Calculate Tax Rebate For Buying House Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

Web 14 juin 2022 nbsp 0183 32 The standard deduction for married taxpayers who file joint returns is 25 900 for tax year 2022 It s 12 950 for single filers and Web 26 oct 2022 nbsp 0183 32 The amount of rebate you can receive for the GST Portion is 36 of the GST tax amount up to a maximum of 6 300 The amount of rebate you can receive

Calculate Tax Rebate For Buying House

Calculate Tax Rebate For Buying House

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Tax Rebate Calculator On Home Loan TAXW

https://i.pinimg.com/originals/2d/bd/5f/2dbd5ff444ba9c2a0ba1915a2d8781b2.jpg

Web Calculate Your Savings Calculator Rates Above field set to quot yes quot if tax benefit is more than 200 as itemizing deductions increases chance of an audit amp preparing itemized returns typically costs somewhere between Web You may be eligible to save up to 40 000 tax free to buy a home with an annual contribution limit of 8 000 Learn more about the First Home Savings Account Your

Web 23 mai 2023 nbsp 0183 32 When you do your taxes for the year in which you purchased your first home enter the Home Buyer s Amount of 10 000 on Line 31270 of your income tax return The amount is calculated at the Web This will determine the amount of tax paid that you will use to calculate your rebate amount on Form GST191 GST HST New Housing Rebate Application for Owner Built Houses

Download Calculate Tax Rebate For Buying House

More picture related to Calculate Tax Rebate For Buying House

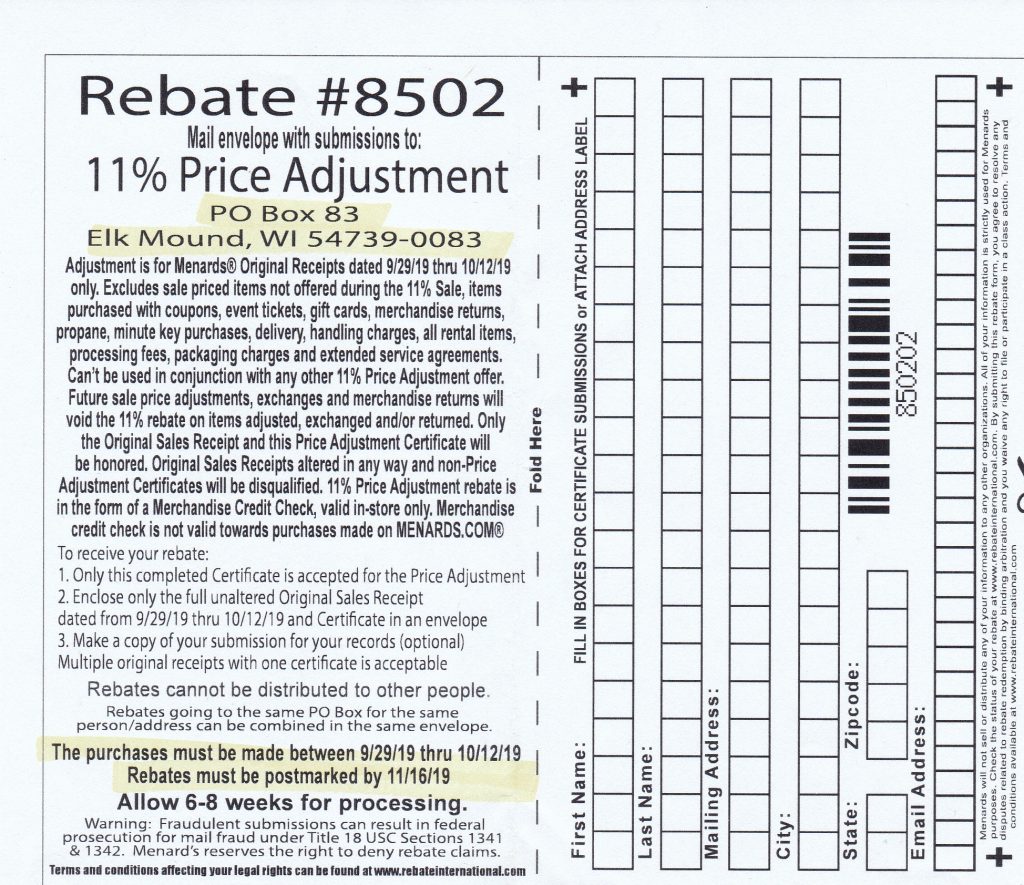

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

http://struggleville.net/wp-content/uploads/2019/10/MenardsPriceAdjustmentRebate8502-1024x885.jpg

