California Employer Mileage Reimbursement HR Manual sections 2201 Travel and Relocation Policy 2202 Mileage Reimbursement and 2203 Allowances and Travel Reimbursements provide additional

Harte Hanks Shoppers Inc the California Supreme Court clarified the parameters of mileage reimbursement under California law as well as the three different methods available for employers to reimburse employees for California Mileage Reimbursement Law requires employers to reimburse employees for all vehicle expenses incurred on the job We help you recover unpaid mileage expenses

California Employer Mileage Reimbursement

California Employer Mileage Reimbursement

https://www.motus.com/wp-content/uploads/2022/08/employer-mileage-reimbursement-header.png

How Does California Mileage Reimbursement Work KAASS LAW

https://kaass.com/wp-content/uploads/2022/09/CA-How-Does-California-Mileage-Reimbursement-Work.jpg?is-pending-load=1

Calculate Gas Mileage Reimbursement AmandaMeyah

https://i2.wp.com/eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png?fit=1600%2C2070&ssl=1

Yes in California employers are legally required to reimburse employees for miles driven using their personal vehicles for work related activities This requirement is outlined under California Labor Code Section Mileage reimbursement is a core component of compliance for California employers whose workers use personal vehicles for business purposes Understanding the legal

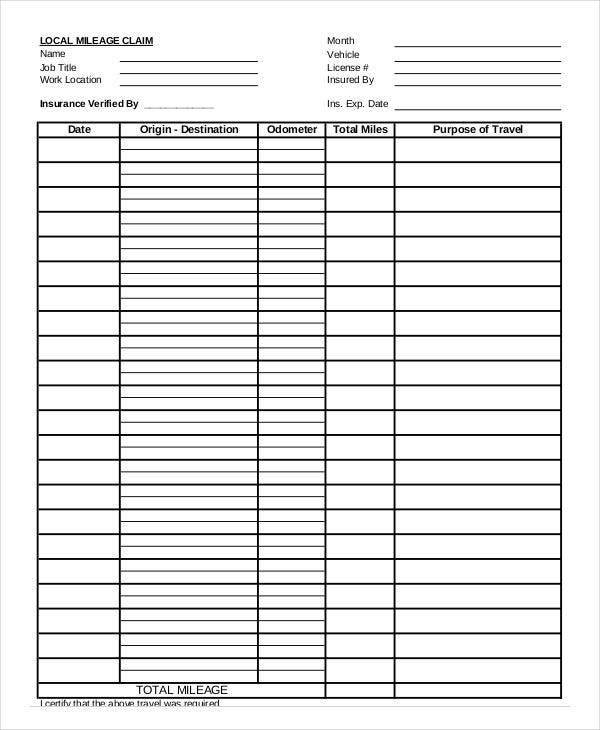

As an employer you can choose between different methods for reimbursing mileage in California You can ask employees to provide records and or receipts of their business As of January 1 2022 the mileage reimbursement rate was increased to 0 585 per mile if an employee uses a personal car SUV pickup truck van or panel truck for work purposes If a personal vehicle is used for work for charitable

