Ca State Tax Rebate Web 26 ao 251 t 2021 nbsp 0183 32 First round 1 600 payment to taxpayers with a Social Security Number who qualified for CalEITC making 30 000 or less 2 600 payment to qualified ITIN filers making 75 000 or less 3

Web 15 oct 2021 nbsp 0183 32 To announce the 2022 Middle Class Tax Refund payments to qualified recipients Background California will provide a one time payment up to 1 050 to Web Check if you qualify for the Golden State Stimulus II To qualify you must have Filed your 2020 taxes by October 15 2021 Had a California Adjusted Gross Income CA AGI of

Ca State Tax Rebate

Ca State Tax Rebate

https://s3.studylib.net/store/data/008273935_1-7dbdf055d5b8fce91dc4ef3b5120205a-768x994.png

IRS Says California Most State Tax Rebates Aren t Considered Taxable

https://assets3.cbsnewsstatic.com/hub/i/r/2022/04/18/bc29efd4-8f27-4c87-90c8-747eac1fcd9e/thumbnail/1200x630/f8794c3cda3ff3cc4a04aac97f532fdb/hypatia-h_0d32f8ab1663c2148ee4151ae6500dae-h_f470ece42eb4c37c3d363bc8cefc94bf.jpg

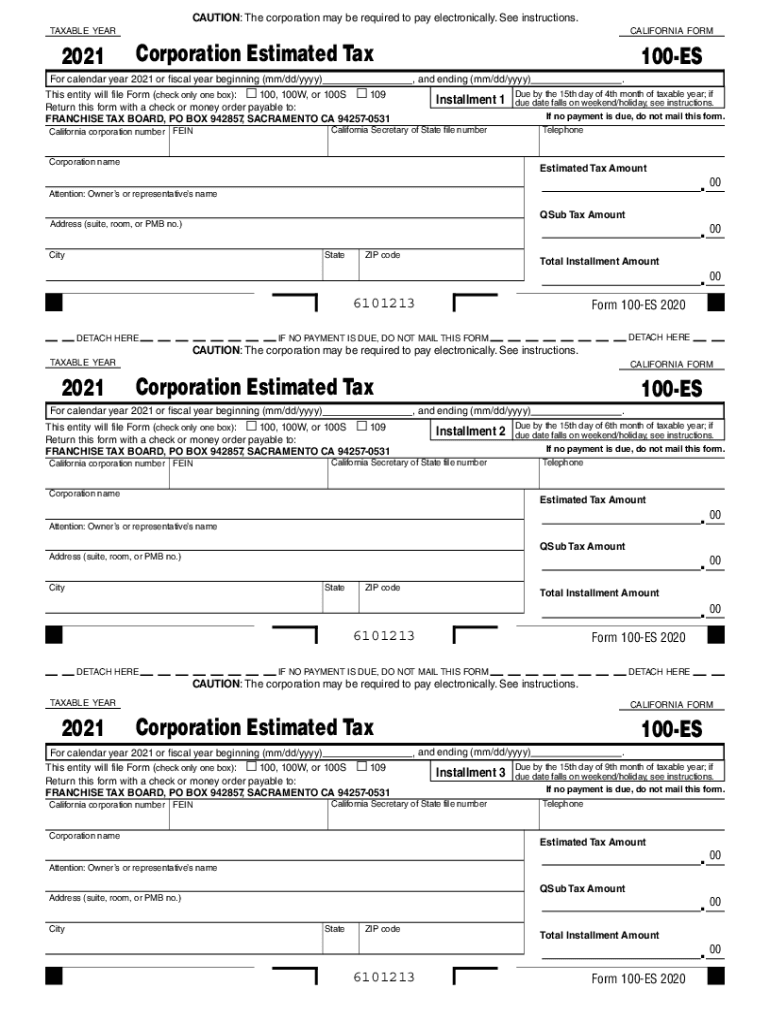

How Do I Cancel My California Estimated Tax Payments

https://lh3.googleusercontent.com/IhyRiLZaHCL43LyogU8NutMVkgYHmrtc_SeBJ5MLvtZEASt_6EK4Rh7cGAG4JrgrMvLWhsN2W9S1D70Y7dmXrj9fijqoYjj4usVqfSZnzsE5KO5DgAuMZHRDq0wMXHKGdjhzj2w

