form Printable Printable Forms

https://img.yumpu.com/36828309/1/500x640/2012-business-personal-property-tax-form-city-of-harrisonburg.jpg

https://www.marylandtaxes.gov/business/business...

Business Personal Property Taxes In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments Responsibility for the

https://dat.maryland.gov/SDAT Forms/PPR_Forms...

ABOUT THE BUSINESS PERSONAL PROPERTY TAX RETURN WHAT MUST BE REPORTED Generally all tangible personal property owned leased consigned or used by

Download Instructions For Form 2 Business Personal Property Tax Return

Fillable Business Personal Property Tax Return Form Printable Pdf

Business Personal Property Tax Protest Reduction

Fillable Business Personal Property Tax Return Form Printable Pdf Download

FREE 50 Property Forms In PDF MS Word MS Excel

Your Guide To Business Personal Property Tax In Fairfax City

Your Guide To Business Personal Property Tax In Fairfax City

Everything You Need To Know About Amended Tax Returns In Maryland SH

Maryland Personal Property Tax Return Clearview Group

Business Personal Property Tax Return Augusta Georgia Property Tax

Business Personal Property Tax Return Maryland - However in June 2022 Maryland raised the exemption of business personal property from 2 500 to 20 000 This means that an estimated 42 000 Maryland small