California Tax Rebate Eligibility Web 15 oct 2021 nbsp 0183 32 To announce the 2022 Middle Class Tax Refund payments to qualified recipients Background California will provide a one time payment up to 1 050 to

Web 2 juil 2022 nbsp 0183 32 The refund will be one amount if you had no dependents with an extra flat payment if you claimed a tax credit for one or more dependents The extra payment is Web Check if you qualify for CalEITC The amount of California Earned Income Tax Credit CalEITC you may receive depends on your income and family size To qualify for CalEITC you must meet all of the following requirements during the tax year You re at least 18 years old or have a qualifying child

California Tax Rebate Eligibility

California Tax Rebate Eligibility

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

California Ev Rebate Lease Californiarebates

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/california-ev-rebate-eligibility-2022-rebate2022.jpeg?fit=1035%2C487&ssl=1

Tax Rebate 2023 California Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/05/Tax-Rebate-2023-California.jpg

Web California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify This payment is different than the Golden State Stimulus I GSS I Check if you qualify for the Golden State Stimulus II To qualify you must have Filed your 2020 taxes by October 15 2021 Web 8 oct 2022 nbsp 0183 32 To qualify you must have lived in California for at least six months in 2020 and filed a state tax return that year and you must be a California resident on the day

Web 10 mai 2021 nbsp 0183 32 Published May 10 2021 Two thirds of Californians set to benefit from Golden State Stimulus checks amounting to nearly 12 billion in total the largest state Web 26 ao 251 t 2021 nbsp 0183 32 Expanded Golden State Stimulus the Largest State Tax Rebate in American History to Start Reaching Californians Tomorrow Published Aug 26 2021 Two out of every three Californians eligible for Golden State

Download California Tax Rebate Eligibility

More picture related to California Tax Rebate Eligibility

How To Cash California s Middle Class Tax Refund Debit Card

https://i0.wp.com/wpdash.medianewsgroup.com/wp-content/uploads/2022/11/OCR-L-MCTR-DEBIT-2.jpg?fit=1280%2C9999px&ssl=1