Web 30 juin 2022 nbsp 0183 32 Under the tax rebate plan households making as much as 75 000 for individuals or 150 000 for joint filers would receive 350 per taxpayer plus an additional Web Golden State Stimulus II California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify You may receive this payment if you

Web 6 oct 2022 nbsp 0183 32 SACRAMENTO Starting tomorrow 9 5 billion in Middle Class Tax Refund payments will begin going out to Californians with refunds of up to 1 050 that will Web 29 avr 2022 nbsp 0183 32 For a family of four that meets the income requirements the state would provide an 800 tax rebate Leaders of both legislative houses embraced a similar idea

Download Ca State Tax Rebate

More picture related to Ca State Tax Rebate

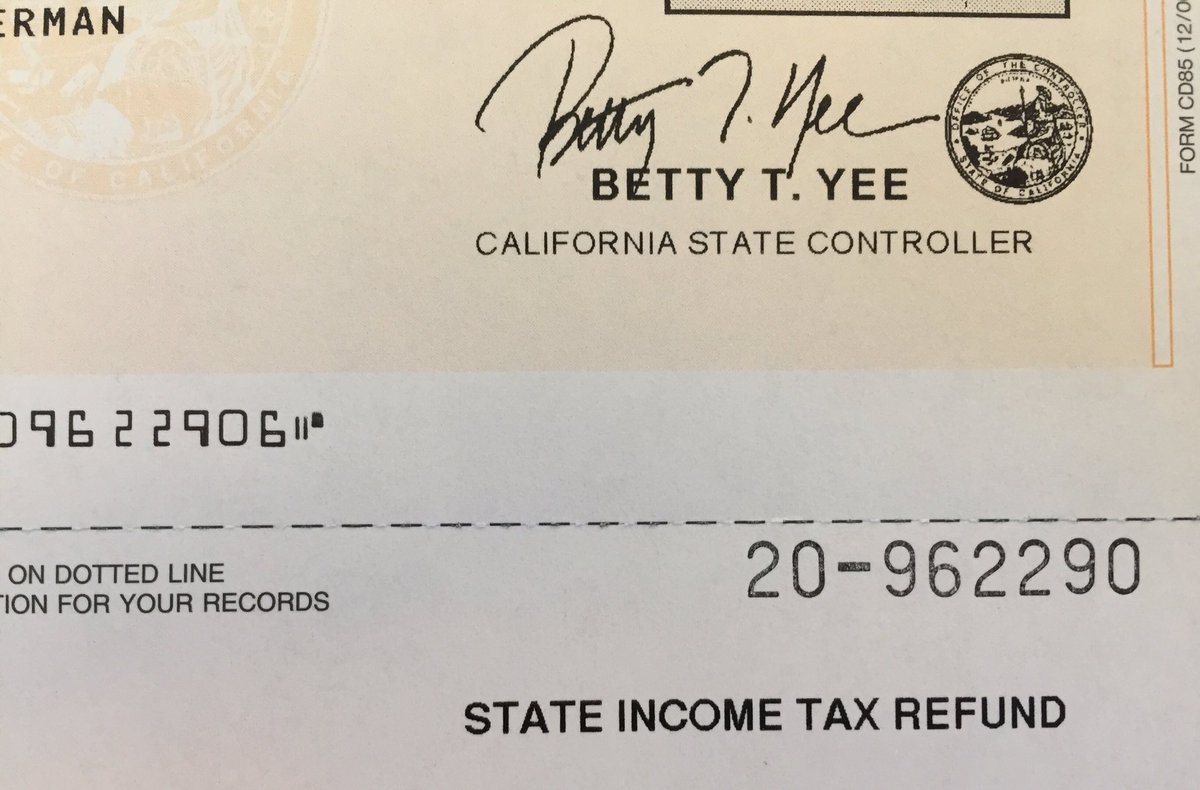

How To Check California State Refund Artistrestaurant2

https://losthorizons.com/tax/taximages2/GZeltCA2016.jpg

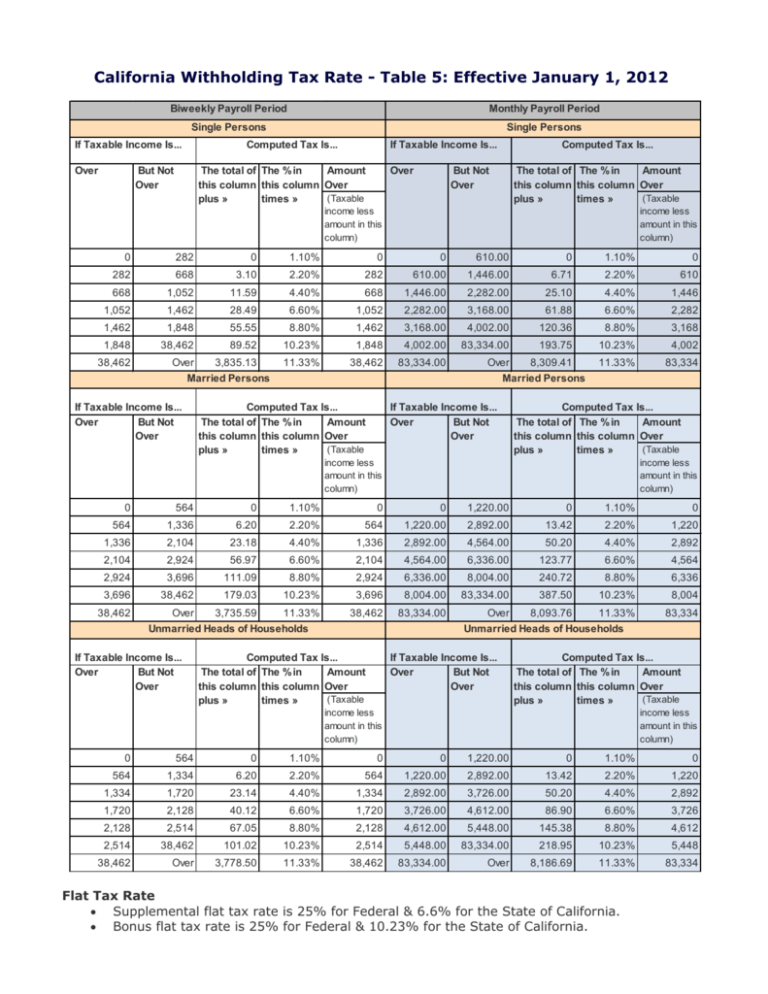