Download California Employer Mileage Reimbursement

More picture related to California Employer Mileage Reimbursement

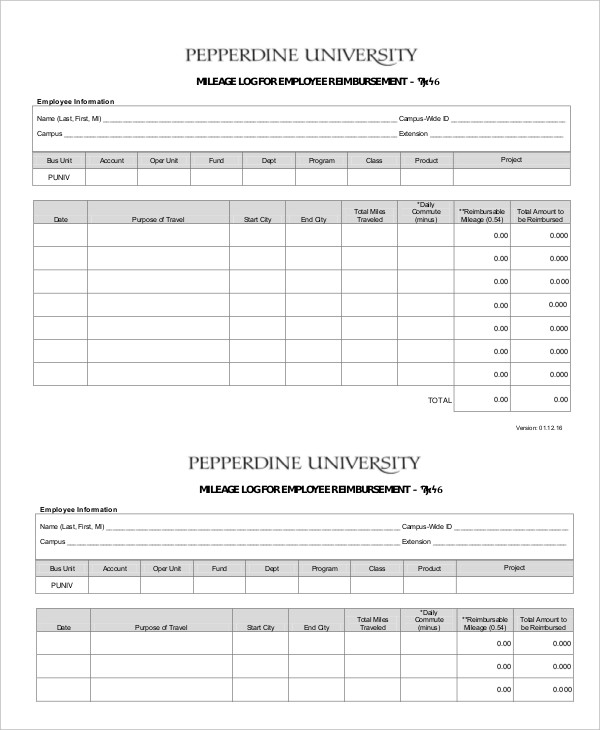

11 Free Mileage Reimbursement Form Templatesz234

https://images.template.net/wp-content/uploads/2016/12/20050052/Employee-Mileage-Reimbursement-Form.jpg

