Calculate My Child Care Rebate Web Understand how we work out your Child Care Subsidy rate using your income and the number of children in your care The type of child care you use affects it The amount of

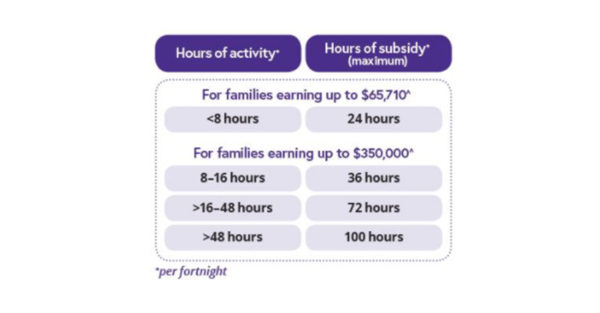

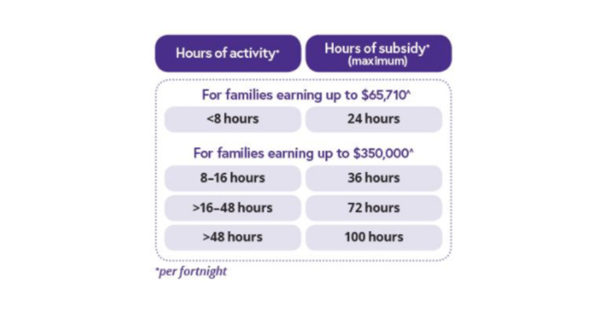

Web For families with an annual Combined Household Income of more than 186 958 and less than 351 248 the annual cap on the funding they receive will be 10 190 per child The Web First Nations families can now get at least 36 hours of subsidy per fortnight for each child attending childcare regardless of their activity hours Use our simple child care subsidy estimator to find out how much

Calculate My Child Care Rebate

Calculate My Child Care Rebate

https://printablerebateform.net/wp-content/uploads/2022/02/Childcare-Rebate-2022-768x455.png

Five Things You Need To Know About The New Child Care Subsidy

https://cdn.babyology.com.au/wp-content/uploads/2017/11/childcarerebate2-600x313.jpg

