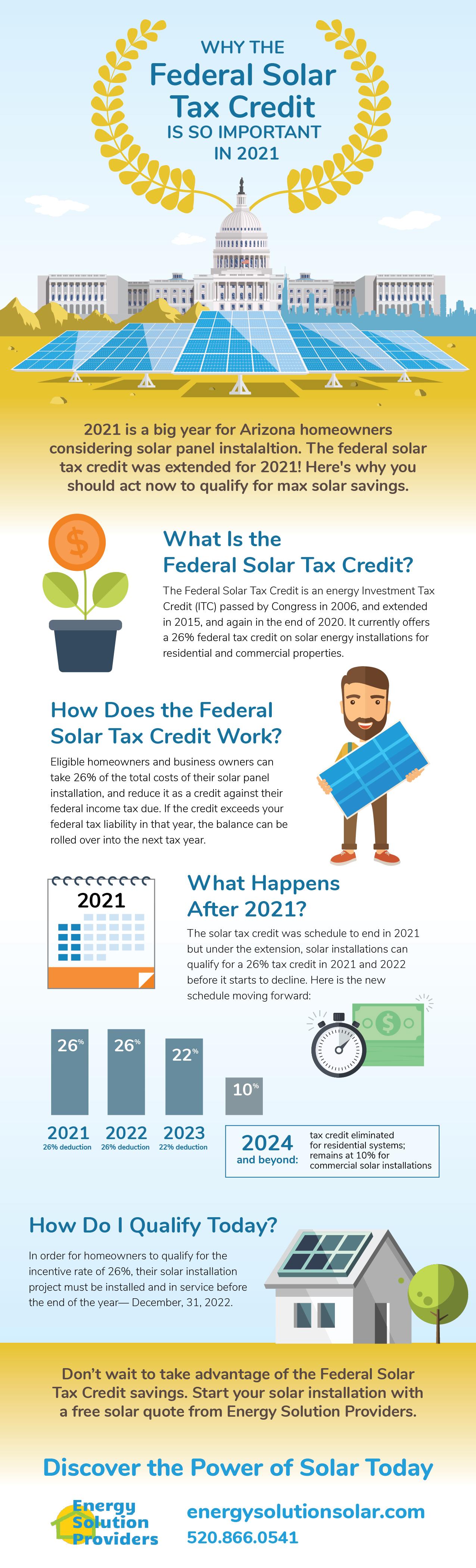

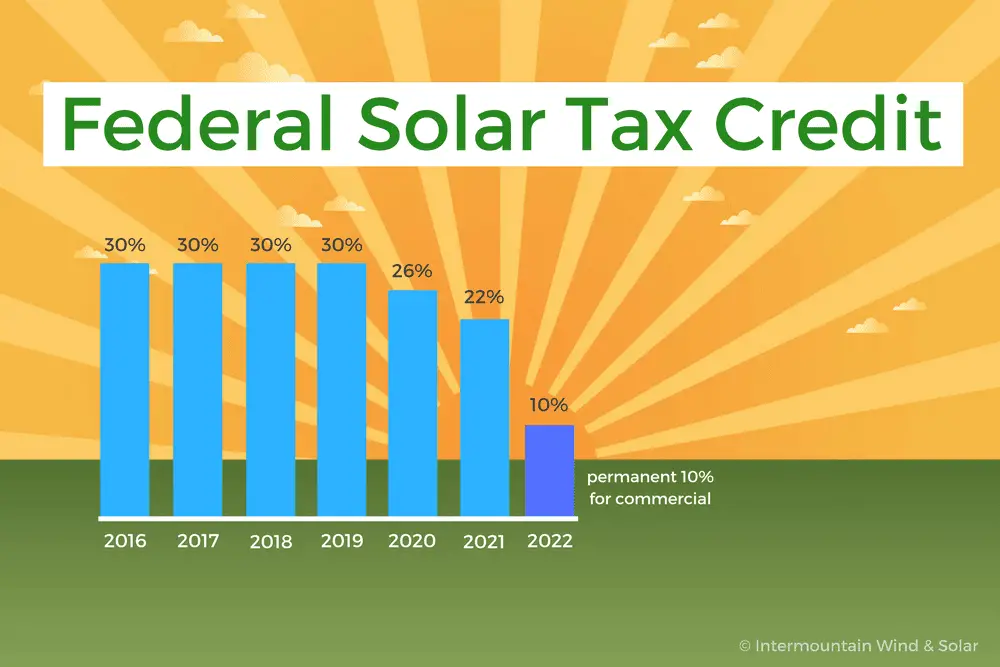

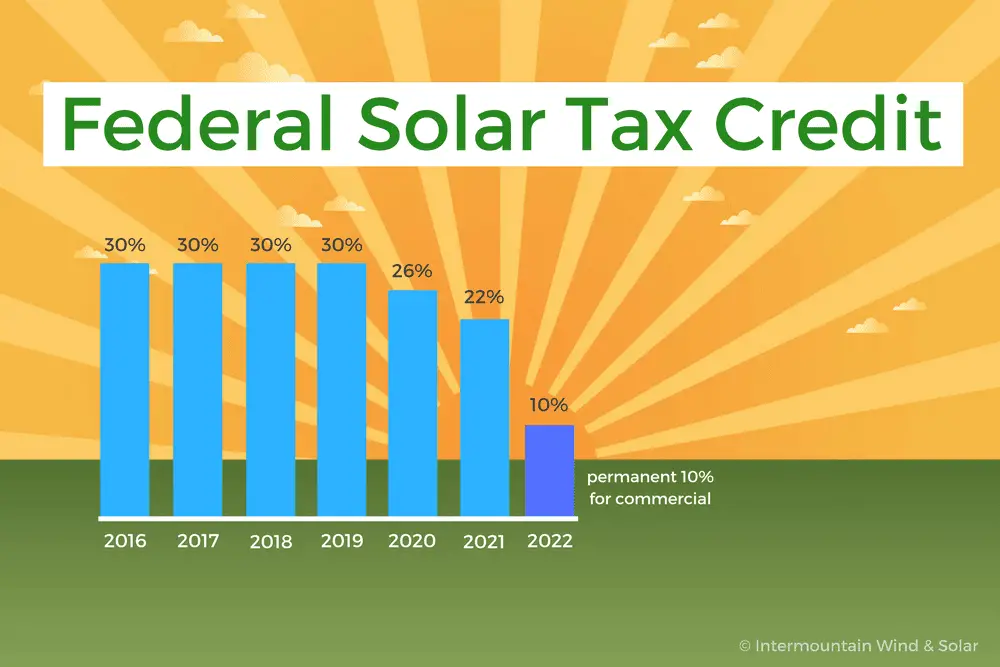

California Solar Tax Credit 2022 Form The Inflation Reduction Act of 2022 keeps the federal solar tax credit at 30 until 2033 when it will drop to 26 The credit will further decrease to 22 in 2034 and expire in 2035

You will claim the tax credit on your federal tax return for the year you install a solar system To apply download and fill out IRS Form 5695 for residential energy credits Form 5695 calculates tax credits for various qualified residential energy improvements including geothermal heat pumps solar panels solar water heating

California Solar Tax Credit 2022 Form

California Solar Tax Credit 2022 Form

https://www.gov-relations.com/wp-content/uploads/2023/06/How-To-Claim-Solar-Tax-Credit.jpg

