Ca Tax Rebate 2024 Jan 26 2024 at 4 27 PM EST By Suzanne Blake Reporter Consumer Social Trends 0 Residents in California could earn up to 12 000 if they qualify for a combination of state and federal

The California Tax Credit Allocation Committee CTCAC will not accept submissions of application documents in the form of hard copy paper by email or over the internet CTCAC will continue to require that any hand delivered applications be submitted to the Sacramento headquarters office by 5 p m on the application due date January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

Ca Tax Rebate 2024

Ca Tax Rebate 2024

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

CA Tax Rebate 2023 Eligibility Application And Tips Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Ca-Tax-Rebate-2023.jpg?ssl=1

Tentative Agreement Reached On CA Tax Rebate YouTube

https://i.ytimg.com/vi/t3pDeVfMeeY/maxresdefault.jpg

The CalEITC program is designed to assist low income working individuals or families in California offering a maximum benefit of 3 529 for the 2023 tax year Eligibility for this credit is On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year Jan 13 2023 The Inflation Reduction Act also includes a 2 000 federal tax credit for heat pumps which can be taken now Some states and utilities also offer their own rebates

Download Ca Tax Rebate 2024

More picture related to Ca Tax Rebate 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

GAS REBATE CALIFORNIA MCTR DEBIT CARD CALIFORNIA MIDDLE CLASS TAX REFUND CARD ACTIVATE FAST

https://i.ytimg.com/vi/AIu-Ifra3Cs/maxresdefault.jpg

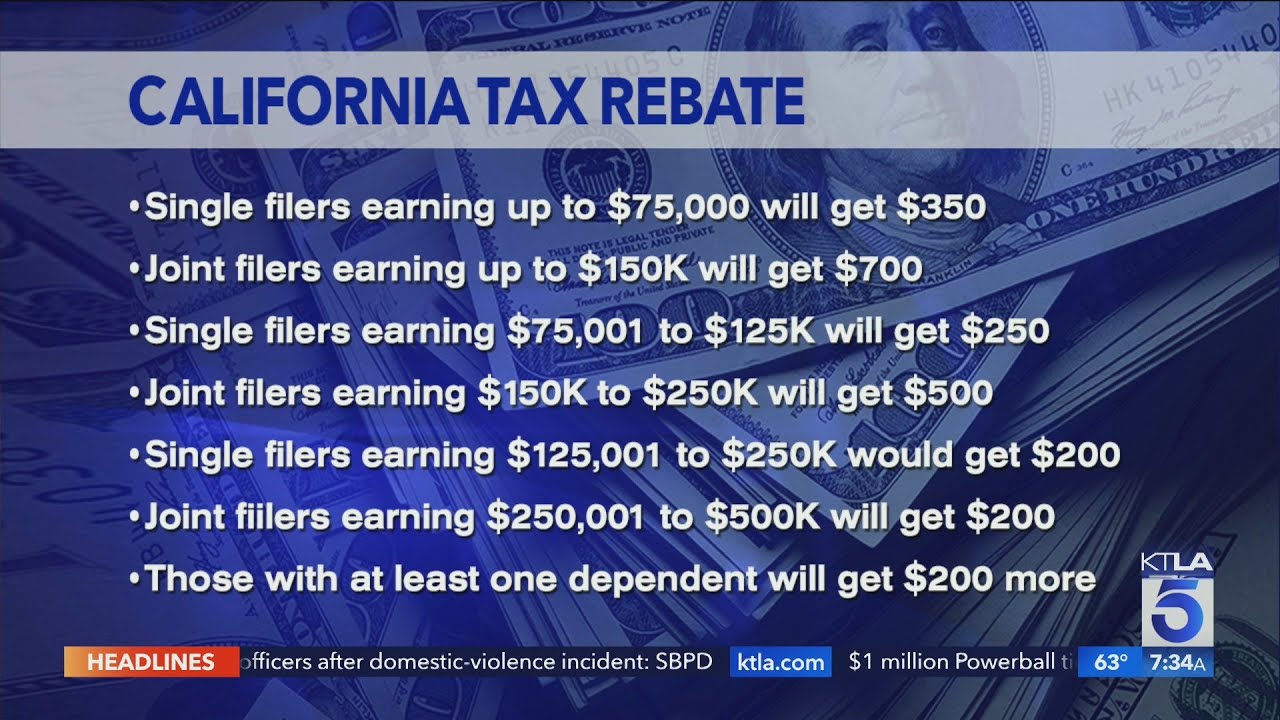

Payments range from 200 to 1 050 depending on household income dependents and other factors Details on the amount issued can be calculated via the Franchise Tax Board s website So far about There are nine California tax rates ranging from 1 to 12 3 Tax brackets depend on income tax filing status and state residency California also levies a 1 mental health services tax on

Explore the child tax credit and other provisions in the 2024 bipartisan tax deal Tax Relief for American Families and Workers Act of 2024 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income California has been allocated 292 million in HOMES funding to support whole home energy retrofits and 290 million in HEEHRA funding to support point of sale rebates for qualified electrification projects

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

https://www.newsweek.com/california-tax-rebates-available-thousands-payment-1864478

Jan 26 2024 at 4 27 PM EST By Suzanne Blake Reporter Consumer Social Trends 0 Residents in California could earn up to 12 000 if they qualify for a combination of state and federal

https://www.treasurer.ca.gov/ctcac/2024/applications/competitive-tax-app-instructions.asp

The California Tax Credit Allocation Committee CTCAC will not accept submissions of application documents in the form of hard copy paper by email or over the internet CTCAC will continue to require that any hand delivered applications be submitted to the Sacramento headquarters office by 5 p m on the application due date

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Income Tax Rebate Under Section 87A

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Are You Due A Tax Rebate Leitrim Live

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Ca Tax Rebate 2024 - So you fall in the adjusted gross income of 50 60 000 dollars you may not be able to use the full tax credit because you don t have a big enough tax liability so this is really a benefit for