Business Travel Tax Rebate Web 28 mars 2014 nbsp 0183 32 An employee travelling on business who makes a detour for private purposes will still be entitled to tax relief for the full cost of the business part of the

Web 28 mars 2014 nbsp 0183 32 In most cases tax relief is available for the full cost of business travelling expenses except where motoring expenses are paid to employees who use their own Web 5 avr 2013 nbsp 0183 32 Stepping It Up Small amp midsized travel programmes Diversity Equity amp Inclusion in business travel Business Travel Rebooted New Horizons The 2022

Business Travel Tax Rebate

Business Travel Tax Rebate

https://images.sampletemplates.com/wp-content/uploads/2017/06/Travel-Company-Invoice.jpg

The Star Tax Rebate For Domestic Travel Among Incentives Proposed To

https://global-uploads.webflow.com/5e15da6978f3a3f265178139/63b7955762c88f46410d1a6c_amirudin-shari-com-Star-TaxTravel.jpg

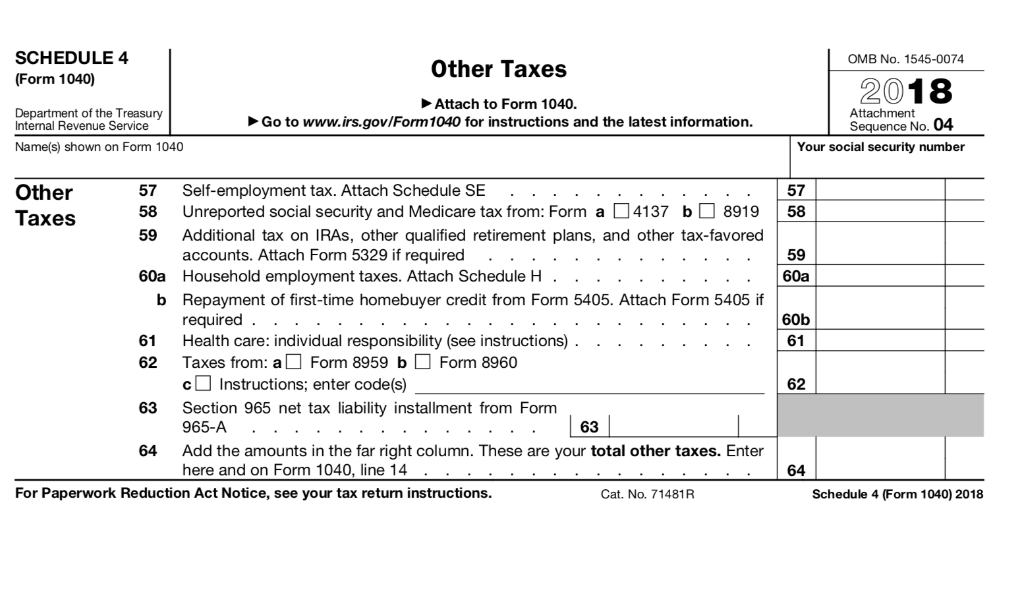

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Web You cannot claim for travelling to and from work unless you re travelling to a temporary place of work You can claim tax relief for money you ve spent on things like public Web 18 ao 251 t 2023 nbsp 0183 32 August 18 2023 You don t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions Conferences worksite visits and even a change of

Web 7 f 233 vr 2023 nbsp 0183 32 Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons A taxpayer is traveling Web 2 mars 2023 nbsp 0183 32 If you travel for work incur expenses as a result and these expenses are not reimbursed by your company you may be able to claim tax back from the government To claim tax back for any kind of

Download Business Travel Tax Rebate

More picture related to Business Travel Tax Rebate

Is Business Travel Tax Deductible Exploring The Basics Recent Changes

https://www.lihpao.com/images/illustration/is-business-travel-tax-deductible-3.jpg

