California Income Tax Deductions 2023 Find out which credits and deductions you can claim

California Earned Income Tax Credit EITC EITC reduces your California tax obligation or allows a refund if no California tax is due You may qualify if you have wage income earned in Complete the Itemized Deductions Worksheet in the instructions for Schedule CA 540 line 29 29 30 Enter the larger of the amount on line 29 or your standard deduction shown below

California Income Tax Deductions 2023

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

California Income Tax Deductions 2023

https://blog.churchillmortgage.com/hs-fs/hubfs/tax graphic_2020 (1).jpg?width=8333&name=tax graphic_2020 (1).jpg

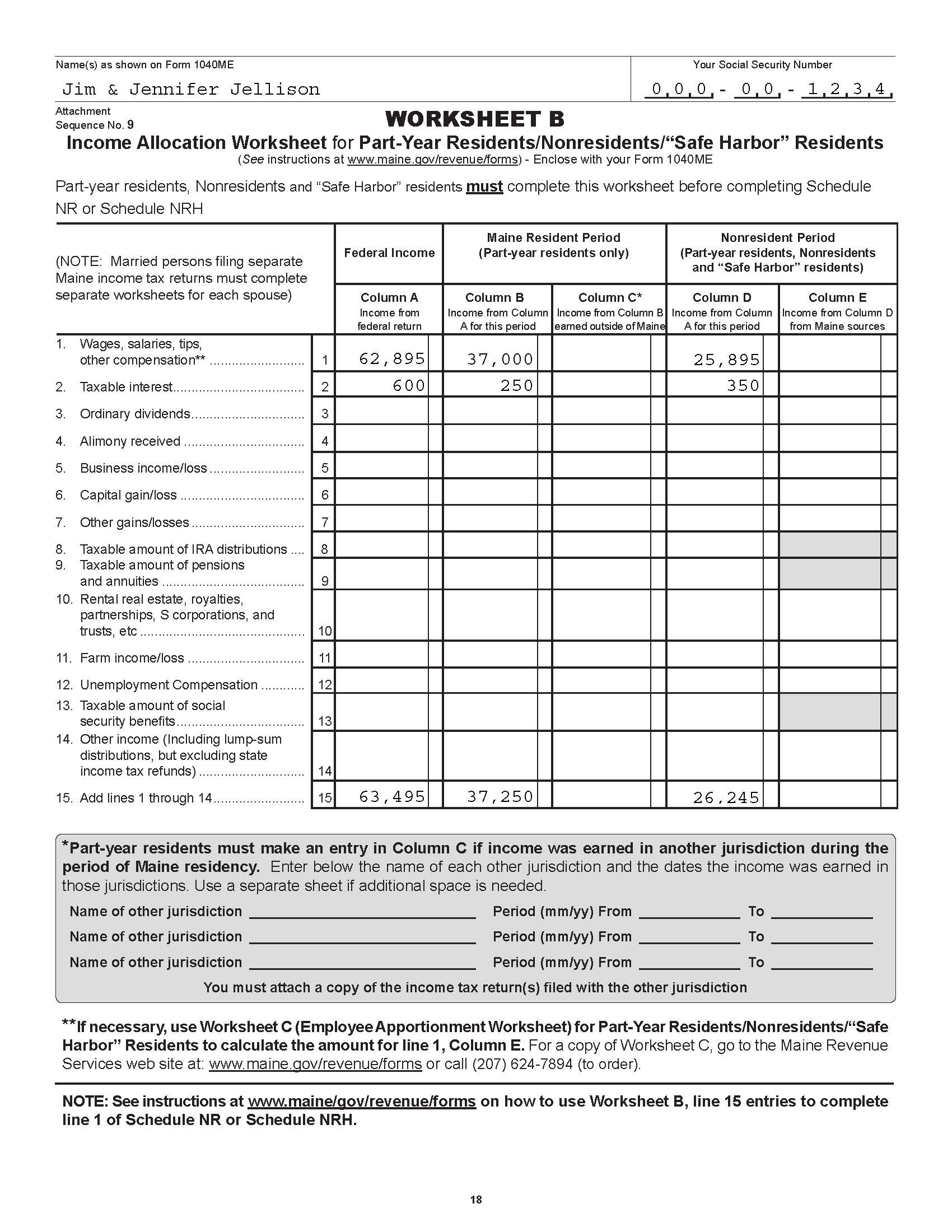

14 Best Images Of Federal Itemized Deductions Worksheet Federal

http://www.worksheeto.com/postpic/2014/06/federal-income-tax-deduction-worksheet_449368.jpg

5 Best Images Of Itemized Tax Deduction Worksheet 1040 Forms Itemized

http://www.worksheeto.com/postpic/2010/07/schedule-c-tax-deduction-worksheet_449335.png

California provides a standard Personal Exemption tax deduction of 144 00 in 2023 per qualifying filer and 446 00 per qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2023 The standard 2023 California Tax Rates Exemptions and Credits The rate of inflation in California for the period from June 1 2022 through June 30 2023 was 3 1 The 2023 personal income tax