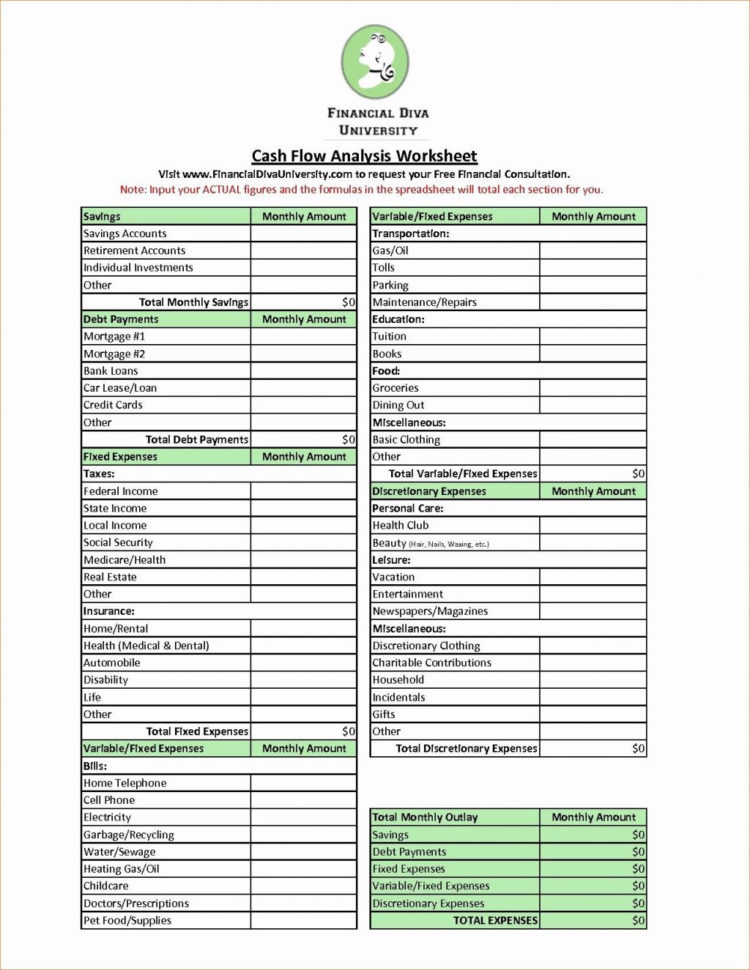

Excel Mortgage Worksheet

https://db-excel.com/wp-content/uploads/2019/01/home-buying-spreadsheet-template-for-home-buyers-plan-tax-credit-unique-house-buying-calculator-750x970.jpg

Car Allowance Tax Rebate Calculator 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/62-online-real-estate-calculators-proapod-re-calculator.png

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Web 11 mai 2020 nbsp 0183 32 Calculating the GST HST New Housing Rebate For both the GST and HST rebates the calculations are similar Let s take a look at how you would calculate the taxes and rebates on a home purchased in

Web Until 2022 the Home Buyers Tax Credit at current taxation rates worked out to a rebate of 750 for all first time homebuyers However in the 2022 budget the rebate amount was Web Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the tax return You will get money back from the

What Are The Best Ways To Manage Tax Rebates

https://bloggercreativa.com/wp-content/uploads/2022/08/Tax-Rebate-Calculator-2-1200x675.jpg

Bonus Tax Rate 2018 Museumruim1op10 nl

https://atotaxrates.info/wp-content/uploads/2012/09/DMLr3h1.png

https://www.canada.ca/en/revenue-agency/programs/about-canada-reven…

Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

https://www.thebalancemoney.com/do-you-ge…

Web 14 juin 2022 nbsp 0183 32 The standard deduction for married taxpayers who file joint returns is 25 900 for tax year 2022 It s 12 950 for single filers and

