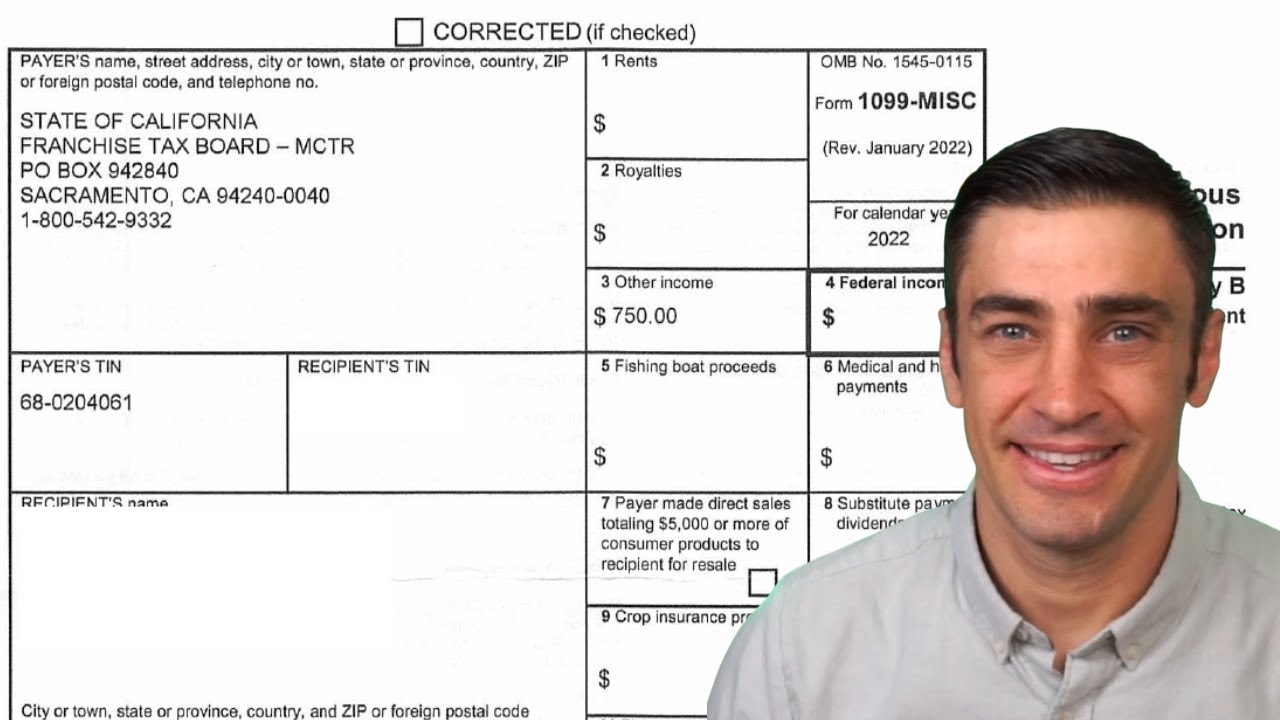

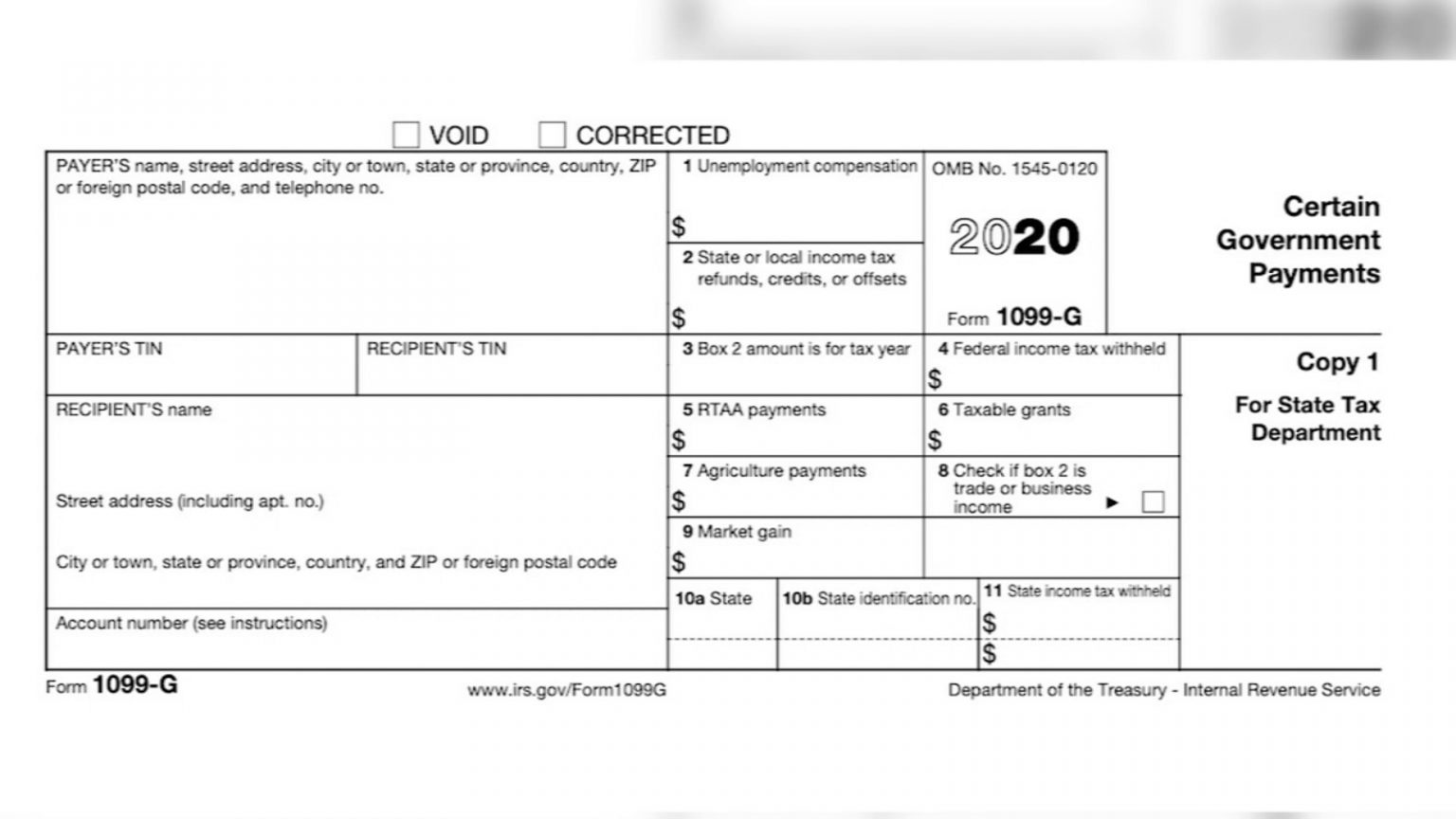

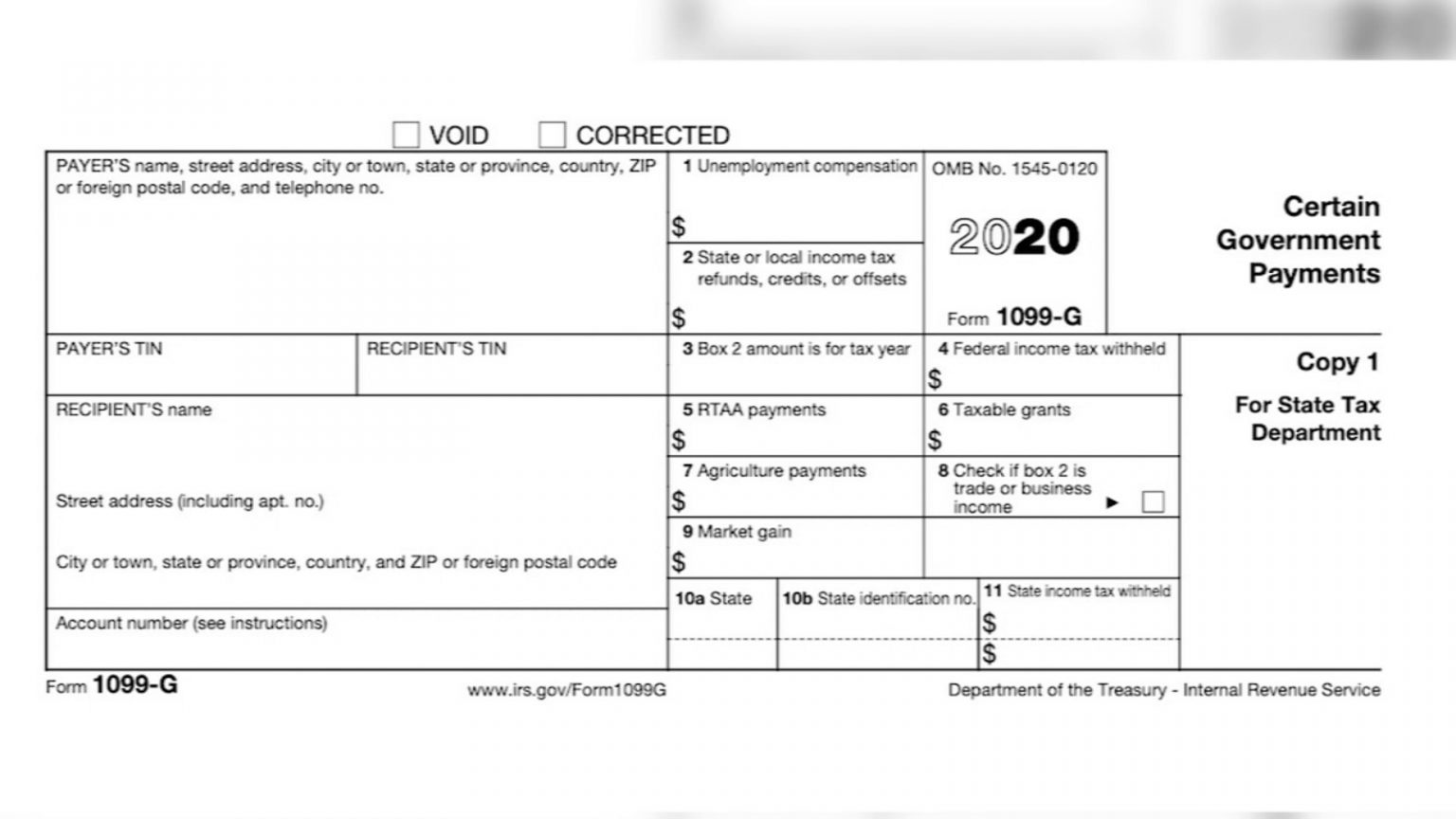

California State Tax Refund Form 1099 G Can someone help me understand how a refund in a 1099G from the state is treated as taxable income I overpaid in my taxes and gave California an interest free loan I m

Access your California Franchise Tax Board account and view details of issued 1099 G forms Your form 1099 G for the 2020 unemployment compensation should be available on this CA website