By using deductions and credits you can potentially lower your overall tax liability and keep more of your income California Standard Deductions Here s a table outlining the California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax METHOD A WAGE BRACKET TABLE METHOD Limited to

Download California Income Tax Deductions 2023

More picture related to California Income Tax Deductions 2023

Printable Practice Tax Forms Printable Forms Free Online

https://i.pinimg.com/originals/fc/a8/63/fca8634c3622bd645d83db89c69895fd.jpg

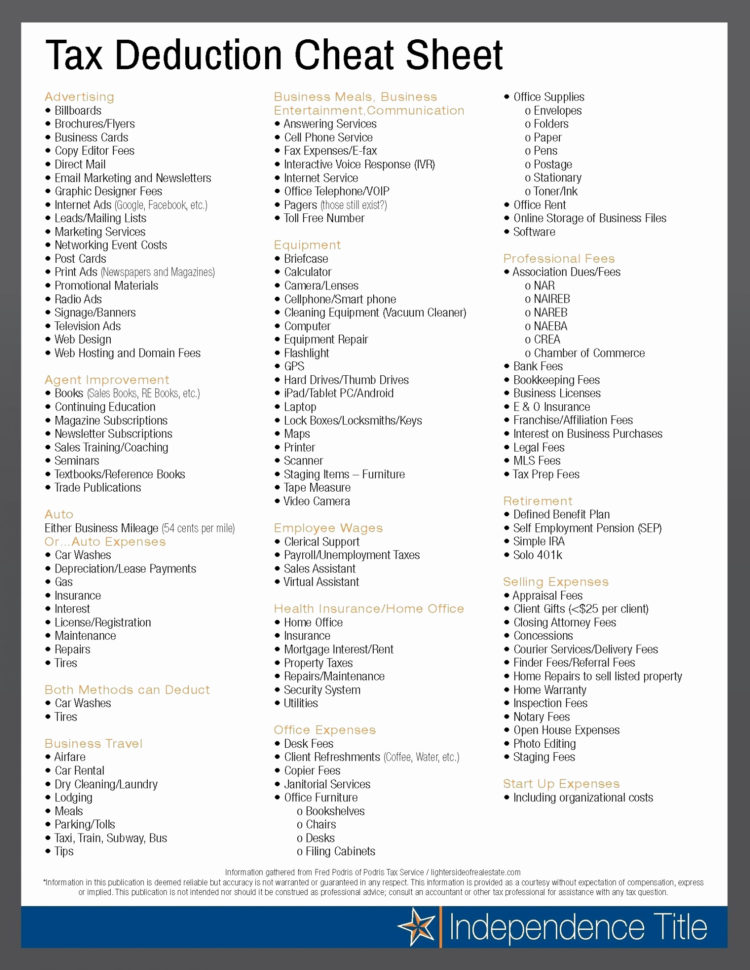

Can You Deduct Business Expenses From 1099 Income Erin Anderson s

https://i.pinimg.com/originals/78/30/8f/78308f869cd60b9b02d5515c65a65de1.png

Real Estate Agent Expenses Spreadsheet Best Of 50 Beautiful Real To

https://db-excel.com/wp-content/uploads/2018/11/real-estate-agent-expenses-spreadsheet-best-of-50-beautiful-real-to-cleaning-business-expenses-spreadsheet-750x970.jpg

Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your California has one of the highest income tax rates in the country but it offers several unique deductions credits rates and income exclusions

Find out how much you ll pay in California state income taxes given your annual income Customize using your filing status deductions exemptions and more Deductions including the standard deduction and itemized deductions help reduce taxable income in California Various tax credits are available such as the California

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

IRS Announces 2022 Tax Rates Standard Deduction

https://specials-images.forbesimg.com/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?fit=scale

.jpg?width=8333&name=tax graphic_2020 (1).jpg?w=186)

https://taxes.ca.gov › income-tax › credits-deductions

Find out which credits and deductions you can claim

https://www.ftb.ca.gov › forms

California Earned Income Tax Credit EITC EITC reduces your California tax obligation or allows a refund if no California tax is due You may qualify if you have wage income earned in

California Itemized Deductions Worksheet

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Charitable Contributions And How To Handle The Tax Deductions

No Itemizing Needed To Claim These 23 Tax Deductions Don t Mess With

8 Best Images Of Tax Preparation Organizer Worksheet Individual

Police Officer Tax Deductions Worksheet Form Fill Out And Sign

Police Officer Tax Deductions Worksheet Form Fill Out And Sign

Farm Cash Flow Spreadsheet Google Spreadshee Farm Cash Flow Projection

California Income Tax Brackets 2020 In 2020 Income Tax Brackets Tax

Printable Itemized Deductions Worksheet

California Income Tax Deductions 2023 - California provides a standard Personal Exemption tax deduction of 144 00 in 2023 per qualifying filer and 446 00 per qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2023 The standard