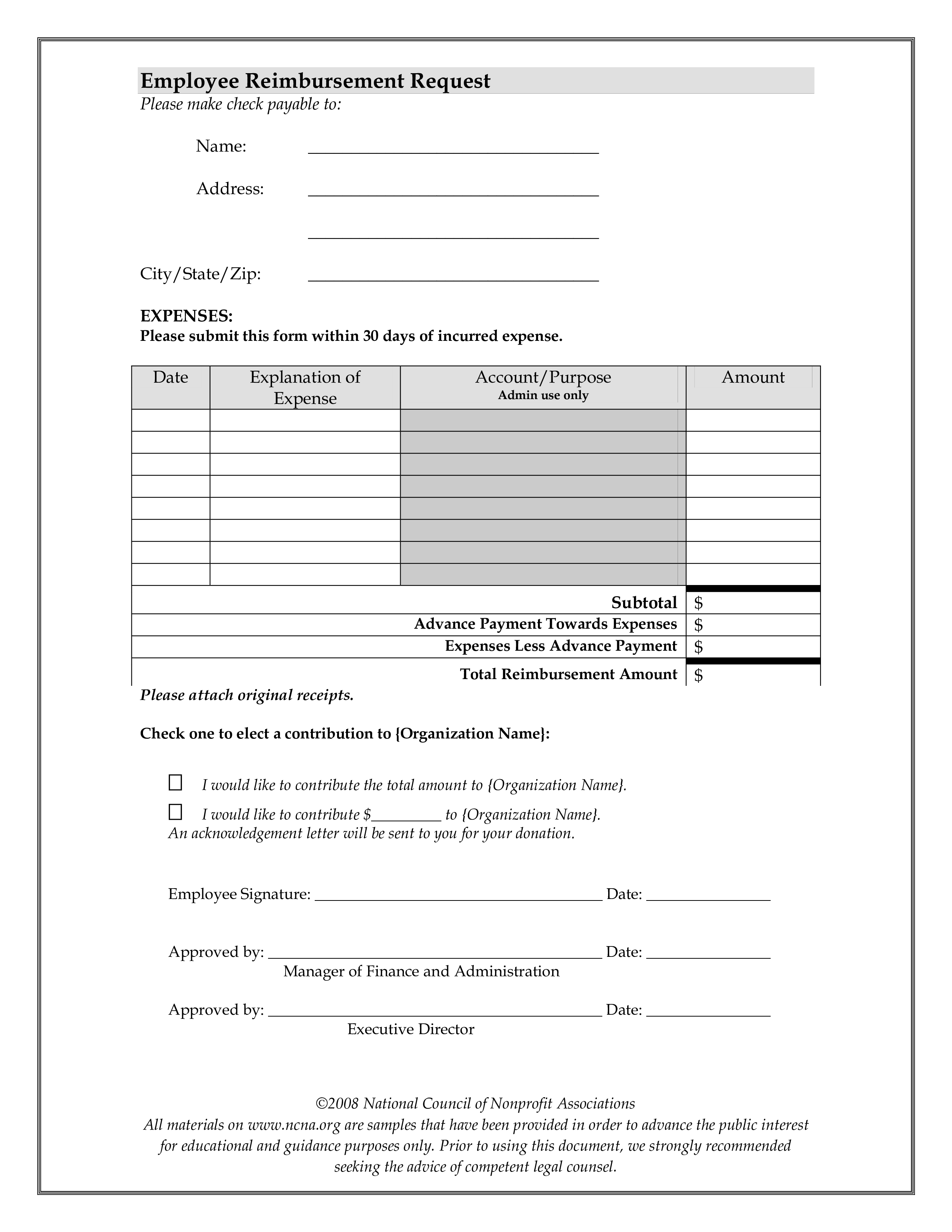

Employee Reimbursement Form Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/43579d3b-72b6-4dab-9686-1071789b6e1d_1.png

Mileage Reimbursement Template 2017 Template 1 Resume Examples

https://www.contrapositionmagazine.com/wp-content/uploads/2021/05/california-workers-compensation-mileage-reimbursement-form-2017.jpg

Understanding Travel Compensation for Work in California In the Golden State employees who travel for work related purposes are entitled to certain Under California labor laws you are entitled to reimbursement for travel expenses or losses directly related to your job If your employer tries to shortchange you or fails to reimburse you for work related travel expenses you may be able to

California law requires an employer to maintain daily records of reimbursable mileage and also mandates that reimbursement payments must be made by the end of the Here s a breakdown of the current IRS mileage reimbursement rates for California as of January 2025 Employees will receive 70 cents per mile driven for business use 3 cents

Mileage Reimbursement Rate 2024 California Clem Melita

https://static.dexform.com/media/docs/5994/mileage-reimbursement-form-3_1.png

Mileage Reimbursement Form In PDF Basic Mileage Reimbursement Form

https://caboolenterprise.com/d72e84c9/https/a69880/www.generalblue.com/mileage-reimbursement-form/p/tbm51rd9k/f/basic-mileage-reimbursement-form-in-pdf-lg.png?v=cf4df8a1f9370604785404377890fc51

https://www.calhr.ca.gov › employees › Pages › travel...

HR Manual sections 2201 Travel and Relocation Policy 2202 Mileage Reimbursement and 2203 Allowances and Travel Reimbursements provide additional

https://www.californiaemploymentlawreport…

Harte Hanks Shoppers Inc the California Supreme Court clarified the parameters of mileage reimbursement under California law as well as the three different methods available for employers to reimburse employees for