California State Tax Refund Form 1099 G

California State Tax Refund Form 1099 G

https://i.ytimg.com/vi/t_qqSQEAl10/maxresdefault.jpg

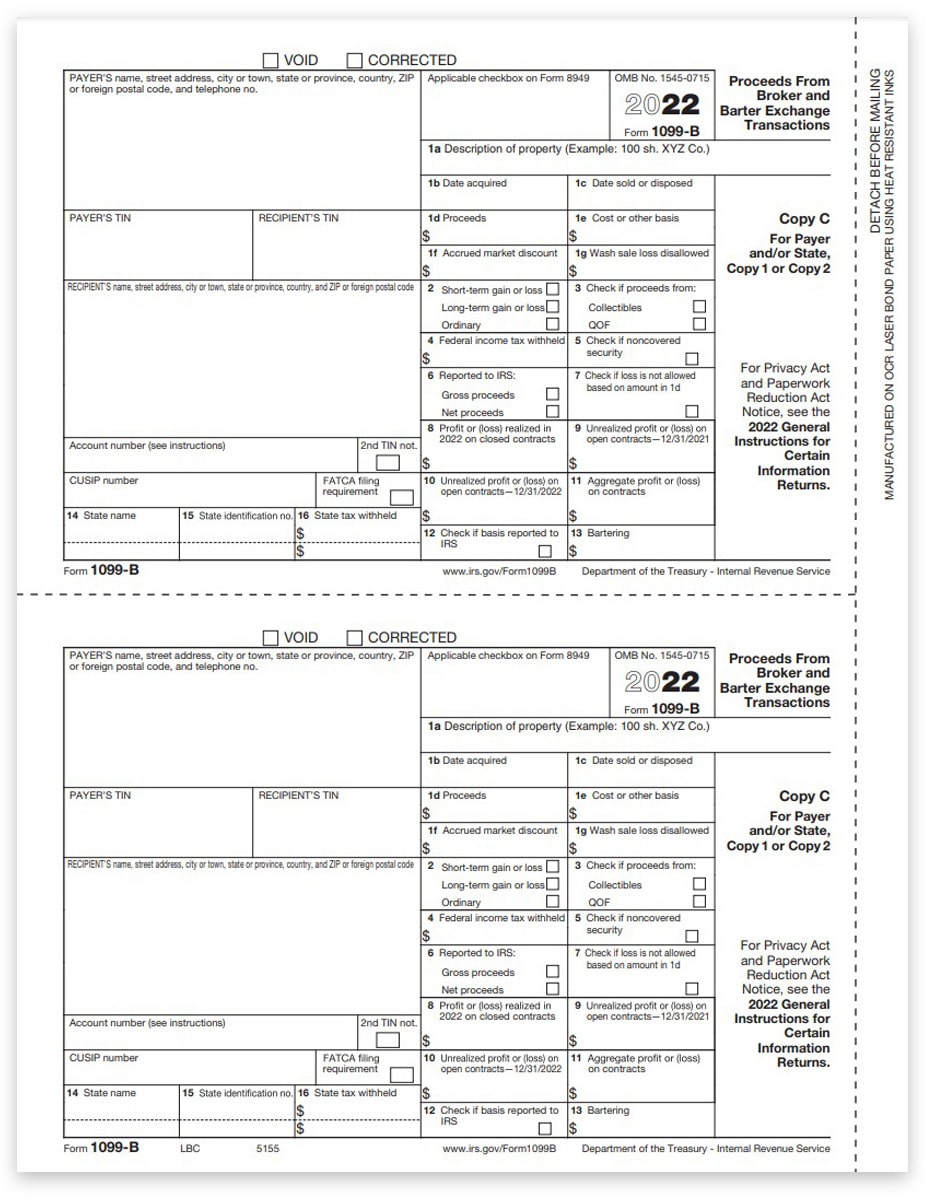

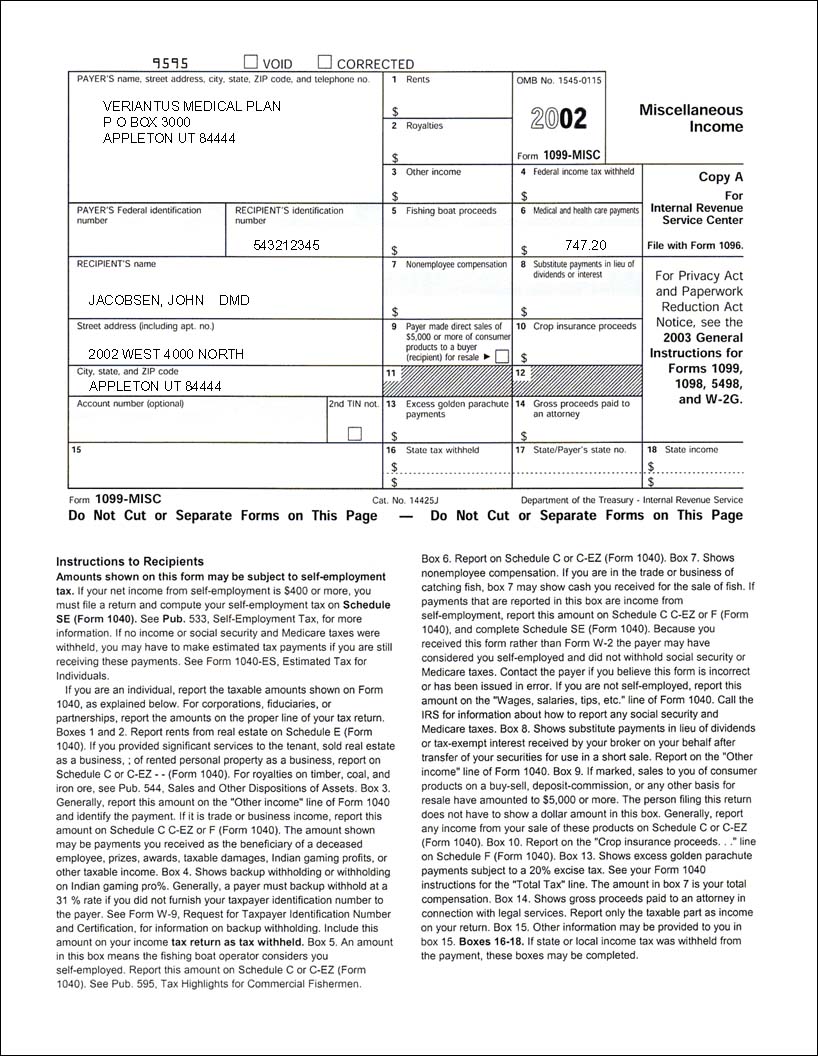

1099B Forms For Broker Transactions State Copy C DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1099B-Form-Copy-C-1-2-Payer-State-LBC-FINAL-min.jpg

1099 G FAQs

https://www.uc.pa.gov/faq/claimant/PublishingImages/UC-1099G-OnlineForm.jpg

1099 G Information All States Frequently clients don t bring us the 1099Gs for the state refunds and we are held up waiting to get the EINs and addresses that would appear on File Form 1099 G Certain Government Payments if as a unit of a federal state or local government you made payments of unemployment compensation state or local income