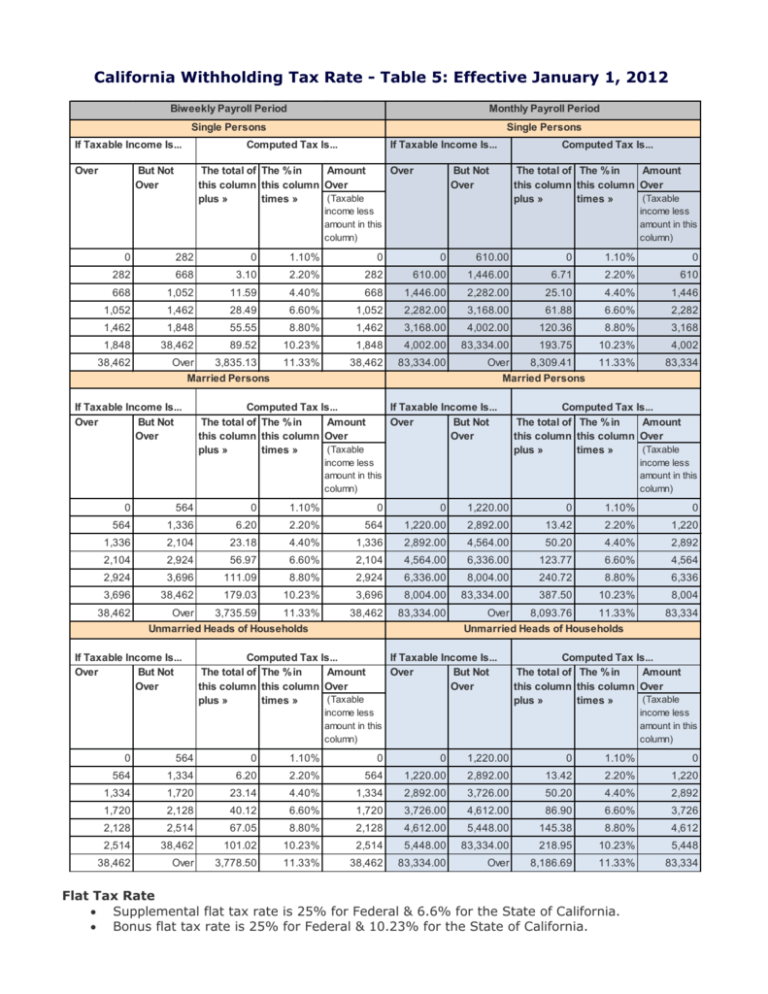

Ca Tax Rate Schedule 2017 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/541/357/541357675/large.png

Why Not 10 Reasons Not To Move To California State Bliss

https://bloximages.chicago2.vip.townnews.com/napavalleyregister.com/content/tncms/assets/v3/editorial/0/50/050c1488-5a75-11e0-b85b-001cc4c002e0/4d9294aab075b.image.jpg

Web 10 mai 2021 nbsp 0183 32 SACRAMENTO Calif AP Aided by an astonishing nearly 76 billion budget surplus California Gov Gavin Newsom on Monday proposed tax rebates of up to 1 100 for millions of households and Web 13 avr 2023 nbsp 0183 32 California middle class tax refunds sometimes called California stimulus payments were one time relief payments that ranged from 200 to 1 050 The amount eligible residents received

Web 5 janv 2023 nbsp 0183 32 By the end of 2022 the Franchise Tax Board the state agency tasked with distributing the payments had issued 7 020 930 direct deposits and 9 112 953 debit cards The payments which range from Web 11 f 233 vr 2023 nbsp 0183 32 It means that people in the following states do not need to report these state payments on their 2022 tax return California Colorado Connecticut Delaware Florida

IRS Says California Most State Tax Rebates Aren t Taxable Income

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17lDJ6.img?w=1600&h=1600&m=4&q=74

100 Ca Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/540/72/540072215/large.png

https://www.gov.ca.gov/2021/08/26/expande…

Web 26 ao 251 t 2021 nbsp 0183 32 First round 1 600 payment to taxpayers with a Social Security Number who qualified for CalEITC making 30 000 or less 2 600 payment to qualified ITIN filers making 75 000 or less 3

https://www.ftb.ca.gov/about-ftb/newsroom/public-service-bulletins/...

Web 15 oct 2021 nbsp 0183 32 To announce the 2022 Middle Class Tax Refund payments to qualified recipients Background California will provide a one time payment up to 1 050 to