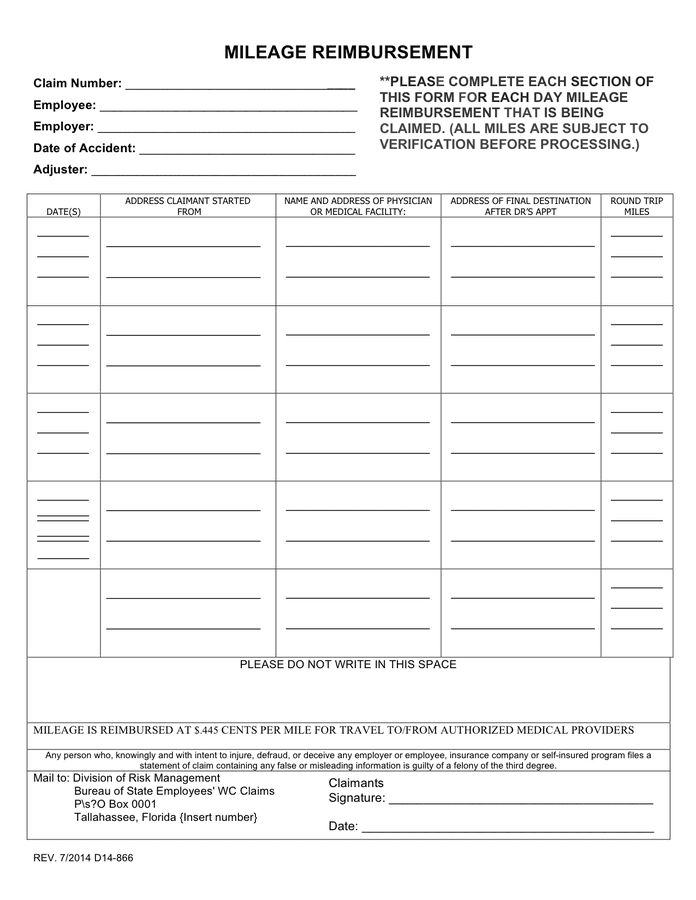

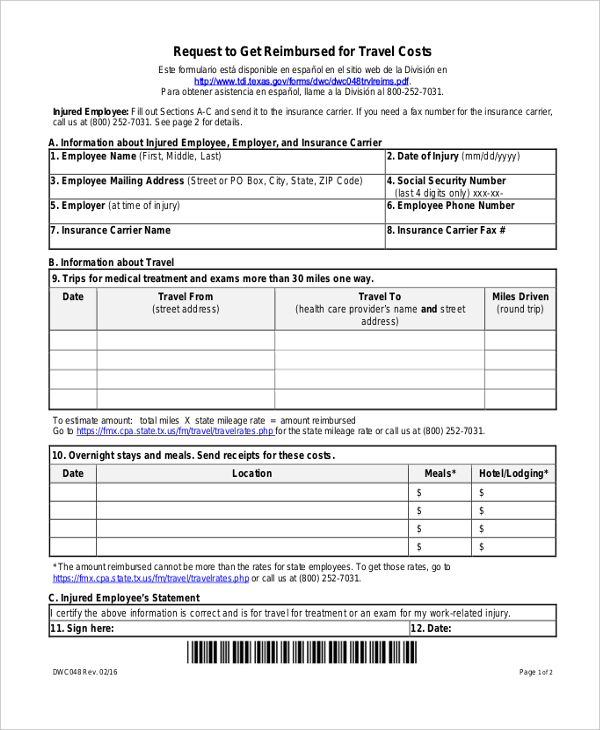

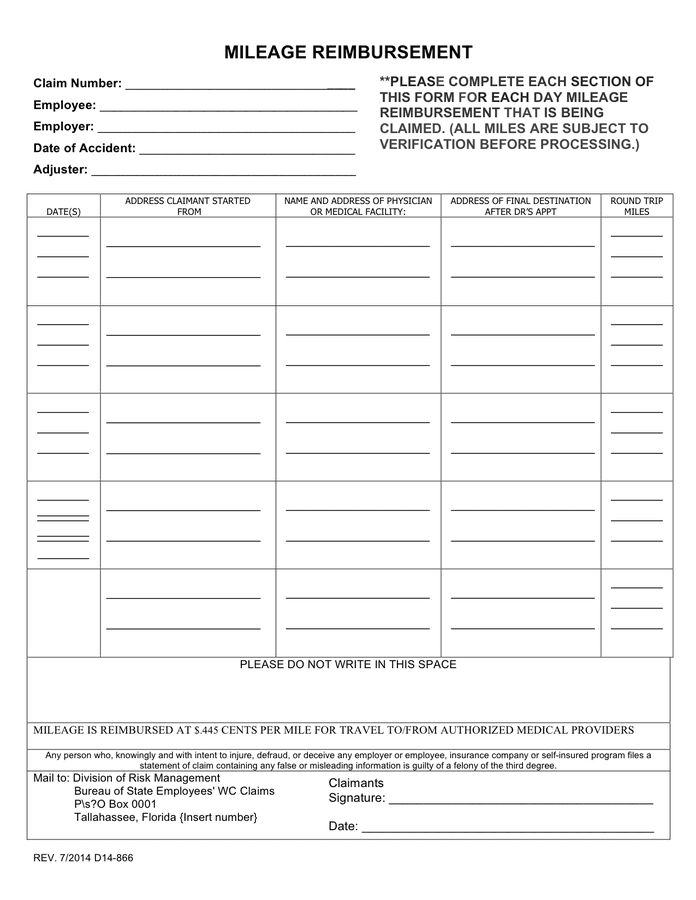

FREE 9 Sample Mileage Reimbursement Forms In PDF Word Excel

Mileage Reimbursement Rate 2024 California Clem Melita

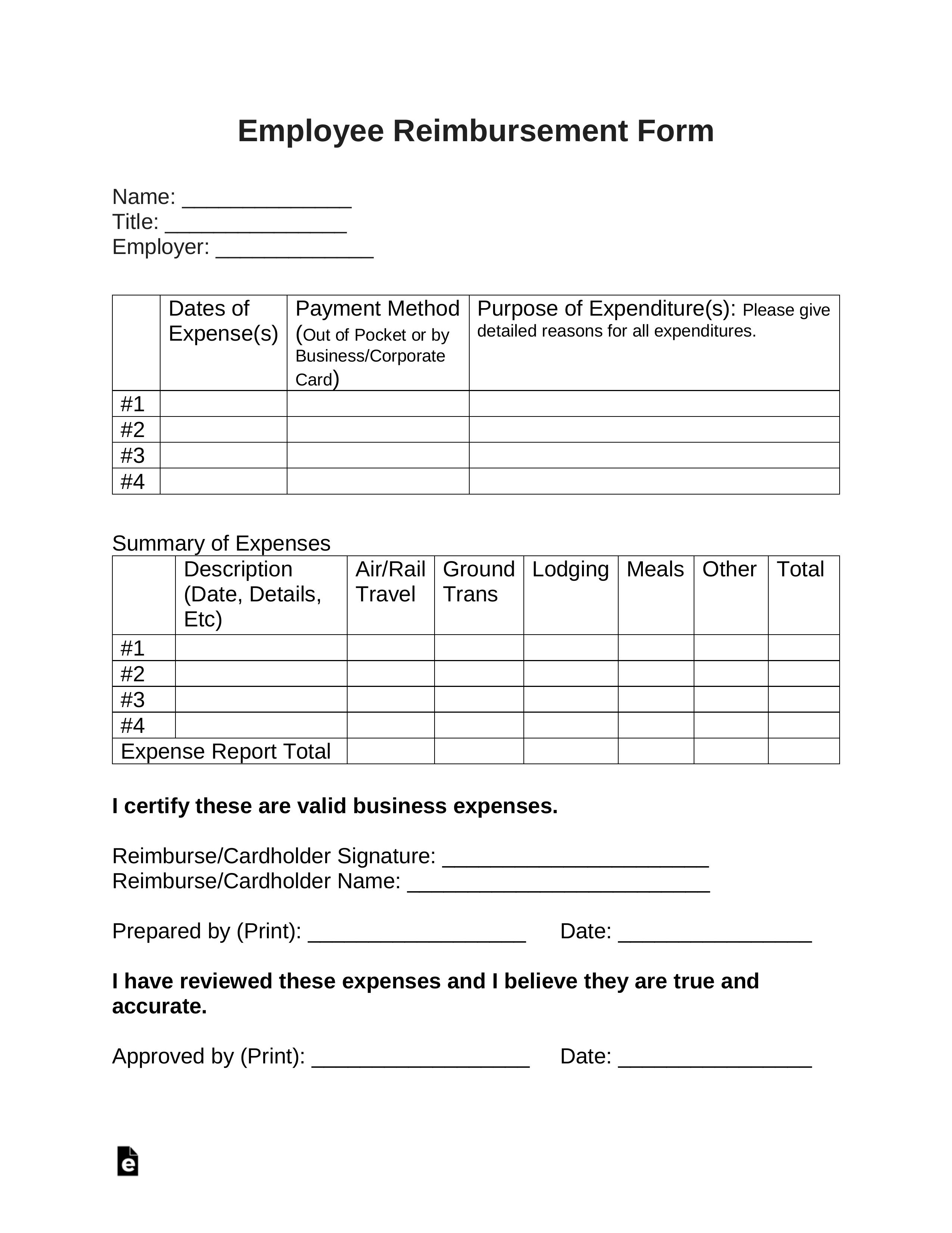

Free Employee Reimbursement Form PDF Word EForms

