California Energy Tax Credits 2023 Tax Provision Description Provides a tax credit for energy efficiency improvements of residential homes New or Modified Provision Modified and extended Credit rate increased from 10 to

What you need to know Eligible Californians can apply to save thousands of dollars on home energy costs through rebates now available to homeowners as part of a federal rebate program The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help reduce energy costs while reducing demand in the

California Energy Tax Credits 2023

California Energy Tax Credits 2023

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

Energy Tax Credits For 2023 One Source Home Service

https://onesourcehomeservice.com/wp-content/uploads/2023/03/One-Source-Energy-Tax-Credits-for-2023-1-1-1024x1024-1-1.webp

The Internal Revenue Service has published a guide to Home Energy Tax Credits as well as detailed instructions on how to calculate and claim the credits Financing refers to You can get a tax credit of up to 30 of the price of many home energy upgrades You ll get this money when you file your taxes How to claim your credits Find out what credits you can claim at Rewiring America Claim the

Compared with many other states California residents have more access to tax breaks rebates and loan programs to help cover the upfront costs of installing solar panels We re here to give Tax credits help reduce the amount of tax you may owe If you pay rent for your housing have a family with children or help provide money for low income college students you may be

Download California Energy Tax Credits 2023

More picture related to California Energy Tax Credits 2023

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

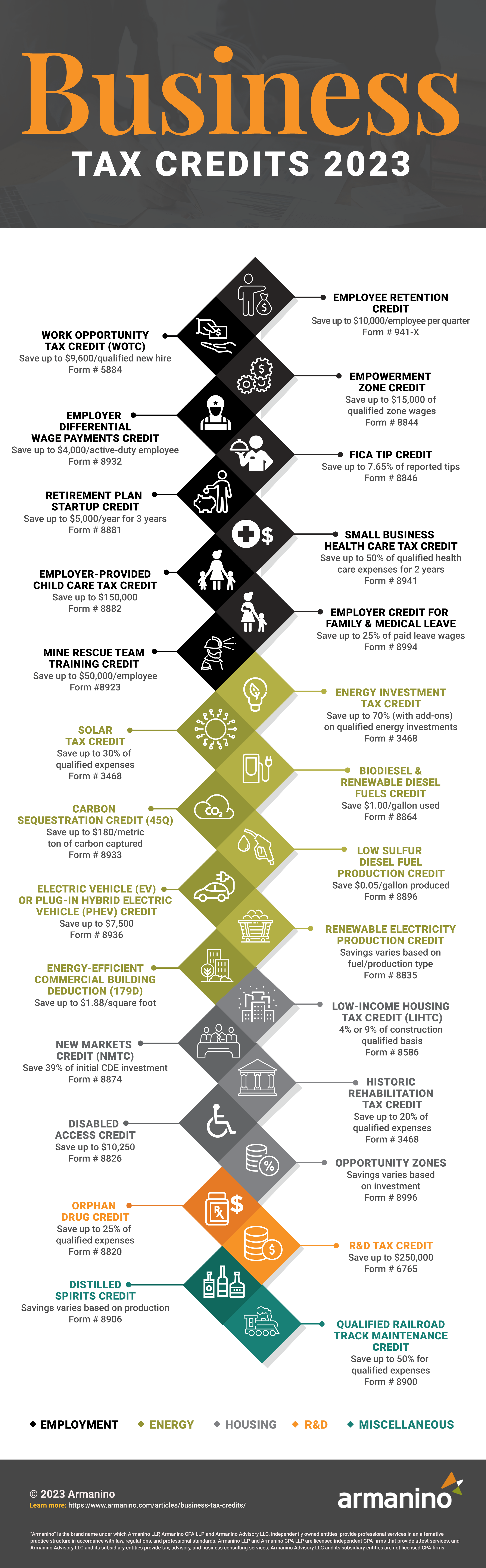

Business Tax Credits 2023 Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2023-infographic.png

Tax Provision Description Provides a tax credit for construction of new energy efficient homes New or Modified Provision Existing but the credit had previously expired at end of 2021 There is no state tax credit for solar equipment in California but all California residents are eligible for the federal investment tax credit which provides an income tax credit in the amount of 30 of your entire installation

Residential Clean Energy Credit See instructions before completing this part Note Skip lines 1 through 11 if you only have a credit carryforward from 2023 Enter the complete address of The biggest solar incentive California residents can take advantage of is the federal solar tax credit also called the Investment Tax Credit ITC According to our 2024 survey of

Energy Tax Credits For 2024

https://airprosusa.com/wp-content/uploads/2023/03/AirPros-Energy-Tax-Credits-for-2023-1024x538.jpg

2023 Energy Efficient Home Credits Tax Benefits Tips

https://accountants.sva.com/hubfs/sva-certified-public-accountants-biz-tip-energy-efficient-home-improvement-credit-more-opportuniities-in-2023-01.png

https://business.ca.gov › wp-content › uploads › ...

Tax Provision Description Provides a tax credit for energy efficiency improvements of residential homes New or Modified Provision Modified and extended Credit rate increased from 10 to

https://www.gov.ca.gov › california...

What you need to know Eligible Californians can apply to save thousands of dollars on home energy costs through rebates now available to homeowners as part of a federal rebate program

Federal Solar Tax Credit What It Is How To Claim It For 2024

Energy Tax Credits For 2024

2023 Residential Clean Energy Credit Guide ReVision Energy

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

Receive Your Tax Credits

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

Federal Tax Credits For Air Conditioners Heat Pumps 2023

California Energy Tax Credits 2023 - One of the key components of the IRA is its financial incentives for homeowners to upgrade to more energy efficient systems Notably heatpumps are eligible for significant