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

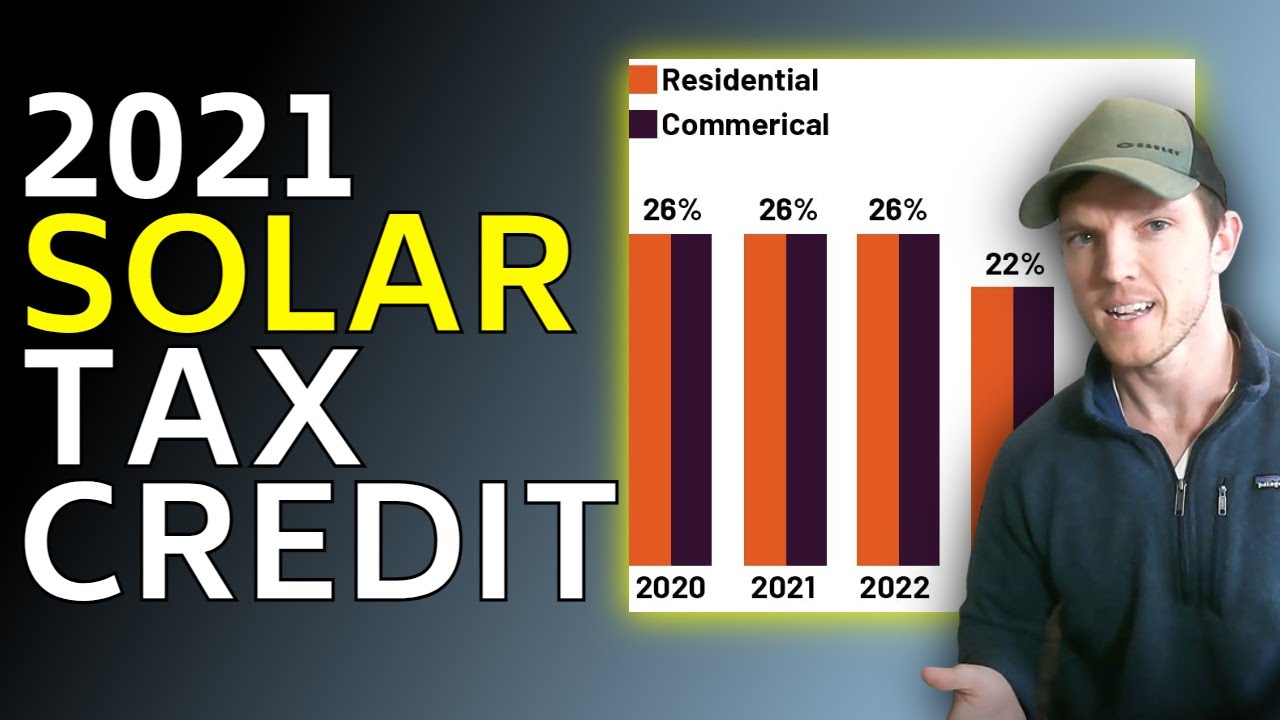

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

https://i.ytimg.com/vi/u143Lcm-QG4/maxresdefault.jpg

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an

How the Federal Solar Tax Credit Works 1 The Solar Tax Credit is 30 2 You Must Have Taxable Income 3 You Must Own Your Solar System 4 The Solar Must Be At Your Primary Residence or Second After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR Instructions on filling out the form

Download California Solar Tax Credit 2022 Form

More picture related to California Solar Tax Credit 2022 Form

California Solar Tax Credit Rebates And Incentives In 2022

https://enphase.com/sites/default/files/styles/max_650x650/public/2022-05/Blog-images-Tax-Credit-2.png?itok=xilathGg

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2021-01.jpg?itok=SJbBX9lJ

A Comprehensive Guide To The Solar Investment Tax Credit In 2022

https://aztecsolar.com/wp-content/uploads/2022/01/A-Comprehensive-Guide-to-the-Solar-Investment-Tax-Credit-in-2022.jpg

Step 1 When you or your accountant are ready to file your taxes print IRS form 5695 which is the form for Residential Energy Credits Step 2 Fill out the form using the information provided by your solar installation company The federal and state solar tax incentives in California are the best options for saving money and maximizing your returns with your solar array However there are also some

Federal tax credit Applying for the federal tax credit is easy just fill out form 5695 from the IRS and include it with your tax return Be sure to attach the required documentation Navigate the latest California solar tax credit and incentives in 2022 Maximize your green energy journey with updated solar incentives in California Read more

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

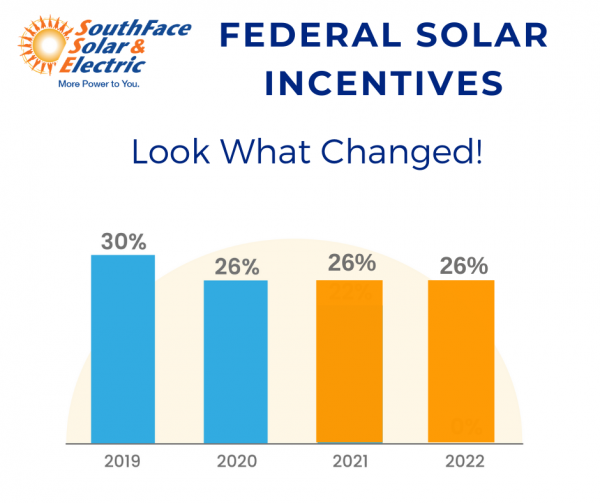

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

https://southfacesolar.com/wp-content/uploads/2021/01/136682227_5076885039018728_2629942985947998441_n-600x503.png

https://www.cnet.com/home/energy-and-utilities/...