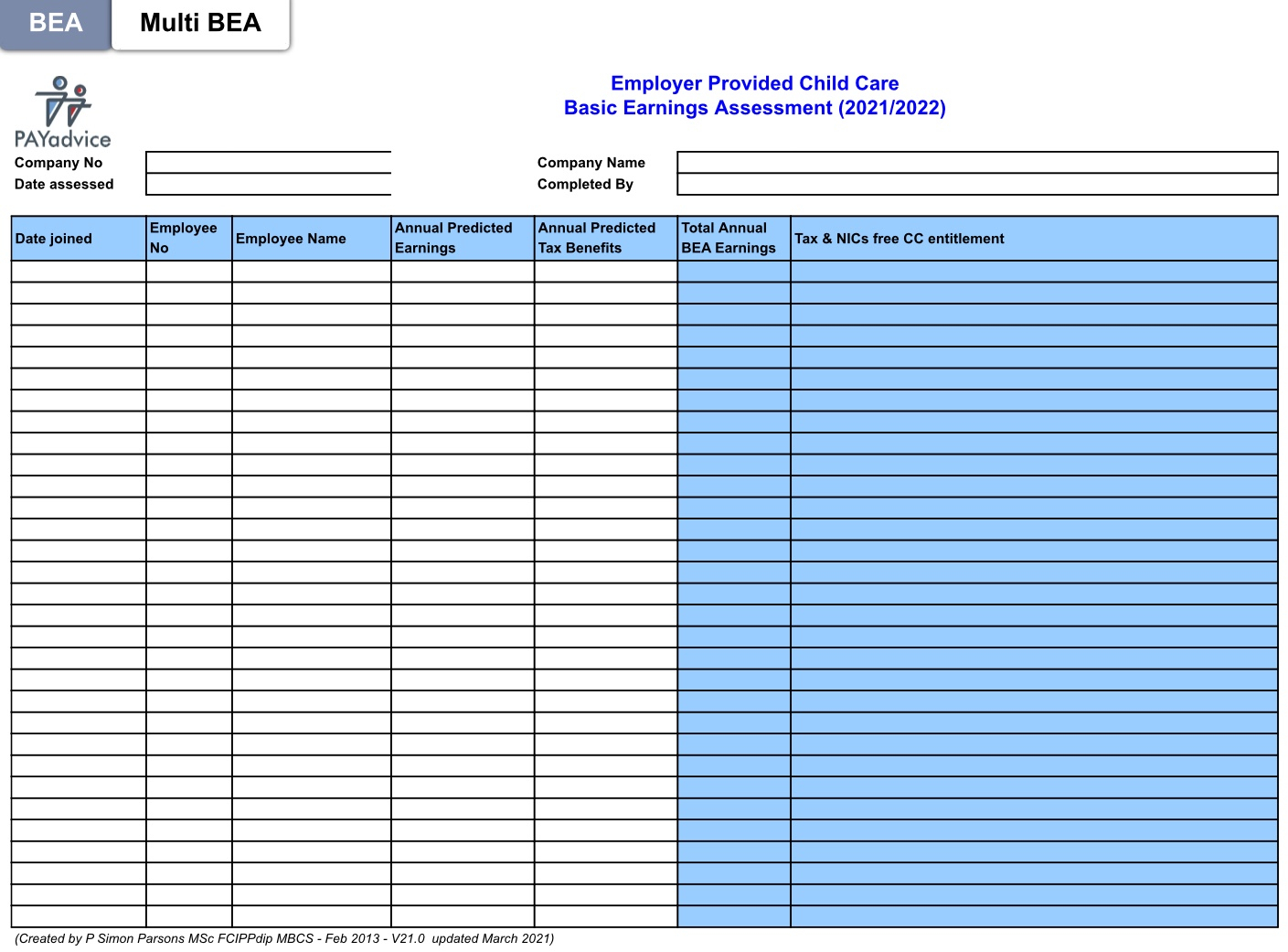

Child Care Tax Rebate 2022 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-vouchers-2021-2022-basic-earnings-assessment-calculator.jpg

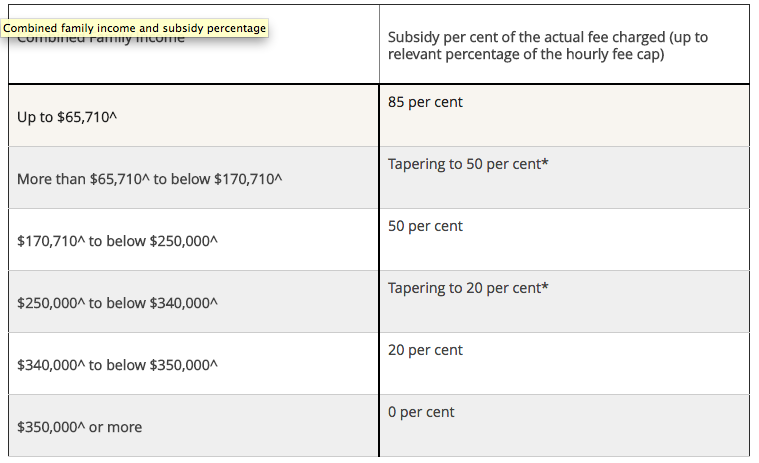

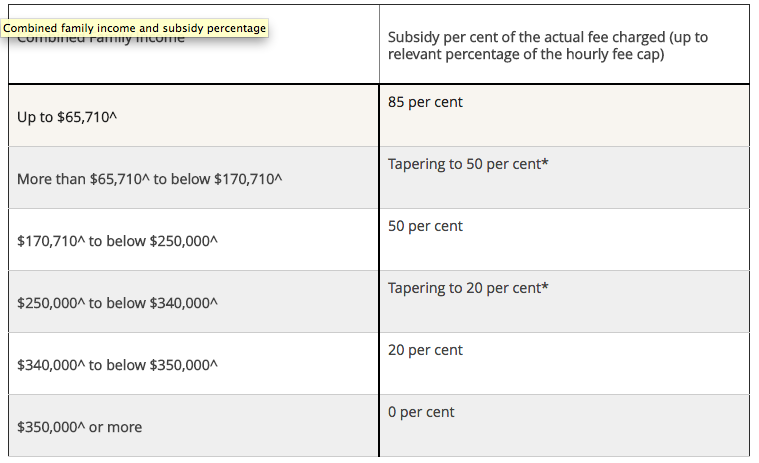

Web 10 juil 2023 nbsp 0183 32 If you get Child Care Subsidy you have an ongoing responsibility to keep your information up to date How to balance your payment We compare your income Web 10 juil 2023 nbsp 0183 32 We ll work out your Child Care Subsidy CCS percentage using your family income estimate Your CCS percentage applies to either your hourly fee or the relevant