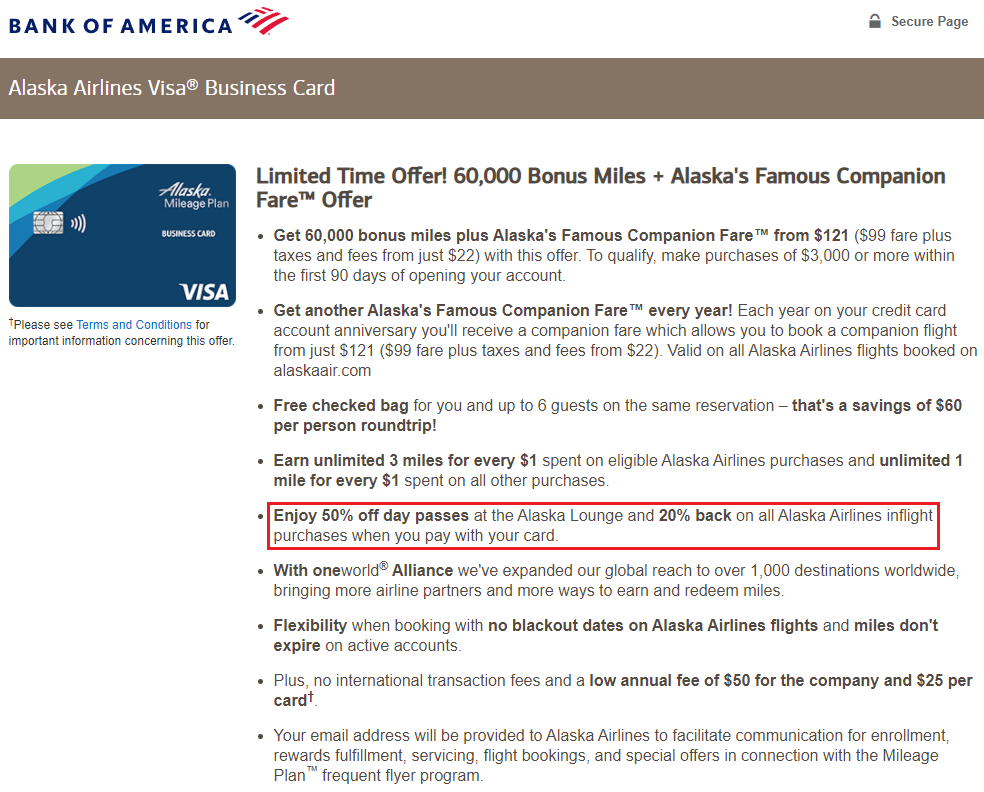

Bank Of America Alaska Airlines Credit Card 20 Rebate For In Flight

https://travelwithgrant.boardingarea.com/wp-content/uploads/2021/12/Bank-of-America-Alaska-Airlines-Business-Credit-Card-20-Percent-Rebate-In-Flight-Purchases.png

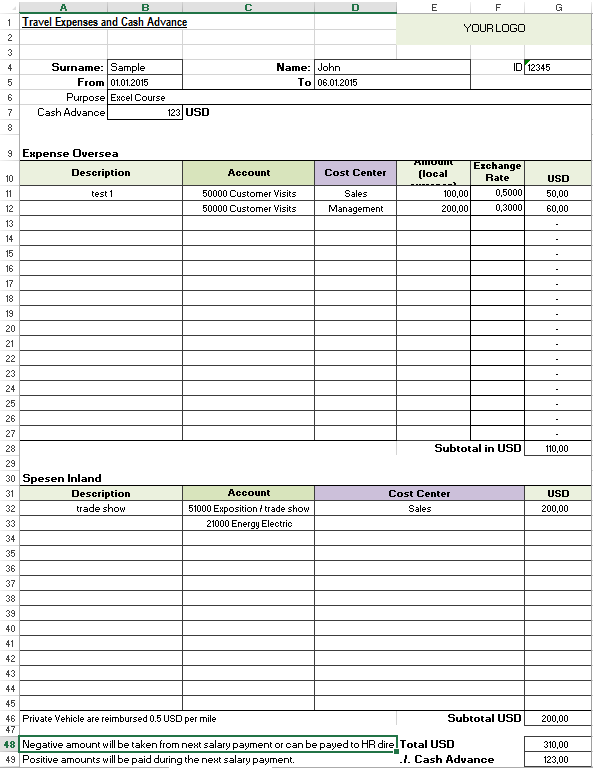

Travel Expenses Template Free Download Printable Templates

https://www.excelmadeeasy.com/images/image-excel-travel-expense-img200.png

Web 25 juil 2023 nbsp 0183 32 Business travel expenses are the necessary expenses a person has while traveling away from their home for something that relates to their job or business In Web 30 sept 2020 nbsp 0183 32 Travel expenses you incur in connection with acquiring or starting a new business are not deductible as business expenses However you can add these costs

Web The sale in tax free form is an exemption from value added tax VAT on the price of goods purchased by people passing through France This exemption is subject to conditions Web Business travelers are a diverse lot the C level executive the hard charging sales representative the technician sent to handle a customer crisis Road warrior travel

Don t Forget Your Receipts Wendy Barlin

https://wendybarlin.com/wp-content/uploads/2022/07/Traveling-this-summer-Woohoo-business-travel-tax-deductions-for-you.-Dont-forget-to-keep-your-receipts.jpg

Is Your Business Travel Tax Deductible Smith Patrick CPAs

https://smithpatrickcpa.com/wp-content/uploads/2021/05/Business-Travel-Deductions.jpg

https://www.gov.uk/guidance/business-journeys-tax-relief-490-chapter-5

Web 28 mars 2014 nbsp 0183 32 An employee travelling on business who makes a detour for private purposes will still be entitled to tax relief for the full cost of the business part of the

https://www.gov.uk/guidance/when-travel-qualifies-for-tax-relief-490...

Web 28 mars 2014 nbsp 0183 32 In most cases tax relief is available for the full cost of business travelling expenses except where motoring expenses are paid to employees who use their own

Travel Industry Airlines Tax Refunds Gorilla Tax Rebates

Don t Forget Your Receipts Wendy Barlin

Is Business Travel Tax Deductible Exploring The Basics Recent Changes

Is Business Travel Tax Deductible Exploring The Basics Recent Changes

R D Tax Rebate Check Who Qualifies Business Owners 95 Of Eligible

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Pin On Services

Business travel tax HRPT

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Business Travel Tax Rebate - Web You cannot claim for travelling to and from work unless you re travelling to a temporary place of work You can claim tax relief for money you ve spent on things like public