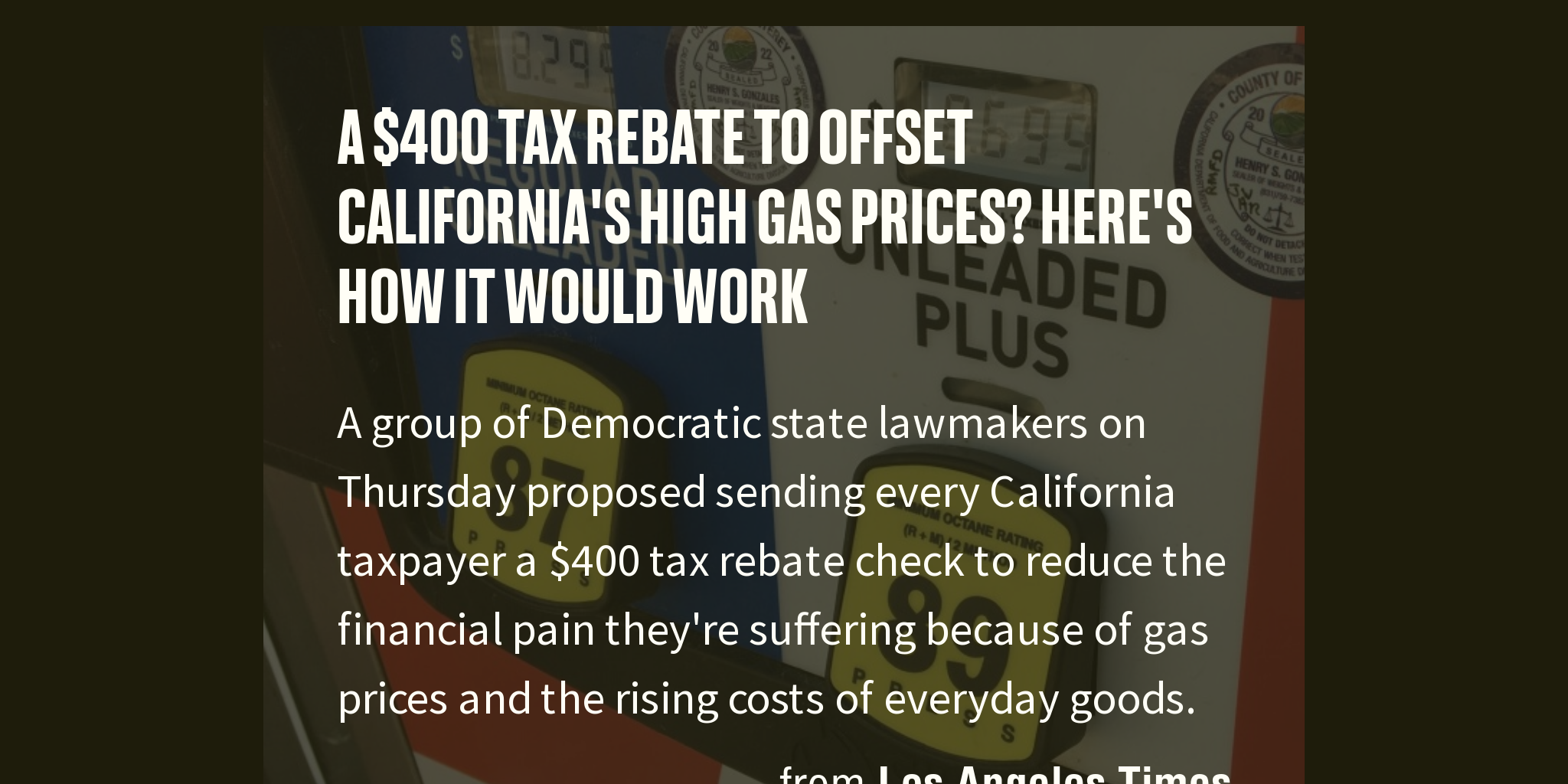

A 400 Tax Rebate To Offset California s High Gas Prices Here s How It

https://pic.briefly.co/anchor/Los_Angeles/story/a-400-tax-rebate-to-offset-californias-high-gas-prices-heres-how-it-would-work?format=wide-twitter

