California Ev Rebate 2024 Eligibility Eligible applicants must meet requirements that include but are not limited to the following Be an individual business nonprofit or government entity that is based in California or has a California based affiliate at the time the rebated vehicle is purchased or leased Meet income eligibility requirements at the time application is received

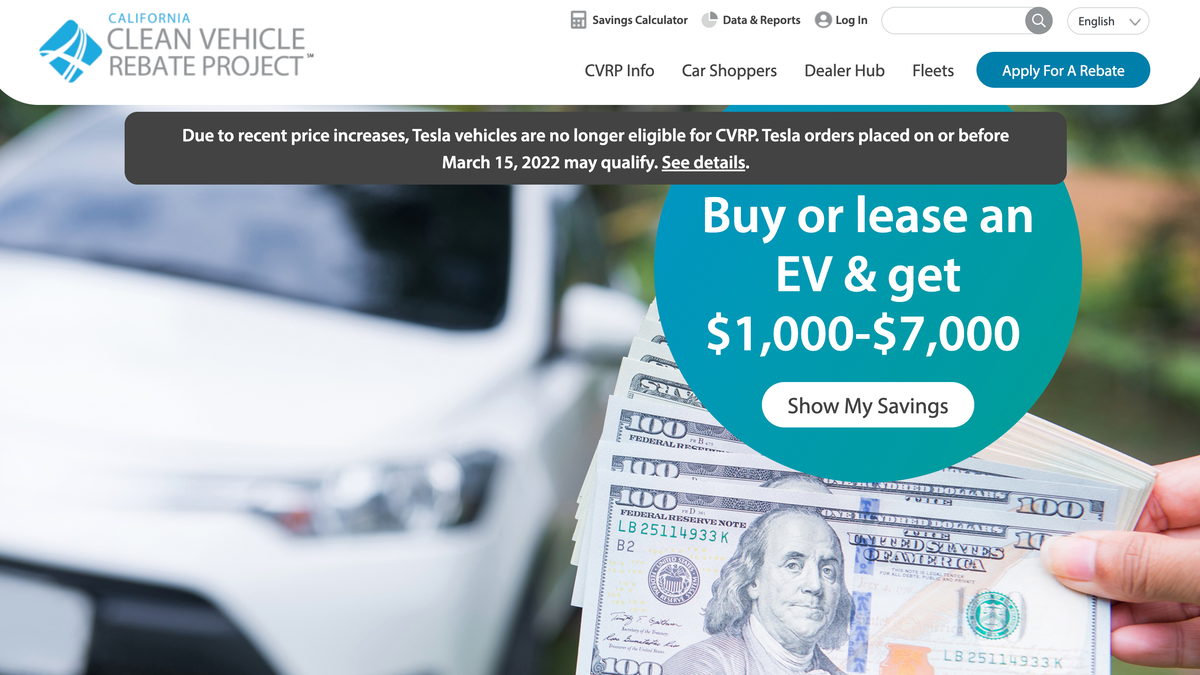

California is eliminating its popular electric car rebate program which often runs out of money and has long waiting lists to focus on providing subsidies only to lower income car buyers The Clean Vehicle Rebate Project in existence since 2010 will end when it runs out of money this year In its place the state will expand a program Apply for a rebate Effective November 8 2023 CVRP is closed to new applications Applications submitted on or after September 6 2023 were placed on a standby list For more information view the standby list FAQ If you missed out on CVRP several EV incentives are still available

California Ev Rebate 2024 Eligibility

California Ev Rebate 2024 Eligibility

https://di-uploads-pod35.dealerinspire.com/rogersrogerskia/uploads/2021/12/California-EV-Rebate-What-You-Need-to-Know.jpg

California EV Rebate Program Clean Vehicle Rebate Program

https://www.ny-engineers.com/hs-fs/hubfs/ev charger-3.jpg?width=2250&name=ev charger-3.jpg

2023 California Ev Rebate Californiarebates

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/rising-demand-delays-california-ev-rebate-programs-youtube.jpg?fit=1280%2C720&ssl=1

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify As of January 1st 2024 buyers are able to transfer the federal EV tax credit to a qualified dealer at the point of sale and effectively turn the credit into an immediate discount See

Your new electric vehicle could qualify for up to 7 500 If you bought it after April 18 2023 the vehicle needs to meet battery and mineral requirements to get the full incentive Those Fact Sheet Project Background Outcomes and Results Effective November 8 2023 CVRP is closed to new applications CVRP offers up to 7 500 to purchase or lease a new plug in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell electric vehicle FCEV

Download California Ev Rebate 2024 Eligibility

More picture related to California Ev Rebate 2024 Eligibility

California Ev Rebate Eligibility 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/wait-lists-and-markups-are-keeping-california-ev-incentives-from-those.jpg

How Does The California EV Rebate Work United Nissan Imperial

https://di-uploads-pod34.dealerinspire.com/rogersrogersnissan/uploads/2021/12/How-Does-the-California-EV-Rebate-Work--1024x576.jpg