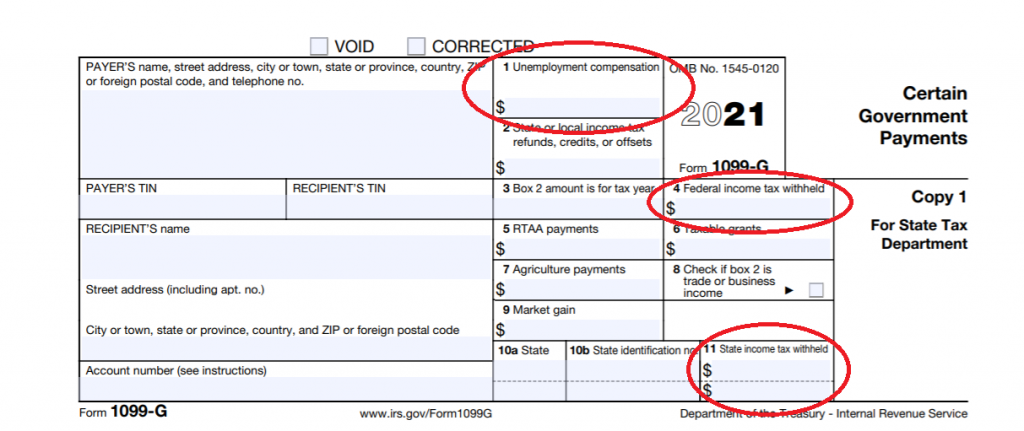

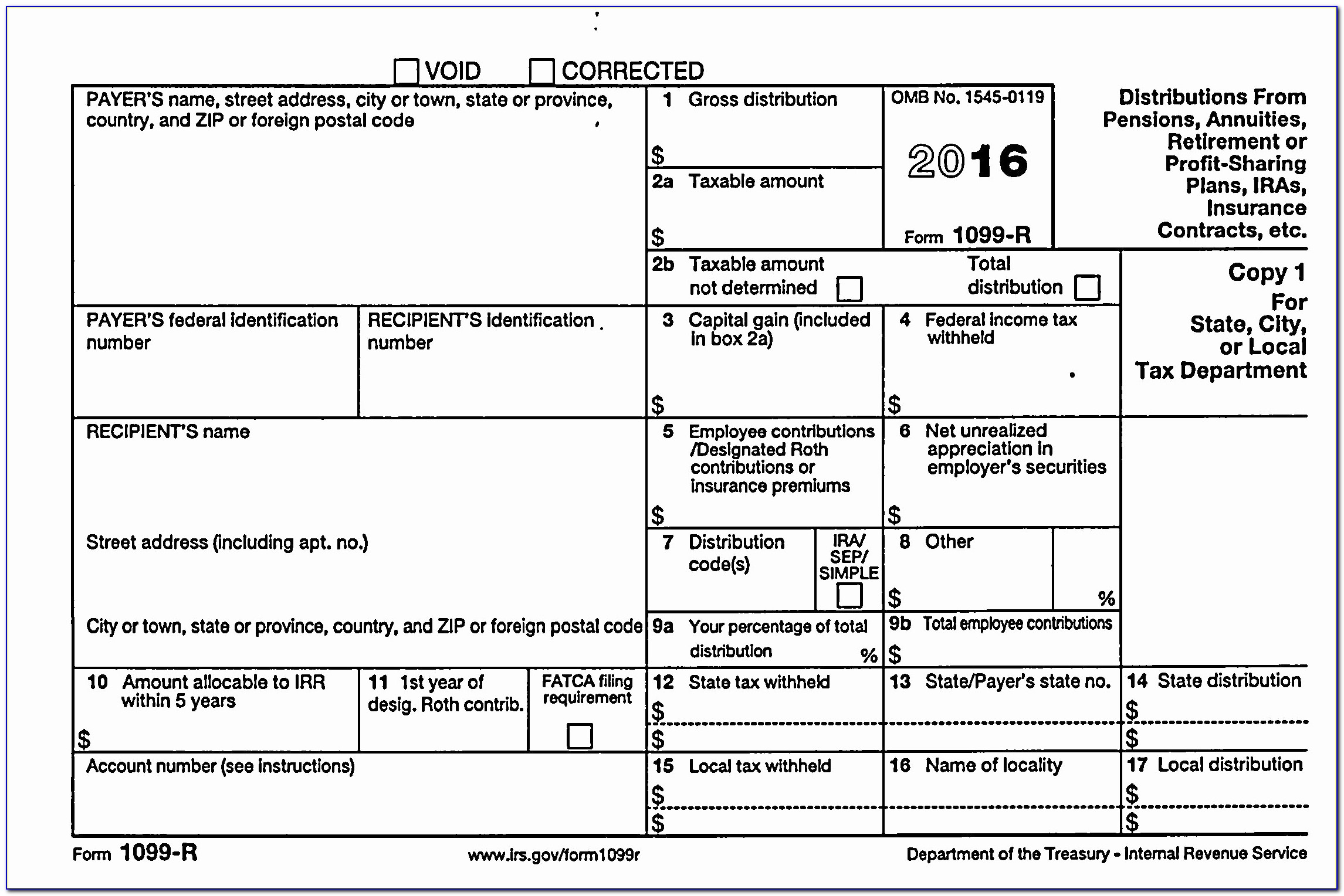

Overpayments or interest income reported on Form 1099 G or Form 1099 INT are considered refunded in the following situations If paid directly to the taxpayer or The Form 1099 G for tax year 2022 is reporting the state tax refund you received from your 2022 state tax return The state tax refund from 2022 would have been received