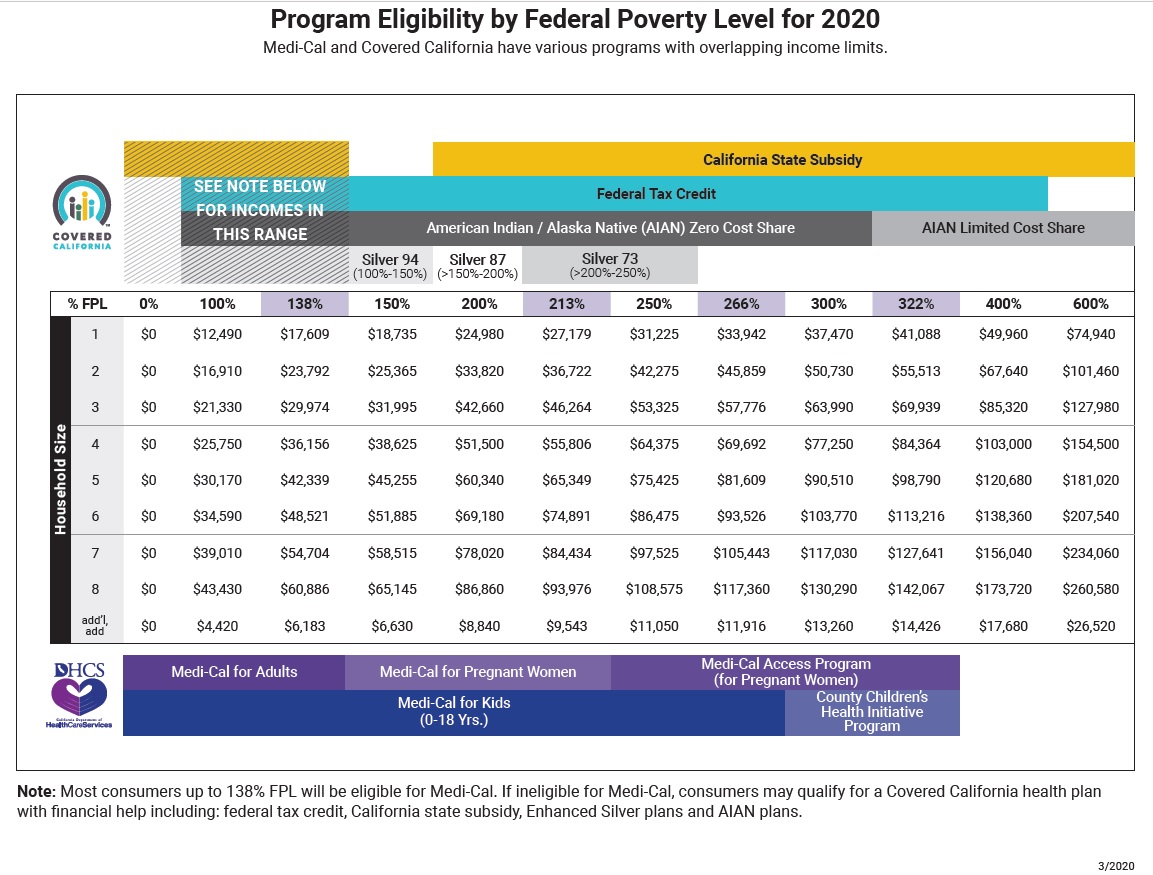

Revised 2020 Covered California Income Eligibility Chart

https://insuremekevin.com/wp-content/uploads/2020/04/2020-April-Covered-California-Income-Chart.jpg

Web Overview You may be eligible for a California Earned Income Tax Credit CalEITC up to 3 417 for tax year 2022 as a working family or individual earning up to 30 000 per year You must claim the credit on the 2022 FTB 3514 form California Earned Income Tax Credit or if you e file follow your software s instructions Web 26 juin 2022 nbsp 0183 32 The 9 5 billion in tax refunds which CalMatters reported Friday is part of a 12 billion relief plan that is central to a broader 300 billion budget deal that state leaders announced Sunday night

Web California provides the Golden State Stimulus to families and individuals who qualify This is a stimulus payment for certain people that file their 2020 tax returns The Golden State Stimulus aims to Support low and middle income Californians Help those facing a hardship due to COVID 19 Web The California Earned Income Tax Credit CalEITC is a refundable cash back tax credit for qualified low to moderate income Californians Many hard working individuals and families are eligible including Californians

California Tax Gas Rebate Californiarebates

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/gas-rebate-california-mctr-debit-card-california-middle-class-tax-6.jpg?resize=1024%2C576&ssl=1

Federal Tax Rebates LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/federal-recovery-rebates-california-budget-and-policy-center-768x591.png

https://www.ftb.ca.gov/about-ftb/newsroom/public-service-bulletins/...

Web 15 oct 2021 nbsp 0183 32 To announce the 2022 Middle Class Tax Refund payments to qualified recipients Background California will provide a one time payment up to 1 050 to

https://www.sfchronicle.com/california/article/California-2022...

Web 2 juil 2022 nbsp 0183 32 The refund will be one amount if you had no dependents with an extra flat payment if you claimed a tax credit for one or more dependents The extra payment is

IRS Says California Most State Tax Rebates Aren t Considered Taxable

California Tax Gas Rebate Californiarebates

What To Know About California Middle Class Tax Refund Debit Cards

Calif EV Rebate Program Expected To Run Empty Ahead Of Plan RTO Insider

IRS Payroll Tax Rebates For 2020 2021 2022 Free ERTC Eligibility Test

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained

California Proposes Tax Rebates To Offset High Fuel Costs The New

California Ev Rebates For 2023 Californiarebates

California Electric Car Rebate EV Tax Credit Incentives Eligibility

California Tax Rebate Eligibility - Web 26 ao 251 t 2021 nbsp 0183 32 Expanded Golden State Stimulus the Largest State Tax Rebate in American History to Start Reaching Californians Tomorrow Published Aug 26 2021 Two out of every three Californians eligible for Golden State