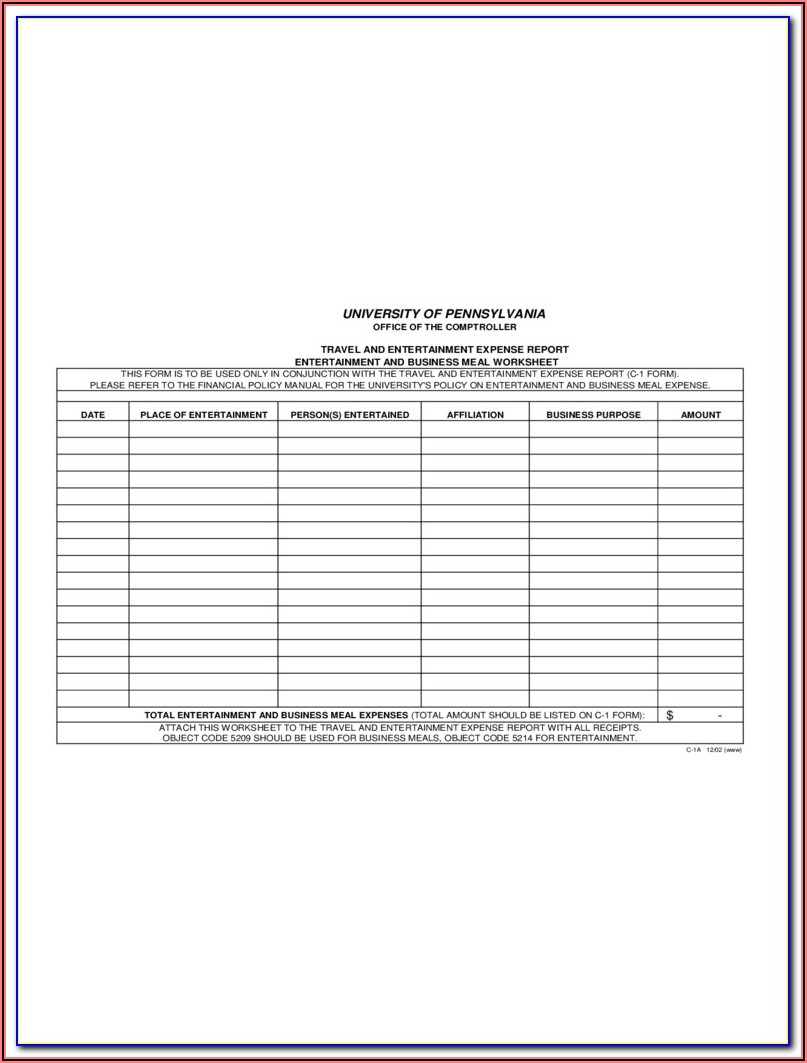

California Workers Compensation Mileage Reimbursement Form Form

Are Employee Reimbursements Taxable Accounting Portal

Expense Reimbursement Form Template Download Excel Expenses

Expense Reimbursement Form Template Download Excel Expenses

Employee Expense Reimbursement Form Fiscal Calendar 2019 Excel Template

Mileage Reimbursement Form IRS Mileage Rate 2021

Mileage Guide For Employers TripLog

California Employer Mileage Reimbursement - Mileage reimbursement is a core component of compliance for California employers whose workers use personal vehicles for business purposes Understanding the legal