Download California State Tax Refund Form 1099 G

More picture related to California State Tax Refund Form 1099 G

E file 2022 1099 G Form Online Certain Government Payments

https://d2rcescxleu4fx.cloudfront.net/images/1099-G.jpg

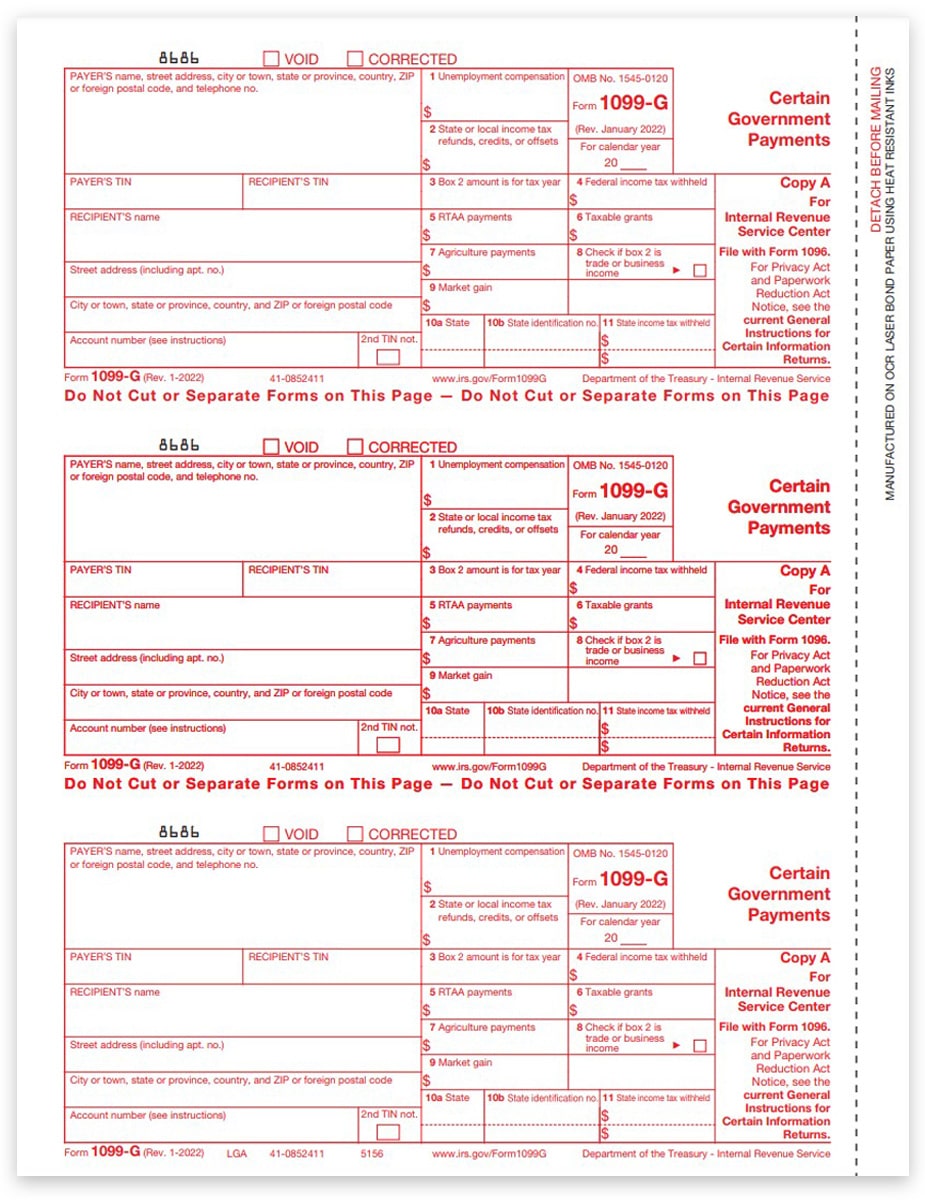

1099G Tax Forms For Government Payments IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1099G-Form-Copy-A-Federal-Red-LGA-FINAL-min.jpg

Promo Integra

https://www.taxoutreach.org/wp-content/uploads/Form-1099G-1-1-1024x431.png

We use 1099 G to report amounts Refunded to you by direct deposit or check Offset against other liabilities such as Tax Penalties Interest Credited toward estimated tax If you ve received unemployment compensation or a state tax refund you ll receive Form 1099 G Learn more about Form 1099 G and how it affects your taxes

Box 2 of Form 1099 G shows the state or local income tax refunds offsets or credits you received but these amounts typically only need to be reported if you took a federal State tax refunds are always reported to you using a 1099 G form but not always included in taxable income the year you receive the 1099 G If you itemized your deductions in

1099G Forms For Government Payments Recipient Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1099G-Form-Copy-B-Recipient-LGB-FINAL-min.jpg

Georgia Tax Refund Form 1099 G Universal Network

https://www.universalnetworkcable.com/wp-content/uploads/2019/03/georgia-tax-refund-form-1099-g.png

https://www.reddit.com/r/tax/comments/1ai6a0w/i...

Can someone help me understand how a refund in a 1099G from the state is treated as taxable income I overpaid in my taxes and gave California an interest free loan I m

https://webapp.ftb.ca.gov/etfprd1/pit/pit_account...

Access your California Franchise Tax Board account and view details of issued 1099 G forms

How To File A 1099 Form For Vendors Contractors And Freelancers

1099G Forms For Government Payments Recipient Copy B ZBPforms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

Az 1099 Form Printable Printable Forms Free Online

2022 2024 Form IRS 1099 G Fill Online Printable Fillable Blank

1099 Form Michigan Printable

1099 G Unemployment Forms Necessary To File Taxes Are Now Available At

1099 G Unemployment Forms Necessary To File Taxes Are Now Available At

State Income Tax Refund Form 1099 G Report Of State Income Tax Refund

Solved Turbo Tax Tells Me I Need To Enter A State Identification

California Estimated Tax Worksheet 2022

California State Tax Refund Form 1099 G - The Form 1099 G for tax year 2022 is reporting the state tax refund you received from your 2022 state tax return The state tax refund from 2022 would have been received