Home Ownership Expense Calculator What Can You Afford

What Are The Best Ways To Manage Tax Rebates

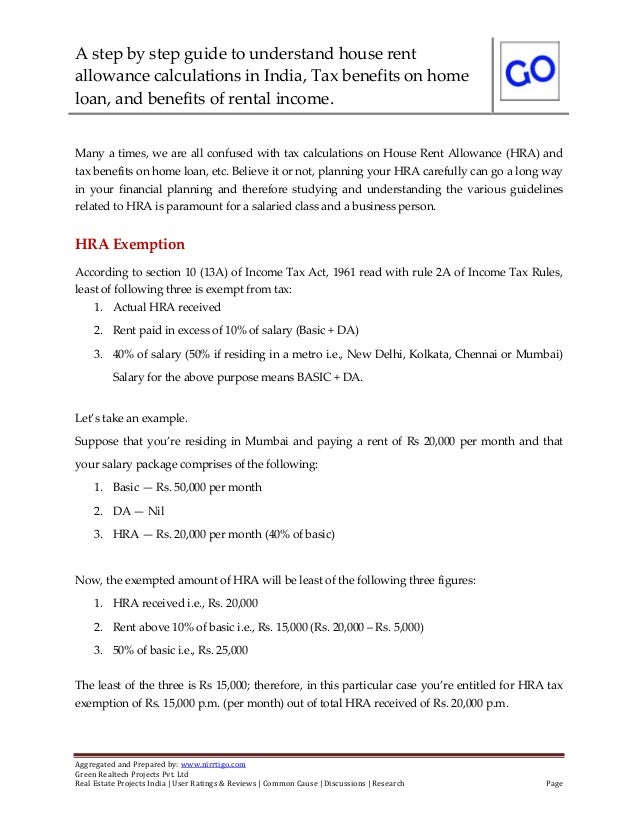

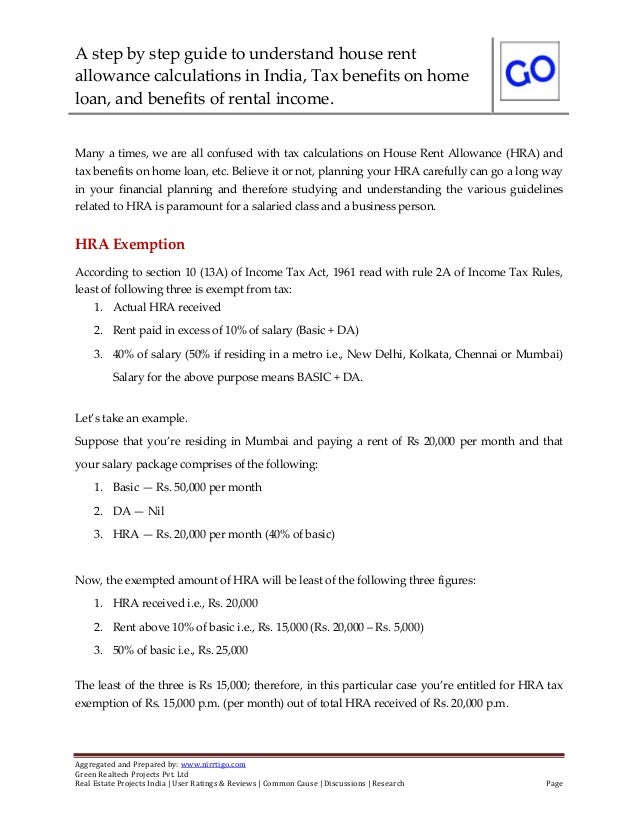

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

How Do I Claim The Recovery Rebate Credit On My Ta

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

Working From Home Tax Rebate Form 2022 Printable Rebate Form

Ptr Tax Rebate Libracha

H And R Block State Tax Calculator Printable Rebate Form

Calculate Tax Rebate For Buying House - Web 8 sept 2023 nbsp 0183 32 California Solar Panel Costs Various factors such as system components size fees permits and labor charges determine overall solar panel pricing