The Inflation Reduction Act of 2022 keeps the federal solar tax credit at 30 until 2033 when it will drop to 26 The credit will further decrease to 22 in 2034 and expire in 2035

https://www.marketwatch.com/guides/solar/california-solar-tax-credits

You will claim the tax credit on your federal tax return for the year you install a solar system To apply download and fill out IRS Form 5695 for residential energy credits

Solar Tax Credit California 2022 YouTube

When Does Solar Tax Credit End SolarProGuide 2022

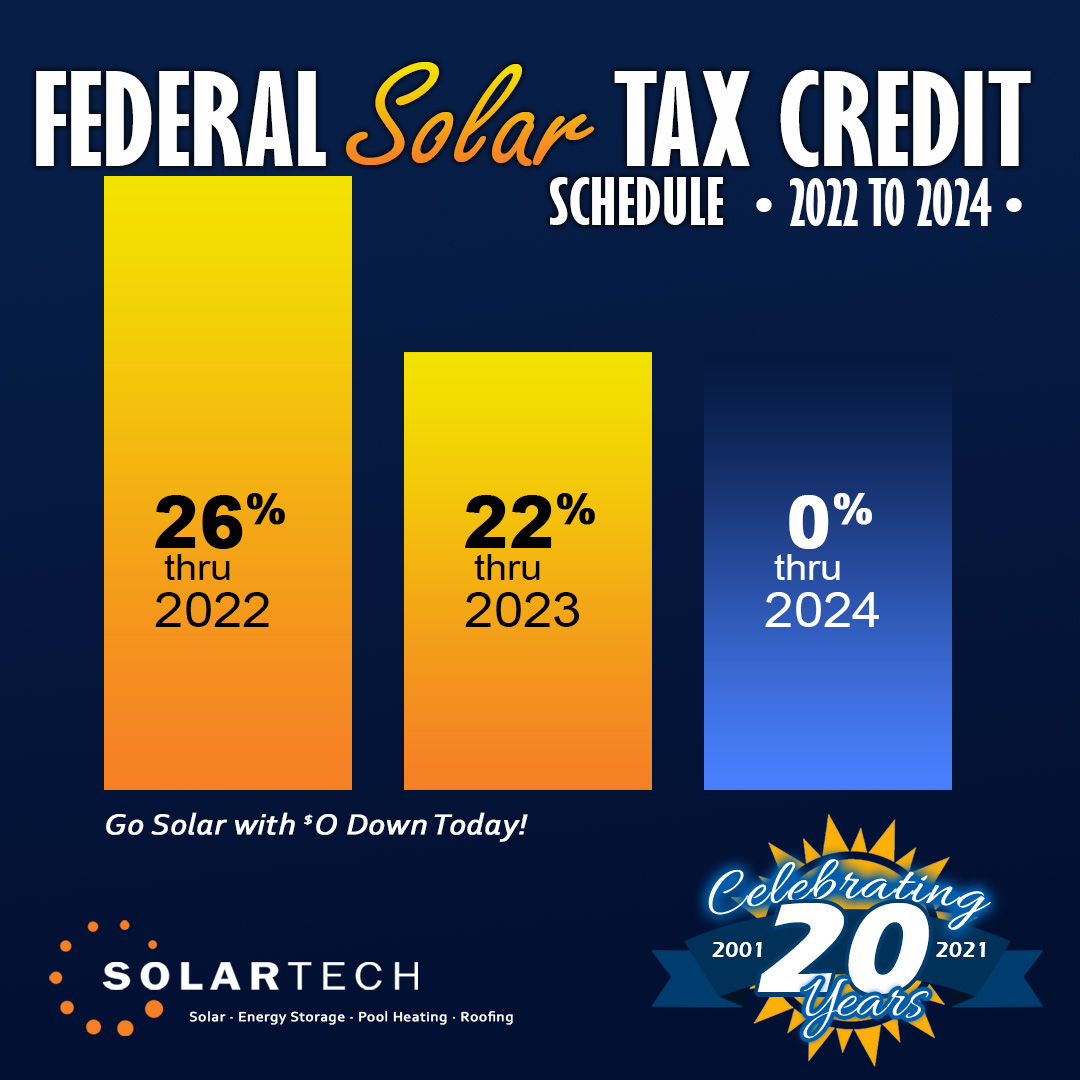

26 Federal Solar Tax Credit Extended SolarTech

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Is There A California Tax Credit For Solar Simply Solar

Is There A California Tax Credit For Solar Simply Solar

Your Guide To Solar Federal Tax Credit

The 30 Solar Tax Credit Has Been Extended Through 2032

The Federal Solar Tax Credit What You Need To Know 2022

California Solar Tax Credit 2022 Form - Between the federal tax credit and other state specific incentives you can save thousands on solar panels making them well worth the investment Here s how you can lower the