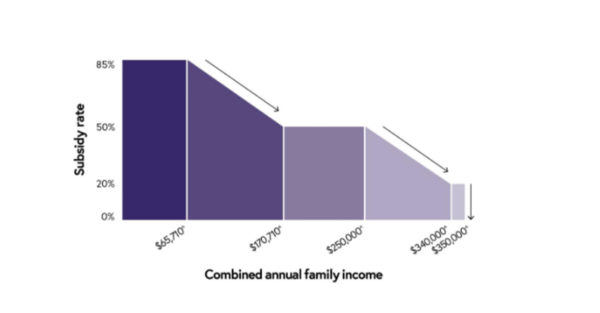

Web From July 2023 Child Care Subsidy rates will lift from 85 per cent to 90 per cent for families earning less than 80 000 Subsidy rates will then taper down one percentage point for Web Calculate your Child Care Subsidy Find out how much of the Government Child Care Subsidy you re entitled to with our handy calculator

Download Calculate My Child Care Rebate

More picture related to Calculate My Child Care Rebate

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

FREE 11 Child Care Application Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Child-Care-Rebate-Application-Form.jpg?width=320

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Web To help you work out how much money you could be saving with your application for childcare benefits we have put together a unique Child Care Subsidy calculator Child Web 10 juil 2023 nbsp 0183 32 Families earning up to 80 000 can get an increased maximum CCS amount from 85 to 90 If you earn over 80 000 you may get a subsidy starting from 90

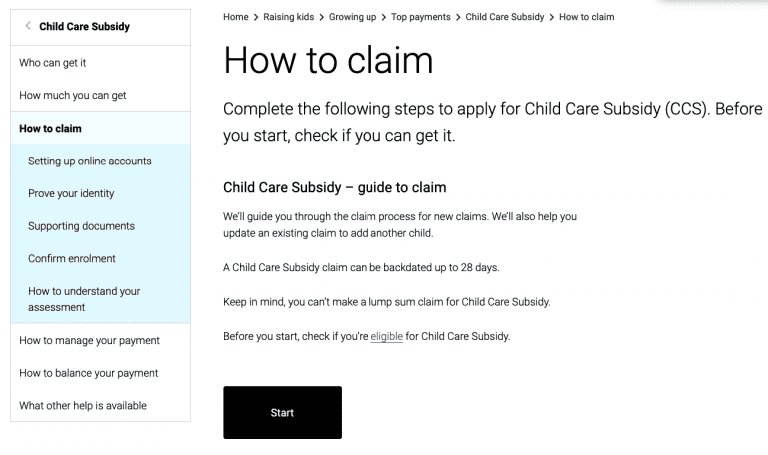

Web You can track your Child Care Subsidy CCS balancing online Understanding your Child Care Subsidy balancing outcome Once we ve balanced your Child Care Subsidy CCS Web 22 sept 2023 nbsp 0183 32 Child Care Subsidy This is a Services Australia payment that helps with the cost of approved child care This payment has changed Who can get it How to get it

New Childcare Rebates And What They Mean For You Ellaslist Ellaslist

https://www.ellaslist.com.au/ckeditor_assets/pictures/1682/content_family_income_subsidy_childcare.png

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-rebate-application-form-d1.png

https://www.servicesaustralia.gov.au/how-much-child-care-subsidy-you...

Web Understand how we work out your Child Care Subsidy rate using your income and the number of children in your care The type of child care you use affects it The amount of

https://www.careforkids.com.au/child-care-subsidy-calculator

Web For families with an annual Combined Household Income of more than 186 958 and less than 351 248 the annual cap on the funding they receive will be 10 190 per child The

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

New Childcare Rebates And What They Mean For You Ellaslist Ellaslist

Child Care Expenses Tax Credit Colorado Free Download

Five Things You Need To Know About The New Child Care Subsidy

Child Care Benefit Claim Form Notes Australia Free Download

Child Care Rebate Application Form Free Download

Child Care Rebate Application Form Free Download

Child Care Rebate Changes 2017 What It Means For You

Child Care Rebate Income Tax Return 2022 Carrebate

Benefits How To Calculate Your Child Care Rebate Harmony Learning

Calculate My Child Care Rebate - Web 10 juil 2023 nbsp 0183 32 If you get Child Care Subsidy you have an ongoing responsibility to keep your information up to date How to balance your payment We compare your income