How To Check California State Refund Artistrestaurant2

IRS Says California Most State Tax Rebates Aren t Taxable Income

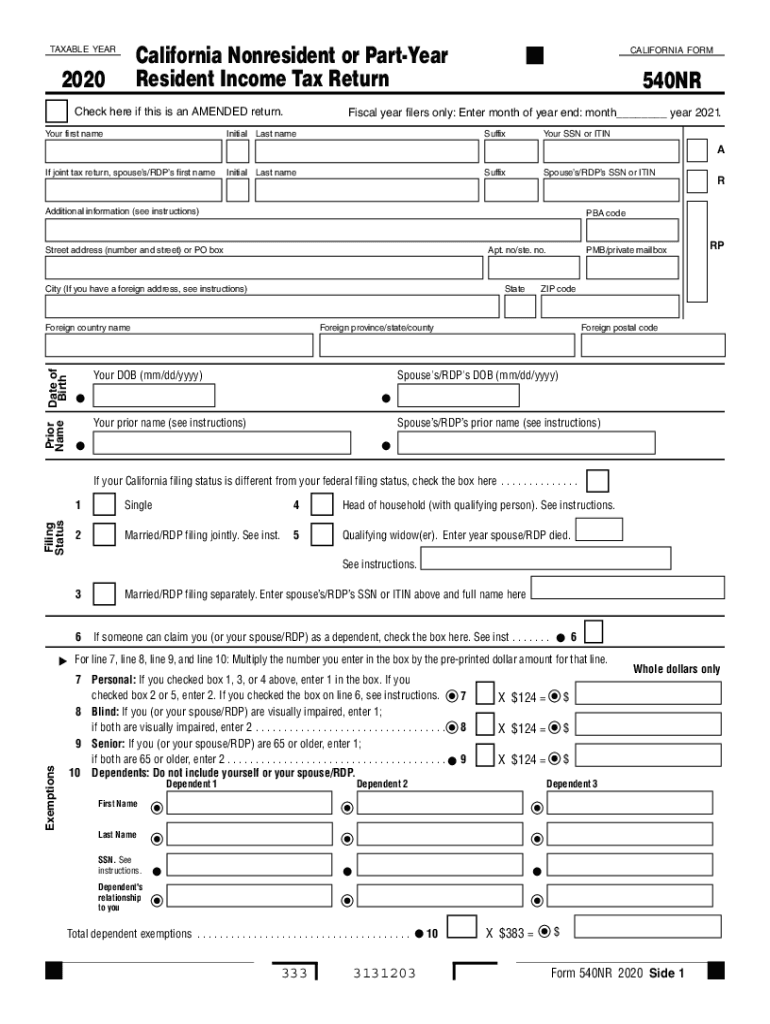

2019 California 540nr Fill Out Sign Online DocHub

State Of California Tax Form 540nr Fill Out Sign Online DocHub

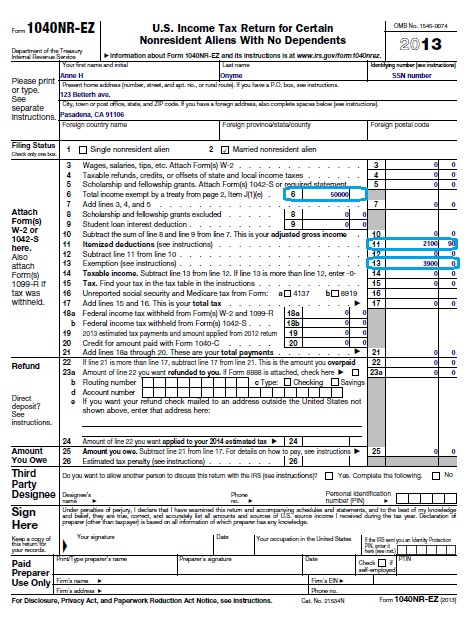

Comment Remplir Sa D Claration D imp Ts En Californie Achat Voiture

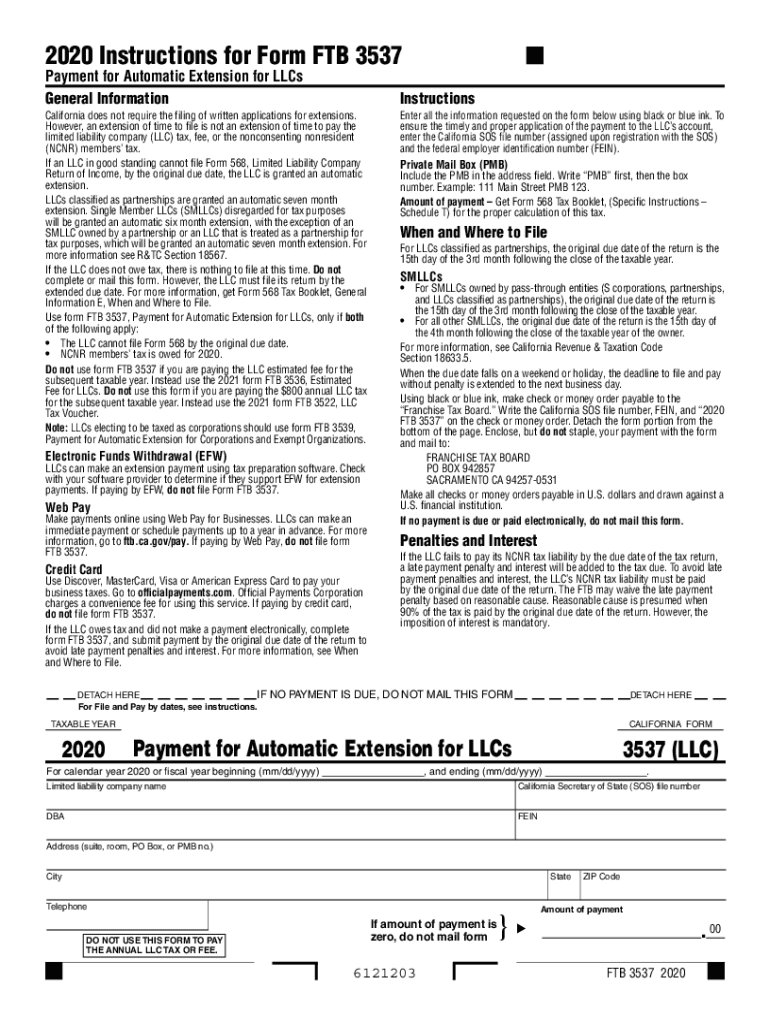

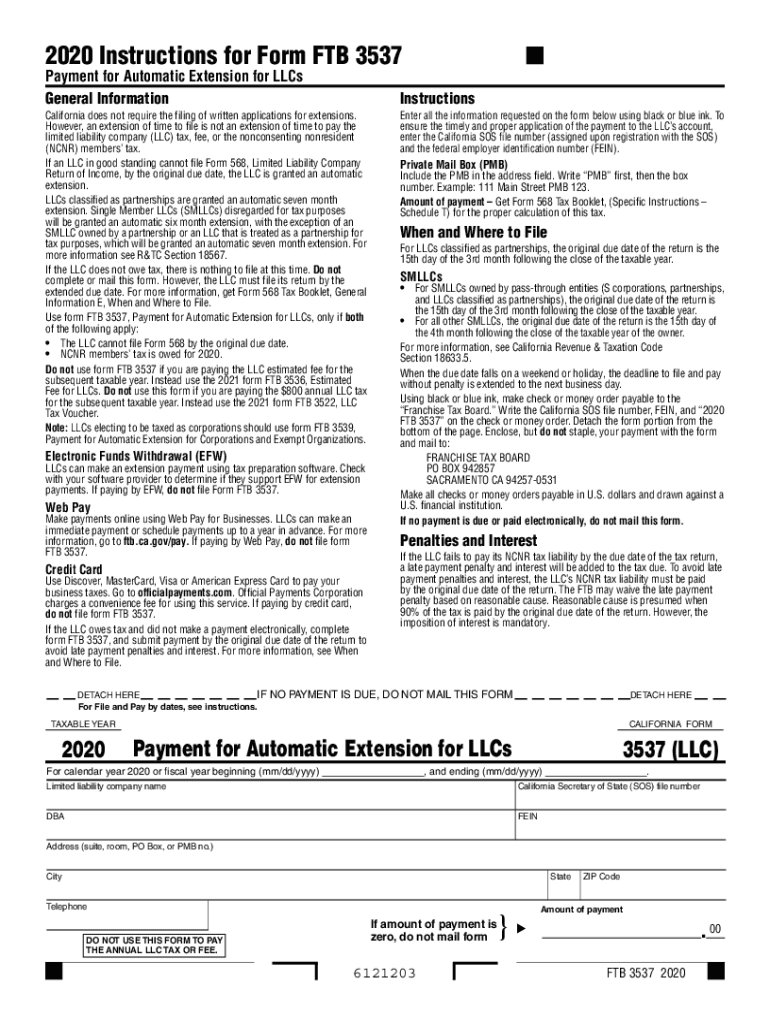

2020 Form CA FTB 3537 Fill Online Printable Fillable Blank PdfFiller

2020 Form CA FTB 3537 Fill Online Printable Fillable Blank PdfFiller

Calif State Tax Refund Radati77

What To Know About California Middle Class Tax Refund Debit Cards

Printable Federal Withholding Tables 2022 California Onenow

Ca State Tax Rebate - Web 29 avr 2022 nbsp 0183 32 For a family of four that meets the income requirements the state would provide an 800 tax rebate Leaders of both legislative houses embraced a similar idea