California Energy Tax Credits 2022 Tax credits allow you to claim a portion of your solar system cost to reduce your tax liability Several utility companies and government programs offer rebates that further decrease your

If you are a California resident looking to install solar panels there are multiple incentives you can take advantage of to lower the cost of your system including a property tax exclusion California no longer has a state solar tax credit However the federal solar tax credit is worth 30 of the installed cost of a solar and or battery system This credit can be used to decrease your federal tax liability and

California Energy Tax Credits 2022

California Energy Tax Credits 2022

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Energy Credits For 2022 2023 Beyond Blog OvernightAccountant

https://overnightaccountant.com/images/uploads/misc_files/energy-credits-2022.jpg

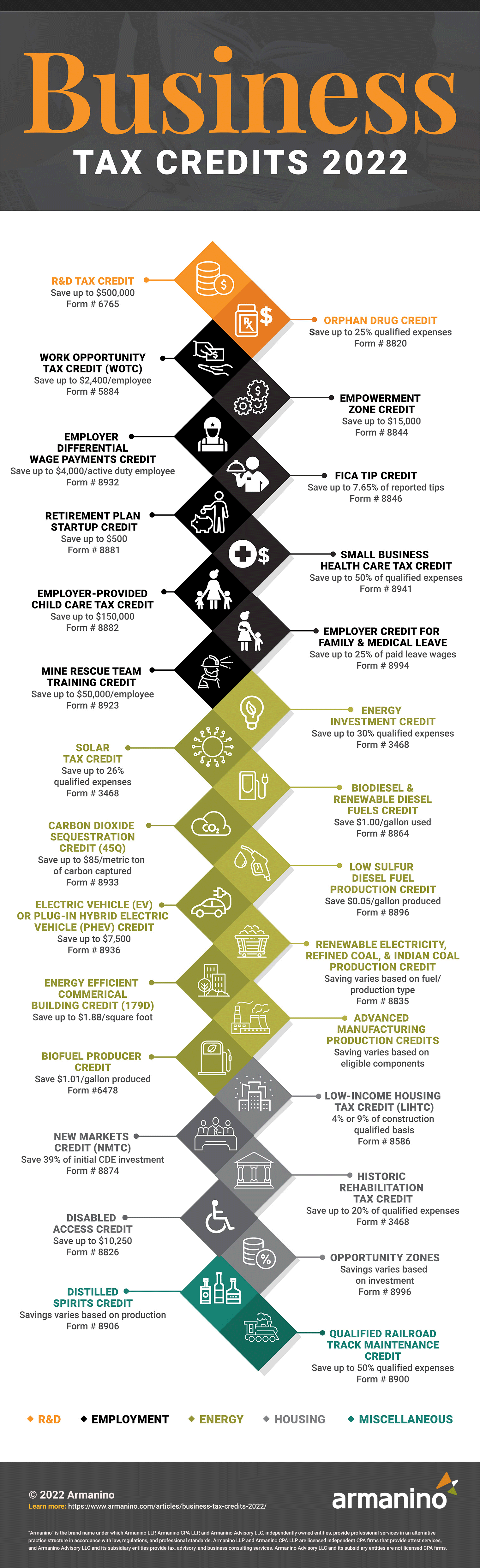

2022 Business Tax Credits Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2022-infographic.jpg

The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help reduce energy costs while reducing demand in the Electric cooperatives which serve thousands of homes businesses and other customers in California will for the first time be eligible for direct pay clean energy tax credits

Regardless of where you live in California there are a few solar incentives and rebates for you including property assessed clean energy PACE property tax exemption for PV systems and net energy metering NEM This bill would allow a credit for a backup electricity generator or solar battery that may be currently deductible as a business expense Generally a credit is allowed in lieu

Download California Energy Tax Credits 2022

More picture related to California Energy Tax Credits 2022

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Energy Tax Credits For 2024

https://airprosusa.com/wp-content/uploads/2023/03/AirPros-Energy-Tax-Credits-for-2023-1024x538.jpg

Tax Provision Description Provides a tax credit for energy efficiency improvements of residential homes Period of Availability 2022 2032 Tax Mechanism Consumer tax credit New or The federal solar investment tax credit ITC is the biggest incentive for most going solar in California The ITC is worth 30 of the system s total cost including equipment

Residents benefit from various incentive opportunities such as tax credits solar rebate programs property tax exclusions discounted rates and solar protection laws These 2022 Tax Credit Information Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Tax

Receive Your Tax Credits

https://pacificinterwest.com/wp-content/uploads/2021/04/piw_45Lenergytaxcredits-1.jpg

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

https://www.ivy-energy.com/post/california-solar...

Tax credits allow you to claim a portion of your solar system cost to reduce your tax liability Several utility companies and government programs offer rebates that further decrease your

https://www.marketwatch.com/guides/…

If you are a California resident looking to install solar panels there are multiple incentives you can take advantage of to lower the cost of your system including a property tax exclusion

Federal Solar Tax Credit What It Is How To Claim It For 2024

Receive Your Tax Credits

Irs Solar Tax Credit 2022 Form

Understanding The Inflation Reduction Act The Council Of State

2022 Education Tax Credits Are You Eligible

Energy Tax Credits US 2022 Apps On Google Play

Energy Tax Credits US 2022 Apps On Google Play

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Tax Credits Save You More Than Deductions Here Are The Best Ones

California Energy Tax Credits 2022 - Find current credits and repealed credits with carryover or recapture provision