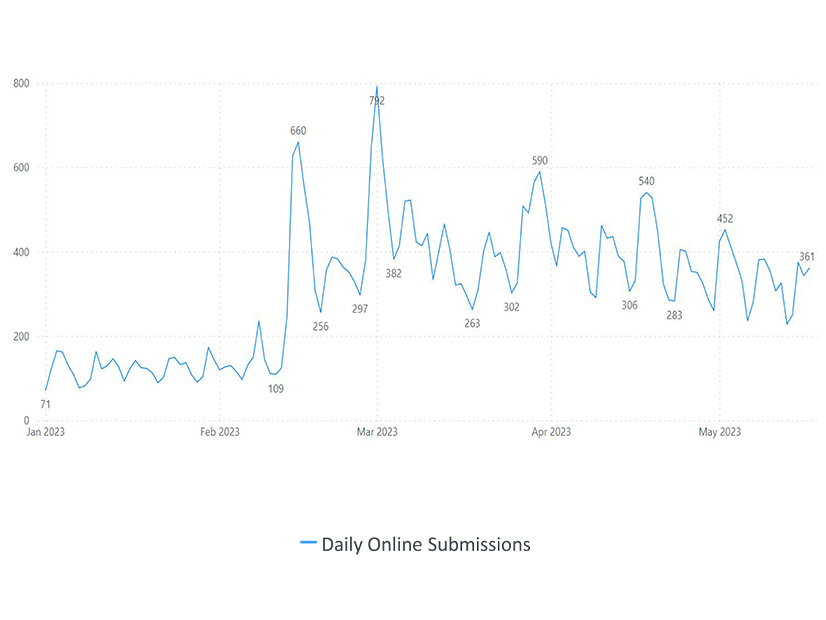

California EV Rebate Program Expected To Run Empty Ahead Of Plan RTO Insider

https://www.rtoinsider.com/wp-content/uploads/2023/06/140620231686775964.jpeg

Eligible Vehicles Clean Vehicle Rebate Project Effective November 8 2023 CVRP is closed to new applications Applications submitted on or after September 6 2023 were placed on a standby list For more information view the standby list FAQ If you missed out on CVRP several EV incentives are still available Rebates from 2 000 7 500 1 The California Zero Emission Vehicle ZEV program The ZEV program established by the California Air Resources Board CARB requires automakers to produce a certain percentage of zero emission vehicles each year This program encourages the development and adoption of EVs by incentivizing manufacturers to increase their ZEV production

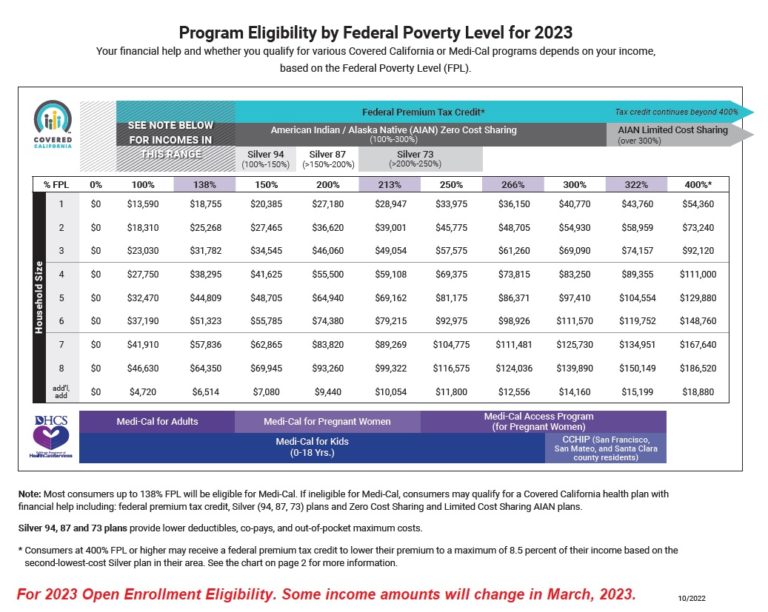

In California buyers of new electric vehicles would be eligible for a tax credit of up to 7 500 in 2024 while buyers of older vehicles would also be eligible for tax breaks of up to 4000 as per California EV Rebate 2024 The nonrefundable credit may be claimed on tax returns filed in 2024 Accordingly we offer all of our users regardless of whether you are a resident of a state that has adopted a State Privacy Law the right to opt out of this type of sale or sharing of your

California EV Rebate Program Soon To End Drive Tesla

https://driveteslacanada.ca/wp-content/uploads/2022/03/Small-837-ElectrifyAmerica-SanDiegoCalifornia.jpg

California EV Rebate Programs Are Running Out Of Money

https://i.kinja-img.com/image/upload/c_fill,h_675,pg_1,q_80,w_1200/93a4f77dc6965f8997043a7bdb58aaf9.png

https://cleanvehiclerebate.org/en/eligibility-guidelines

Eligible applicants must meet requirements that include but are not limited to the following Be an individual business nonprofit or government entity that is based in California or has a California based affiliate at the time the rebated vehicle is purchased or leased Meet income eligibility requirements at the time application is received

https://calmatters.org/environment/2023/09/california-electric-car-rebates/

California is eliminating its popular electric car rebate program which often runs out of money and has long waiting lists to focus on providing subsidies only to lower income car buyers The Clean Vehicle Rebate Project in existence since 2010 will end when it runs out of money this year In its place the state will expand a program

California EV Rebate Program What Has Changed In 2022 Californiarebates

California EV Rebate Program Soon To End Drive Tesla

California EV Rebate Program Soon To End Drive Tesla Rebate2022

How California s EV Rebate Works Who s Eligible And Is It Worth It Thepinkstocks Stock

California Electric Car Rebate I Cartelligent

California EV Rebate And Incentives Kearny Mesa Kia

California EV Rebate And Incentives Kearny Mesa Kia

California EV Rebate Program Clean Vehicle Rebate Program

California Tax Rebate 2023 How To Claim And Eligibility Criteria Tax Rebate

2023 Covered California Open Enrollment Income Chart

California Ev Rebate 2024 Eligibility - A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify